Mitto Markets Review 2024

Mitto Markets Review

Mitto Markets offers diverse trading assets on standard and ECN accounts, as well as investment management portfolios. The broker aims to provide dedicated customer support, coupled with easy to use platforms. Our review of Mitto Markets details payment options, bonuses and promos, demo accounts, and more.

Mitto Markets Details

Mitto Markets is a trading name of Kapwealth Limited, based in London and regulated by the Financial Conduct Authority (FCA). The company was established in 2020 by Founder, Tim Sunderland, who previously worked as a stockbroker.

Mitto Markets offers an attractive range of instruments, from forex to mutual funds, using a variety of trading platforms, including MetaTrader 4 and Trader Workstation. The broker also emphasises its superior customer support and low fees with interbank price execution.

Trading Platforms

MetaTrader 4

MT4 is a fully-featured trading software packed with interactive charting tools for advanced technical analysis of currency and commodity pairs.

The platform is easy to use for both novices and seasoned traders. Various strategies can be executed using the market and pending orders, with instant execution and trading from the chart. Traders can also access a library of trading robots to implement algorithmic strategies, plus full trade history and financial news.

New traders will need to sign up for a Mitto Markets account before they can download and access the platform.

Trader Workstation (TWS)

TWS is a downloadable multi-asset platform, allowing you to trade equities, forex, CFDs, funds, futures, and options.

The platform offers a sophisticated workspace containing real-time account balance and margining data, comprehensive news, and specialised tools such as SpreadTrader and OptionTrader. The multiple window view in Mosaic offers impressive streamlining capabilities, which can be enhanced and customised to suit a professional trader’s needs.

Instruments

Mitto Markets clients can trade over 135 equities and shares across 33 different countries. There’s also over 75 currency and commodity pairs on offer, plus a range of CFDs, over 30,000 mutual funds, plus futures and options. The only major absence is cryptocurrency and Bitcoin trading.

Spreads & Commission

Spreads start from 1.3 pips in the Standard MT4 account. In the ECN account, traders get raw spreads from 0.0 pips. The Standard account is commission-free, but the ECN account charges commissions at $3 per lot per side.

For traders using TWS, there is a minimum trade charge, which ranges from £3 to £5 depending on the asset class. Financing costs are around 1.59%, which is cheaper than many other brokers who typically charge above 5%.

Leverage Review

Leverage is offered up to a maximum of 1:30 for major forex pairs. Minor forex pairs, indices, and gold can be leveraged up to 1:20, and all other commodities can be leveraged up to 1:10. Professional clients can request leverage up to 1:100.

Mobile Apps

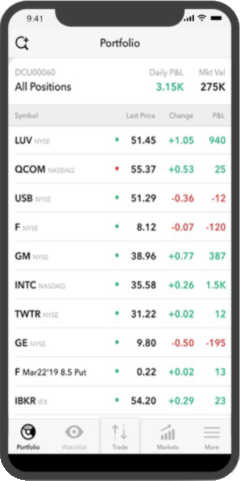

The MT4 trading platform is available on iPhone and Android mobiles and offers ultimate usability and convenience for the remote trader. The app comes with most of the same features provided in the desktop app, including historical data, financial news, and a suite of indicators and drawing tools. The app is hugely popular among traders of all levels and receives positive customer reviews online.

Mitto Markets also offers the Handy Trader app, which offers multi-asset access, supporting real-time market data, charts, and order management. The app uses routing technology that scans for the best available price and can re-route orders to achieve superior execution.

Payment Methods

Mitto Markets currently offers funding via credit/debit card or bank wire transfer. This is rather limited compared to other brokers, so we hope that Mitto Markets includes some more options in the future.

There is also a lack of transparency in terms of funding fees and processing times, which is disappointing as many traders will rely on this information before opening an account.

Demo Account Review

Mitto Markets offers an MT4 demo in either the Standard or ECN account. Demo accounts are a great way to practice trading skills before investing real money. Traders can also use an unlimited number of Expert Advisors and experience live pricing with leverage up to 1:30.

Mitto Markets Bonuses

The Financial Conduct Authority restricts incentivised trading in order to protect the investor. Mitto Markets therefore does not provide any no deposit bonuses or promotional offers at this time.

Regulation

Kapwealth Limited (Mitto Markets) is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, under FRN 590782. The broker does not hold client funds and uses third-party custodian services. Accounts are also covered by the Financial Services Compensation Scheme (FSCS), which insures up to £85,000 per claim.

FCA oversight is a good indication that the broker is safe to trade with and not a scam.

Additional Features

Mitto Markets does not yet offer much in terms of educational resources or tools. At the time of writing, the broker is developing its Trading Ideas section, which contains market insights from the founder. We hope that Mitto Markets will implement some more resources and trader tools in the near future.

Account Types

For traders using MT4, you can choose between the Standard or ECN Account. The Standard offers spreads from 1.3 pips and no commissions. The ECN account is ideal for experienced traders, offering raw spreads and commissions at $3 per lot per side. There’s no minimum deposit requirement for both accounts and the minimum trade size is 0.01 lots.

Share dealing is also available in the ISA and SIPP accounts, or you can opt for a portfolio management service.

Benefits

Features offered at Mitto Markets that receive positive customer ratings in this review include:

- Mobile and desktop trading

- Diverse range of assets

- $0 minimum deposit

- FCA regulated

- ECN Account

- Low fees

Drawbacks

Improvements could be made in the following areas:

- Limited funding methods

- US clients not allowed

- No crypto trading

- No FAQ section

Trading Hours

Trading sessions in MT4 are 00:02 to 23:54 GMT+2, Monday to Friday. For precious metals, hours are 01:00 to 23:55 GMT+2, Monday to Friday. UK oil is 03:00 to 24:00 and US oil is 01:00 – 24:00 GMT+2. All other assets will vary and are provided within the trading platforms.

Customer Support

Mitto Markets is available by calling the helpline, +44 (0) 208 159 8985, emailing newaccounts@mittomarkets.com, or by leaving a message via the online contact form. There’s no live chat support, however, so it would be nice to see this offered in the future.

Mitto Markets is located at the 28th Floor, The Shard, 32 London Bridge Street, London SE1 9SG.

Safety

MT4 is an encrypted software, so data exchange between the client platform and the trading server is fully safeguarded. The broker also uses segregated bank accounts for client money and transactions are carried out via the encrypted Client Portal.

Mitto Markets Verdict

Overall, Mitto Markets offers some impressive features, including ECN spreads and a good selection of trading assets. The available platforms also provide access to charting tools, technical indicators, and order management features to suit all levels. However, potential new traders may want to see the payment options expanded and access to live chat support.

Top 3 Alternatives to Mitto Markets

Compare Mitto Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Mitto Markets Comparison Table

| Mitto Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, futures, options, mutual funds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 2 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Mitto Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Mitto Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Mitto Markets vs Other Brokers

Compare Mitto Markets with any other broker by selecting the other broker below.

FAQ

Does Mitto Markets offer a no deposit bonus?

Mitto Markets currently does not offer any bonus deals or promo codes, due to FCA restrictions.

Who owns Mitto Markets?

Mitto Markets is owned by Kapwealth Limited and the management team is headed up by founder, Tim Sunderland.

Is Mitto Markets a scam?

Kapwealth Limited is a legitimately registered company in the United Kingdom and is authorised and regulated by the Financial Conduct Authority (FCA).

What can I trade at Mitto Markets?

You can trade forex, commodities, shares, CFDs, mutual funds, options and futures at Mitto Markets. Cryptocurrency and Bitcoin trading is not offered.

Where is Mitto Markets based?

Mitto Markets is based at the 28th Floor, The Shard, 32 London Bridge Street, London SE1 9SG.

Customer Reviews

There are no customer reviews of Mitto Markets yet, will you be the first to help fellow traders decide if they should trade with Mitto Markets or not?