Financika Review 2024

Financika Review

Financika Trade is an online forex broker, offering a range of financial instruments to both beginners and veterans. This review will guide you through the trading platform, spreads, minimum deposits, and more. Find out if Financika is the right broker for you.

Financika Details

Operated by Sharp Trading Ltd, Financika is registered with the Vanuatu Financial Services Commission (VFSC) and also operates as a European entity in Cyprus. The company’s customer service address is based in Bulgaria, but its clients can be found from Europe to Chile, Mexico, Peru, and Colombia.

Trading Platform

Financika offers WebPROfit, a non-downloadable trading platform suitable for all levels. Features of the web-based platform include advanced charting tools, one-click trading, no slippage, and direct platform support. To access these features users will need to open an account via an online form on the website.

Markets

Financika offers a variety of products:

- Currencies – Trade 40+ major, minor, and exotic currency pairs including the EUR/GBP & USD/GBP.

- Indices – Trade 7 of the world’s most popular indices including the FTSE, Dow Jones, and DAX.

- Stock CFDs – Trade on over 90 global companies such as Apple, Facebook, and Uber.

- Commodities – Trade on gold, silver, oil, wheat, and more.

Spreads & Commissions

For major forex pairs such as the EUR/USD and GBP/USD, spreads start from 3 pips – higher than at most other brokers. Brent crude oil is offered at a spread value of $0.12, whilst for silver and gold, it ranges from $0.04 to $1 respectively.

There are other costs to be aware of, for example, a swap fee on positions held overnight and a significantly high inactivity fee of $500, charged quarterly. This is much higher than fees levied against dormant accounts at other brokers.

Leverage

Leverage at Financika ranges from 1:10 on CFD shares to 1:200 on commodities and forex with indices offered at 1:100. These are decent leverage rates and will allow traders to take large positions with minimal capital outlay.

Mobile Apps

Financika offers the WebPROfit platform in a mobile app, allowing users to manage their accounts and place trades as they travel. Mobile traders enjoy the same features as the web platform, including real-time quotes and charts, financial news, and fast account monitoring.

The app is compatible with all iOS and Android mobile devices and can be downloaded via the Play Store or App Store. FinancikaTrade.com desktop login credentials should work with the mobile app.

Payment Methods

Deposits

Deposits can be made via credit card, bank wire transfer, and e-wallets (Skrill and Neteller). Note the minimum deposit amount for a credit card is $200. Credit cards and wire transfers take 2 – 5 business days to process, while deposits via an e-wallet can take up to 5 business days.

Withdrawals

Withdrawals can be made via the same methods, with an average processing time of 4 – 5 business days. Financika claims they do not charge for withdrawals, however, many customer reviews online suggest otherwise. We recommend caution when considering a broker that has a history of bad withdrawal practices.

Demo Account

Financika does not offer a demo account. This is a real downside as a practice account is a great way to try a broker’s platform, instruments, and customer support before opening a real trading account.

Deals & Promotions

Clients are entitled to weekly bonuses, the amount and type of which will vary each week. Traders should check the broker’s homepage for updates on these bonuses.

New users receive trading credit upon opening an account, though information about sign-up deposit bonuses is limited. With that in mind, it’s worth speaking to the customer support team, using the details below, to find out more. Financika also offers traders investment protection on their first five trades, meaning beginners can test the waters in a safe trading environment. Note that this insurance is subject to the specific terms and conditions found on the broker’s website.

Regulation & Licensing

Financika (Sharp Trading) Ltd is registered and licensed by the Vanuatu Financial Services Commission (VFSC). It also operates under its European entity, Cubbon Services Limited, in Larnaca, Cyprus. However, the VFSC is not a well-respected body and it’s relatively easy for a potentially fraudulent company to secure a license.

Scam Warning

There are multiple customer complaints regarding scams at Financika. These reviews are particularly concerning given the lack of reputable regulatory oversight. Users are advised to carefully consider these warnings before trading with the broker.

Additional Features

Financika offers an Academy with tools specially designed for beginners. Features include a glossary of terms, the basics of trading, charts and technical analysis, plus video tutorials. Though there are some useful education tools on offer, they are not as comprehensive as those found at other brokers.

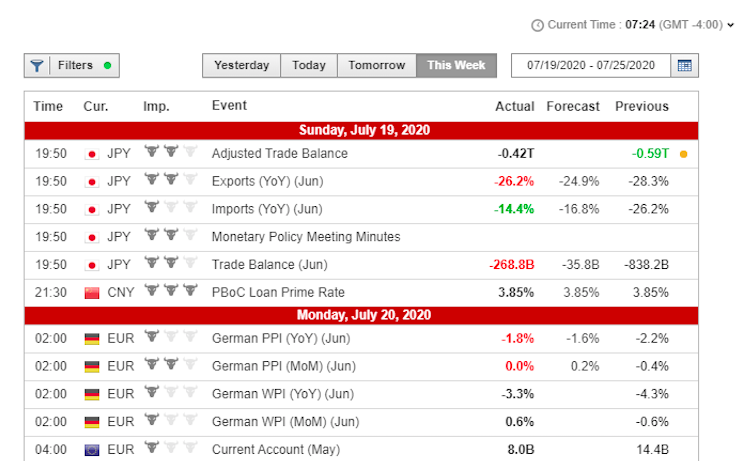

Other more practical tools include currency rates charts, a daily economic calendar, and forex video analysis.

Account Types

Financika only offers one standard account, which you can sign up for on the home page. The minimum deposit requirement is $200 and the maximum leverage is 1:200. Speak to the support team for account-specific questions.

Benefits

Advantages of choosing Financika include:

- Economic calendar and daily analysis

- Learning centre for beginners

- Personal account manager

Drawbacks

There are some considerable drawbacks to using Financika:

- Complaints & poor customer reviews

- UK customers restricted

- $500 inactivity fee

- No demo account

- One account type

Trading Hours

Users can trade forex and commodities from 22:00 GMT on a Sunday until 22:00 GMT on a Friday. CFD trading hours vary as follows:

- US markets – 2:30 pm – 9:00 pm GMT, Mondays to Fridays

- European & British markets – 8:00 am – 4:30 pm GMT, Mondays to Fridays

- Asian markets – 0:00 am – 2:00 am GMT and 3:30 pm – 6:00 pm GMT, Mondays to Fridays

Trading hours for individual indices also vary and can be found on the Indices page on the broker’s website.

Customer Support

Customers can access 24/7 support via:

- Online request form – Contact Us page

- Telephone contact number – +27212004239 (South Africa)

- Email – customer.service@financika.com

- Live chat – logo located in the bottom right-hand corner of the website

Financika (Sharp Trading) Ltd is headquartered at Law Partners House, Kumul Highway, Port Vila, Vanuatu.

User Safety

Financika holds an eTrust seal, which indicates compliance with high standards of privacy and data protection. Trading systems are also secured with 128-bit Secure Sockets Layer (SSL) encryption. But due to its lack of regulation and unproven legitimacy, there may still be a risk to trading with Financika.

Financika Verdict

Although Financika does offer a decent range of educational resources for beginners, the single account offering and lack of demo account are fairly limiting. More importantly, the lack of top-tier regulation and concerns around scams may deter many prospective traders. See our list of alternatives.

Top 3 Alternatives to Financika

Compare Financika with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Financika Comparison Table

| Financika | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | Variable deposit bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:10 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 3 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Financika and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Financika | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Financika vs Other Brokers

Compare Financika with any other broker by selecting the other broker below.

FAQ

What trading platform is available at Financika?

Users can access web PROfit and mobile PROfit. The web-based platform is user-friendly with multiple chart types, technical indicators, and one-click trading.

What is the maximum leverage at Financika?

Financika offers maximum leverage of 1:200 on commodities, 1:100 on forex and indices, while leverage up to 1:10 is available on share CFDs.

What is the minimum deposit at Financika?

The minimum deposit amount is $200. Whilst not particularly high, there are also brokers that accept a lower minimum deposit, which may appeal to new traders.

Does Financika offer a demo account?

No, Financika does not offer a demo account. This is a serious drawback as it means prospective clients aren’t able to test the trading platform or broker’s services.

Is Financika a scam?

Financika claims to be registered under the Vanuatu Financial Services Commission (VFSC). Although this means the broker is licensed, the VFSC is not a well-regarded body and there are multiple complaints online that the broker is a scam. As a result, we’d recommend caution before opening an account.

Customer Reviews

There are no customer reviews of Financika yet, will you be the first to help fellow traders decide if they should trade with Financika or not?