‘Rally in Everything’: What Needs to Happen for It to Continue

When central banks turn dovish (i.e., ease policy through lower rates and/or asset buying), this is bullish for both risk and safe assets. Namely, it is bullish for stocks and bonds, and is commonly dubbed in the media as the “rally in everything”.

It is also bullish for gold. Gold is a type of shadow currency, or a currency proxy. Gold is a type of alternative cash or alternate money. When reserve currencies decline – the US dollar, in particular – gold typically increases. The charts below shows the rolling correlation between gold and the US dollar, generally always showing a negative correlation.

Currencies with newly dovish messaging form their central banks tend to decline because their yields fall. Traders are no longer compensated as much holding them, pushing them into other assets.

Lower real (i.e., inflation-adjusted) rates are also supportive of commodities. Since the increasingly dovish shift from the Fed – namely, acknowledgement that they need to cut rates – we’ve seen oil rise close to 20%. Oil tends to follow economic activity and industrial production expectations, as it increases demand for the commodity.

Granted, not “everything” increases when a central bank turns dovish. For example, in order to properly trade individual commodities, you need a deep understanding of the cost structures of each micro commodity market.

What will keep the ‘rally in everything’ going?

Traders expect 90 basis points of easing in the federal funds rate over the next year (currently at 240bps). This is mildly aggressive but doable. The best environment for stocks is not generally a big, booming economy. Rather it’s a slower, languishing economy that central banks are trying to get going again. Accordingly, slower growth and slower inflation can be beneficial if the Fed (and European Central Bank and Bank of Japan) respond in conjunction and follow what’s discounted within the curve.

Moving forward, US GDP is expected to be around 1.0-1.5 percent by the end of the year. Core inflation is expected to come in around 1.5-2.0 percent. That comes to 2.5-3.5 percent nominal adding the two ranges together. Generally, overnight interest rates that are set by the central bank should be some 175-225 basis points lower than nominal growth. Central banking is fundamentally about debt and credit management, as that’s what drives economic cycles. Overnight rates feed into the capital market rates that consumers, corporations, and governments borrow at. If debt servicing payments exceed income for a long enough period at a pervasive enough level in the economy, then a recession will be inevitable.

Lowering rates also boosts what are known as “financial conditions”. There is no agreed upon standard by which financial conditions are measured, but they are generally defined as how the changes in credit, currency, equities, volatility, and credit spreads have an effect on growth.

The Fed is likely to lower the fed funds rate by 25 basis points later this month at its policy meeting. Most Fed officials are currently on board with reducing the rate 25bps, though some (a minority) want to hold steady.

A September rate cut is also likely, though they have little clarity beyond that. Current expectations can always be tracked via the CME FedWatch Tool, posted on the CME Group’s website. The calculations are always relatively accurate. This takes the fed funds market and tabulates the implied probabilities of the Fed moving to a certain rate range by the given date.

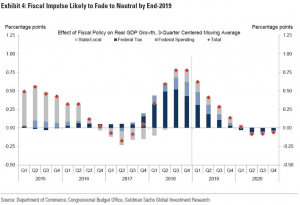

Much of ongoing decline in US GDP is a function of the pass-through of the US tax cuts and spending bill that was passed in 2017.

Based on the decline in real GDP, the Fed cutting rates once per quarter over the next year would be a good baseline plan. Monetary policy is fundamentally based on maximizing real output within the context of price and financial stability. Accordingly, rates of change in real output should be used as a basic policy standard.

Threats to the Rally

Central bank easing helps support the growth and inflation environment. Higher growth and higher inflation are generally bad for bonds and can be bad for stocks. As mentioned above, while it may seem like a rebound in growth should be beneficial for stocks, if the rise in rates offsets the rise in growth, then stock prices will decline due to the present value effect by which their expected future cash flows are calculated.

A rebound in inflation expectations is a headwind to stocks and bonds, holding all else equal. US 10-year inflation expectations (called the 10-year “breakeven”) have rebounded from 1.61% as of June 17 to 1.77% on July 12. 1.61% was a low that hadn’t been seen since October 2016:

However, it is unlikely that inflation expectations will rebound in a material way because there’s a lot of debt throughout developed market economies. This directs more income toward debt servicing and away from consumption and investment.

Monetary policy being run through the rates and bond market channels – rate adjustments and asset buying – only helps to facilitate so much inflation in goods and services.

Inflationary pressures have been subdued throughout the developed world for a number of factors:

– technological improvements that have helped productivity and increased pricing transparency throughout economies

– globalization, including labor arbitrage behavior (using offshore workers to save on costs),

– the effects of more businesses that are heavily driven by market share (rather than profits) – e.g., think Amazon, Uber, Lyft

If central banks were to target their policies toward spenders more directly, the case for rising inflation expectations would be clearer. However, the current path linkage between monetary policy and its influence on consumer spending is very indirect.

With the rates and quantitative easing path taken on by the US Federal Reserve, European Central Bank, and Bank of Japan, there’s a large asymmetry where a mild tightening in policy will easily thwart inflation expectations. This is because of the amount of debt relative to income. On the same token, large bursts of stimulus passed through the financial markets will do relatively little. The main effects are asset price inflation. And while asset price inflation helps to make the holders of assets wealthier, it is not clear that this has a big influence on spending and consumption behavior.

Bonds / Interest Rates

Personally, I am long-term bullish on US rates and US Treasuries. I believe that the US is going to have a yield curve eventually on par with other developed markets like Japan and Germany that has maturities anchored at around zero many years out.

If the monetary policy paradigm shifts away from the financial markets toward targeting spenders directly, then inflation expectations would be expected to re-rate higher. This can take a variety of forms. For example, there is what is broadly known as helicopter money – sometimes intended to denote that central banks can put money in the hands of consumers and tie it to spending incentives (for example, giving them money but having it disappear if not spent by a certain date). But, more generally, it is the concept of a central bank adopting the power to engage or assist in fiscal policy.

Stocks

The current room remaining under the US yield curve is why I think US stocks still have a decent bit left in the tank long-term. In the short- and medium-term the Fed needs to run monetary policy easy enough to avoid a contraction in aggregate demand.

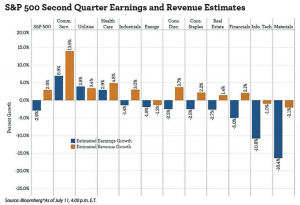

Earnings are also a growing headwind, as several forward indicators (e.g., semiconductor sales, South Korean exports), point toward slowing earnings growth in the near-term. This is expected to be the first dip in earnings, on a quarter-over-quarter basis, since 2016.

The European and Japanese stock markets have languished behind those in the US since the financial crisis (and even before that). With rates at zero (or negative) so far out in Japan and most of developed Europe, they are essentially out of monetary policy tools in terms of the traditional tool kit. There is little to no spread left to capture to stimulate the economy.

This means that for these markets more of their growth has to come from organic sources – namely, revenue growth and margin expansion. In Japan and most of developed Europe, growth is limited to some 3 to 4 percent in nominal terms per year in otherwise good economic circumstances.