AAATrade Review 2024

Pros

- I was glad to see commission-free trading available in the Novice account, though seasoned traders can also benefit from low commissions from 0.125% in the Experienced account

- I feel assured the AAATrade is regulated by tier-1 authority, the CySEC and is also a member of the Investor Compensation Fund (ICF)

- There's a good range of trading platforms, including the new AAATrader™ and MT5 mobile app. I particularly appreciated the broker's in-house crypto exchange platform

Cons

- I'm a little disappointed that fees charged on deposits, which puts the broker behind most competitors offering free deposits

- Crypto trading does not have the same protection or regulation as other markets, though this is industry standard

AAATrade Review

AAATrade is a broker and trading platform which caters for retail traders, institutional investors and other brokers. Thousands of financial instruments and products are offered, including the opportunity to exchange cryptos. This review will look in more depth at AAATrade’s product offering, its fees, regulation and more.

Broker Headlines

The company was established in 2013 in Cyprus, with its purpose to ensure clients of various sizes had access to a wide range of financial products for trading. AAATrade is regulated by the Cyprus Securities and Exchange Commission (CySEC), and is also regulated by BaFin, the FCA and the CNMV.

AAATrade caters for both retail and institutional clients, while recognising that every trader is different. There are some who want access to portfolio management and some who don’t. There are some who prefer an account with zero commission and those who would prefer low commissions and tighter spreads. And there are traders who’d rather trade on just the price movement of an underlying asset, whereas others would rather own the asset itself. AAATrade recognises these differences – and caters for all.

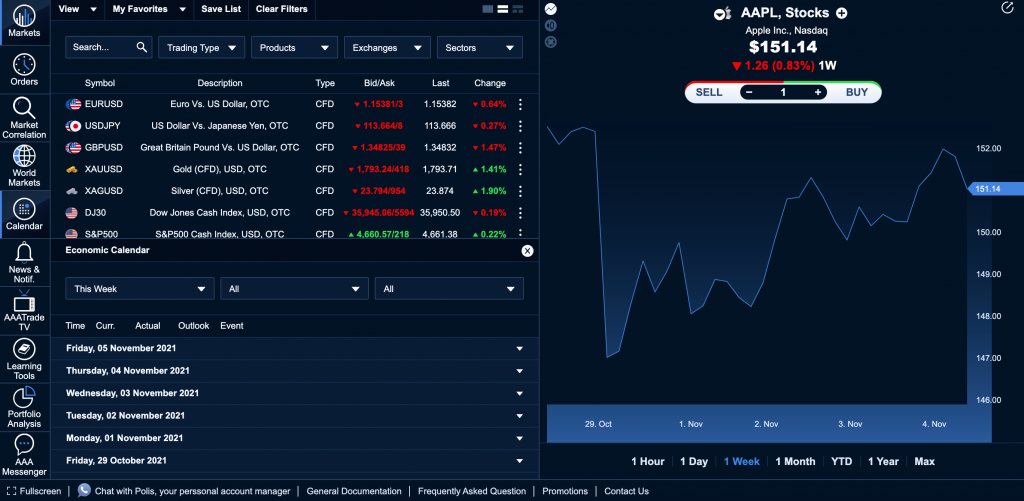

Trading Platforms

AAATrade offers various types of trading platforms: a mobile app designed for trading on the go, a desktop app downloadable to your device, and a web-based version. Let’s look at each one:

AAATrader™

- Brand new web trading platform

- Available to all traders on AAATrade

- Access tens of thousands of ETFs, stocks etc.

- Built-in market updates including an economic calendar

MT5 Webtrader

- Access MT5’s rich offering including technical indicators and graphical objects

- Trade directly from your browser (e.g Safari or Windows) – no need to download any software

MT5 Desktop Download

- Trading signals and copy trading

- Trade currencies, stocks and futures

- Make use of analytical tools and news reports

- Four order execution modes and all types of trade orders

- Software download required – available for download on Apple or Windows devices

MT5 Mobile App

- Available on Android and iOS

- Includes all types of trade orders

- Access the features of MT5 on the go

CryptoExchange™

- Access more than 50 cryptocurrency pairs

- Real time market analysis and market updates

- Download the mobile app on iOS or Android, or use the web platform

Assets

Users can trade tens of thousands of assets on AAATrade:

- CFDs – Including forex, futures (e.g crude oil), indices, bonds, stocks, cryptos, metals and ETFs

- Securities – Including stocks from over 60 global stock exchanges, derivatives, money market securities, bonds, ETFs, precious metals, fixed income, alternative investment funds, and treasury bills

- Cryptocurrencies – More than 50 crypto pairs, including those with the highest market cap, such as Bitcoin and Ethereum

Fees & Spreads

Commission

When trading CFDs, AAATrade offers different spreads and commission rates depending on the chosen account. With a Novice Account, there is zero commission with AAATrade making its money through spreads. This account is comparable to the commission-free trading accounts offered by Trading 212 and eToro.

With an Experienced Account, a commission is charged but spreads are generally lower. For forex majors, a charge of 4 USD/lot applies. For assets traded on the London Stock Exchange, it is 0.85%. Minimum commission applies, even when trading in small volumes.

Spreads

The average CFD EUR/USD spread on the AAATrade Novice Account is 0.0002 (equal to 2 pips). This is a reasonably high spread for such a liquid market.

For CFD Brent Crude futures, the average spread is 0.2 and for the FTSE 100 index, it is 5.31. Average spreads change frequently.

Note, spreads also apply to crypto pairs.

Other Fees

Overnight rollover fees are applicable when you hold a CFD position overnight on AAATrade.

There are also safekeeping fees (Global Custody Services). For portfolios of up to 5 million euros, this is charged at 0.65% p.a. (note, minimum fees apply). This fee is usually debited on the close day of the position.

Other fees may also apply for securities when trading through AAATrade, including execution fees and other custody fees. A 1% exchange fee is charged for all exchanges between fiat currencies.

5% exchange fees are charged when exchanging a fiat currency to cryptocurrency or vice-versa. When exchanging crypto with another token, the exchange fee is 1%.

Traders should also be aware that when transferring crypto between an AAATrade virtual wallet and an external wallet, a 0.2% fee per transfer is charged to cover miners’ fees. Minimum charges apply.

Institutional traders of crypto should contact AAATrade for pricing details.

Be aware of deposit and withdrawal fees too, which are explained further down.

Leverage

On AAATrade, the maximum leverage ratio for CFDs is 1:200. CFDs are a leveraged financial instrument, meaning greater exposure to risk. Let’s say that the margin requirement is 10%. This means an investment of £100 would actually mean exposure to £1,000 of potential losses. Luckily, AAAtrade offers negative balance protection, meaning you cannot lose more than your deposit amount. If your account slips into the negative, this will be capped by the brokerage.

Note, no leverage is available when investing in securities.

Mobile Apps

At this stage, those wanting to trade traditional assets and instruments using a mobile/tablet app should use the MT5 mobile app. Developed by MetaQuotes, MT5 is a familiar platform for many traders, with rich features, a range of technical analysis instruments and various trade orders. The MT5 mobile app can be downloaded on iOS or Android.

AAATrade is working towards releasing its own mobile app that will allow users to trade over 60,000 assets.

The company also has their own separate CryptoExchange app to give customers the opportunity to delve into the world of digital currencies, although this is currently undergoing maintenance.

Payments

Deposits

AAATrade accepts the following deposit methods:

- Credit/debit card (including Visa, Mastercard, and Maestro)

- Bank Transfer (wire transfer)

- Crypto wallet

- QIWI wallet

- UnionPay

- FasaPay

- Neteller

- Skrill

For trading accounts, deposits can be made using EUR, USD or GBP. Credit/debit card deposits are processed immediately but bank transfers can take a few business days. Something else which may slow down the process is that for some methods (e.g wire transfer), AAATrade requires proof of transaction.

Fees apply for deposits unless it is an internal transfer of funds. For example, direct wire transfers cost 10 euros plus foreign charges. For deposits via credit/debit card, the fee is 1.5% plus foreign charges.

Withdrawals

Withdrawal requests are usually processed by AAATrade within 24 hours, although the funds may take longer to reach your account depending on which withdrawal method you choose.

In line with anti-money laundering laws, funds withdrawn will be returned back to the same account that you made your deposit from, although you can contact AAATrade if this is not possible.

Withdrawals via credit/debit cards and e-payment methods do not attract a fee. However, those made via wire transfer cost 10 euros plus foreign charges (i.e the same as the cost of deposits using this method). Keep this in mind when choosing a deposit method as this will impact your cost of withdrawal.

Demo Account

AAATrade does offer a demo account, which is particularly helpful for novice traders who want to experiment before risking any of their own funds.

There is no limit to how long you can use your demo account and you can also request that AAATrade add additional funds if you wish to trial managing large portfolios.

Deals & Promotions

A regulatory crackdown on promotional and financial offers by the Cyprus Securities and Exchange Commission (CySEC) has limited AAATrade’s options when it comes to offering marketing deals.

There are offers of a positive 0.25% yearly interest rate on free margin if your account balance exceeds 25,000 USD/EUR/GBP, as well as commission rebates if your balance exceeds a certain amount (25,000 USD/EUR/GBP for a 5% rebate, 100,000 USD/EUR/GBP for a 10% rebate).

Unfortunately, no sign-up bonuses are currently offered by AAATrade, in line with CySEC regulation.

Licensing

AAATrade is well regulated. The firm is based in Cyprus and is therefore regulated by the Cyprus Securities and Exchange Commission (CySEC). For UK clients, it is covered by the Financial Conduct Authority (FCA). And for German traders, the Federal Financial Supervisory Authority (BaFin) and the National Securities Market Commission (CNMV).

AAATrade Ltd is also a member of the Investor Compensation Fund (ICF) for the clients of Cyprus Investment Firms (CIFs) which protects retail clients up to 20,000 euros if the company was to default on its obligations.

However, crypto traders should be fully aware of the risks involved due to a lack of regulatory protection in this area. Investors in crypto are not entitled to any protection under the Investors’ Compensation Fund and have no rights to report to the Cypriot Financial Ombudsman in the event of a dispute.

Additional Features

- Trading calculators – For calculating trading profits across currency pairs

- Analysis – Provides market forecasts based on fundamental and technical analysis

- Portfolio management (AAATrade Discretionary Mandate) – AAATrade can manage your assets for you

- Advisory services – Offering advice and investment strategies on global markets for individuals, institutions and corporations

- AAATrade Academy (and other educational material) – Includes webinars and e-books

- Economic calendar and live market updates – News on upcoming and live events which may impact the price of assets and instruments

Accounts

To open an account, you will need to complete the following steps:

- Register for a trading account using the ‘sign up’ button in the top right corner of their website

- Complete the Client Questionnaire

- Once completed, you will be able to invest limited funds and have access to AAATrade’s services for up to 14 days

- Verify your account by uploading Proof of Identity and Proof of Residence to continue accessing services beyond the 14 day ‘pending’ period

- Start trading with no limits on deposits

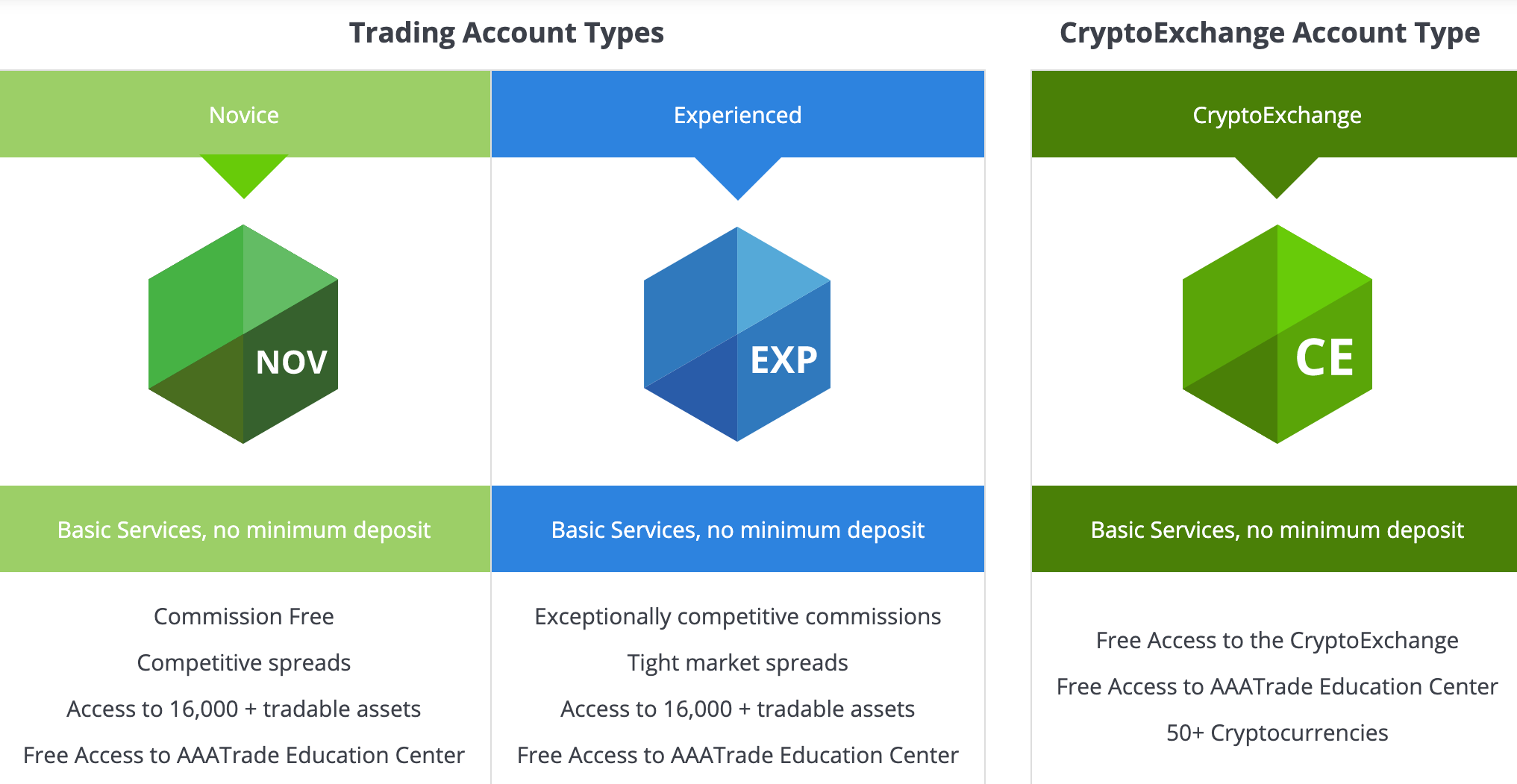

In addition to the demo account offered by AAATrade, there are three main account types:

Novice Account

As the name suggests, this account is more suitable for amateur traders looking for commission-free trading. Be aware that spreads may be higher on this account.

For basic services on the Novice account, there is no minimum deposit. However, advanced and premier versions are available.

A minimum deposit of 25,000 USD/EUR/GBP is required for advanced services, which include 1 on 1 training with technical analysts and a 0.25% positive interest rate. The minimum deposit increases to a sizeable 100,000 USD/EUR/GBP. Plus, you’ll receive a dedicated account manager.

Experienced Account

Tight market spreads are available on the Experienced Account, although commission rates apply.

Advanced and premier services, like with the Novice Account, are also available with the same minimum deposits. The additional benefits, such as dedicated account managers and positive interest on margins also apply, including commission rebates on trades.

CryptoExchange Account

Over 50 crypto pairs are available, and no minimum deposit is required for basic services. Like with the Novice and Experienced Trading Accounts, advanced services (2,500 USD/EUR/GBP minimum deposit) and premier services (25,000 USD/EUR/GBP) are available to crypto enthusiasts. Premier services include a dedicated account manager and priority access to customer support.

Other Services

In addition to accounts for retail investors, AAATrade facilitates institutional investors and also offers liquidity services to other brokers.

Trading Hours

As with most brokers, trading hours depend on the specific market being traded.

Crypto markets are open 24/7, whereas CFD forex trading is 24/5 and the London Stock Exchange is open between 10:00-18:30 (GMT+2).

Customer Support

The customer support team are contactable through the following methods:

- Live chat – Contact can be made through their website (aaatrade.com)

- Email – cs@aaatrade.com

- Phone – Dial +44 203 769 2245 (other local contact numbers available on the website)

- Request a call back by completing the ‘Contact Us’ form on the website

AAATrade also has a presence on Twitter, Facebook, Instagram, LinkedIn and YouTube.

Security

AAATrade uses segregated EU and Swiss bank accounts to hold their clients’ fiat currency.

The broker uses high levels of encryption to protect customer information. Plus, AAATrade works with external IT security providers to ensure their systems are not compromised.

AAATrade Verdict

AAATrade has a large product offering, giving traders of all types and abilities the opportunity to invest in the financial markets. Its commission-free account may appeal to more amateur traders, though it does have a fairly complicated fee structure. Fortunately, the variety of trading platforms used by AAATrade (including MT5) provide good options for a range of traders.

FAQs

Is AAATrade Regulated?

Yes, AAATrade is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) and other regulators within the EU. However, its crypto services are not afforded the same protection.

Does AAATrade Charge Deposit Fees?

Yes, AAATrade charges fees for all deposit methods except for an internal transfer of funds. This includes debit and credit card deposits, though this particular method is not charged for withdrawals.

Does AAATrade Require A Minimum Deposit?

There is no minimum deposit to access basic services for the Novice, Experienced and CryptoExchange accounts. However, advanced and premier services require minimum deposits of 25,000 and 100,000 units of the base currency respectively.

Does AAATradde Allow Mobile Trading?

Yes, AAATrade provides the MT5 trading platform which has a mobile/tablet app with the same features as MT5 Webtrader. The broker is also developing its own mobile app to build on the new AAATrader™ desktop platform.

Does AAATrade Offer A Demo Account?

Yes, AAATrade offers a demo account so you can experiment with the products and services offered before using your own funds.

Top 3 Alternatives to AAATrade

Compare AAATrade with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

AAATrade Comparison Table

| AAATrade | Interactive Brokers | IG | World Forex | |

|---|---|---|---|---|

| Rating | 3.5 | 4.3 | 4.4 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1 |

| Minimum Trade | $0 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SVGFSA |

| Bonus | None | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:1000 |

| Payment Methods | 9 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by AAATrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AAATrade | Interactive Brokers | IG | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

AAATrade vs Other Brokers

Compare AAATrade with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of AAATrade yet, will you be the first to help fellow traders decide if they should trade with AAATrade or not?