Orbex Review 2024

Awards

- Best FX Broker Europe 2020 - Global Banking & Finance Review

- Best FX Broker Mena 2020 - Global Banking & Financing Review

- Best Forex Broker 2019 - Global Banking & Finance Review

- Best Trading Education Provider 2018

Pros

- Access additional trading tools to help you make informed decisions, including integrated Trading Central analysis and a free VPS

- Excellent monthly webinars aimed at various experience levels plus comprehensive educational hub

- 24/5 multilingual customer support via telephone, email and live chat

Cons

- No copy trading solution

- Prepaid card only available to clients in the Gulf Region and Palestine

- No top-tier regulation

Orbex Review

Orbex is an award-winning global forex broker. This review explores the pros and cons of trading with Orbex, including its MT4 platform, account types and minimum deposit. Make an informed decision before you open an account and login.

Orbex Company Details

The Orbex group was formed in 2010 and operates under two official entities: Orbex Limited & Orbex Global Limited. The former has headquarters in Limassol, Cyprus, providing services to European clients while the latter is based in Mauritius and operates outside of the EU, subject to local restrictions.

Trading Platforms

Orbex-MetaTrader 4

MetaTrader 4 (MT4) efficiently marries a user-friendly interface and design with a data-rich environment and advanced capabilities. Available in over 40 languages, the platform shows deep market history, supports automated trading through expert advisors (EAs) and boasts more than 50 technical indicators, 30 charting tools and nine timeframes.

MT4 WebTrader

MT4 also has a browser-based trading platform that can be used from any computer with an internet connection and access to the Orbex website. WebTrader requires no download and has many of the functionalities of the desktop platform. The platform supports one-click trading and offers 30 technical indicators, such as Elliott Wave patterns, nine timeframes and a range of charts, graphical tools and order options.

MT4 MultiTerminal

The MultiTerminal platform is geared towards account and fund managers. The platform allows access, monitoring and trading on several accounts from one place. Accounts can be grouped or managed separately and the platform contains its own internal communication system and automatically generates reports. Also, the full capability of MT4 carries over to the MultiTerminal system.

Both MT4 and MT4 MultiTerminal can be installed on Windows, Mac and Linux computers. The Orbex website contains download links for the software packages.

Assets

Orbex supports digital trading on a range of spot instruments and CFDs. There are 44 forex pairs offered, comprised of 7 majors, 22 minors and 15 exotics. There are spot prices on seven commodities, including 3 energies and precious metals such as gold. Orbex clients can trade in 8 global indices and 66 of the most traded EU and US company stocks. The broker also offers OTC futures contracts on indices, commodities and energies.

Spreads & Commission

Trading costs and commissions vary with account type. As the name suggests, the Fixed account offers fixed spreads, set at 1.9 pips for forex pairs. Other accounts offer floating spreads and while no averages are provided by Orbex, minimum spreads for the Starter account can reach 1.7 pips and zero pip spreads are available with the Premium and Ultimate accounts.

There are no commissions charged on the Fixed and Starter accounts. However, the Premium account is subject to an $8 round turn commission and the Ultimate account charges a $5 commission.

The broker also charges swaps for holding positions open overnight, though Islamic trading accounts are exempt from this fee.

Leverage

Leverage rates at Orbex are competitive, reaching 1:500 for forex pairs on all accounts. However, to mitigate the risks of margin trading, leverage rates are capped at 1:100 if trading in volumes of over 40 lots.

The maximum leverage rates provided for indices are 1:100, though Chinese indices are capped at 1:20. Commodities can be leveraged at either 1:100 or 1:50 and stock CFDs are limited to 1:5.

For EU retail traders, leverage is capped at 1:30.

Mobile Apps

There is a mobile version of the MT4 platform for clients who like to trade and monitor their accounts while away from their computers. The Orbex app supports every order type available on the desktop version, though with fewer charting and indicator options.

The app is available for both Android- and iOS-powered mobile devices and receives good reviews from mobile traders.

Payment Methods

Deposits and withdrawals can be made through payment cards (Visa and Mastercard), Skrill, Neteller, WebMoney, Fasapay or bank wire transfer. Deposits take up to two hours to reach your account, except for wire transfers, which take three to five business days. The minimum accepted deposit is $200.

Withdrawals via e-wallets are processed within 24 hours, however payment cards and bank transfers can take three to five business days.

There are no deposit or withdrawal charges.

Demo Account

Orbex offers a demo version of each account type. Practice accounts can be loaded with up to 5,000,000 EURO/USD/PLN in virtual funds. The practice account uses real market data but simulated money, providing an opportunity to trial new strategies and EAs, explore new platforms and familiarise yourself with markets.

Deals & Bonuses

At the time of writing, Orbex doesn’t offer any no deposit bonuses, welcome deals or rebate promotions. Traders can, however, access a free VPS, regular market analysis and a series of video tutorials.

Regulation

Orbex Limited is licensed by the Cyprus Securities and Exchange Commission (CySEC) and is part of the EU Markets in Financial Instruments Directive (MiFID II), allowing it to offer trading solutions in Europe. Orbex Limited is also a member of the Cypriot Investor Compensation Fund (ICF). This fund protects traders to the sum of €20,000 should the broker be unable to pay out returns.

Orbex Global Ltd is licensed and regulated by the Mauritius Financial Services Commission (FSC). The broker is authorised to provide services outside the EU, though not if domestic regulations prohibit their operation, such as in the US, Cuba, Sudan, Syria and North Korea.

Additional Features

VPS

The broker offers a range of additional solutions and features. The first is a free virtual private server (VPS) for traders. These servers allow 24/5 access to markets for automated trading, even without an internet connection. Servers support MT4 EAs and have faster executions than the desktop platform.

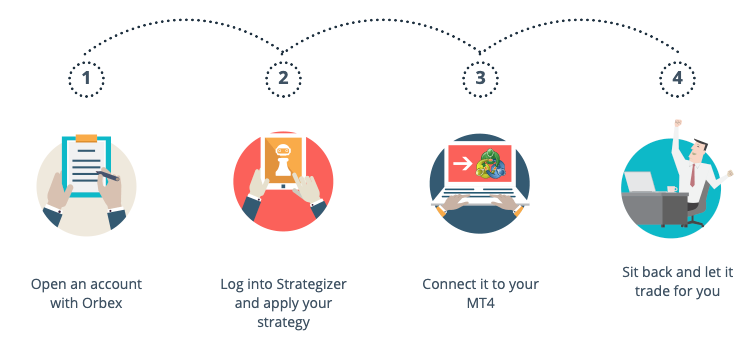

Orbex Strategizer

Orbex also offers a strategy building tool. The Strategizer system allows algorithms to be created and EAs to be built without any coding or programming, using visual tools. The Strategizer is free and integrates with MT4 for up to five strategies. It includes the ability to add stop losses, trailing stops, signal rules, trade timings and logical algorithms.

Education Centre

Orbex has a well-equipped education centre with a range of free learning resources, as well as some that are limited to Premium and Ultimate account holders. There are several free ebooks, video training courses, a webinar series and online lessons. There is also Orbex Web TV, a video blog with daily and weekly technical reports, financial news, forecasts and research.

Trading Central

Orbex also offers Trading Central, a plug-in that integrates with MT4. It provides investment and economic analysis, plus analytic forecasts and trading tips.

Account Types

Orbex offers four account types, each for traders with different experience levels and requirements. All the options offer a maximum leverage of 1:500, stop-outs at 20% and the option to use a free VPS. The key features and differences of the account types are:

Fixed Account

- Regular training sessions

- No commissions

- Basic education

- $500 deposit

- Fixed spreads

- Free signals

- No scalping

- No EAs

Starter Account

- Regular training sessions

- Variable spreads

- No commissions

- Basic education

- $200 deposit

- Free signals

- Scalping

- EAs

Premium Account

- 1-on-1 training sessions

- Advanced education

- Spreads from 0 pips

- $5,000 deposit

- $8 commissions

- Premium signals

- Scalping

- EAs

Ultimate Account

- 1-on-1 training sessions

- Advanced education

- Spreads from 0 pips

- $25,000 deposit

- $5 commissions

- Ultimate signals

- Scalping

- EAs

For Islamic traders, the broker offers swap-free versions of each account type. However, Islamic accounts are subject to additional commissions.

Trading Hours

Orbex follows industry-standard trading hours. Forex markets are open 24/5, starting at 23:00 EEST on Sundays and closing at 22:30 EEST on Fridays. Commodities open at 00:00 EEST Mondays to 22:30 EEST Friday, with a daily break from 23:00 to 00:00 EEST. Stocks and indices have different opening times, depending on their respective stock markets.

Customer Support

Orbex has a large customer service team that provides multilingual support to traders 24 hours a day, five days a week. The team can be contacted using the details below. Alternatively, you can request a call-back using a website form.

- Live chat – bubble in the lower right corner of the website

- Global telephone number – +962 6 5622268

- MENA telephone number – +965 22968150

- EU telephone number – +44 2035 198 170

- Email – support@orbex.com

Security

All sensitive data is backed up and transfers use Single Sockets Layer (SSL) encryptions. Orbex also conforms to security standards set out by the regulatory agencies it operates under.

In addition, client funds are fully segregated from the company’s capital in tier 1 banking institutions. This removes the possibility of the broker using client money for anything other than carrying out requested trades and funding withdrawals.

Orbex Verdict

Orbex is a competitive forex broker, with a good range of tradeable assets, the trusted MT4 platform, plus a free VPS and EA builder. There are also several account types to fit a range of requirements. Even though there is no social trading capability or cryptocurrencies offered, Orbex still provides a solid, well-rounded trading service.

Top 3 Alternatives to Orbex

Compare Orbex with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Orbex Comparison Table

| Orbex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.4 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, commodities, futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, BaFin, FSC (Mauritius) | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Orbex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Orbex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Orbex vs Other Brokers

Compare Orbex with any other broker by selecting the other broker below.

FAQ

What is the minimum deposit for an Orbex account?

Orbex’s minimum deposit is $200 with the Starter account, which has the least competitive spreads and the fewest additional features. For the more advanced accounts, minimum deposits rise to $500 for the Fixed account, $5,000 for the Premium account and $25,000 for the Ultimate account.

What trading platforms does Orbex offer?

Orbex offers MT4 to its traders, a reliable platform that is held in high regard. The broker also offers MT4’s MultiTerminal platform for account managers, allowing access to several accounts at once.

Is there an Orbex demo account?

The broker offers a demo account that can be loaded with up to $5 million of simulated money. Once logged in, traders can use the demo account for risk-free strategy trials and platform familiarisation.

Are there accounts for Islamic traders with Orbex?

Forex and day trading can be considered haram due to the presence of overnight interest charges. Orbex addresses this issue by offering Islamic-friendly, swap-free accounts.

Does Orbex offer binary options trading?

No, binary options cannot be traded through Orbex. There are, however, a range of forex pairs and commodities to be traded, as well as stock CFDs and global indices.

Can I open an Orbex account in Venezuela?

Yes, Orbex Global Limited is licensed to provide its services to many countries outside the EU, such as Venezuela. Other accepted countries include Egypt, the UAE and the UK.

Customer Reviews

There are no customer reviews of Orbex yet, will you be the first to help fellow traders decide if they should trade with Orbex or not?