CGS-CIMB Review 2024

CGS-CIMB Review

CGS-CIMB is a Singapore-based broker offering trading in forex, CFDs, futures, and securities, among others. The broker also provides cross-platform trading on the MT4, iTrade and Viewpoint platforms. If you’re thinking about opening a CGS-CIMB account, our review covers the key features, including brokerage fees and the login process.

CGS-CIMB Company Details

CGS-CIMB Securities International Pte. is a joint venture between China Galaxy International Financial Holdings Limited and CIMB Group Sdn Bhd. Following the merger, the broker is regulated by the Monetary Authority of Singapore (MAS).

The board of directors have a global vision for the firm which can be found in over 20 countries across Asia and beyond, with headquarters in Singapore and additional branches in Thailand, Malaysia, Indonesia, and India.

CGS-CIMB provides financial instruments to over 2,600 institutional clients and 400,000 retail clients. There is also an impressive selection of trading platforms and tools on offer, including MetaTrader and iTrade.

For brokerage fees, contact numbers, address details and more, read on.

Platforms

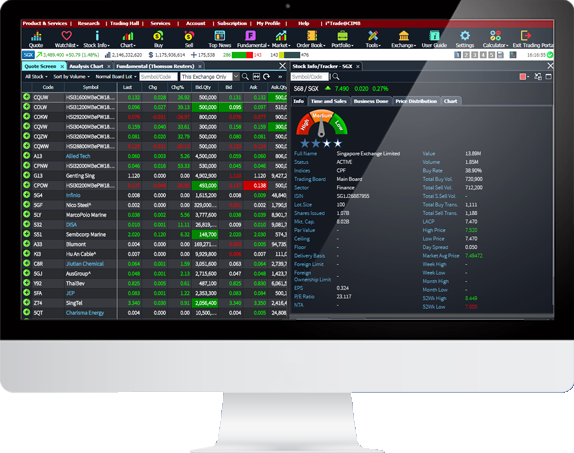

iTrade

CGS-CIMB’s proprietary web-based platform, iTrade, is a stock trading tool, offering real-time pricing, market news, fundamental reporting features, and more. The platform comes with 77 pre-built indicators and drawing tools, plus free access to intuitive investing tools: iScreener, iFilter, and Stock Filter.

Professional users can also opt for iTradePro, offering advanced features including customisable strategy analysis, multiple charts and timeframes, back-testing with unlimited combinations, Market Streamers to uncover opportunities, and advanced technical charting tools.

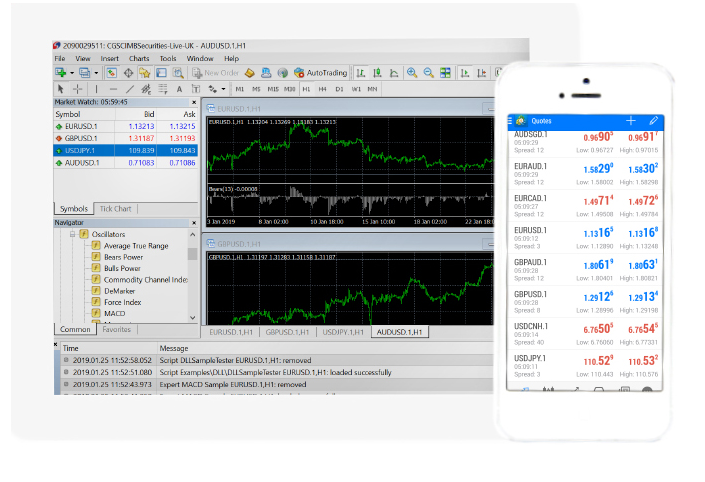

MetaTrader 4

MT4 has been a favourite among retail and professional forex traders for 15 years. With low latency and fast execution, traders can execute several order types including stop limits and trailing stops.

Traders can also explore automated strategies and conduct advanced price analysis using dozens of technical indicators and graphical objects.

MT4 is downloadable from the website once an account has been created.

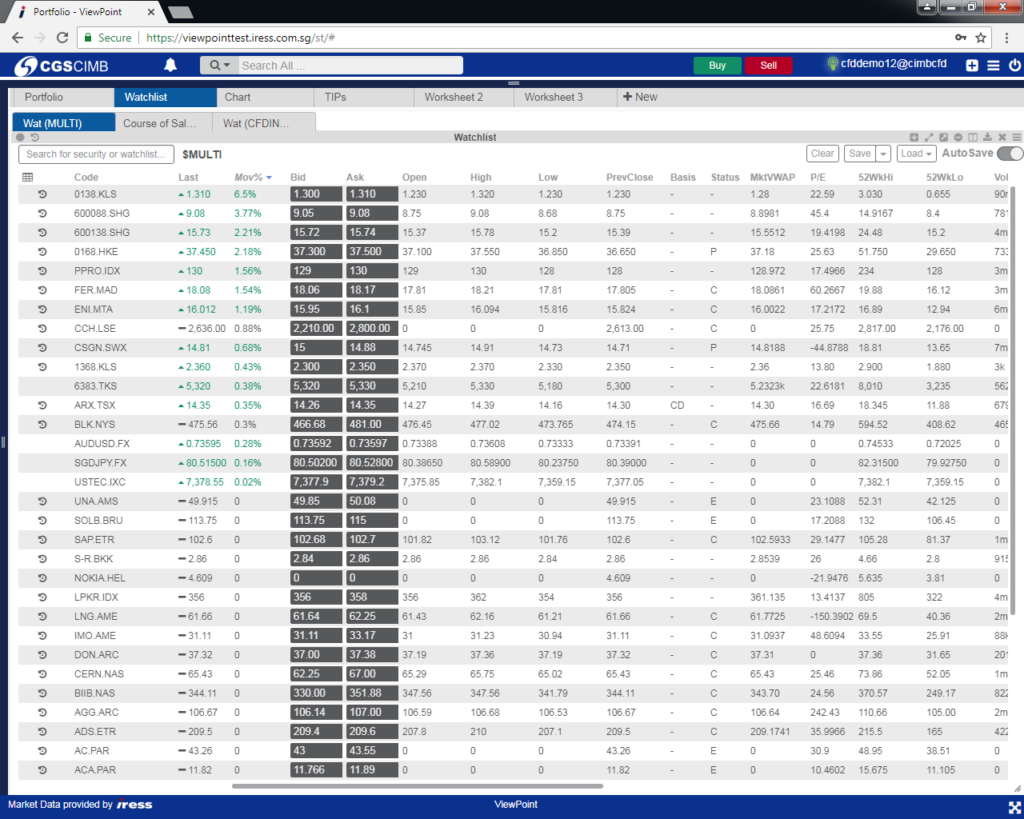

Viewpoint

Viewpoint is the largest Direct Market Access (DMA) CFD provider, offering access to over 14,000 counters across 20 markets. The platform is easily accessible via a desktop browser.

Viewpoint is highly customisable with a library of widgets to suit different preferences. There’s also a range of powerful charting tools, advanced order management plus real-time risk management tools, including P&L statements of your portfolio.

Assets

CGS-CIMB offers an array of assets:

- Leveraged products – FX currency pairs and synthetic crosses, CFDs, Equity Linked Notes (ELN), and Daily Leveraged Certificates (DLC)

- Futures – Commodities, stocks, indices, currencies, interest rates, fixed income, shares, and options

- Wealth management assets – Mutual funds and unit trusts

- Securities – Stocks, shares, and ETFs

- Bonds – Corporate and government

Spreads & Fees

For FX, trading is commission-free with spreads starting as low as 0.3 pips in the starter account and 0.7 pips in the other accounts.

If you’re trading FX CFDs, target spreads are 0.36 pips for EUR/USD and 1 pip for FTSE 100. Fees are charged at 0.4 pips. For CFD shares, all-in commissions are charged from 0.20%, plus a 3.75% +/- base rate financing fee.

Leverage

For forex products, leverage is offered up to a maximum of 1:20 and for CFDs on equities, you can leverage up to 1:10. A breakdown of CFD margin requirements is provided on the website.

Mobile Apps

CGS-CIMB offers mobile app versions of all its platforms, iTrade, MT4, and Viewpoint, meaning users can access their investment portfolios and real-time information from anywhere.

iTrade users can access the same desktop trading tools, including iScreener, as well as set stock alerts to track the latest market movements. With MT4, you can execute trades easily on the interactive mobile-friendly charts while tracking financial news and events. The Viewpoint mobile app offers all the same CFDs available on the desktop platform, as well as advanced risk management tools.

All apps are compatible with iOS and Android smart devices and can be downloaded from the respective app stores.

Payment Methods

Deposits for the Mini, Classic, or Accredited Investor FX accounts are only available via digital bank transfer or cheque. Whilst the broker doesn’t charge any fees, bank charges may apply in some cases. Fund deposits are only available in the base currency of the account (SGD or USD) and if any deposits are made in a different currency, there will be a non-refundable conversion.

Funding in the CFD account is available via cash payment, online transfer via PayNow, bank transfer, or cheque. Note that you can only withdraw excess funds in a CFD account if your free equity is more than 2,000 SGD or if there are no open CFD positions. Withdrawals can take up to 5 days to be processed.

Margin financing is also available for shares, where users can enjoy interest-free financing of up to 12 calendar days and leverage up to 3.5 times their cash collateral.

CGS-CIMB Demo Account

The broker offers a 14-day free trial of the iTrade stocks trading platform, although this is not available in all jurisdictions. The broker doesn’t make it clear whether any general demo accounts are available, which may be a concern for beginners.

Deals & Bonuses

CGS-CIMB does not have any promotional offers available at the time of writing. Given its background and regulation, it is unlikely that the broker will offer any such deals in the future.

CGS-CIMB Regulation

CGS-CIMB is a member of Singapore Exchange Limited (SGX) and is regulated by the Monetary Authority of Singapore. As per the Securities and Futures Regulations, the broker segregates client funds in separate trust accounts.

The MAS not only prioritises client fund safety but also aims to educate consumers on the risks of financial services. The regulator’s MoneySENSE education program was thus launched in 2003 to protect investors.

Additional Features

CGS-CIMB offers a knowledge centre that includes fundamental and technical analysis, as well as market news and an IPO library. However, it would be nice to see greater diversity with resources, such as webinars and e-books.

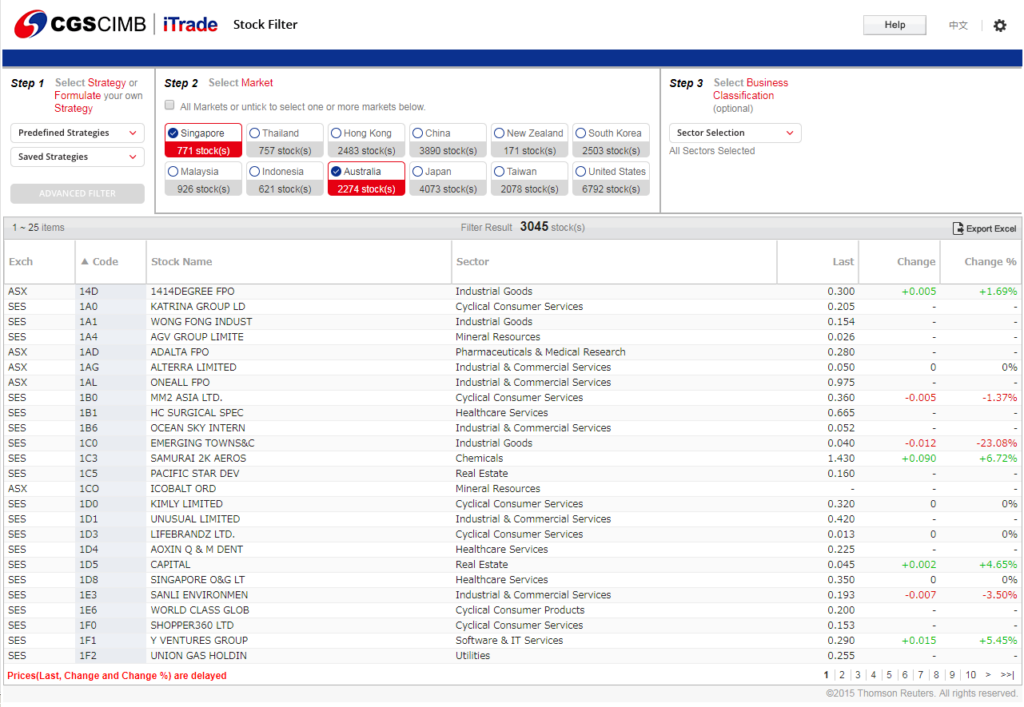

As mentioned earlier, the iTrade platform comes with additional free integrated tools:

- iScreener – Equities research dashboard with 4-star risk ratings of stocks

- iFilter – Real-time alerts of Big Block Trades and large market movements

- Stock Filter – Stock screener across 12 markets to filter trading opportunities

The Viewpoint platform also utilises the Thematic Investment Portfolio System (TIPS), which is a CFD research portal that allows clients to identify market trends and themes.

CGS-CIMB Accounts

The account type you choose will depend on the asset you are trading and in most cases, traders will need to contact customer service to initiate account opening.

Forex Trading

For forex trading, there are three options: Mini, Classic, and Accredited Investor. Note that all accounts can only be held in a single base currency of USD or SGD.

The Mini account asks for a 100 SGD initial deposit, offering spreads from 0.3 pips and a minimum lot size of 0.01 lots. There is a maximum trading limit of 0.5 lots.

The Classic account is aimed at corporate clients and requires a 5,000 SGD initial deposit, 0.1 lots minimum order volume, and offers spreads from 0.7 pips. There is an unlimited maximum order volume.

The Accredited Investor account is subject to eligibility requirements and is characterised by a 10,000 SGD initial deposit, a minimum order volume of 0.1 lots, an unlimited maximum order volume, and spreads from 0.7 pips.

CFD Trading

For CFD investing, users must open a separate CFD account which uses the Viewpoint platform. The minimum deposit to open an account is 2,000 SGD with typical spreads from 0.3 pips.

Securities Trading

For securities, users can choose between a Cash Trading Account (CTA), Margin Trading Account (MTA), or Securities Borrowing and Lending (SBL). Details of these must be requested from customer support.

Islamic Cross-Border Trading solutions are also available by filling in an application form.

Benefits

There are several benefits to signing up with CGS-CIMB:

- MT4, iTrade, and Viewpoint

- eWealth robo advisors

- Dividend payments

- Range of assets

- Tight spreads

Drawbacks

Reasons not to register for a CGS-CIMB account in this review include:

- Only available in SGD or USD

- Limited funding methods

- Complex group structure

- No cryptocurrencies

- No live chat

Trading Hours

Forex trading is available 24 hours a day, from 05:00 PM Sunday until 05:00 PM Friday (EST). Other operating times vary depending on the instrument traded. These can be found within the platforms or on the CGS-CIMB Securities website.

Customer Support

With the absence of live chat, traders can only contact the broker between 8.30 am and 6.00 pm (SGT) Monday to Friday, via:

- Email address – clientservices.sg@cgs-cimb.com

- Telephone contact number hotline – 1800 538 9889 or +65 6538 9889

- Head office location – 50 Raffles Place, #01-01 Singapore Land Tower, Singapore 048623

Customer service agents can help with most issues, including logins suspended for forgotten passwords to how to check account balances and resetting analyst reports.

You could also try the broker’s FAQ pages for news and information on their prime services.

Trader Security

All available platforms use optional two-factor authentication, which enables a One-Time Password upon login. Data exchange within the platforms are also securely encrypted.

CGS-CIMB Verdict

CGS-CIMB is a world-renowned financial services provider with an impressive offering of diverse products and web trading platforms. There’s also a good supply of additional research tools and user guides. However, beginners may find the services a little confusing and the lack of deposit methods may be limiting for some.

Top 3 Alternatives to CGS-CIMB

Compare CGS-CIMB with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

CGS-CIMB Comparison Table

| CGS-CIMB | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.7 | 4.3 | 4 |

| Markets | Forex, CFDs, futures, mutual funds, securities, bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | 100 SGD | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | MAS | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:20 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | – | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by CGS-CIMB and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CGS-CIMB | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

CGS-CIMB vs Other Brokers

Compare CGS-CIMB with any other broker by selecting the other broker below.

The most popular CGS-CIMB comparisons:

FAQ

Where is CGS-CIMB based?

The broker is headquartered in Singapore, with additional branch locations in Kuala Lumpur, Jakarta, and Bangkok. Other global locations include London, Mumbai, and South Korea.

How can I contact CGS-CIMB?

The broker can be reached by the contact number or email addresses listed on the regional websites. There is also a central dealing desk hotline for those who wish to place an order on an overseas bourse (NYSE, AMEX, and NASDAQ) outside of office hours.

How do I sign up for a CGS-CIMB live account and begin trading?

You can register for cash trading, margin trading or CFD accounts via the online registration form. You will need to provide your full name, contact details and ID for a validity check. For all other account types, you will need to email customer services. To help you get started, the broker provides MT4, Viewpoint, and iTrade user guides.

Is CGS-CIMB regulated?

CGS-CIMB is regulated by the Monetary Authority of Singapore, a highly regarded bank and regulatory body in Asia.

How can I reset my CGS-CIMB account password?

If your login has been suspended or you have forgotten your password, you will need to email customer support to reset it.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of CGS-CIMB yet, will you be the first to help fellow traders decide if they should trade with CGS-CIMB or not?