DIF Broker Review 2024

Awards

- Best Online Broker Western Europe 2013 - 2017 - Global Banking & Finance Review

- Best Multi-Asset Provider 2017 - Global Banking & Finance Review

Pros

- I feel fairly confident in the broker's established reputation, long history in the financial industry, and CMVM regulatory oversight

- I'm thoroughly impressed with the vast product catalog of 30,000+ CFD instruments including stocks, forex, futures and indices

- DIF Brokers offers a powerful and intutive proprietary trading terminal which I enjoyed using, with 40+ technical indicators and advanced graphical objects

Cons

- The demo account is restricted to a time limit of 15 days, which is disappointing and far lower than most of the brokers I have reviewed

- I'm disappointed that the minimum deposit requirement of €2000 will price out most beginners, and the lack of any educational content is a further setback

- I think it's a bit of an oversight that the live chat customer support is only available to customers after they have registered

DIF Broker Review

DIF Broker is based in Portugal and offers thousands of online instruments including currencies, CFDs, and ETFs. Our review of the app dives into demo and live accounts, fees, and more. Whether you’re an independent trader or a professional investor, find out if you should login with DIF Broker.

DIF Broker Headlines

DIF Broker was established in 1999 in Portugal and is regulated by the Portuguese and Spanish Authorities for Financial Supervision (CMVM and CNMV) and the Bank of Portugal. The brokerage also has a branch in Uruguay (regulated by the Central Bank of Uruguay) and is registered with other European regulators, including the FCA in the UK.

Since 2016, the company has expanded rapidly, acquiring Saxo Bank retail operations in Latin America, as well as independent fund company, Optimize. Today, the provider serves thousands of clients in over 20 countries.

DIF Broker strives to provide a unique service, emphasising technological innovation and long-term support for both casual traders and high volume investors.

DIF Broker Platform

The broker’s proprietary multi-asset platform provides access to over 35,000 instruments on an intuitive and user-friendly interface.

Traders can utilise over 50 technical indicators including RSI, Moving Averages, and Bollinger Bands. There’s also access to financial news, an economic calendar, and integrated trading signals via Autochartist. Within the account dashboard, you can also produce trading reports on profit and loss statistics, performance history, and more.

Overall, the platform’s charting and analysis capabilities are fairly impressive compared with the likes of MetaTrader 4. The platform is available as a downloadable desktop solution or a non-downloadable web terminal.

Markets

DIF Broker offers thousands of instruments across a range of asset groups, including over 180 currency pairs, thousands of CFDs on global shares, plus 21 indices. There’s also a good selection of precious metals and other commodities, as well as futures, ETFs, bonds, and options. The only thing missing that this review would have liked to have seen is cryptocurrencies, such as Bitcoin.

Trading Fees

Average spreads on popular currency pairs such as EUR/USD and GBP/USD are 3 pips. Spreads are around 1 pip for the S&P 500 and 0.05 for crude oil. Compared to similar providers such as XTB, DIF Broker’s forex prices are not the most competitive.

Commissions and custody fees also apply depending on the instrument you are trading. US shares, for example, are charged at 0.10% of the volume (minimum 10 USD) and from 0.75 points on the S&P 500. The brokerage also applies an inactivity fee of 36 EUR if you leave your account dormant for 12 months.

Leverage

The maximum leverage available at DIF Broker is 1:30 on popular currency pairs, which is in line with European regulatory restrictions. Margin requirements are also provided within the trading platform.

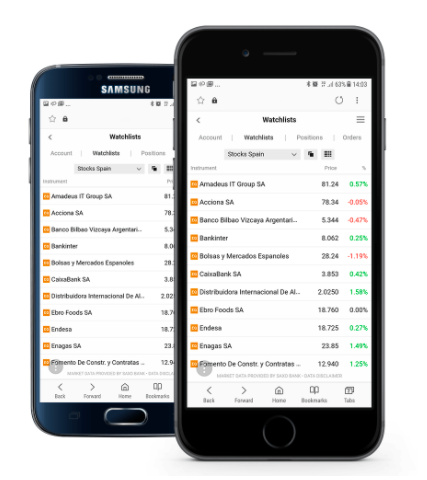

Mobile Apps

The broker’s platform is available on tablet and mobile devices, downloadable from the App Store or Google Play. The app offers thousands of instruments that can be traded directly through live, customisable charts. Users can also access a financial news feed, as well as integrated trade signals and a real-time display of account performance.

Payment Methods

Clients can load trading accounts using online bank transfers. Payments are processed instantly but users will have to pick up any intermediary fees. Unfortunately this review was disappointed with the limited information surrounding deposits and withdrawals, including minimum deposit requirements. This is certainly something that should be improved moving forwards, as most other competitors are transparent with this information.

Demo Account

DIF Broker offers a demo account that is available for 15 days and is pre-loaded with €100,000 in virtual cash.

The demo account is important for anyone considering this provider, as it’s a good way to test out the proprietary platform before committing real money. Traders can place simulated trades, monitor the markets in the live feed, or run trading reports within the account section.

DIF Broker Bonus

DIF Broker does not offer any bonus deals. With regulatory oversight provided by several European institutions, the lack of promotional offers is no surprise.

Regulations

DIF Broker is authorised and regulated by the Bank of Portugal, the Portuguese Securities Market Commission (CMVM) under license number 276, and the Spanish National Securities Market Commission (CNMV) under license number 36. The company is also registered with other European regulators, including BaFin (Germany) and the FCA (UK).

As part of its regulatory requirements, DIF Broker uses segregated bank accounts for storing and moving customer funds. The brokerage also participates in the Investor Compensation System, offering a refund guarantee of up to €25,000.

Additional Features

Traders who meet a minimum number of monthly transactions get exclusive access to two daily webinars, conducted by industry professionals. Note that this also requires a subscription, details of which are only briefly mentioned in the FAQ section. There are also monthly educational courses, as well as a selection of ebooks, YouTube tutorial videos, and a blog.

Accounts

Accounts at DIF Broker are based on what type of investor you are, i.e. whether you plan to invest by yourself, invest with an advisor, or invest with a portfolio manager.

If you are investing by yourself, a standard brokerage account will give you access to all the instruments and tools provided in the demo account. Those investing with an advisor or portfolio manager will receive custom portfolios tailored to their trading style and risk tolerance.

Trading Hours

Trading hours for different assets depends on the specific platform session times. The product dashboard within the platform will tell you if the particular asset is open for trading.

Customer Support

DIF Broker can be reached via telephone, email, or one of the office addresses in Lisbon, Porto, or Madrid. There is also an integrated chat within the platform, however, this is only accessible once you open a live account.

- Email – hdesk@dif.pt

- Telephone – +351 211 201 595

While the team are helpful, we’d like to have seen a support forum and a more detailed FAQ portal.

Security

The brand is not very transparent about the security of its platform. Most trading platforms come with industry-standard encryption systems and dual-factor authentication, so we hope that DIF Broker’s solution provides the same level of protection.

DIF Broker Verdict

DIF Broker excels in its asset offering, though it would be nice to see Bitcoin and other cryptocurrencies offered. The brokerage’s trading conditions and fees are certainly not the most competitive in the industry, however, and the demo account expires after 15 days. With this in mind, traders may want to consider opening an account elsewhere.

Top 3 Alternatives to DIF Broker

Compare DIF Broker with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

DIF Broker Comparison Table

| DIF Broker | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, ETFs, indices, shares, energies, futures, options, bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €2000 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CMVM, CNMV | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 1 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by DIF Broker and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| DIF Broker | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

DIF Broker vs Other Brokers

Compare DIF Broker with any other broker by selecting the other broker below.

FAQ

Is DIF Broker regulated?

Yes, DIF Broker is regulated by the Bank of Portugal and the Portuguese and Spanish supervisory authorities, CMVM and CNMV.

Where is DIF Broker located?

DIF Broker is based in Lisbon, Portugal, but also has additional offices in Madrid as well as Uruguay.

How do I open an account with DIF broker?

You can open an account by filling in the short registration form on the website. You will need to verify your identity by providing documents and participating in an identity verification video call.

What platforms does DIF Broker offer?

DIF Brokers only offers its own trading platform which can be downloaded onto desktop PCs or mobiles and can be accessed via a web browser.

Does DIF Broker offer a demo account?

Yes, DIF Broker offers a 15-day practice account which includes €100,000 in virtual cash.

Customer Reviews

There are no customer reviews of DIF Broker yet, will you be the first to help fellow traders decide if they should trade with DIF Broker or not?