Invest.com Review 2024

Invest.com provide portfolio management plus standard trading. Leverage and spreads improve with each account level - Bronze, Silver or Gold

Stock Trading

Invest.com offer trading on over 100 assets across the globe. Margin requirements are generally 5% on US and UK stocks.

Invest.com have ceased offering online trading of any description. To view a list of the best online brokers, in your region, visit the brokers page.

Invest.com was founded in 2014 and has grown in the last three years into a well-established CFD broker. Their slogan reads ‘smart investing, made simple’. This page is here to put that slogan to the test. This in-depth Invest.com review will consider the platform, apps, fees, regulation, features, account types, and more. The page will then offer a final verdict.

A Brief History

An Israeli venture capital firm by the name of Singulariteam took control of the domain name in 2014. It brought with them an affiliate, in the form of Renren, the Chinese social network. A quick look at Invest.com Crunchbase shows that together they invested $20m into the new platform.

That investment has brought with it more than a clean new logo. Operations have expanded across the globe. Invest.com now offers a multitude of trading features to day-traders from all over. It’s headquartered in Limassol, Cyprus and more importantly, it’s regulated by CySEC, but more on that later.

Minimum Initial Deposit

Let’s cut to the chase. What is the minimum initial deposit you will need? The amount will vary depending on payment method. However, for e-wallets, it’s $100. For credit cards, it’s $250, and for bank transfers, it’s $500. The variation in charges is mainly down to the processing costs of different payment methods. However, there are other brokers out there who offer minimums as low as $50. So, this may deter some first time traders.

It’s also important to note that whether you’re day trading on Invest.com for futures, forex, bitcoin, crude oil, or natural gas, the minimum requirements will not change.

Spreads & Commissions

Many customer reviews of Invest.com will disappointingly point out that the spreads are not fully disclosed upfront. You get access to two different platforms (more on that below). The ‘Simple’ platform offers some of the characteristics of options trading, whilst the ‘Pro’ version provides a more classic trading environment.

Unfortunately, Invest.com has variable spreads on the ‘Pro’ version which leave a lot to be desired. They are significantly worse than the current industry standard. For example, the EUR/USD spread has been found to be as high as 5.2 pips. Normally anything above 2 pips is considered high.

Leverage

Another essential component of any Invest.com review has to be leverage offerings. The greatest leverage on offer is 1:200. Although, the initial leverage is 1:50, in line with CySEC regulations. This is fairly industry standard. However, if you go elsewhere you can find brokers that will offer up to 1:500.

It is worth highlighting though, that if you’re new to trading, opting for low leverage is often a wise decision. This will prevent you taking considerable losses. CySEC enforced a 1:50 leverage rule specifically to protect new traders.

Other Trading Fees

As a day trader making a high volume of trades, fees can quickly add up. You may have seen in Invest.com news that they’ve tried to make their fee structure as transparent as possible. Invest.com is following the ‘two and twenty’ structure often seen in hedge funds. This means they charge you a flat 1.5% annual fee for accounts under $10,000, and .99% fee on accounts over $10,000. You will then pay 15% on profits.

Trading Platform

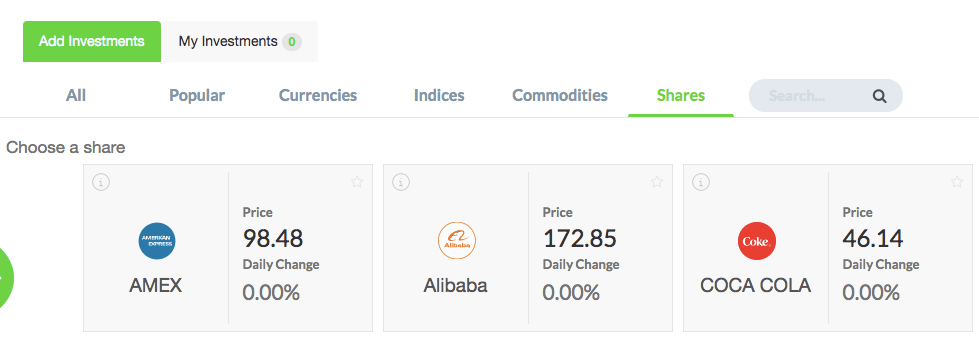

Day traders have the choice of two trading platforms for CFDs and Forex. The first is called ‘Simple Invest’ and the second ‘Pro Invest’. You’ll benefit from a selection of over 60 common underlying assets for trading currencies, shares, indices, and commodities.

‘Simple’ Platform

With the simple platform, you get a clear break down of all the CFD instruments available.

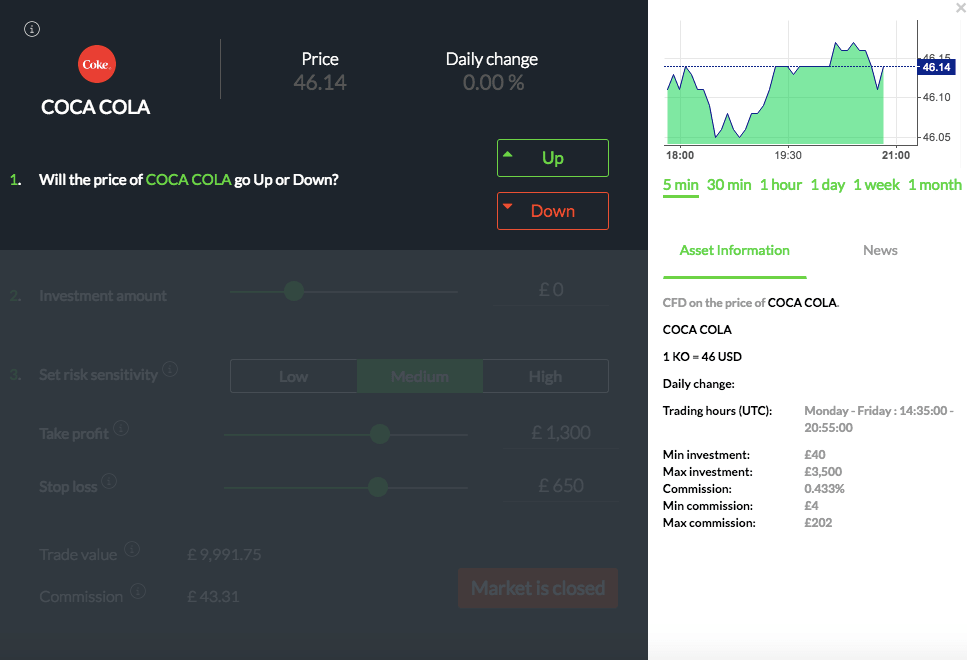

Once you hit the ‘invest’ button the potential actions are presented and you can select which one you’d like to go for, such as ‘up’ or ‘down’. You’ll also see a small chart area with time frames ranging from 5-minutes up to 1 month. You’ll also get a newsfeed and information about the asset in question.

Whilst some platforms display investment rates that are generated by derivative values of market prices, at Invest.com you get real-time market rates. In addition, you’ll never be trading against your broker. This means you don’t need to worry about the price manipulation associated with some unregulated brokers.

‘Pro’ Platform

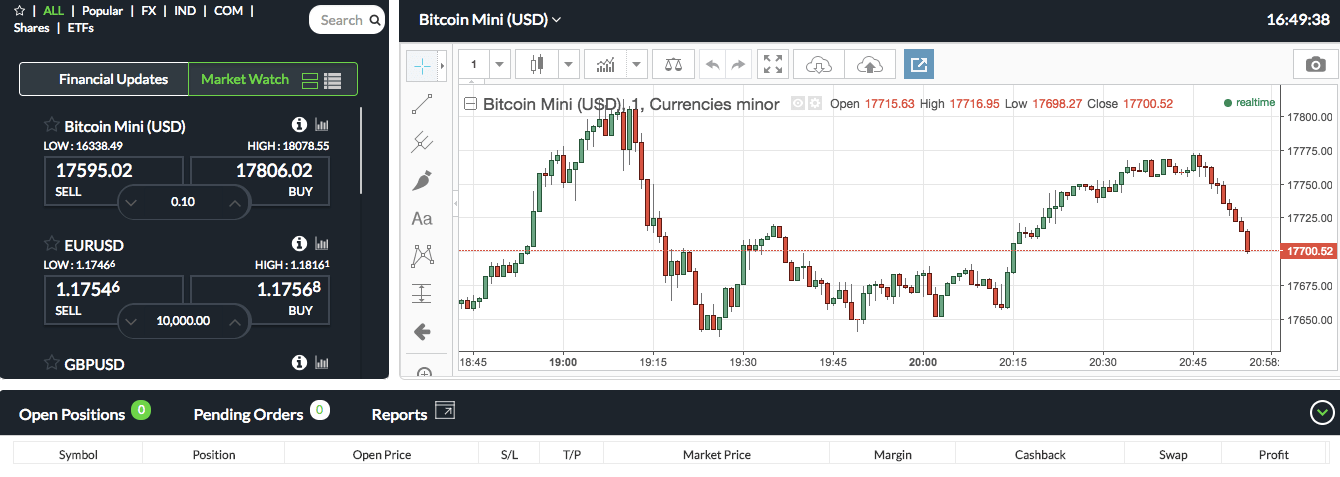

The ‘Pro’ version offers advanced charting and over 100 technical indicators. The charting package comes from TradingView. This is a highlight of the Invest.com review. TradingView is widely agreed to be one of the best and a worthy competitor of MetaTrader4. You can choose between bars, candles, hollow candles, line, and, Heikin-Ashi charts.

There are generous customisability options, plus the platform is sleek and straightforward to navigate. It takes just a couple of clicks to bring up oil price, for example. You can also reverse, double your position, and close all trades with a single click. You’ll also benefit from the liquidity you’d want to see in your platform.

On top of that, you get an Invest.com economic calendar in the form of a news feed. Just click the ‘Financial Updates’ button. You’ll also get market commentary along with the news.

The ‘Simple’ version is perhaps best for novice day traders, and the ‘Pro’ version will tick most boxes for experienced traders.

However, whilst the platform is relatively reliable, it does lack in some areas. Other more sophisticated platforms offer enhanced functionality and additional features.

Mobile apps

Both versions of the web-based platforms also come with mobile apps, which can be used on both iOS and Android devices. When you place an order you are faced with a simple panel that allows you to enter in the parameters of the deal.

This technique of applying risk management, however, is not ideal. Normally you would pick a level on a chart. This will show you whether your trading idea is valid and determine the position size, based on the distance to both their entry point and account balance. However, with the Invest.com app interface you have no such option. This makes implementing effective risk levels trickier.

It’s also worth noting that most Invest.com app reviews from customers point out the ‘Pro’ trading app is what most brokers deem a standard app. So, their app offerings will suffice, but by no means do they go above and beyond.

Methods of Payment

If you’re using Invest.com from the UK, US, Europe, or anywhere else, you need to be able to deposit and withdraw money conveniently. Invest.com score well in this area. You can use any of the following payment methods:

- Debit cards

- Credit cards

- Bank transfer

- iDEAL

- Gate2Shop

- Checkout.com

- Sofort

- Skrill

- Neteller

This means wherever you’re based, transferring funds should be a walk in the park. Really, it’s only Bitcoin users that are left out, for now.

Demo Account

A strong point of Invest.com is their demo account. This is a totally free practice account, ideal for beginners looking to get familiar with the markets. You’ll receive $10,000 in simulated money, plus you don’t have to worry that the results you see are manipulated. Unfortunately, some brokers have been known to fiddle with demo account results to encourage you to start live trading with them. However, because Invest.com is regulated by a reputable body, this is not an issue.

With the demo account on Invest.com, you can trade gold, silver, and a whole host of other assets. Plus, the rates are in real-time and you can match them with rates from the financial markets. This means you know the results you achieve with their practice account can be replicated in live mode.

Additional Features

There are a number of other advantages this review of Invest.com has found. These include opting for investment strategies and portfolio advisers, plus automated account trading.

Investment Strategies

You complete an online survey to establish your risk tolerance before you join one of seven investment strategies. They will ask about your age, net worth, and how much time you would like to invest. These strategies then use CFDs to bet on stocks and other assets. The strategies are as follows:

- Daily Trend

- Divorcing Pairs

- Smart EU Indices

- Smart US Indices

- Momentum Algo

- Calm Algo

- Smart APAC Indices

The strategies above are totally free. You’ll also benefit from the detailed explanations of how they can help you. The break down will cover their effectiveness, risk, and the assets they are most commonly used with.

Managed Accounts

This is a topic that divides opinion amongst traders. Invest.com have managed accounts which see a professional money manager oversee your capital. Whilst you do still own the funds, in theory, these accounts will tailor portfolios specifically to your needs. You should not confuse these accounts with Expert Advisors.

However, as Invest.com customer reviews have highlighted, there are a couple of issues. Firstly, using such a system will bring with it its own set of fees. These will vary depending on what you choose to trade and in what volume.

In addition, there are concerns over conflicts of interest. Some feel that strategies used by Invest.com trade too often. This allows them to generate greater revenue via commissions. Giving Invest.com such control with a blatant financial motivation to excessively trade should make customers proceed with caution.

Safety & Security

Invest.com security is high. In an era when some traders have lost serious capital to scams, prioritising security is sensible. Any review of Invest.com would be impressed with the most advanced SSL encryption they use to protect your data and personal information. They routinely update their systems to ensure they are employing the most intelligent fraud detection systems.

Regulation

Head over to Invest.com LinkedIn and you’ll see they are proud to be licensed in Europe by the CySEC Securities and Exchange Commission. Their license number is 262/14.

Too many day traders have fallen victims to online scams. That is why brokers today have to be regulated by credible bodies, such asCySEC. Such a reputable regulator allows you to relax in the knowledge your capital is secure.

CySEC has made promising steps in recent times to monitor the behaviour of brokers under their watch. They have cracked down on broker bonuses that can tie customers in. They have also enforced more prominent risk warnings.

The Invest.com CEO has also ensured they remain within ‘segregated accounts’ guidelines. This means the broker cannot freely access your funds. Specific protocols have to be followed before funds can be transferred.

All CySEC regulated brokers must also take part in the local investor compensation scheme. This protects customers from brokers going insolvent. The scene will cover investments of up to €20,000, per account.

So, it would be unfair not to mention in this review of Invest.com that they have taken appropriate steps to stay in line with regulations and to ensure they do not misrepresent any of their products.

Invest.com Trading Hours

Invest.com trading hours are in line with competitors, so you can trade between the following hours:

- Currencies – Sunday 21:10 to Friday 21:10

- Commodities – 22:05-20:55 daily, from Monday to Friday

- Indices – 22:05-20:55 daily, from Monday to Friday and 06:05-19:55 daily, from Monday to Friday (DAX 40)

- Equities – Varies depending on the instrument in question, but in line with competitors.

- ETF – Monday 13:31 to Friday 13:31

Contact & Customer Support

Invest.com customer support is strong. Customer feedback shows they reply to queries as quickly as possible and extend numerous support channels. Their email address is Support@Invest.com and the phone number from the UK is +44 203 608 8025.

Alternatively, you can write to Invest.com. The address is, GS Sharestocks Ltd, 1 Chrysanthou Mylona and Griva Digeni Street, Panayides Building, 3030 Limassol, Cyprus.

Part of extending their global reach and being accessible is offering their platform and support in a number of languages. So, their website is available in English, Spanish, Arabic, French, Polish, Russian, Slovenian, and, Bulgarian.

Verdict

This review of Invest.com has highlighted the benefits on offer. Sophisticated portfolio customisation and reputable regulation are the biggest attractions. Having said that, they fall short with high spreads, managed accounts, plus a relatively basic trading platform. Overall, Invest.com can facilitate safe and secure access to the market. However, if you’re looking for low cost and a more advanced trading platform, you may be better off elsewhere.

Top 3 Alternatives to Invest.com

Compare Invest.com with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade

Invest.com Comparison Table

| Invest.com | IG | Pepperstone | AvaTrade | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.8 | 4.9 |

| Markets | CFDs, Forex, Stocks, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | – |

| Minimum Trade | £1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | $30 | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Leverage | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail) 1:400 (Pro) |

| Payment Methods | – | 6 | 11 | 13 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Pepperstone Review |

AvaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Invest.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Invest.com | IG | Pepperstone | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Invest.com vs Other Brokers

Compare Invest.com with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Invest.com yet, will you be the first to help fellow traders decide if they should trade with Invest.com or not?