Stratton Markets Review 2024

Stratton Markets offers leveraged online trading on its Trader platform & MT4.

Forex Trading

Stratton Markets offers major, minor and exotic currencies.

Stock Trading

Stratton Markets offers single stock trading and access to major indices.

CFD Trading

Invest on the financial markets with leveraged contracts for difference (CFDs).

Stratton Markets is an online broker offering forex and CFD trading. Our review covers the important features of working with this broker, including the login process, deposits and withdrawals, plus mobile apps. Find out whether to open an account with Stratton Markets.

Company Headlines

Stratton Markets is operated by F1 Markets Ltd, a firm regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker provides services to residents in the EU and European Economic Area, except the UK and Belgium, in addition to Switzerland.

With a generous portfolio of products and multiple account tiers to suit client needs, the brokerage attracts attention from retail traders and professionals.

Trading Platforms

To open the trading platforms, users need to log in via the Trade section of the broker’s website after they have registered for an account. Once passed the login portal, clients can choose between two trading terminals.

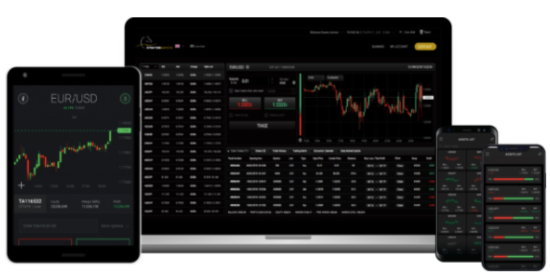

Stratton Trader

Stratton Trader is the broker’s web-based platform, developed in-house with the client in mind. The slick solution offers a suite of charts, graphs and technical indicators, along with multiple order windows. Traders can follow the markets in real-time and implement a breadth of risk management tools. Features include:

- No download requirement

- Flexible interface including multi-view option

- All assets available to trade with one click

- Stop loss and take profit operations

Clients who are Gold account holders or higher can also sign up for trading signal alerts via SMS, provided by Trading Central.

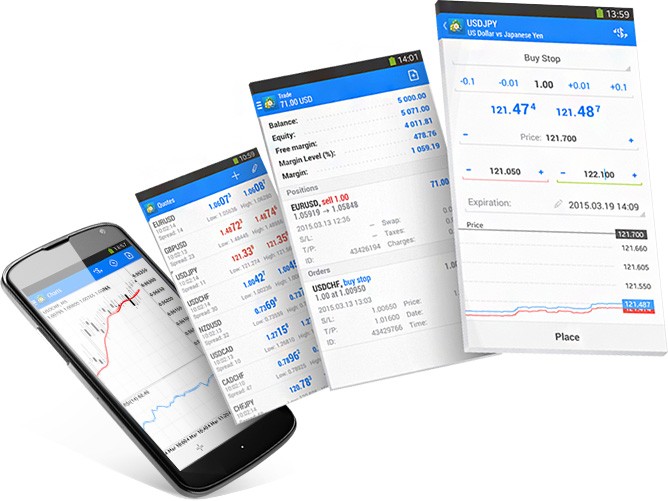

MetaTrader 4

The MetaTrader 4 (MT4) platform is a popular user-friendly software solution for forex and CFD trading. As the industry titan, the terminal ticks the box for beginners and experienced professionals, providing an all-in-one trading solution. MT4 has a highly customisable appearance along with a wide range of industry-leading trading tools, including:

- 30 in-built technical indicators

- 3 execution modes and 4 order types

- Interactive charts with 9 time-frames

- 23 analytical objects

Assets

Stratton Markets clients have access to over 290 trading assets across four instrument classes:

- Forex – take positions on major USD pairs along with minor and emerging currencies

- Commodities – speculate on the price of metals such as gold and silver along with energies such as oil

- Stocks – buy and sell single stocks in some of the world’s foremost companies, from Google to Facebook

- Indices – take positions on leading stock exchanges from the US and UK to Europe and Asia

Spreads & Commission

Stratton Markets fees are built into its fixed spreads, which are advertised as some of the lowest in the industry. As such, the broker charges no additional commission for individual trades.

However, the firm does charge swap fees for positions held open overnight, and clients can expect considerable monthly inactivity bills. These begin at €80 for 1-2 months, rising to €120 and €200 for 2-6 and 6-12 months of inactivity. Trading accounts inactive for over 12 months are considered ‘dormant’ and charged €500 – clients must then pay €1,000 if they wish to reactivate. These rates are steep and may deter many traders.

Leverage

Leveraged trading is available to clients at Stratton Markets, and the maximum that is accessible depends on the account type held and professional vs retail status.

Retail

- Forex majors and minors – 1:30

- Forex exotics, gold, and major indices – 1:20

- Energy commodities and minor indices – 1:10

- Stocks and shares – 1:5

- Cryptocurrency – 1:2

Professional

- Forex majors and minors – 1:400

- Gold and major indices – 1:200

- Forex exotics and energy commodities – 1:100

- Minor indices – 1:50

- Stocks and shares – 1:10

- Cryptocurrency – 1:5

Traders can apply for professional status if they meet two of the following criteria:

- Sufficient volume – at least ten trades per quarter over the last year, and each trade size worth a minimum of $4,000 in stocks/cryptocurrency or $18,500 in forex/commodities

- Employment – at least one year in a financial field with expertise in CFDs

- Portfolio size – at least €500,000

Mobile Apps

The Stratton Markets mobile app is available from Google Play for Android devices. The app allows clients to trade on-the-go and includes charting operations. Straightforward deposits and withdrawals are also available on the application along with customer support options.

The MT4 mobile app can be downloaded to Android and iOS smartphones and tablets. Traders have access to much of the functionality found on the desktop version, including interactive charts, key analytical tools, and one-click execution. The app also offers a chat function between users.

Payment Methods

Deposits

Stratton Markets traders can make payments into their account using credit cards, Skrill, Neteller, and wire transfer. Clients can deposit in one of four currencies – US Dollar, British Pound, Euro, and Swiss Franc. The minimum payment is $/£/€/Fr 250, and there are maximum deposit limits of €10,000 daily and €40,000 monthly for traders using a credit card.

Withdrawals

Clients can request a withdrawal via the website banking page. Users may have to produce identifying documents and each new payment method must be verified upon first use. At Stratton Markets requests are processed the next business day, but receipt of funds depends on the payment method. Withdrawal times for bank transfer are 3 – 5 days, and 5 – 7 days for credit cards.

Payment fees depend on account type and funding route. Basic and Silver account holders can expect to pay 3.5% charges on card and Neteller withdrawals, 2% on Skrill, and €24 or currency equivalent for wire transfers. Gold and Platinum members and any trader using the service for the first time can withdraw for free.

Demo Account

Stratton Markets offer a risk-free demo account to traders. The account includes $100,000 in virtual funds to test the MT4 or Stratton Trader platforms before making a cash deposit. Users get access to the full range of financial instruments along with customer support.

Stratton Markets Bonuses

Stratton Markets is not currently advertising offers to retail clients due to licensing conditions.

Regulation

Stratton Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), a major financial authority. Clients can trust that their funds are safe as this broker is a member of the Investor Compensation Fund, and uses segregated accounts at Tier 1 banks. It also provides negative balance protection to all retail clients, which prevents you from falling into negative equity.

Additional Features

Stratton Markets offers educational material and training sessions to all traders, including webinars with prominent speaker Michalis Efthymiou for all but Basic account members. Clients can also enjoy the #AskStratton podcast and daily market wrap up alerts. In addition, professional clients can access VIP Platinum education and exclusive trading contests, as well as the VIP room podcast.

Stratton Markets Accounts

Clients can choose from five account options: Basic, Silver, Gold, Platinum, and Diamond:

- Minimum volume per trade is 0.01 for Basic and Silver account holders, 0.05 for other members

- Gold and Platinum members get monthly and weekly account overviews respectively

- The Diamond solution has many of the same perks as professional accounts

- Top three tiers get free entry into Stratton trading contests

Benefits

Trading with Stratton Markets has several benefits:

- MT4 integration

- Several account types to fit your needs

- Educational and training content plus webinars

- Functional own brand platform and mobile app

Drawbacks

- No Bitcoin trading

- High monthly inactivity fees

- Lack of transparency around spreads

Trading Hours

The Stratton Markets website is available to clients 24/7. However, trading hours for each instrument depend on when the market is open and this varies for each asset. For example, stocks are usually traded during daytime hours on weekdays, whereas the forex market trades 24/5.

Customer Support

Traders can contact the customer team, called Strattoneers, using the following channels:

- Phone number – +351 304502720

- Email – hello@strattonmarkets.com

- Online contact form – broker’s website

- Address – 43 Kolonakiou Avenue, Limassol 4103, Agios Athanasios, Cyprus

Security

Stratton Markets have a robust privacy policy including administrative, technical, and physical safeguards to protect your personal data, which is stored on secure servers. The MT4 platform also offers dual factor authentication at the login stage.

Stratton Markets Verdict

Stratton Markets is a forex and CFD broker with its own platform and mobile app alongside MT4. It provides several payment routes for deposits and withdrawals in addition to a wide range of trading assets. The broker may appeal to traders looking for a variety of account options and a wealth of educational content.

Top 3 Alternatives to Stratton Markets

Compare Stratton Markets with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

Stratton Markets Comparison Table

| Stratton Markets | IG | AvaTrade | FP Markets | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4.9 | 4 |

| Markets | Forex, CFDs, shares, indices | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | £250 | $0 | – | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | ASIC, CySEC, ESMA |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | 1:30 (Retail), 1:400 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:30 (Retail) 1:400 (Pro) | 1:30 (UK), 1:500 (Global) |

| Payment Methods | 6 | 6 | 13 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

AvaTrade Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Stratton Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Stratton Markets | IG | AvaTrade | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Stratton Markets vs Other Brokers

Compare Stratton Markets with any other broker by selecting the other broker below.

FAQ

Is Stratton Markets regulated?

The broker is located in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC). Oversight by this major financial body should give traders confidence when opening an account.

What leverage is available at Stratton Markets?

Maximum leverage of 1:30 is offered to retail traders at Stratton Markets. Professional traders can access leverage rates up to 1:400.

What account types are offered by Stratton Markets?

The broker has Basic, Silver, Gold, Platinum, and Diamond accounts. Higher account tiers offer benefits like free entry into trading contests, additional educational content, and webinars.

What payment routes can I use with Stratton Markets?

Clients can use credit cards, Skrill, Neteller, or wire transfer to make deposits. Deposits are fee-free but clients can expect a charge for withdrawals.

Does Stratton Markets have a demo account?

The broker offers a demo account, funded with $100K in virtual money. The trial account allows clients to practice on the trading platforms before committing capital.

Customer Reviews

There are no customer reviews of Stratton Markets yet, will you be the first to help fellow traders decide if they should trade with Stratton Markets or not?