Trading EURCAD

The EURCAD is one of the most-traded currency pairs by volume. However, complexity and volatility can lead to unsettled price action. This guide will analyse the trading view of the EURCAD cross-currency pair, including historical data, long-term forex forecasts, correlation calculators, investing strategies, live charts, and more.

Best EUR/CAD Brokers

We've tested hundreds of brokers and these 4 stand out as the best for trading EUR/CAD:

EURCAD Explained

The Euro (EUR) is the official currency of respective European nations, and the Canadian Dollar (CAD) is that of Canada. The exchange rate of both currencies is impacted by respective monetary policies from the European Central Bank (ECB) and the Bank of Canada. Today, the Euro is the second most traded currency in the world, while the Canadian Dollar is the sixth.

Importantly, the EURCAD exchange rate denotes the buy or sell price of the Euro to the Canadian Dollar. For example, 1 EUR to 2 CAD means to buy 1 Euro, you will pay 2 Canadian Dollars.

Exchange rate history, future prognosis, real-time news, and decisions from central banks can all help traders make predictions about the value of the currency today, tomorrow, or several months from now.

Live Chart

History

The EURCAD is a fairly new forex pairing following the introduction of the Euro. The Euro was established as a digital currency in 1999 before gaining power as a physical asset across European Union zones. Significant economic events, including Brexit, and Eurozone performance have impacted the value of the Euro over the years.

The Canadian Dollar, originally the Canadian Pound, was developed in the 1850s and renamed to strengthen trade affiliation with the US. The value of the Canadian Dollar was set at 1.1 CAD to 1 USD until 1970 when it then became a floating currency. The Canadian Dollar is a commodity-sensitive currency with exchange rate fluctuations responding to price movements of their most lucrative export asset, crude oil.

In recent history, inflation rates and the Russia-Ukraine war also destabilized the EUR, which has since been losing ground against the CAD. This is a very good example of how global political events can impact forex trading markets, even though Ukraine doesn’t directly use the Euro.

Note, the all-time high for the EUR/CAD was 1.71 in December 2008 while the all-time low was 1.21 in August 2012.

Influences On Price

Many influences can cause movements in the value of the EURCAD, lending it to various trading strategies. Fundamental and technical analysis play a key role in most strategies, helping to inform investment decisions.

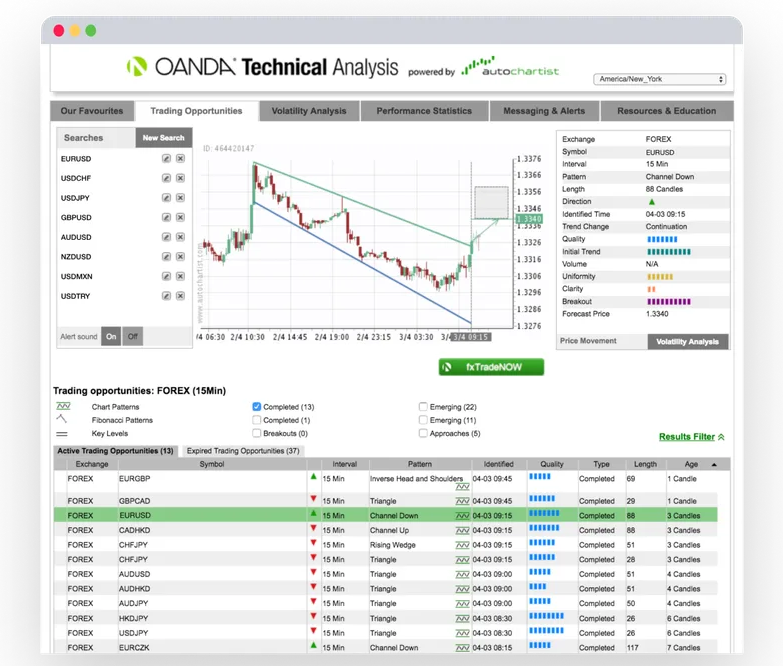

Technical Analysis

Today, technical analysis for trading forex pairs such as the EURCAD typically involves reviewing price trends and patterns on graphs. Historical 5 /10/ 20 years price data and monthly average charts are available at many top brokers, including IG. In fact, most of the best brokers offer software free downloads with a suite of charts and indicators to aid with technical analysis. Competitive forward rates are also available at top providers.

Fundamental Analysis

Fundamental analysis involves looking at economic, social, and political influences on the EURCAD. For example, investors should look at Canadian GDP growth data, plus unemployment and interest rates. Lots of the best platforms for day trading currencies offer economic calendars with upcoming events, along with the latest news bulletins.

Features Of The EURCAD

The EUR/CAD is known as a cross-currency forex pair. Cross pairs are those that do not include the US Dollar and have particular features to take into account:

- Uncorrelated pairs are highly volatile

- Reduced exposure to exchange rate fluctuations from US Dollar sensitive events

- Lower volume traded vs. major currency pairs can lead to increased price swings

- Weaker liquidity may lead to increased spreads with additional pips to enter trades

Despite this, it is important to note that the value of the US Dollar can still influence price movements in the EURCAD. A strength or weakness in the USD against other currency pairs can indirectly impact cross pairs.

Use a correlation calculator to understand the variables impacting the EURCAD versus the EURUSD and USDCAD. A positive correlation indicates a forex pair that reacts in line with movements in the EURCAD. A negative correlation suggests the currency pair will move in the opposite direction.

How To Trade The EURCAD

Currency pairs such as the EURCAD are bought and sold via a network of banks and brokers in a decentralized OTC market. Traders can use CFDs, forwards and futures, options, and more to speculate on the value of the pair.

Regardless of instrument, employment rates, political events, and demand for key commodities such as oil can all impact the EURCAD.

Trading Strategies

Many forex trading styles can be used to speculate on the price of the EURCAD:

- Swing – Holding positions for one or more days. Identify the market range and buy or sell according to support and resistance signals, pivot points, or other indicators.

- Scalping – Opening and closing positions, usually holding for just a few minutes to take advantage of small gaps between the bid and ask price. Intraday candlestick charts are a useful tool for scalpers.

- Carrying – Using a low-interest-rate currency to invest in a high-interest rate currency. EURCAD swap strategies usually involve going short. Sell the Euro to benefit from an interest rate differential between the EURCAD and your position size.

Pros Of Trading EURCAD

There are several reasons why this forex pair is popular:

- High volatility – Strong market trends means greater potential to generate revenue.

- Interest rates – Discrepancies between interest rates create opportunities for carry trade strategies.

- Information – Plenty of financial information is available on the EURCAD exchange rate online. Data includes weekly forecasts, live exchange rate charts, and currency conversion graphs. These can all help with trader outlooks and market sentiment.

Cons Of Trading EURCAD

There are some drawbacks to consider before investing money in the EURCAD:

- High risk – The volatility of the pair can create a complex environment for traders with limited experience or knowledge.

- Euro cross – The Euro links make the FX pair susceptible to intense price fluctuations from political and economic events in Europe.

Best Time To Trade

The majority of price movement occurs during the crossover between the London and New York financial market sessions, 1 pm to 4 pm GMT. Keep an eye on FX spot rate real-time charts and live graphs during this time. Most popular day trading strategies can be used during this period of increased liquidity.

Final Word On Trading EURCAD

The EURCAD offers traders both liquidity and volatility. There is a wealth of market data and trading tools available at leading forex brokers to help traders take positions on the FX pair. But before you start investing money, it is important to keep abreast of factors that can influence the exchange rate, including central bank decisions, news events, and indirect impacts from US Dollar sensitivities.

FAQs

Which Monetary Authority Regulates The Canadian Dollar?

The Central Bank of Canada is the nation’s primary bank. While intervention is rare, it is worth keeping an eye on announcements from the central banking authority as they may influence the value of the EURCAD.

How Do I Read The EURCAD Forex Pair?

In this forex pair, the Euro is the base currency and the Canadian Dollar is the quote currency. The base currency signifies how much of the quote currency is needed to buy one unit of the base currency. For example, 30 EUR versus 45 CAD means to buy 30 Euro you will pay 45 Canadian Dollars.

When Is The Best Time To Trade EURCAD?

The best time to trade the EURCAD currency pair is generally during the crossover between London and New York market sessions, 1 pm to 4 pm GMT. This is where the majority of price movement will occur creating trading opportunities.

How Much Is 1 EUR To CAD?

Exchange rates for the EUR to CAD fluctuate daily, noted in historical charts by date. Live currency exchange rate charts offered by leading forex brokers show how many Canadian Dollars are needed to buy 1 Euro.