LCG Review 2024

- Daytrading Review TeamLCG will appeal to traders looking for wide market coverage with 7000+ instruments spanning 9 asset classes. The around-the-clock customer support will also appeal to new traders.

London Capital Group was established in 1996 and is regulated by the FCA and CySEC. Today the firm is a popular CFD and spread betting provider, with $20+ trillion in executed trading volume, 24/5 customer support, and a number of industry awards.

Forex Trading

LCG offers 60+ major, minor and exotic currency pairs on MT4 or LCG Trader. Leverage is available up to 1:30 with average spreads of 1.5 pips on key currency pairs.

Stock Trading

Speculate on hundreds of shares from international markets including Germany, US and the UK with leverage up to 1:5. Average 0.10% spreads apply to stock positions.

CFD Trading

Trade thousands of CFDs on reliable trading software. Leverage up to 1:30 is available in line with regulatory restrictions. Beginners can also utilize the firm's training videos.

✓ Pros

- Heavily regulated by the FCA in the UK and CySEC in the EU

- Trading Central partnership with pattern recognition technology

- In-house trading software plus access to MetaTrader 4

- Excellent suite of instruments with 7000+ assets

- Swap-free Islamic account available

- Demo account provided

✗ Cons

- Nearly twice as high commissions on MT4 ($10.00 per $100.000), compared to LCG Trader ($45.00 per $1.000.000)

- Spreads are not the most competitive averaging 1.5 pips on the EUR/GBP

- A high $10,000 minimum deposit is needed for the ECN account

We have dug deep into the business of London Capital Group (LCG), testing and comparing the accounts, fees, platforms and safety. In this review, you will get valuable information about one of the United Kingdom’s largest online brokers. Is LCG a good broker?

Company Details

London Capital Group started of in 1996 as a financial holding company. A few years later, they steered their ship towards other sharky waters – heading for a pioneering position in online brokerage industry. Today, they’re one of United Kingdoms most experienced online brokers.

- Headquartered in London

- Registered in England and Wales

- Regulated by Financial Conduct Authority (FCA)

- 50-100 employees

Overall, LCG holds a good reputation among both stakeholders and customers. However, there has been some criticism in recent years due to financial losses and the fact that experienced employees left the firm. Still, they are one of Europes most used and praised online brokers, famous for low prices and high quality support.

Superior Alternatives To LCG

Trading Platforms

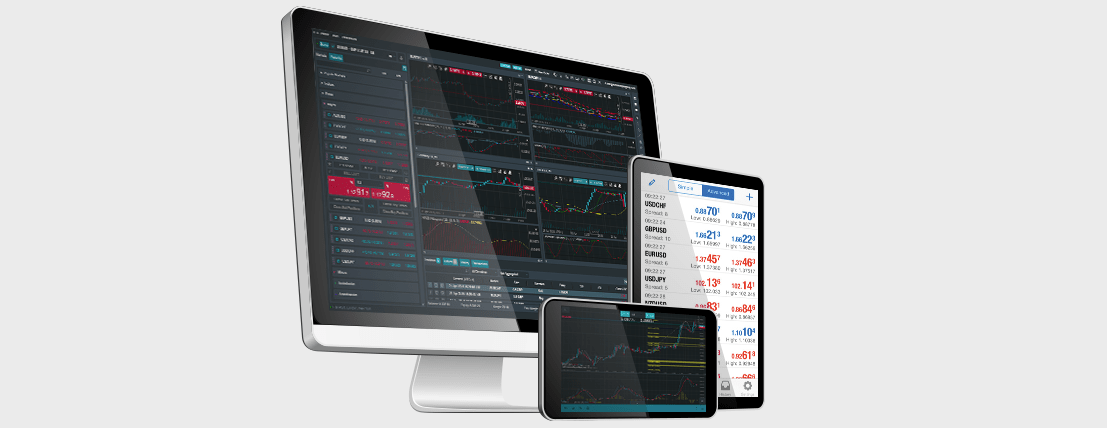

LCG offers you two platform choices – LCG Trader and Meta Trader 4. Both options have benefits and limitations. Before making a decision, you should weigh your options. What are your trading preferences and overall expectations? Are you going to use a standard account, ECN account or Islamic account? Do you have any previous experience in one of those platforms? Answering these, and similar, questions, will guide you toward the best platform for you.

LCG Trader

Don’t be fooled by the name – the LCG Trader is a branded version of cTrader. It’s developed by Spotware Systems and FxPro-traders probably recognize it. Yep, they use the exact same platform. And it’s a good one. Look at some of the benefits:

- 5000 different instruments from 7 different assets classes

- A customizable charting package

- Optimized for a well-diversified portfolio

- Valuable features such as Client Sentiments and Depth of Market – to mention a few

- More favourable pricing

- Web-based and applicable for mobile devices

The LCG Trader is a multi-asset platform suited for ECN traders. According to their own website, it’s developed and tailored for the needs of professional traders. Therefore, we are not surprised that many day traders prefer this platform over the MT4.

MetaTrader 4

The MT4 is well-known for high perfomance and reliability. It was developed by MetaQuotes Software Corporation and has been on the market for many years. Experienced day traders knows pretty much everything about the MT4. Why? MetaQuotes artwork is not only popular – it’s more or less a standard in online brokerage.

What’s making the MT4 different from LCGs own branded platform? Well, there are some advantages:

- It works for both ECN, Classic and Islamic accounts

- It’s optional for trading with FX currency pairs, commodities and spot metals

- It’s very user-friendly

- Beginners will probably have a smoother ride

Even though the MT4 is one of the best platforms out there, many day traders frequently reports some common issues (or rather frustrations). Often it’s about slow executions and the limited number of markets.

Asset / Markets

We’ve mentioned LCGs fantastic accessibility in terms of markets, but it’s worth mentioning again. You’ll get access to more than 7000 global markets across 9 asset classes. That’s pretty impressive. Even the most demanding investors would find what they need:

- Forex

- Shares

- Commodities

- Interest rates

- Bonds

- Vanilla options

- ETFs

- Indices

- Cryptocurrencies

The exact amount of markets you can trade in will be depending on your account. Make sure you read all information about LCGs different options.

Low Spreads And Commissions

LCG is an ECN/STP broker. They are the matchmaker between you, your orders and the liquidity providers. This is one of the main reasons behind the low commissions and competitive spreads. When trading on Forex, pip spreads on majors starts from 0.8 (EURGBP) up to 1.6 (GBPJPY) with an average of 1.45 pips for EURUSD.

The charges may vary, depending on what platform you use and what kind of account you have. LCG tends to favour customers who are using the branded cTrader, imposing twice as high commissions on the MT4 platform.

A full list of all commissions and spreads are available on the LCG website.

Leverage

Maximum leverage for most Forex majors pairs extends to 1:500 (1:200 for EURCHF and USDCHF). On Forex minors, leverage ranges from 1:50 to 1:200. You can also trade with 1:100 for commodities and 1:40 for indices and shares.

For EU traders, leverage is capped at 1:30 for Forex and lower for more volatile products (1:2 for Crypto for example)

Mobile Apps

LCG deliver a slick mobile app, compatible for iOS and android. Download MT4 or LCG Trader from Google Play or Apple Store and trade on the move or monitor your portfolio.

The mobile version works very well. It’s possible to make orders, use some of the analytics tools and stay updated with your watch list. The applications are not intended to be a substitute for LCGs desktop versions. Rather it’s a useful complimentary tool, helping you out with your investments – no matter your location. User interface is one of the most important things and many companies struggle with this big time. This is not the case for LCG.

Payment Methods

We know too well about rigid online money transfers. Less restrictions equals better trading experiences and happier customers. LCG is a high performer in terms of flexibility, accepting a variety of safe deposit methods:

- Bank Transfers for free

- Almost all major credit and debit cards (2 % fee for deposits)

- E-wallets such as Skrill and Neteller

- Withdrawals are free from fees which is a big plus.

Demo Account

Not ready to open a live account yet? No problem. LCG offers a demo version and it’s completely free. We especially recommend it to beginners. There are no differences compared to the live versions and you can make yourself comfortable with all features before you start trading. Beginners can use it to gain new skills and learn all about each platform.

Getting access to the demo account is a simple process:

- Fill in your personal data.

- Choose your preferred platform – both Meta Trader 4 and LCG Trading platform are available in demo mode.

- Decide which currency to use. Select GBP, USD, EUR or CHF.

- Be ready to roll.

Note: You can only use the classic account in the demo mode.

Bonus

$5000 is a lot of money. But that’s how much you can get from LCGs welcome bonus. All new traders gets 10 % extra money from the first deposit. Due to regulatory restrictions, the bonus may not be available in all locations.

Regulations and Licensing

London Capital Group Ltd are regulated by both the FCA in the UK and CySec in Cyprus. This level of regulation ensures the ESMA guidelines are adhered to – this limits leverage, ensures negative balance protection and strengthens ‘Know Your Customer’ protocols. For some traders, this level of protection is stifling and perhaps not required – where this is the case, trader can apply for ‘Professional’ status. This requires proof of trading experience and capital – but can mean increased access to leverage and additional investment types.

Account Types

Before you start trading at LCG there are three different accounts to choose from:

- ECN Account

- Standard (Classic) Account

- Islamic Account

All of these three options has advantages and limitations. Which one to pick? It all depends on your preferences, strategies and overall expectations.

Electronic Communication Account (ECN)

In general, day traders prefer to sign up for LCGs ECN account. More active traders turn to ECN brokers due to favourable pricing and directly connections to liquidity providers. If you plan to deposit at least $10.000, an ECN account is a better option.

- Many traders experience fast execution of orders

- No market makers – LCG will only connect you to the market itself

- Lower charges compared to the standard account and very low spreads

Standard (Classic) Account

A standard account will often give you the same possibilities as an ECN account, but the average spreads are higher. There are no hidden fees as the commission is included in the spreads. This is a good option if you don’t meet all requirements for the ECN account.

Islamic Account

LCGs Islamic account is the swap-free option for muslim day traders, designed to follow rules and obligations in Sharia Law.

- No charges or overnight financing costs.

- No up-front commissions or widening spreads

Islamic accounts gets the same conditions as the other accounts

Trading Hours

Between Sunday 21:00 – Friday 22:00 (GMT). Trading schedule may vary due to holidays and official days of the world financial markets. LCG will basically be available when the markets are open, including global forex markets.

Contact Details / Customer Support

Fast and helpful. We found the support team to be polite and knowledgeable.

- UK OFFICE – CUSTOMER SUPPORT

Opening Sundays 22:00 (GMT)

- Closing Fridays 22:00 (GMT) +44 (0) 207 456 7020 customerservices@lcg.com

- UK OFFICE – SALES SUPPORT

- Opening Mondays 08:00 (GMT) Closing Fridays 20:00 (GMT) +44 (0) 207 456 7072 sales@lcg.com

- UK OFFICE – DEALING DESK

- Opening Sundays 22:00 (GMT) Closing Fridays 22:00 (GMT) +44 (0) 207 456 7010

- CYPRUS OFFICE – CUSTOMER SUPPORT +44 (0) 207 456 7020 customerservices@lcg.com

Safety and Security

LCG states that 8 out of 10 non-professional traders loses money when trading with CFDs. Thankfully, some online brokers believe in transparency and responsibility. LCG is one of them, using negative balance protection. In fact, the NBP ensures that your Forex account never goes into negative balance – protecting you from debts.

A company’s usage of NBP should be one criteria when beginners choosing between different online brokers.

You will also have FSCS on your side in case of an unlikely bankruptcy. The Financial Services Compensation Scheme could be seen as an insurance company that protects customers deposits. At LCG the protection is up to 50.000 GBP.

Overall Verdict

LCG is probably one of the best ECN/STP online brokers out there – no matter your skills and level. The company is highly regulated and holds a great reputation from decades of excellent services on the stock market.

The low commissions and tight spreads offered to LCGs customers puts the company in a good position. Day traders can choose to invest in lots of markets and make a good profit. Stocks, spot metals, shares, indices and even cryptocurrencies – the options are only limited by lack of imaginations.

LCGs excellent choice of trading platforms comes with benefits. Both LCG Trader and MT4 are powerful tools, opening up more than 7000 markets across 9 asset classes. Enjoy one of the markets best online trading platforms in one place. With the user-friendly applications you can always stay on top, wherever you are.

Last but not least – the customer support is excellent.

Top 3 Alternatives to LCG

Compare LCG with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

FxPro – Founded in 2006, FxPro is an established forex, CFD and spread betting broker offering 2100+ assets to over 2 million clients worldwide. The broker is regulated in 4 jurisdictions and offers reliable 24/5 customer support, earning it a high trust and safety score. FxPro has also picked up more than 100 industry accolades for its competitive trading conditions, including fast execution and deep liquidity.

Go to FxPro

LCG Comparison Table

| LCG | IG | Swissquote | FxPro | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4 | 4.4 |

| Markets | CFDs, Forex, Stocks, Futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Futures |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $1000 | $100 |

| Minimum Trade | Lots vary by asset | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC | FCA, CySEC, FSCA, SCB, FSC |

| Bonus | – | – | – | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral | FxPro Platform, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

| Payment Methods | – | 6 | 5 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Swissquote Review |

FxPro Review |

Compare Trading Instruments

Compare the markets and instruments offered by LCG and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| LCG | IG | Swissquote | FxPro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | No | No |

LCG vs Other Brokers

Compare LCG with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of LCG yet, will you be the first to help fellow traders decide if they should trade with LCG or not?