Core Spreads Review 2024

- Daytrading Review TeamCore Spreads, now Trade Nation, will suit UK traders seeking a secure and reliable spread betting environment with good all-round service.

Core Spreads is an FCA-licensed broker offering CFD and spread betting opportunities on a proprietary platform or MetaTrader 4. Traders can access more than 1000 instruments, including company shares, commodities, indices and forex. Spread bets have fixed spreads that start from 0.4 with no commission, while CFDs start from 1 pip plus a $1.50 charge per lot.

Forex Trading

Core Spreads offers trading on 34 forex pairs through spread betting and 40 currencies through CFDs, with both vehicles covering major and minor pairs. Spread betting spreads start from 0.6 for EUR/GBP; CFD spreads are variable and start from 1.2 pips on EUR/GBP.

Stock Trading

Core Spreads traders can access spread betting on 1000+ UK, US and European stocks and shares, a decent selection. However, CFD stock trading is not available and clients cannot directly buy and own shares through this broker.

CFD Trading

Core Spreads offers CFD trading on 40 forex pairs plus 13 commodities, including metals and energies, and 13 global stock indices including the UK100 and US30. CFDs are traded through the MT4 platform with leverage up to 1:30 in line with UK regulations.

Spread Betting

Spread betting is available with very tight fixed spreads starting from 0.4 with no commissions. Core Spreads has a full asset list for spread betting, including 1000+ stocks and shares, 34 forex pairs, 16 global stock indices and five metals and energies.

Awards

- Best Value Forex Broker 2017 - UK Forex Awards

✓ Pros

- Reliable, FCA-regulated broker with FSCS protection and good customer service

- Strong range of assets with 1000+ stocks and shares and 40 forex pairs

- MT4 support plus proprietary platform for spread betting

- Good spreads available on spread betting

- Demo account on both platforms

- Free deposits and withdrawals

- No inactivity fee

✗ Cons

- CFD spreads and charges are more expensive than some competitors

- Narrow range of CFDs

- No MetaTrader 5 platform

Core Spreads is a global broker offering day trading opportunities in CFDs and spread betting. Clients can access over 1,000 instruments, including forex, commodities and indices. Our detailed review will cover login requirements, fees, platforms, minimum deposits and more. Find out whether to register for a live trading account today.

Core Spreads Is Moving…

Core Spreads has announced that they will no longer accept new account applications as they transition to their new global brand – Trade Nation. This is the latest step to bring the established brokers with a long-standing history under the same umbrella.

Trade Nation promises the same company, staff and top-tier regulatory protections as Core Spreads, but with a clean new look.

For now, you can follow the sign-up link through the Core Spreads website. Alternatively, you can open an account directly at Trade Nation.

Core Spreads Headlines

Core Spreads, a trading name of Finsa Europe Limited, was founded in 2009. The broker operates in 150+ countries worldwide, with headquarters located in London, UK. The company is authorised and regulated by the Financial Conduct Authority (FCA), a well-regarded body with stringent compliance requirements.

The broker also has branches in Australia and South Africa. Both operate with local jurisdiction regulation from the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) respectively.

Core Spreads strives to provide the best service across three pillars; pricing, platform technology, and customer experience.

Platform Reviews

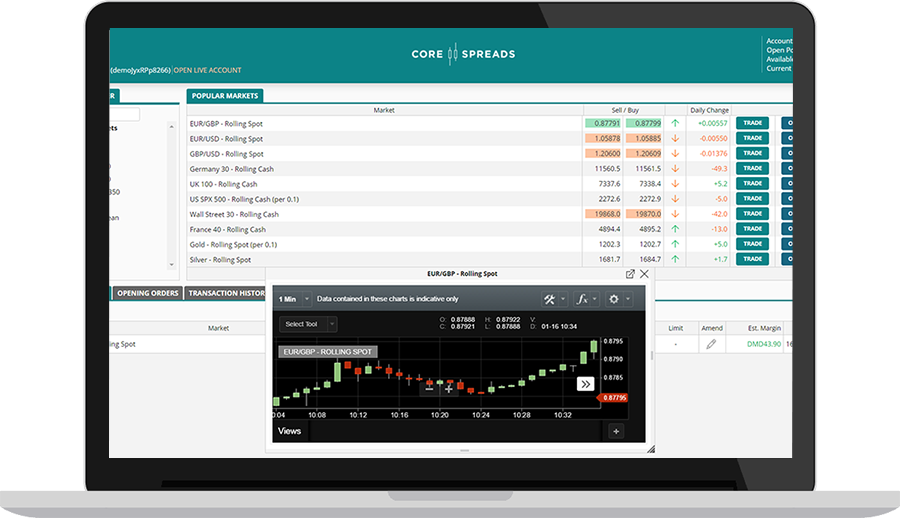

Core Spreads offers two platform options with easy logins; a proprietary platform, CoreTrader, for spread betting; and CoreMT4 for CFD trading.

The MT4 platform requires a download to desktop devices while CoreTrader is a web-based software designed for trading through major browsers.

CoreMT4

A favourite among retail traders, MetaTrader 4 offers a clean interface, a wide selection of analysis tools and a mix of instant and pending order types. Additional features include:

- One-click trading

- Market news streams

- 24/5 customer support

- Access to Expert Advisors

- Ultra-fast execution speeds

- Customisable graphs and charts

- Hundreds of technical indicators

CoreTrader

CoreTrader is a hassle-free platform designed for spread betting. Clients can browse popular financial markets and take positions in a few clicks. Features include:

- 24/5 customer support

- One-click demo account

- Fully customisable charts

- Trade directly from charts

- Advanced technical analysis

- Simple and easy to use interface

- Comprehensive risk management tools

Markets & Assets

Core Spreads offers clients trading opportunities in various global markets. Access varies by the chosen account/platform.

Spread Betting

- US, UK & European equities – Access to 1,000+ shares

- Commodities – Five metals and energies, including gold and oil

- Indices – 16 global stock indices, such as the UK100, Germany30 and US500

- Forex pairs – 34 major and minor currency pairs, including EUR/USD and USD/CAD

CFDs

- Commodities – 13 metals and energies, including gold, silver and oil

- Indices – 13 global stock indices, such as the HK50, UK100 and US30

- Forex pairs – 40 major and minor currency pairs, including EUR/GBP and GBP/USD

Spreads & Commission

Spreads vary by account type and platform but are competitive. On spread betting accounts, forex pairs such as EUR/GBP are offered at a fixed rate of 0.6 pips while GBP/USD comes in at 0.8 pips. The UK100 and US500 indices are offered from 0.4 points.

Variable spreads are offered on the CFD account. The EUR/GBP currency pair comes in at a minimum of 1.2 pips, UK100 and DE30 indices from 1.0 pip and energies from 3.5 pips. Full details can be found in the market information section of the broker’s website.

Core Spreads does not charge commissions on spread betting accounts but a $1.50 per lot charge is applied to CFD accounts. The broker also charges a swap rate for positions held overnight at 2.5% +/- Libor.

Leverage

Leverage is capped at a maximum of 1:30 in line with ESMA trading regulations. The maximum leverage offered also varies by asset:

- Equities – 1:5

- Commodities – 1:10

- Major forex pairs – 1:30

- Minor forex pairs and indices – 1:20

Mobile Trading

Core Spreads offers mobile app versions of both platforms in most major jurisdictions, including Europe, Australia and the UK. These are available for free download to iOS and Android devices. Users can access the full range of trading features, respond to market movements, complete transactions and view public holiday hours while on the go. Customer support can be contacted from within the apps.

The only downside is that detailed technical analysis is harder to conduct on mobile applications versus desktop-based solutions.

Payments

Deposits

There are no minimum deposit requirements to open a live account. Accounts can be funded in the following currencies: GBP, USD, EUR, AUD, and ZAR. The broker accepts the following payment methods:

- Skrill e-wallet

- Bank wire transfer

- Debit/credit cards, including Visa, MasterCard and Amex

There is no deposit fee with any payment method. Processing times are not published however debit/credit card and e-wallet payments often support instant funding.

Withdrawals

Core Spreads does not charge for withdrawals. However, in line with regulations, funds must be processed back to the original payment method. A minimum withdrawal of $50/£/€ applies. The broker processes withdrawals within 24 hours of requests but funding settlement varies by payment method.

Demo Account

Core Spreads offers a demo account on both platforms. This is a good way to understand platform features, explore interface navigation, and practise trading strategies. Upon registration and login, users can access up to £10,000 in virtual funds and test strategies risk-free in simulated market conditions.

Core Spreads Bonuses

At the time of writing, Core Spreads does not offer any promotions to new or existing clients, this includes no deposit bonuses. EU and UK traders are not eligible for bonuses due to ESMA trading regulations which restrict financial incentives. Keep an eye on the broker’s website for upcoming offers in other jurisdictions.

Regulation Review

Core Spreads is licensed with the Financial Conduct Authority (FCA), meaning the broker operates under established regulatory standards. Clients can be assured of segregated funds in top-tier banks and negative balance protection. Retail traders are also protected by the FSCS compensation scheme up to the value of £85,000 in the case of business insolvency. The broker is also fully compliant with the European Securities and Markets Authority (ESMA).

Additional Features

Global market news, trading insights, and weekly articles are posted on the Core Spreads website. The blog-style platform also integrates tutorial posts analysing topics such as using financial signals, forex strategies such as scalping and hedging, margin trading, plus trailing stops. Video content is also posted providing tips for investing in popular markets.

Market information sheets by platform are available to download. This includes a breakdown of spreads, trading hours and guaranteed stop distances by instrument.

Live Accounts

The broker offers two account types; one for CFD trading (platform CoreMT4) and one for spread betting customers (platform CoreTrader). Clients can open one spread betting account and one CFD account and these can be opened in different currencies. The key features of each account are listed below.

CoreMT4

- Variable spreads

- No minimum deposit

- 0.01 lot minimum order

- CFD trading – indices, forex and commodities

- $1.50 (or equivalent currency) commission per lot

CoreTrader

- Fixed spreads

- No commission

- No minimum deposit

- £0.50/$/€ minimum order

- Spread betting – indices, forex, commodities, UK, US and European equities

Clients are required to upload identification documents and proof of residency to open a live account. This is standard practice aligning with KYC policies. Details of trading experience and knowledge must also be submitted. The average processing time for account approval is one working day.

Opening Hours

Core Spreads is available to contact 24/5, operating Sunday 10 pm GMT to Friday 10 pm GMT. Trading hours vary by instrument. An upcoming month trading calendar is available on the Core Spreads website and includes information on market holidays.

Customer Support

Core Spreads offers various customer support options available 24/5:

- Email – support@corespreads.com

- Address – 9th Floor, 30, Crown Place, London, EC2A 4ES

- Telephone – 08008620780 (free calls for UK users) or +442034754830 (international users)

The broker can also be found on social media platforms including LinkedIn. Unfortunately there is no FAQ section on the website for quick help.

Security

Core Spreads assures client funds are secured in segregated accounts. Client portal access is password protected. Both platforms offer high-tech encryptions, secure logins, and industry-standard data privacy.

Core Spreads Verdict

Core Spreads provides CFD and spread betting opportunities for traders of different abilities on the established CoreMT4 and bespoke CoreTrader solution. Benefits include FCA regulation, a free demo account, 24/5 customer support, and no minimum deposit requirements. The broker offers a good all-round service and will be particularly popular among spread betters.

FAQs

Is Core Spreads Legit?

Core Spreads offers a safe and reliable trading environment for global customers. Our review highlights the FCA regulatory oversight, positive customer reviews, and multiple security protocols in place to protect client data. We’re comfortable the broker is a legitimate online trading broker.

What Trading Platforms Does Core Spreads Offer?

Core Spreads offers two platforms; CoreTrader for spread betting and CoreMT4 for CFD trading. The MT4 solution can be downloaded to desktop devices while CoreTrader can be opened in web browsers.

What Trading Education Does Core Spreads Offer?

The Core Spreads website supports several additional features including market analysis reports from David Buik, financial trend insights, and investing tutorials. Other education includes free forex trading tips with useful video content on specific currency pairs.

Does Core Spreads Offer A Demo Account?

Yes, Core Spreads offers a demo account accessible on both trading platforms; CoreMT4 and CoreTrader. Users get access to £10,000 virtual funds and can upgrade to a live account when they feel ready.

Is Core Spreads Regulated?

Yes, Core Spreads (operating under trading name Finsa Europe Ltd, UK) is authorised and regulated by the Financial Conduct Authority (FCA), firm reference number 525164. Whilst a good indication that clients can trust the broker, it’s always worth checking whether a provider is regulated in your local jurisdiction.

Top 3 Alternatives to Core Spreads

Compare Core Spreads with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Admiral Markets – Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

Go to Admiral Markets -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

Core Spreads Comparison Table

| Core Spreads | IG | Admiral Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.9 | 4.4 | 3.5 | 4.8 |

| Markets | Spread betting, forex, commodities, indices, equities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, CySEC, ASIC, JSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 5 | 6 | 11 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Admiral Markets Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by Core Spreads and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Core Spreads | IG | Admiral Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Core Spreads vs Other Brokers

Compare Core Spreads with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Core Spreads yet, will you be the first to help fellow traders decide if they should trade with Core Spreads or not?