Windsor Brokers Review 2024

Awards

- Best Multi-Trading Platform 2018 - Global Brands Magazine

- Best CSR Company 2018 – International Finance Magazine

- Most Transparent Forex Brokers 2018 - Jordan Forex Expo

- Most Trusted Forex Broker 2017 - UK Forex Awards

- Best Forex Provider 2014 - China International Expo

- Best Forex Broker 2011 - Middle East Forex Expo

Pros

- MT4 platform support plus copy trading functions

- Overseen by reputable regulators including CySEC

- Tight spreads and competitive commissions on Zero account

Cons

- Weak customer support and live chat function

- Regulatory oversight varies between entities

- No additional trading platform support

Windsor Brokers Review

Windsor Brokers is an established forex and CFD trading broker. Our review covers spreads, no deposit bonus promotions, MT4 platform downloads and more. Find out whether to open an online trading account with Windsor Brokers.

Windsor Brokers Details

Windsor Brokers was established as an investment firm in 1988. The company has two arms: Belize-based Windsor Brokers (BZ) Ltd, regulated by the International Financial Services Commission and the Jordan Securities Commission, and Cyprus-based Windsor Brokers Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC).

With these branches combined, Windsor Brokers offers its financial services to clients in over 80 countries, including Thailand, Indonesia, Malaysia, South Africa, Dubai, Kenya and Iran.

MetaTrader 4 Trading Platform

Following the registration and login process, clients can download the MetaTrader 4 (MT4) platform. Used by millions of traders worldwide, MT4 offers market-leading features, including:

- In-depth price analysis with 30 built-in technical indicators

- Three execution modes including instant and pending orders

- Expert Advisor programs for automated trading

- A signals service that allows copy trading

- Straightforward and secure login

MT4 WebTrader

The browser-based version of MT4 offers one-click trading without a software download. The same breadth of indicators and drawing tools are available with the web-based platform. WebTrader is compatible with most operating systems and provides full data encryption, so it’s safe to use.

MT4 Multiterminal

Windsor Brokers (BZ) also offers trading via the MT4 Multiterminal platform, an additional component of MT4 that lets clients trade on multiple accounts (up to 128) simultaneously. This can prove useful for advanced traders handling many accounts or professional investors.

Windsor Brokers does not offer MT5 integration.

Assets

Clients at Windsor Brokers can trade on a range of financial instruments:

- Forex – 40+ forex pairs including majors

- Indices – 16 indices offered including Dow Jones and UK100

- Shares – 30+ prime companies such as JPMorgan and Walmart

- Commodities (BZ only) – a choice of five energy and six soft commodities

- Treasuries (BZ only) – four bonds are available including three US treasury notes plus German Bund

- Metals (BZ only) – gold and silver

Although the range of assets available at Windsor Brokers is broad, they could improve their rating in this review by offering cryptocurrencies and binary options trading.

Spreads & Commission

Spreads at Windsor Brokers vary by account type. For Prime account holders, the EUR/USD spread is typically 1.5 pips while with the Zero account, the same spread is around 0.2 pips, though it can drop to zero. Crude oil spreads go as low as 0.03 pips while zero-point spreads are available on indices and shares. Generally, spreads are competitive and comparable with the offering from large providers such as the IG Group.

As a result of low spreads, Windsor Brokers offers a fixed round turn commission of $8, which may be the preferred choice for clients executing large volume trades vs the risk of volatile spreads.

Leverage

Windsor Brokers (BZ) Ltd offers maximum leverage at the following rates:

- Forex – 1:500

- Metals – 1:250

- Spot and CFD indices – 1:200

- Spot and CFD energies – 1:100

- Commodities – 1:50

- Treasuries – 1:250

- Shares – 1:20

In line with EU regulations, the European branch of Windsor Brokers offers maximum retail leverage of 1:30. Professional traders can access the greater leverage rates listed above.

MT4 Mobile App

Trading is also accessible on phones and tablets through the MT4 mobile app, which can be downloaded from the Apple App Store or Google Play Store for iOS and APK users. The mobile app offers all the main platform features including interactive charts and analytical tools. In addition, it provides the functionality to chat with other traders.

Payment Methods

Deposits

Windsor Brokers (BZ) requires a minimum deposit of $100 with their Prime account and $2,500 with their Zero account. Accepted deposit methods include Visa and Mastercard, plus e-wallets like WebMoney and Skrill. Aside from WebMoney, deposits are free to make.

With Windsor Brokers Ltd, most of the same payment methods are available, but there is a 3% transaction fee. Clients can expect same-day processing from both branches.

Withdrawals

Withdrawal requests are also processed the same-day at Windsor Brokers, though at both branches a 3% or £3 fee is charged per transaction. Funds are returned to the same credit card, e-wallet or bank as the deposit was made from, except when using a credit card where more than six months has elapsed. In this instance, funds will be transferred to a named bank account. Withdrawal times and periods depend on the initial payment method.

Note the broker may require identification documents to process withdrawals.

Demo Account

Prospective traders can sign up for a demo account from the Windsor Brokers website. The demo simulator does not require a real-money deposit and allows traders to get a grasp of the MT4 trading platform before they decide to invest.

Bonuses & Promos

Our review was pleased to see Windsor Brokers (BZ) currently offers a free Prime account $30 promotion. This no deposit welcome bonus is available to clients opening their account with USD as their base currency, and cannot be transferred or withdrawn. Full bonus terms and conditions are available on the Windsor Brokers website.

Windsor Brokers (BZ) also offers a deposit bonus of up to $10,000 where the broker will match 20% of the client’s deposit. Clients must deposit at least $500 to claim this promotion and bonus withdrawals are prohibited.

Windsor Brokers Ltd does not currently have promotional offers advertised on their website, which is unsurprising as CySEC-regulated providers are not permitted to offer incentive promotions or bonuses.

Windsor Brokers Regulations

Windsor Brokers (BZ) is regulated by the International Financial Services Commission in Belize and caters to clients globally except the US, EU, and Belize. The branch is also regulated under the holding company Seldon Investments Ltd by the Jordan Securities Commission and accepts clients from Jordan and Arabic regions, with an office in Amman.

Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) and is authorised by the Financial Conduct Authority (FCA). This branch mainly caters to traders from the EU. This broker offers negative balance protection, an assurance that reduces risk as it prevents you from losing more than the amount you deposited. Windsor Brokers is also a member of the Investor Compensation Fund which ensures funds being unreasonably withheld from the client are compensated back to them.

Overall, our review gives Windsor Brokers a good ranking for trust based on these features.

Additional Features

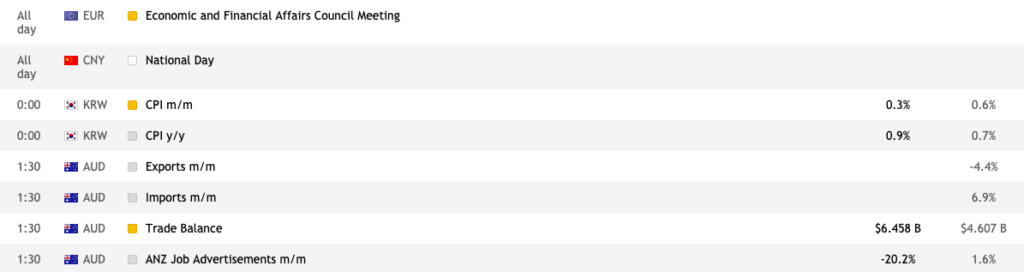

Windsor Brokers (BZ) has a blog with a technical outlook and news section, publishing daily articles on world events and subsequent market effects. The broker also offers an economic calendar and forex calculators, and websites are available in several languages including Farsi.

This broker ranks particularly highly in our review for their strong education department:

- A library of 70 educational videos on trading strategies, market analysis and other useful topics

- A glossary of financial terms with translations in 12 languages

- eBooks on how to succeed in trading forex, stocks, and CFDs

- Regular forex webinars for clients (BZ only)

Account Types

Traders can open Prime or Zero MT4 accounts at Windsor Brokers (BZ):

The Prime option offers a low minimum deposit, no commission charges, and training to equip you with useful trading skills. This account is geared towards novice and casual traders.

The Zero account is meant for more experienced traders and offers low spreads starting at 0 pips, but charges a commission of $8 per round trip and training is not provided.

Those with larger bankrolls may be interested in applying for a VIP Zero account, which comes with a dedicated client manager and one-to-one meetings with technical analysts.

Windsor Brokers Ltd offers an account similar to the Prime with low spreads, commission-free CFD trading, and 1:30 leverage. Professional clients can also apply and benefit from increased leverage rates up to 1:500.

The account verification process is quick and easy across all accounts.

Trading Hours

Users can access the customer trading portal 24/7, however trading times vary depending on the market. Most asset classes at Windsor Brokers can be traded throughout the week, and some markets also have weekend trading hours.

Customer Support

The customer support team can be contacted through the following channels:

Belize

- Phone – +44 3301280930

- Email – support@windsorbrokers.com

- Address – 35 Barrack Road, Belize City, Belize

Jordan

- Phone – +962 6 550 9090

- Email – support.jo@windsorbrokers.com

- Address – 198 Zahran Street Emmar Towers, Amman, Jordan

Windsor Brokers Ltd

- Phone – +357 25 500 700

- Email – support@windsorbrokers.eu

- Address – Windsor Brokers Business Center Spyrou Kyprianou 53, Mesa Geitonia 4003 Limassol, Cyprus

A live chat function is also available on both websites from the chat logo. However upon writing this review, we were not connected to an agent, so traders may find the alternative channels more useful.

Security

Windsor Brokers have a thorough privacy policy to ensure client data is collected and handled securely. This broker also uses firewalls, encryption, and authentication protocols to protect against unauthorised access or misuse of data.

Windsor Brokers Verdict

Windsor Brokers is a good choice for both beginner and advanced traders, offering forex and CFD trading with low spreads and a wealth of educational resources, in addition to no deposit bonus promotions and CySEC regulation. Our review would like to see improvements in the European offering to match the wide asset and account range of the BZ-branch of the firm.

Top 3 Alternatives to Windsor Brokers

Compare Windsor Brokers with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Windsor Brokers Comparison Table

| Windsor Brokers | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, treasuries | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC (Cyprus), IFSC (Belize), JSC (Jordan) | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | $30 no deposit bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 4 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Windsor Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Windsor Brokers | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Windsor Brokers vs Other Brokers

Compare Windsor Brokers with any other broker by selecting the other broker below.

FAQ

Is Windsor Brokers a trustworthy broker?

Windsor Brokers is a safe and well-established broker with good website security. This broker has given clients access to the markets for over thirty years and has won awards for its transparency and customer service.

Is Windsor Brokers regulated?

Windsor Brokers is regulated in Europe by the Cyprus Securities and Exchange Commission (CySEC) and by the International Financial Service Commission of Belize. Seddon Investments also use the Windsor Brokers brand name and are regulated by the Jordan Securities Commission.

What is the minimum deposit at Windsor Brokers?

The minimum deposit accepted is $100, offered on the Prime account type. This low deposit amount is similar to other leading brokers and makes Windsor Brokers accessible for beginners.

What platforms are offered by Windsor Brokers?

Windsor Brokers provides the MetaTrader4 platform. MT4 offers market-leading technical analysis alongside one-click trading, and is available as downloadable software, on internet browsers and as a mobile app.

Does Windsor Brokers offer any bonuses?

Windsor Brokers (BZ) Ltd offers a free account $30 promotion and a $10,000 deposit bonus that credits traders with up to 20% of their deposit.

Customer Reviews

There are no customer reviews of Windsor Brokers yet, will you be the first to help fellow traders decide if they should trade with Windsor Brokers or not?