Finspreads Review 2024

Open an account with the UK-regulated Finspreads to start spread betting.

Forex Trading

Invest in online currencies, including the US Dollar and Euro.

Stock Trading

Trade UK, US, EU and Asian shares at Finspreads.

Spread Betting

Spread bet in major financial markets with Finspreads.

Finspreads is a leading UK spread betting broker offering a variety of assets, including currency pairs and commodities. Before you login to the platform, follow this review for details of minimum deposit requirements, account types, the mobile app and demo account.

Finspreads Details

Finspreads was founded in 1999 and was the first provider of spread betting via a browser-based platform. In 2006, Finspreads was acquired by City Index Ltd and in 2015, City Index was acquired by GAIN Capital Holdings, Inc, one of the global leaders in online trading. The broker is regulated in the UK, by the Financial Conduct Authority (FCA).

The broker offers three accounts types, including a limited risk account, plus competitive spreads on a proprietary web and mobile trading app. There’s also a range of markets to trade, including currencies, commodities, indices and shares.

Advantage Web Trading Platform

The broker’s platform is a sophisticated software which can be accessed straight from an internet browser, with no need to download any applications.

The platform offers two interactive charting packages with technical indicators, a fully customisable layout, one-click dealing and multiple watchlists. Traders can also use market profiling techniques where you can view top equity gainers and losers, stay ahead of the most active shares and pinpoint trading opportunities with ease.

Markets

There’s a good choice of markets available at Finspreads, including major, minor and exotic forex pairs, large indices, commodities and precious metals, plus UK, EU, US and Asian shares. The broker also offers Day Trades, a selection of 15 popular stocks, such as BP and Tesco, which traders can spread bet with no overnight risk.

Spreads & Commission

Finspreads offers competitive variable spreads starting from 0.5 pips for EUR/USD and USD/JPY and 0.8 pips for GBP/USD. Spreads start from 0.4 points for the S&P 500 and 4 points for US crude oil.

Other fees may include a monthly inactivity fee of £25, which is charged on accounts left dormant for a period of 12 months or more. There may also be daily holding costs charged each night a position is held.

Leverage

Finspreads offers low margins from 1% in order to open a position. The broker also uses a Step Margin feature, where the amount of initial margin per trade may increase depending on the trade size. This has allowed the broker to reduce margin rates by an average of 48% over the last few years.

Traders should be aware that lower margin rates may increase the amount of risk you are exposed to. It is therefore recommended that you use guaranteed stop losses to help minimise risk.

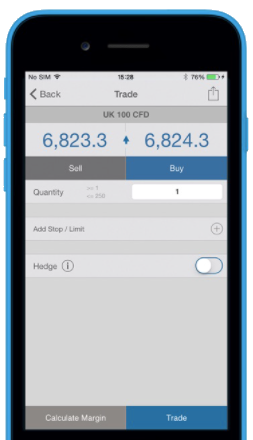

Mobile Apps

Finspreads offers an iPhone and Android mobile trading app which allows you to access your spread betting account from anywhere and at any time.

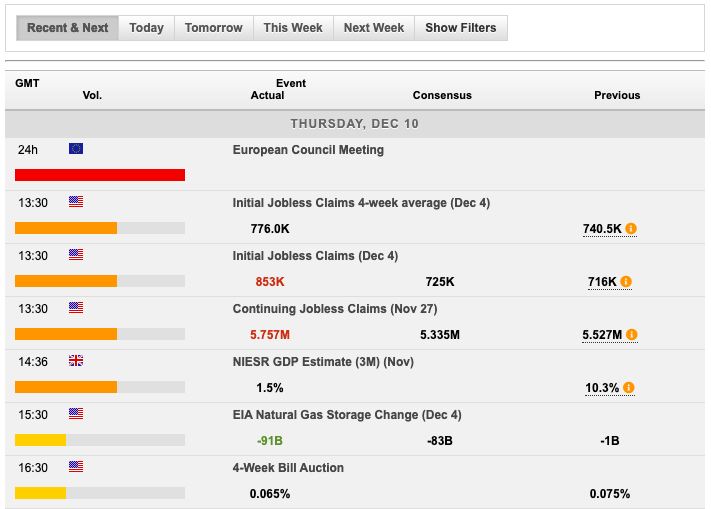

Key features of the app include a full range of order types including guaranteed stop losses and limit orders, customised watchlists, interactive charting with technical indicators, and an economic calendar. Traders can also set mobile trading alerts to keep up-to-date with the markets.

Payment Methods

Deposits

You can fund your account using debit/credit cards including Visa, Mastercard and Maestro, as well as direct bank transfer. There are no charges for depositing via debit card, however there is a 1.5% processing fee for credit cards. Your bank may also charge their own fees for transfers.

Withdrawals

Withdrawals should be returned via the original funding source wherever possible. In some cases where credit cards are not accepted (i.e. if they are issued in a restricted country) the broker will arrange for funds to be returned to your bank account. The minimum withdrawal amount is £50 (or currency equivalent); the maximum is £20,000 (or currency equivalent).

Demo Account

One downside of Finspreads is that they do not offer a demo account. Demo accounts are ideal for new traders who want to explore the trading platform before signing up. They are also equally useful for experts who need to practice any trading strategies.

Nonetheless, the broker does offer a very accessible Beginner account, as well as a Limited Risk account, with small stake sizes from 10p.

Finspreads Bonuses

Finspreads is a fully regulated broker in the UK and therefore does not provide any bonuses or deals. The FCA introduced such restrictions to protect new traders from monetary and non-monetary inducements, designed to encourage trading.

Regulation Review

GAIN Capital UK Limited (Finspreads) is licensed and regulated by the UK Financial Conduct Authority (FCA) with FRN 113942. GAIN Capital UK Limited is a subsidiary of GAIN Capital Holding, Inc, a publicly traded company listed on the NYSE exchange.

Finspreads therefore operates in accordance with the FCA’s rules on client money, including segregated accounts. The broker also uses the leading independent clearing house, LCH.Clearnet, which is also regulated by the FCA and within other jurisdictions.

Additional Features

Finspreads offers some spread betting education for beginners with accompanying video training. There’s also some pages on other key topics including risk management, trading psychology, fundamental and technical analysis, as well as spread betting tips. Traders can also access an economic calendar and market news.

Trading Accounts

Traders get a choice of 3 account types at Finspreads, for those who are new to spread betting, those who want to limit their risk, and those who are experienced in spread betting. All accounts provide access to the Advantage Web platform, with competitive spreads, low margins and Guaranteed Stop Loss Orders (GSLOs).

The Beginners Account allows a minimum stake size from 10p and provides access to indices, commodities and currencies. Note that you can lose more than your initial deposit with this account. The minimum deposit is £50.

The Limited Risk Account offers minimum stake sizes from 50p and offers all available assets, including Day Trades and shares. GSLO is also enforced on all trades and traders can not lose more than their initial deposit. The minimum initial deposit is £100.

The Standard Account, for experienced spread bettors, also offers a minimum stake size of 50p and all available assets. Traders can lose more than their initial deposit. The minimum deposit is £100.

Benefits

There are some good reasons to sign up with Finspreads, including:

- Established broker and regulated in the UK

- Beginner and limited risk accounts

- Low stake sizes from 10p

- £50 minimum deposit

- Range of markets

Drawbacks

Some limitations of trading with Finspreads may include:

- No e-wallets or online payment methods

- No choice of platforms

- No demo account

Trading Hours

You can trade with Finspreads 24 hours a day, but dealing times for individual markets will vary. These can be found by clicking on the instrument within the trading platform. Note that Day Trades markets close at 4.30 pm UK time.

Customer Support

Help is available Monday to Friday, from 9am to 6pm, UK time, via:

- Email – enquiries@finspreads.com

- Live chat – Located at the top of the website page

- Telephone – 020 3194 1802 (local) or +44 (0) 8000 96 96 20 (international)

- Postal address – Park House, 16 Finsbury Circus, London EC2M 7EB, United Kingdom

Security

Most trading platforms use standard SSL security features and encryption technology, as well as login protection. Traders can always get in touch with the broker for details on their security protocols.

Finspreads Verdict

Finspreads offers competitive spreads and low margins across a range of popular assets. The reasonable £50 minimum deposit and minimum stake sizes from 10p also makes this broker highly accessible for beginners. There is only one trading platform and mobile app, however, which may be limiting for some traders.

Top 3 Alternatives to Finspreads

Compare Finspreads with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

Finspreads Comparison Table

| Finspreads | IG | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.6 | 4.4 | 4.3 | 4.8 |

| Markets | Spread betting, forex, stocks, indices, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | £50 | $0 | $0 | $0 |

| Minimum Trade | £0.10 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 4 | 6 | 6 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by Finspreads and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Finspreads | IG | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Finspreads vs Other Brokers

Compare Finspreads with any other broker by selecting the other broker below.

FAQ

What accounts are on offer at Finspreads?

Finspreads offers 3 account types: Beginners Account, Limited Risk Account and Standard Account. All accounts come with the Advantage Web platform, low spreads and GSLO.

How much capital do I need to trade at Finspreads?

The minimum deposit required is £50 for beginners and £100 for limited risk and experienced spread bettors. Minimum stake sizes start from 10p.

Does Finspreads offer a practice account?

No, Finspreads does not offer a demo account, however new traders can sign up with a beginners account where you can start trading with small stakes.

What can I trade at Finspreads?

Finspreads offers currency pairs, commodities, precious metals, shares and indices. They also offer Day Trades, which consists of 15 popular shares which can be traded with no overnight risk.

What are the margin rates at Finspreads?

Finspreads offers low margins from 1% to open a position. The broker also uses Margin Step rules which go up as your position increases. You can find details of margin rates within the trading platform.

Customer Reviews

There are no customer reviews of Finspreads yet, will you be the first to help fellow traders decide if they should trade with Finspreads or not?