TeraFX Review 2024

Pros

- Top-tier regulation by the UK's FCA, boosting the firm's trust and security score

- A good range of free deposit methods, including credit cards, bank transfers and e-wallets, plus 4 accepted currencies

- Spread betting opportunities on 29 instruments with zero commissions and competitive minimum bets from £0.50

Cons

- MT5 only available to spread betting clients

- $100 minimum withdrawal

- Narrow range of instruments compared to other brands, and no stocks

TeraFX Review

TeraFX is a forex broker providing regulated trading services to clients within the EEA. This review explores the pros and cons of opening a trading account, including customer opinions, minimum deposits and leverage rates. We’ll also explore the client portal and login requirements.

TeraFX Company Details

TeraFX UK is a brokerage brand owned by Tera Europe Limited. The broker’s headquarters are in London, UK, though there is a second office in Warsaw, Poland. TeraFX provides trading services with forex pairs and contracts for difference (CFDs) in commodities, indices and precious metals.

The broker is regulated by the UK Financial Conduct Authority (FCA).

MetaTrader 4 Trading Platform

TeraFX offers MT4, one of the industry’s top trading platforms. Great for all experience levels and trading strategies, the platform has many tools and features, including:

- 30 customisable indicators

- 50 technical analysis tools

- Bollinger bands & pivot points

- Four pending order types

- One-click trading

- Nine time frames

- Intuitive design

Tera FX’s website offers a MT4 download for both Windows and Mac computers.

Markets

TeraFX offers a range of tradeable forex pairs and CFDs. There are 59 forex pairs, six metal CFDs, 12 stock indices, four cryptocurrencies, and two energies available.

Overall, the broker covers a decent breadth of financial markets.

Spreads & Commission

TeraFX offers raw spreads with the ECN account. In addition, the broker charges a $7 commission, which is fairly steep. As a result, the broker isn’t the cheapest forex broker on the market.

Swaps are charged for holding positions open overnight. These rates vary daily and can be found on the broker’s website.

Leverage

Leverage rates with TeraFX are limited due to EU regulation. 1:30 is the maximum rate for major forex pairs and some minors whereas other minors are capped at 1:20. Exotic pairs, along with metals and indices vary up to 1:20, while other commodities are limited to 1:10 and no leverage is available on cryptos.

Professional clients can access higher leverage rates. Major and minor forex pairs are offered at 1:200 leverage, with exotics, metals and indices varying up to 1:200. Commodities are leveraged at 1:60 and cryptos up to 1:6.

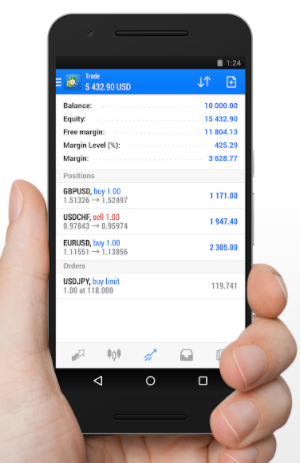

Mobile Apps

The broker offers a free mobile version of its trading platform, MT4. TeraFX’s app contains most of the desktop platform’s capabilities, though with slightly fewer analysis tools. The mobile app can, however, be used wherever you have an internet connection – perfect for traders on the go.

Payment Methods

Transactions with a TeraFX account can be made through Visa and Mastercard payment cards, e-wallets or bank transfers. Accepted currencies are USD, EUR, GBP, PLN. Payment cards have a minimum deposit of £100 and are processed instantly.

E-wallets that can be used are Neteller, Skrill, Sofort and UnionPay. All e-wallets have a maximum deposit of £5,000 and are processed instantly. Bank transfers take 1-5 business days to be processed, though there are no limits.

TeraFX’s withdrawals take longer to process, with payment cards taking two to five business days and wire transfers and e-wallets taking one to five business days.

Deposits and withdrawals are free, however withdrawals from accounts with zero trades are charged $25.

Demo Account

Demo accounts are a great way to explore new brokers and trading strategies, all the while developing your skills in a risk-free environment. TeraFX offers a practice account that can be loaded with up to $10,000 in simulated money and has live prices and order types.

Deals & Bonuses

Current EEA regulations restrict brokers from offering deals and promotions to attract clients. Therefore, TeraFX offers no bonuses at the time of writing. See the broker’s website in case of any changes.

Regulation Status

The broker is regulated by the Financial Conduct Authority (FCA) in the UK, one of the most rigorous regulatory agencies. Clients are also protected by the Financial Services Compensation Scheme (FSCS), which allows claims up to £85,000. Lastly, the broker complies with the EU Markets in Financial Instruments Directive (MiFID II).

Overall, we’re satisfied that the FCA license means TeraFX is not a scam.

Additional Features

TeraFX provides a good VPS service to its clients, with four different levels to cater for a variety of needs. A VPS allows traders to run algorithmic trading strategies on a virtual server that is always connected to the internet. VPS have lower latencies, faster processing, and are not taken down with connectivity issues.

The broker also offers a series of webinars to its clients, that are recorded and accessible on their website. These webinars cover a range of topics, from trading psychology to signals tutorials.

Account Types

There are three account options for retail traders, each aimed at traders of different experience levels. Every account has access to MT4 on desktop and mobile, a minimum deposit of $100 and can be loaded with USD, GBP, EUR or PLN.

- Standard – The most basic option, with a focus on forex trading for newer users. There are 82 tradeable instruments and no commissions.

- Premium – Geared towards more experienced traders with greater knowledge of the markets. There are more assets offered, tighter spreads and no commissions.

- ECN – Aimed at traders with strategies requiring minimal execution speeds. 82 instruments can be traded and there is no spread mark-up from the liquidity providers, however, there is a $7 commission.

Traders that meet the requirements for EU professional classification can upgrade their account for higher leverage rates. There are also Islamic swap-free accounts and corporate accounts. Speak to the customer support team using the details below for more information.

Trading Hours

TeraFX’s forex trading hours are 24/5, starting at 22:10 GMT Sundays and closing 21:50 GMT Fridays, with a break at 21:59-22:05 GMT for swap calculations. Metals are the same though markets open 23:10 GMT Sunday and the break is an hour longer. Cryptos follow forex hours, though they close at 21:20 GMT on Fridays. Commodities and indices follow mostly the same hours, though these can vary and should be checked on the website.

Customer Support

TeraFX can be contacted via telephone, email or a live chat widget on the website. There are separate points of contact for clients looking to contact the UK and Polish offices:

- Telephone UK – +44 203 048 4764

- Telephone Poland – +48 22 3-8 14 06

- Email UK – customerservices@terafx.co.uk

- Email Poland – sekretariat@terafx.pl

- Live chat – Lower right corner of the website

Security

Following regulatory standards, client capital is segregated from the broker’s own funds. Known as ring-fenced protection, the Royal Bank of Scotland and Citi Bank holds client money and does not allow the broker access for other business purposes.

TeraFX also complies with the EU General Data Protection Regulation (GDPR).

TeraFX Verdict

TeraFX is FCA-regulated and offers many tradeable assets, a full suite of VPS solutions, and receives positive customer reviews. We would recommend TeraFX to more experienced traders with a good understanding of the markets and the broker’s fee structure.

Top 3 Alternatives to TeraFX

Compare TeraFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

TeraFX Comparison Table

| TeraFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.6 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:200 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 3 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by TeraFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TeraFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

TeraFX vs Other Brokers

Compare TeraFX with any other broker by selecting the other broker below.

FAQ

Can I trade with TeraFX in Europe?

TeraFX is regulated by the FCA and authorised to provide its services anywhere within the European Economic Area. So clients can trade anywhere in the EU, UK, Iceland, Liechtenstein or Norway.

What is the minimum deposit to open a TeraFX account?

The minimum deposit accepted by TeraFX is $100, or equivalent. There is not a change in requirements for different account types.

What trading platform can I use with TeraFX?

MetaTrader 4, among the most widely used and praised trading platforms, is offered for free to TeraFX clients. It can also be installed and used on the demo account.

How do I open a TeraFX account?

To open a trading account, simply follow the steps given on the website under Open a Live Account, providing the correct information and documents requested. Once registered, clients simply need to login to the TeraFX client portal to start trading.

Is TeraFX a scam?

The broker is regulated by one of the most trusted agencies in the world, the UK FCA. This implies TeraFX is trustworthy and legitimate. Furthermore, if the broker turns out not to be, the FSCS will compensate clients for up to £85,000.

Customer Reviews

There are no customer reviews of TeraFX yet, will you be the first to help fellow traders decide if they should trade with TeraFX or not?