VALR Review 2025

See the Top 3 Alternatives in your location.

Pros

- 0.01% of a trade's value paid to market makers when you use the Exchange Buy/Sell service

- The brokers Exchange Buy/Sell platform will appeal to experienced retail traders, with access to interactive TradingView charts

- Earn hourly staking rewards on certain assets, or save up to 15% on trading fees when you refer a friend

Cons

- Only ZAR fiat currency available

- Limited educational content and resources

- No demo account

VALR Review

VALR is a South African-based crypto broker and digital currency exchange. Users can buy, sell and trade 60+ popular cryptocurrency tokens, including Bitcoin, Litecoin, and Ethereum. This 2025 review of VALR will cover the registration and verification process, login security, deposit and withdrawal fees, platform features and more.

VALR Headlines

VALR was first established in 2019 and has its headquarters in Johannesburg, South Africa. Since becoming fully operational in 2021, the platform has amassed over 100,000 active users. The broker has proven particularly popular at home, where over six million South Africans are estimated to own digital currency.

The purpose of the digital exchange is to bridge the gap between the traditional fiat financial system and the new world of crypto-assets. With this, the company has worked to create a suitable trading environment for both beginner investors and advanced day traders.

The firm aims to provide the best crypto trading solution on the market with transparent fees, alongside high-quality customer service, robust technology and advanced safety protocols. Retail clients can buy, sell, store and transfer crypto-assets seamlessly and securely.

Like most crypto exchanges, VALR does not hold a license with the Financial Sector Conduct Authority (FSCA) or any global regulatory body.

Trading Platforms

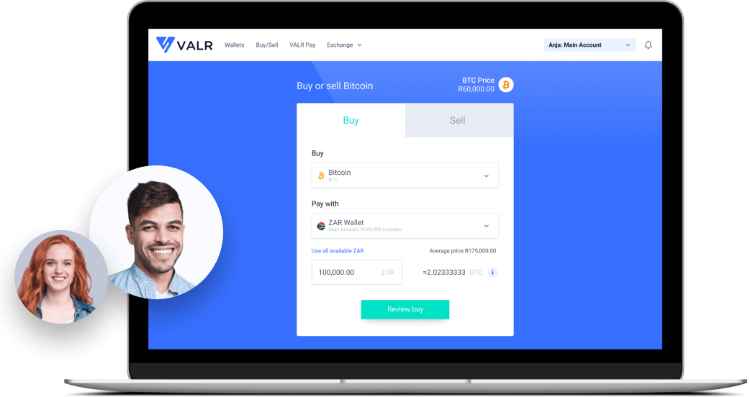

There are two platform options. The Buy/Sell terminal is ideal for beginners, with simple trade executions, clear chart layouts, easy-to-understand price predictions and transaction history information. The Exchange platform is designed for more experienced day traders.

Both terminals are user-friendly and can be accessed via a web browser. There is no downloadable version available on PC devices.

Features include trade history, a common ledger order book interface and advanced charting and technical indicator layers.

Simple Buy/Sell

The easiest way to swap one asset for another via the VALR platform. The Buy/Sell terminal allows users to swap a specific amount of one crypto, for another, at the best price from the VALR exchange or a liquidity partner. Protections are also in place to limit quote acceptance that is significantly different from the current market price.

Exchange Platform

The VALR Exchange is available to all customers, though it is best suited to retail investors with some experience in digital currency trading. Features of the platform include:

- Open/Complete Orders Page – Reflects the list of orders you have placed that have not yet been fully matched with another user

- Interactive Charting – The broker’s charting tools are provided by TradingView. Functionality includes variable time scales, fully customizable views (chart, line, area, heikin) and full price history

- Buy/Sell Order Form – Purchase cryptocurrency at the ruling market price (paying 0.2% in fees) or place a limit order at a certain price (paying 0.2% if you match with an existing order)

Tokens & Assets

VALR has partnered with global players to provide fast trades, dependable digital wallets and industry-leading security. The online exchange provides access to 60+ crypto-assets to buy, hold or trade.

The list of available tokens includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Shiba Inu (SHIB)

- Dogecoin (DOGE)

- Litecoin (LTC)

- Ripple (XRP)

VLAR Fees

Full transparency and fair pricing are among VALR’s main objectives. With that in mind, the broker does not apply any account opening charges, cryptocurrency storage rates or monthly management fees. Below we outline some of the key finance charges to bear in mind when registering for an account:

- Simple Swap – 0.85% per trade

- Simple Buy/Sell – 0.75% per trade

- Exchange Buy/Sell – 0.1% for takers. -0.01% for makers (the broker will pay you)

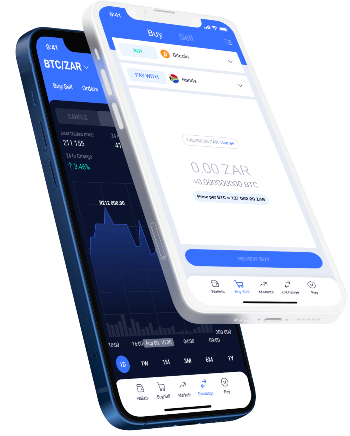

Mobile App

The VALR platform is available as a mobile app. Accessible on both Apple and Android devices, the mobile application features all the functionality of the web terminal in an intuitive interface designed for smaller screens. Clients can execute trades, view portfolio performance and purchase cryptocurrency in one click.

Users simply need to download the mobile app from the relevant app store and sign in with their VALR login details.

Payment Methods

Deposits

VALR accepts account funding in both fiat money and cryptocurrency. There are no minimum deposit requirements and the broker does not charge any deposit fees, although third-party charges may apply.

The exchange accepts payment via bank wire transfers, South African debit/credit cards, and VALR Pay, among others. Accepted currencies include the South African Rand (ZAR), Bitcoin (BTC), Ether (ETH), Solana (SOL), Ripple (XRP) and Binance Coin (BNB).

ZAR deposits can take up to 48 hours to reflect in client accounts. Cryptocurrency deposit processing times can vary depending on network confirmation requirements.

Deposits must be made via the ‘Wallets’ page in the client hub.

VALR Pay

VALR Pay is a fast, free and simple way to make cash or cryptocurrency payments to any mobile number, email address, or other VALR Pay ID. It works by unique QR code reference, meaning customers can simply scan and receive to make a payment.

Minimum (0.00001 BTC or equivalent) and maximum limits (10 BTC or equivalent) apply.

Withdrawals

There are no minimum or maximum withdrawal limits for fiat currency. Daily withdrawal limits are, however, imposed on crypto profiles. This includes a 0.2 BTC daily limit for verified accounts.

Processing times vary by method, but the broker aims to process all requests within 24 hours. Fast withdrawals in South African Rand are also available with some participating banking institutions. No withdrawals are processed on public holidays or Sundays.

There are no withdrawal charges for the first payment per calendar month. Any further withdrawals will incur an R8.50 fee for fiat payments or a network variable crypto charge.

Demo Account

VALR does not offer demo account services to new customers. Although very few crypto exchanges do offer a paper trading account, major competitors, including Binance and KuCoin, do provide demo exchange environments.

Paper trading accounts are a great way to practice strategies risk-free and learn platform features and tools. It might be worth registering for a new profile, without adding any personal capital at first to navigate the broker’s crypto trading services.

Deals & Promotions

There are several reward schemes available for new or existing VALR customers. Benefits include discounts on trading fees. VALR is, in fact, the first exchange in South Africa to pay market makers a percentage of their trade value whenever their orders get matched. The reward scheme pays market makers 0.01% of a trade’s value to provide liquidity to the exchange’s order books.

Alternatively, the broker’s referral program is designed on a rebate and reward scheme. Simply explained, the more referrals you complete, the more rewards you are entitled to. For example, if you successfully refer two or more customers, you are entitled to a 15% rebate on your trading fees and a 10% reward on your referrals’ trading fees.

As with all regulatory guidelines across the cryptocurrency exchange, there are no restrictions on bonuses or financial incentives. With this in mind, always review terms and conditions before you sign-up. Unrealistic minimum thresholds and withdrawal requirements may be set.

Regulation & Licensing

VALR is not licensed by any regulatory body. It is important to note that this is common among crypto exchanges. Still, caution should be taken as the lack of regulation means that in the event of hacks, scams or insolvency, funds may not be refunded.

According to the Cointelegraph, South Africa’s Reserve Bank is set to begin regulating cryptocurrencies as financial assets, with exchanges expecting the move to drive further digital currency adoption across the region. Before this, the cryptocurrency space has been left to develop organically in South Africa, with no clear-cut regulations issued by the South African Reserve Bank (SARB).

Additional Features

It was disappointing to see a lack of educational content and resources for retail traders. The VALR broker platform does not provide access to the latest market news, basic trading terminology or online training guides. It would be good to see this information integrated in the future to create a comprehensive investing environment. A live chat peer forum, integrated YouTube video content or group webinars would also be beneficial.

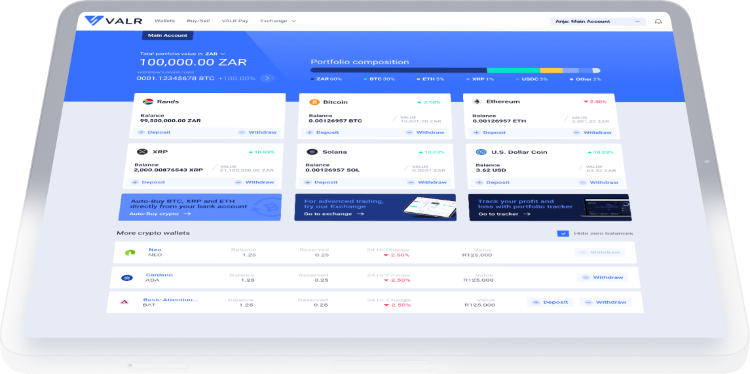

A portfolio tracker is available to all VALR users. This allows clients to monitor the performance and distribution of their holdings on the VALR exchange. Personal portfolios can be displayed in a preferred reference currency, including USD, BTC and ZAR. Investors can view total portfolio distribution, profit/loss performance insights, and composition by asset.

VLAR Accounts

You won’t find multiple account options when signing up with VALR. Retail investors must sign up to one online profile to begin buying, selling or trading cryptocurrency.

Trading with the broker is ideal for investors of all experience levels. Beginners can explore the simple Buy/Sell network vs the more advanced, customizable investing platform to execute trades. There are no restrictions on how you trade.

- Exchange Buy/Sell – For the more experienced day trader. Use the high-performance exchange platform to market make, and in time get paid to trade

- Buy/Sell – Begin with the basics using the buy/sell feature. Simply select an asset, enter the amount you want to spend, and confirm your purchase

Opening An Account

It is easy to register for a new live trading account. Processing can be completed in under five minutes. All registration details must be completed via the ‘Get Started’ icon, located at the top right of the homepage.

Sign-up requirements include completing the online registration form, uploading identity documents with automated verification technology and providing proof of residency.

Trading Hours

The crypto trading market is open 24 hours a day, 365 days a year. This means you can buy and sell digital currency around the clock.

The crypto market isn’t hosted on a regulated exchange – it is spread across a decentralized network of global computers.

Customer Support

We were disappointed with the limited customer service options offered by VALR. All communication requests must be submitted via an ‘issue log’ found on the broker’s website. The automated service directs questions to a specific team member to review and resolve. Although response times are unclear, we found several positive reviews regarding timescales.

It would be good to see the broker’s contact number, email address, office address or live chat service made available in the future. Nevertheless, there is a highly comprehensive FAQ section. The questions cover several in-depth topics, including investor relations, new account registration support and personal hub login help.

Alternatively, the crypto exchange is active across social media channels including Twitter. Visit these profiles for the latest news or live update information on system performance, outages or peer queries.

Security

VALR uses artificial intelligence and machine learning technology to automate compliance measures. The broker’s comprehensive onboarding process is also designed with KYC (know your customer), AML (anti-money laundering) and CTF (counter-terrorism financing) regulations in mind.

Photo evidence of your ID is required before a ‘liveness’ test is requested with a short video or selfie. The broker uses the latest technology to match your face with your ID.

All sensitive information, both in transit and at rest, is fully encrypted. Two-factor authentication (2FA) is enabled by default for all critical transactions. This includes an authorization for all attempts to access an account from any new device or location. We would recommend adding this as a standard for all account transactions.

All funds are 100% fully reserved. The broker has partnered with Bittrex, a leading global blockchain platform, to keep client assets safe. With this, the cryptocurrency storage system spans both ‘cold storage’ and ‘hot wallets’.

VALR Verdict

Our VALR broker guide has highlighted the pros and cons of trading crypto on the investing platform. We were pleased with the transparent fee structure, different platform styles for varying experience levels, advanced security protocols and proprietary payment app. It would be good to see upgrades to the customer support, plus a demo account and improvements to the brand’s educational resources.

Be careful when opening an account with unregulated crypto brokers – your capital may be at risk.

FAQs

Does VALR Offer A Demo Account?

No, VALR does not currently offer a free demo account for new or existing customers. This is common with online crypto exchanges. With this in mind, we would recommend starting with a small deposit to get comfortable with the broker’s trading conditions.

Is VALR Regulated?

VALR is not licensed by a global regulatory body. It is important to note, however, that this is typical among cryptocurrency brokers.

Does VALR Offer Broker Services To Residents In The UK And US?

VALR does not provide crypto trading services to residents of the United States. However, UK residents can sign up with the cryptocurrency exchange.

When Can I Trade On The VALR Platform?

Unlike trading shares or forex, the cryptocurrency market is open 24 hours a day, 365 days a year. This means you can buy and sell digital currency regardless of global exchange timings. Keep an eye on the latest broker news and updates for any planned system outages.

How Do I Register For A New VALR Broker Account?

It is easy to sign up for a new VALR exchange account. All registration details must be completed via the ‘Get Started’ icon, located in the top right on the home web page. Once your ID is uploaded and automated verification is complete, you can login and start trading.

Best Alternatives to VALR

Compare VALR with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

VALR Comparison Table

| VALR | Interactive Brokers | Kraken | |

|---|---|---|---|

| Rating | 2.2 | 4.3 | 3.9 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $0 | $0 | $10 |

| Minimum Trade | Variable | $100 | Variable |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Bonus | Reward Scheme | – | Lower fees when trading volume exceeds $50,000 in 30 days |

| Platforms | TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | AlgoTrader, Quantower |

| Leverage | – | 1:50 | – |

| Payment Methods | 4 | 6 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Kraken Review |

Compare Trading Instruments

Compare the markets and instruments offered by VALR and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| VALR | Interactive Brokers | Kraken | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | No |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | Yes |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

VALR vs Other Brokers

Compare VALR with any other broker by selecting the other broker below.

Customer Reviews

5 / 5This average customer rating is based on 1 VALR customer reviews submitted by our visitors.

If you have traded with VALR we would really like to know about your experience - please submit your own review. Thank you.

I have problem with my password valr it doesn’t give me code to activate my password I have three days trying to reset my password so I decided to valr to refund me