Global Market Index Review 2024

Awards

- Best Liquidity Provider 2017

- Best Trading Environment 2017

- Best Trading Platform Provider 2016

- Best Forex Broker 2016

- Fastest Growing Broker 2016

- Best EA Trading Platform 2016

- Best Forex Broker 2014

- Best Forex Broker 2012

- Best Forex Trading Platform 2012

- Best Forex Broker 2011

Global Market Index Review

Global Market Index (GMI) is an online broker specialising in trading forex, CFDs and commodities. The broker offers five powerful trading platforms, alongside excellent customer service and transparent pricing. Our 2020 Global Market Index Ltd review covers how to open a live account, payment methods, fees and more.

Global Market Index Headlines

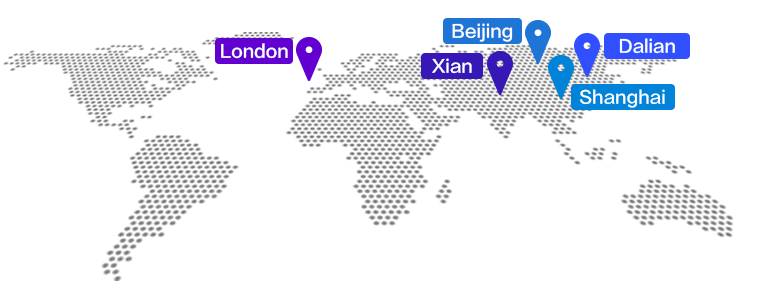

Global Market Index was established in 2009, offering global services from multiple financial hubs, including London and Shanghai. The UK entity, GMIUK, is licensed under the Financial Conduct Authority (FCA) while GMIVN is authorised by the Vanuatu Financial Services Commission (VFSC).

Note: Global Market Index Limited is the registered company name, operating several entities including GMIVN and GMIUK.

Trading Platforms

The broker offers several trading platforms through STP Bridge or ECN solutions. You can download the platforms below to desktop devices or trade through major web browsers.

STP Bridge Platforms

GMI MetaTrader 4

- VPS hosting

- Industry established

- Automated trading enabled

- Charting tools and customisable interface

- Collocation configuration for smart order routing and fast execution

GMI Alpine Trader

- OCO orders

- Intuitive user interface

- Trade directly from charts

- Server-based trailing stops

- Trade in fixed dollar amounts

Note: This platform is not available for GMIUK clients.

ECN Platforms

GMI ClearPro

- Micro-lots enabled

- Full market depth view

- One-click order reversal

- VWAP allowing for different order sizes

GMI MTF

- Flexible connectivity with API’s

- Ultra-high order acceptance rate

- Low latency with no trade rejections

- ECN trading venue for multiple asset classes

Note: This platform is not available for GMIUK clients.

GMI Currenex

- ESP quote system

- Deep liquidity tool

- A wide selection of order types

- ECN automatic matchmaking system

Note: This platform is not available for GMIUK clients.

Trading Products

Global Market Index offers clients investing and trading opportunities in the following markets:

- CFDs – indices and crude oil

- Metals – spot gold and silver

- 40+ forex pairs – G10 and exotic

Unfortunately single stocks and cryptocurrencies are not offered.

Fees

The various account options allow clients to choose between flexible leverage and trading size, with tight floating spreads. The spread offerings are not listed on the broker’s website, however standard EUR/USD spreads, for example, start at 1 pip. Global Market Index does not charge a trading commission on any transactions.

Note, the broker does charge swap rates for positions held overnight, further details of which can be found on the company website.

Leverage

Leverage varies by account type and trading entity due to regulatory requirements. GMIUK is regulated by the FCA and complies with ESMA regulations, capping leverage at a maximum of 1:30 for forex pairs. All MT4 accounts offer leverage between 1:50 and 1:200 with ECN accounts offering tighter leverage between 1:50 and 1:100.

Mobile App

Although not mentioned on the broker’s website, MetaTrader 4 (MT4) is available as a mobile trading tool, compatible with iOS and Android devices. The application allows for complete account management and price analysis from your mobile or tablet device.

Payments

Deposits

Minimum deposits vary by account type. The lowest deposit requirement is $2,000 with the standard account, which is relatively high for new traders vs other brokers. GMI offers several payment methods for live account deposits in USD, EUR, and GBP:

- Card payments

- Bank wire transfers

- E-wallets

- Skrill

Withdrawals

Global Market Index does not charge for withdrawals. Unfortunately the broker doesn’t provide details on processing times, so clients should be prepared to wait several days before receiving any profits.

Demo Account

The broker offers demo accounts on its different trading platforms. Demo accounts are a good way to get familiar with the platforms offered and to test strategies in a risk-free setting. Once satisfied, clients are free to open a live account.

Bonuses

At the time of writing, Global Market Index Limited does not offer any promotions to new or existing clients, this includes no deposit bonuses.

Regulation Review

The UK entity, GMIUK, is licensed under the Financial Conduct Authority (FCA). The FCA is a respectable regulatory body and a good sign that the broker can be trusted.

GMIVN is authorised by the Vanuatu Financial Services Commission (VFSC). Unfortunately this agency isn’t as reputable – allowing for the quick and easy setting up of companies with limited client protection.

Additional Features

Global Market Index offers little in the way of additional trading features. There is no education platform or training tools. Our review has to flag this is a major downside, particularly for beginners who may benefit from extra analysis features and learning services.

Accounts

The broker offers four different account types, three are MT4 accounts with STP connection, and one offers ECN bridging. All accounts present tight floating spreads, flexible trade sizes, and varying leverage to suit the needs of different clients.

A key difference between account options is the minimum deposit requirement:

- MT4 Standard – $2,000 minimum deposit

- MT4 Plus – $5,000 minimum deposit

- MT4 Pro – $30,000 minimum deposit

- ECN – $100,000 minimum deposit

Benefits

- GMIUK is FCA regulated

- 24/5 customer support with live chat

- Choice of trading platforms including industry-renowned MT4

Drawbacks

- No additional educational tools

- High minimum deposits starting from $2,000

- Limited information around spreads and withdrawals

Trading Hours

Global Market Index follows standard office hours and 24-hour trading hours Monday to Friday. With that said, trading sessions may vary by market.

Customer Support

GMI offers a range of customer support options, available 24/5:

- Online contact form

- Telephone at 400-606-3399

- Email at cs@gmimarkets.com

- Live chat engines accessible from the relevant logos on the contact us webpage

Security

The GMI group assures client funds are secured in segregated accounts. Member areas and portal access are password protected. The MT4 platform provides high-tech encryptions, secure logins, and industry-standard data privacy.

GMI Verdict

Global Market Index provides opportunities for traders of different abilities on the established MT4 and bespoke GMI platforms. With that said, minimum deposit requirements are high compared to other brokers, which should should be considered before opening a live account.

Top 3 Alternatives to Global Market Index

Compare Global Market Index with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Global Market Index Comparison Table

| Global Market Index | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, Metals | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $2000 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 4 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Global Market Index and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Global Market Index | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Global Market Index vs Other Brokers

Compare Global Market Index with any other broker by selecting the other broker below.

FAQ

What trading platforms does Global Market Index offer?

GMI offers five trading platforms: GMI MetaTrader 4, GMI Alpine Trader, GMI ClearPro, GMI MTF and GMI Currenex. The choice ensures both beginners and experienced traders are catered for.

What is the minimum deposit at Global Market Index?

The lowest minimum deposit requirement is $2,000 with the standard account. This climbs to a hefty $100,000 for the ECN account.

Is Global Market Index regulated?

Yes, GMIUK is regulated and authorised by the FCA. GMIVN is regulated by VFSC. This ensures the broker is licensed to operate in multiple jurisdictions worldwide.

Does Global Market Index offer a demo account?

Yes, a demo account is offered on trading platforms. Traders can then sign up for a live trading account when ready.

What customer support options does Global Market Index offer?

GMI customer support is accessible 24/5 via telephone, email, online contact form and live chat.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Global Market Index yet, will you be the first to help fellow traders decide if they should trade with Global Market Index or not?