EBITDA

EBITDA (pronounced ee-bit-dah) is an acronym that refers to a company’s earnings before interest, taxes, depreciation, and amortization.

EBITDA is an accounting metric that calculates a company’s earnings before subtracting out interest expenses, taxes, depreciation, and amortization.

The Best Brokers For Stock Trading Using EBITDA

It is used as a representation of a company’s operating cash flow (OCF), or how much cash a company generates from its operations.

This entails revenue minus cost of goods sold (COGS), fixed costs (e.g., employee wages, rent, utilities), and other selling, general, and administrative expenses (SG&A).

To get at an idea of a company’s operating cash flow, certain expenses can be realistically subtracted out to control for differences across a peer group.

Even though depreciation and amortization are real costs borne by a business, they are not a direct cash outlay.

For example, if you own a delivery truck, it will depreciate over time. It might last 10-20+ years and over that time it will lose its value as its useful life and resale value declines.

But as the truck owner, this is not a tangible “as you go” expense. It only becomes an expense in the sense that every so often you will need to buy a new truck.

Taxes are generally paid out on a certain percentage of earnings. Companies that don’t produce a profit typically don’t have income taxes, though they may have operational cash flow.

Tax policies also vary by jurisdiction, which can make it difficult to compare operational efficiency by looking at an after-tax line item (e.g., earnings or net operating profits after tax (NOPAT)).

Interest expense is a function of debt servicing obligations. It is part of the financial side of the business, not the operating side.

Amortization is a function of the “depreciation” of goodwill and intangible assets over time. Much of this is a function of a company’s takeover history. Companies are often purchased or acquired at a premium.

This extra premium is plugged into the balance sheet as “goodwill”, a type of intangible asset.

This goodwill is often written down over a number of a years, depending on accounting rules.

EBITDA As A Proxy For Cash Flow

Operating cash flow is generally the most important metric for a business, especially in the long-run.

The value of a business is the amount of cash you can extract from it over its life.

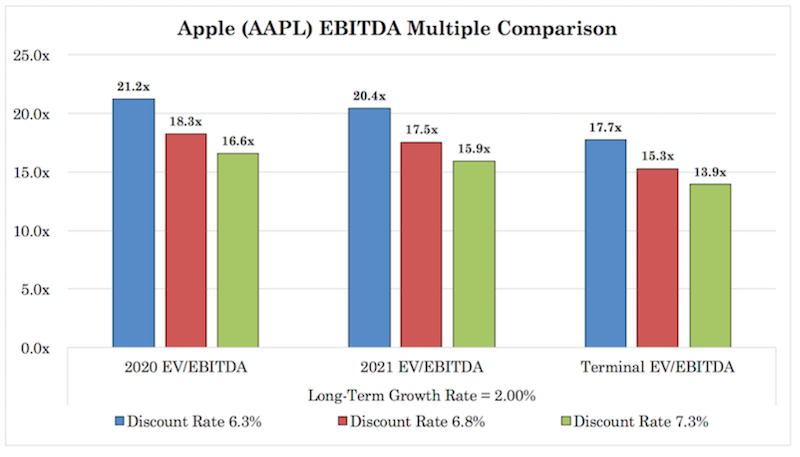

Ultimately, a dollar today is worth more than a dollar in a future period, so the future cash flows are discounted back to the present at a representative discount rate (i.e., a required rate of return) to get the fair value of a business. (See Apple as an example.)

EBITDA is commonly used in the business world, especially for securities analysis to assess the fundamental value of a business.

Investors want to know how much profit a company makes with its asset base and operations on the products and services it makes and sells. For many types of companies it does a good job of isolating this.

It is a non-GAAP metric, though companies will often include EBITDA on their income statement.

A Profitability Comparison

EBITDA helps investors and business people compare the operating performance among different companies.

Interest, taxes, depreciation, and amortization help to normalize comparisons.

Interest expenses reflect different forms of financing.

Tax expenses are dependent on jurisdictions of operation.

Depreciation expenses depend on asset types and accounting treatments.

Amortization is a function of a company’s merger and acquisition activity in the past.

Accordingly, EBITDA comparisons can help more or less put companies on an even playing field for analysis purposes while also being a quality metric for operating cash flow.

Adjustments To EBITDA

Investors, investment bankers, corporate finance teams, and other valuation specialists often make adjustments to EBITDA to help normalize its meaning or make changes appropriate to the industry being evaluated.

This can mean debt write-off expenses, legal settlements, or other one-time items that don’t provide a good picture of the long-run operating health of the business.

What A Positive EBITDA Indicates

A positive EBITDA figure generally means that the business is structurally sound. It, however, doesn’t necessarily mean that the business generates positive cash flow.

Cash flow is equal to earnings plus depreciation and amortization (as a non-cash expense) plus or minus any changes in working capital minus any capital expenditures.

EBITDA includes the depreciation and amortization add back, but it ignores working capital changes (e.g., inventory, cash, and other short-term assets/liabilities) and capex.

Working capital is important as it pertains to making sure the business remains healthy on an asset and liability basis and for purposes of cash flow management.

Capex can be broken down into two general categories:

- maintenance capex

- growth capex

Maintenance capex is the basic amount needed to maintain or replace the assets that break down or depreciate over time.

Growth capex is the amount needed to help grow the asset base to help the company generate more revenue.

Many analysts will adjust EBITDA for estimated required capex going forward. Companies use their asset bases to grow, so including this expense may be viewed as important.

What A Negative EBITDA Means

A negative EBITDA might mean that a company has structural problems generating a profit and cash flow.

It might also, however, entail big one-time expenses, such as legal, write-downs, etc.

Companies operating in industries that often face frequent legal issues, such as pharmaceuticals and tobacco, often see negative EBITDA quarters or for their full-year financials.

Analysts will nonetheless differentiate between one-time items and recurring items.

Legal issues and legal-related expenses may average a certain amount per quarter or year, but big settlements will be discounted by the market when they’re likely to occur.

Temporary negative EBITDA is generally not an issue so long as it’s managed well with an appropriate cash buffer. Structurally negative EBITDA is a problem.

When EBITDA Is Misapplied

EBITDA is used as a financial metric to give a clearer indication of a business than might be achievable with standard GAAP metrics.

But with this comes the potential for abuse.

EBITDA is designed to exclude costs that are not part of the essential nature of running a business. But management teams may use EBITDA as a tool to inappropriately consider many expenses as “unique” or non-recourse in order to artificially boost their reported operating profit.

Since management teams are often compensated based on certain financial metrics and the share price of the company, it incentivizes this behavior.

If certain financial metrics can be improved and give a more optimistic picture of the company’s health, and the market views these as credible, then it will generally improve the share price and management’s compensation as a result.

When these one-time or unusual expenses become frequent enough, to the point where they could be considered misleading, an analyst, valuation specialist, management team, etc., could consider this metric “adjusted EBITDA” or a similar term.

EBITDA and its offshoots (adjusted EBITDA or industry-specific EBITDA-like metrics) are not accepted under Generally Accepted Accounting Principles (GAAP).

So, the US Securities and Exchange Commission (SEC) will require that a company who files securities through the agency to reconcile EBITDA and EBITDA variations with net income.

And that EBITDA and other adjusted measures are not to be taken as an exact measure of free or distributable cash flow available for management or discretionary use.

EBITDA Margin

EBITDA margin is EBITDA divided by total revenue, or total operating profit relative to its revenue. One minus the EBITDA margin shows operating expenses relative to total revenue.

Margin is ultimately what many analysts look at to determine how efficient a company’s cost structure is.

Income statement example

To help visualize how EBITDA fits in, consider the simple income statement below.

| Revenue | |

| Revenue from sales | $100,000 |

| Cost of goods sold (COGS) | $20,000 |

| Gross Profit | $80,000 |

| Operating expenses | |

| Selling, general and administrative expenses (SG&A) | $30,000 |

| Depreciation and amortization (D&A) | $5,000 |

| Other expenses | $1,000 |

| Total operating expenses | $36,000 |

| Operating profit | $44,000 |

| Non-operating income | $2,000 |

| Earnings before interest and taxes (EBIT) | $46,000 |

| Financial income | $3,000 |

| Earnings before interest expense (EBI) | $49,000 |

| Financial expense | $2,000 |

| Earnings before income taxes (EBT) | $47,000 |

| Income taxes | $10,007 |

| Net income | $37,000 |

The company makes $100k in revenue.

COGS is $20k.

That leave a gross profit of $80k.

The main operating expense is SG&A, which here is $30k.

That leaves use with EBITDA of that $80k minus $30k, or $50k.

Taking that $50k over revenue ($100k), that gives an EBITDA margin of 50 percent.

Then we can go all the way down with depreciation and amortization expense and other expenses to get at operating profit.

Add in any non-operating income (i.e., revenue not related to the business) to get at EBIT. Add financial income to get at EBI. Subtract out financial expense (e.g., interest) to get at earnings before tax.

Then we have income taxes and finally net income, which is commonly called earnings.

EV/EBITDA As A Valuation Tool

Valuations are often expressed as multiples.

For example, when it comes to a common metric like after-tax earnings, you will commonly things like “Company X trades for 20x earnings.”

If a company has a share price of $20 and earns $1 per share, it’s a basic division between the two to find that its trades at that 20x earnings multiple (price-earnings ratio, or P/E).

Enterprise value is matched to EBITDA, giving EV/EBITDA multiples.

Why EV?

EV refers to enterprise value. Enterprise value is the sum of all debt and equity claimants, whereas market capitalization is just the equity.

Enterprise value is used instead of market cap when interest expense hasn’t yet been subtracted out.

If interest hasn’t been subtracted out, that means debtholders are still “included” in the metric.

Subtracting out interest expense effectively subtracts out debt claimants. Therefore, an equity metric must be used (i.e., earnings, which is part of P/E).

Special Forms Of EBITDA

There are multiple variations of EBITDA. Some are accounting metrics that analysts feel are improvements over EBITDA. Others are specific to certain industries.

EBITDAX

EBITDAX is Earnings Before Interest, Depreciation, Amortization and Exploration.

EBITDAX is a non-GAAP metric that is commonly used in the oil and gas industry. It is like EBITDA but also takes out exploration expenses.

Energy companies can have wildly different costs for exploration, production, and drilling, given the various types of procedures.

As a result, many analysts prefer to strip out exploration related costs to better compare energy companies.

EBITDAR

EBITDAR refers to Earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (EBITDAR). It is a non-GAAP metric.

EBITDAR can be used when looking at different companies within the same industry that have different types of assets.

For example, consider two trucking companies.

One rents its trucks. Another owns its trucks and incurs depreciation expense, so it eventually needs to replace them.

In the case of the latter, depreciation is equal to capex (i.e., buying of the trucks is equal to the loss of their value over time, as they’re effectively used until they have no residual value).

Using EBITDAR helps understand what the company is doing operationally while controlling for the unique differences in their assets.

EBITDAR is often also used in the gaming, lodging, and leisure space.

Some also use EBITDAR but with the R referring to restructuring costs, as they tend to be a one-time item.

Some will, however, consider restructuring costs as a unique one-off matter and simply make this a part of “adjusted EBITDA” rather than EBITDAR to avoid confusion (and most would agree is more suitable terminology in that case).

EBITDAR also occasionally shows up as EBITDAL, with the R in rent or restructuring costs replaced with the L for “lease costs”.

EBITD

EBITD refers to Earnings before interest, taxes, and depreciation (EBITD, sometimes EBDIT or profit before depreciation, interest, and taxes (PBDIT)).

EBITD is essentially EBITDA but any amortization expenses are factored in.

This can be used in cases where differences in the takeover history of a company (where amortization of goodwill comes in) might be a relevant factor in better determining the value of a company.

EBITD is not widely used.

EBITA

EBITA is Earnings before interest, taxes, and amortization (EBITA).

EBITA takes into account the influence of depreciation expenses, unlike EBITDA.

If amortization expenses of a company are zero, as they often are, then EBITA is the same as the popular EBIT.

EBITA has risen in popularity as the amount of intangible expenses on balance sheets have grown and can be compared alongside EBITDA multiples.

Namely, EBITA is a case where investors may want to control for amortization charges but view depreciation expenses as material.

Given the low interest environment since 2008, this has boosted stock values and pulled forward returns. Companies can use their stock like a currency to fund purchases. And with fewer profitable investments as forward rates of return decline, this incentivized a wave of merger and acquisition activity.

As a result, goodwill on balance sheets has grown, with goodwill representing a balance sheet “plug” to markup the extra value of assets when companies are acquired for a premium.

While goodwill write-downs or charges are relevant expenses, they don’t directly tie into assessing the operational health or income-producing capacity of a business.

OIBDA

OIBDA refers to Operating income before depreciation and amortization (OIBDA).

OIBDA works by taking operating income and adding depreciation and amortization.

OIBDA only includes income earned from operations and not non-operating income (e.g., foreign exchange related changes, accounting changes).

This is different from EBITDA, which starts at earnings and adds back interest, taxes, depreciation, and amortization.

The approach taken through the creation of OIBDA helps to avoid the impact of write-downs from one-time charges.

Some companies may prefer to use OIBDA in lieu of EBITDA if it has to take large write-down charges, usually stemming from a past merger.

OIBDA and EBITDA are both useful for determining the operating cash flow or operating cash flow potential of a business when controlling for taxes and how a company is capitalized.

Net Operating Income (NOI)

Net operating income (NOI) is used in the real estate sector. It’s employed to help determine whether a real estate investment is profitable or is projected to be profitable.

Net operating income helps investors evaluate how much cash flow a property is likely to generate on a standalone basis.

That means excluding costs of financing, taxes, depreciation, and capital expenditures.

Simply, NOI is equal to income generated by a property minus operating expenses.

A property’s income is not just rental income from a living unit, for example, but also things like parking, storage, laundry, amenities and recreation as well.

Expenses include staff wages, property management fees, maintenance fees, utilities and basic costs of operation.

However, thing like property appreciation, property depreciation, debt interest expense, non-operating income or expenses like leasing commission, are not included in the metric.

Businesses Where EBITDA Is Not Appropriate To Use

EBITDA is not used as a metric in the financial services industry.

When evaluating financial institutions and insurance companies, investors will focus on the bottom line (earnings).

Non-financial companies sell their products and services to customers. Those customers/clients pay them money for these products and services, and companies record this money as sales revenue.

Banks and financial institutions also sell “products and services”. But these are made up of money and financial products rather than tangible items.

Rather than making money by selling physical goods or services, they make money by using money.

They get this money from customers (e.g., deposits), its creditors, and/or the central bank (which creates money), pay out a certain interest rate on it.

They then take money and lend it out to other customers, businesses, and large corporations at a higher interest rate or invest it (investing is the same thing in that one is fundamentally chasing a spread).

Namely, banks and other types of financial institutions make money on the interest rate spread.

It boils down to what do they pay on the sources of funds and what do they earn on the uses of it?

Let’s say you deposit $10,000 into your bank account. They pay you a 1 percent interest rate on it. They take your money, package it together with money from other customers, and turn it into a 5 percent interest loan to a customer or business.

If 20 percent of those loans turn bad, for example, and are written off, then the bank is earning an effective return of 4 percent. Paying out 1 percent on the sources of funds, they capture a spread of 3 percent.

Insurance companies are a bit different, but they are in a similar bucket and are not “EBITDA driven” businesses.

Insurance firms sell policies to customers. In doing so, they charge customers a premium to be protected under the policies issued.

Like banks and financial institutions, insurance companies must be highly skilled at pricing risk.

Insurance companies then pay out claims when a risk event occurs.

Like banks, insurance firms are still essentially making money on a spread through the process of collecting premiums from customers in excess of what they pay out in claims.

Insurance companies will take the premiums they get from customers – similar to the concept of a deposit – and invest that cash into various assets that give them a higher long-run return (e.g., stocks, fixed income, real estate, private equity and alternative investments) aiming to achieve higher returns.

Implications of the financial business model as it pertains to EBITDA

i) EBITDA is not a meaningful financial metric in these cases because interest is an important component of both expenses and how revenues are generated.

ii) The balance sheet is how these companies generate profits.

Unlike regular businesses that start their business from the perspective of unit sales and prices per unit, financial services companies start by projecting interest-earning products (loans, insurance float from premiums paid in (which goes into investments)) and interest-bearing liabilities (deposits, claims paid out).

iii) It is difficult to separate the operational and financial part of the business in the case of banks, insurance firms, and other financial institutions.

The core operations of these businesses have to do with funding sources, interest expense and interest generated, and investments.

iv) Enterprise value is not calculated for banks, financial institutions, and insurance firms. It has no real meaning given the unique role of debt and interest.

Equity value is used instead. If enterprise value is not useful, then EBITDA can’t be used as a valuation metric.

v) They use large amounts of capital to make money.

Commercial banks are typically leveraged 8x or more, and many were at 20x or more before the 2008 financial crisis. Because of this risk, banks are subject to regulatory and various capital requirements and must maintain minimum amounts of equity capital funding.

How banks generate revenue is nonetheless more varied

The traditional bank and insurance business model is revenue via interest and investments, which are used to offset the liabilities (e.g., interest on deposits, claims), with the remainder representing profit.

However, banks don’t generate revenue only from interest and investment returns.

On a bank’s income statement, you’ll find revenue from:

- – fees generated on revolving credit lines (consumer and business)

- – trading (commissions, trading returns)

- – investment banking (commissions and advisory fees)

- – asset management (commissions, trading returns)

- – private wealth management (commissions)

And other business lines.

Insurance companies are the same way, but even more of their revenue comes from investment and non-interest-related sources.

A big proportion comes from the premiums that customers pay them to take out insurance policies.

As a result, financial institutions are not entirely different from regular companies.

However, it is the reality that a large percent of their revenue and profit is derived from the use of capital to generate interest and investment returns.

This means these companies need to be modeled, analyzed, and valued differently.

So, EBITDA is never used as a metric in analyzing and valuing financial services companies.

Criticisms Of EBITDA

Many investors, including famous ones like Warren Buffett, have criticized EBITDA.

They often assert that the expenses excluded from EBITDA should not be ignored.

Namely, interest, taxes, depreciation, and even amortization are real expenses and material to the cash flow generation properties and potential of a business. And therefore it is nonsensical or even disingenuous to exclude them.

Buffett wrote in 2002:

It amazes me how widespread the use of EBITDA has become. People try to dress up financial statements with it.

We won’t buy into companies where someone’s talking about EBITDA. If you look at all companies, and split them into companies that use EBITDA as a metric and those that don’t, I suspect you’ll find a lot more fraud in the former group. Look at companies like Wal-Mart, GE and Microsoft — they’ll never use EBITDA in their annual report.

People who use EBITDA are either trying to con you or they’re conning themselves. Telecoms, for example, spend every dime that’s coming in. Interest and taxes are real costs.

Buffett and his long-time associate Charlie Munger wrote the following in a shareholders’ letter in 2003:

[When goodwill was amortized by requirement] we ignored amortization of goodwill and told our owners to ignore it, even though it was in GAAP [Generally Accepted Accounting Principles]. We felt that it was arbitrary.

We thought crazy pension assumptions caused people to record phantom earnings. So, we’re willing to tell you when we think there’s data that is more useful than GAAP earnings.

Not thinking of depreciation as an expense is crazy. I can think of a few businesses where one could ignore depreciation charges, but not many. Even with our gas pipelines, depreciation is real — you have to maintain them and eventually they become worthless (though this may be 100 years).

It [depreciation] is reverse float — you lay out money before you get cash. Any management that doesn’t regards depreciation as an expense is living in a dream world, but they’re encouraged to do so by bankers. Many times, this comes close to a flim flam game.

People want to send me books with EBITDA and I say fine, as long as you pay cap ex. There are very few businesses that can spend a lot less than depreciation and maintain the health of the business.

This is nonsense. It couldn’t be worse. But a whole generation of investors have been taught this. It’s not a non-cash expense — it’s a cash expense but you spend it first. It’s a delayed recording of a cash expense.

We at Berkshire are going to spend more this year on cap ex than we depreciate.

[CM: I think that, every time you saw the word EBITDA [earnings], you should substitute the word [fake] earnings.]

EBITDA came into popularity in the late 1980s and throughout the 1990s.

During the latter part of the 1980s, private equity became popular and entire businesses were bought and sold readily.

Before that point, the public markets were the main focus. Investors in these public companies had evaluated companies on the basis of reported earnings.

Buyers of entire companies in the private markets evaluated them more on the basis of free cash flow.

There was a reason for this.

Ultimately the value of a business is how much cash can be earned discounted back to the present.

However, private equity deals were commonly done with lots of debt, often 75 percent or more of the purchase price. This limited one’s cash outlay and enhanced one’s returns.

Accordingly, private equity investors were less concerned about earnings as they were how much cash would be available to service the debt.

So, they would look at the amount of earnings available before expenses of interest, taxes, depreciation, and amortization were subtracted out.

Public market investors took note of the valuation approach that was largely used among private equity.

After all, if you buy a stock, you’re buying a part of a business.

By extension, it’s not unreasonable for investors in public securities to think like buyers and sellers of entire businesses.

So, public market investors began examining their approach and focusing on other metrics alongside basic earnings.

Many equity and junk bond investors in the latter half of the 1980s began to use measures of free cash flow in lieu of earnings as the analytical measure of a company’s value.

In this shift to analyze free cash flow instead of earnings, investors began using a basic calculation to represent a company’s cash generation potential.

Most investors settled on EBITDA as the standardized operating cash flow metric.

Analyses of leveraged companies relied heavily on EBITDA. Using EBITDA multiples (i.e., EV/EBITDA) as a way to judge relative value became the common standard.

Investment banks adopted the approach as well and investors used the metric to determine fair value or value relative to a peer group.

During the leverage buyout (LBO) wave of the late 1980s, many companies became increasingly thought of as potential takeover candidates, so the EBITDA approach bled into public securities securities analysis as well.

Those who relied on standard earnings analysis and the more traditional Benjamin Graham approach (e.g., Warren Buffett) were less than thrilled.

Critics found it to inflate measures of earnings and cash flow and was analytically flawed.

Just how should cash flow be measured?

Before junk bonds became popular, investors generally focused on two components of a business:

– earnings (net income, after-tax earnings)

– cash flow – i.e., after-tax net operating profit (NOPAT) plus depreciation and amortization plus/minus any changes in working capital minus capital expenditures

Depreciation and amortization minus capex represents the net investment or disinvestment in the assets of a business.

When junk bonds and debt to fund buyouts became popular, all this non-recourse financing changed the financial landscape to a degree.

Interest expense is tax deductible in most jurisdictions. That means pre-tax earnings (not after-tax earnings) are available to service debt payments.

Money that could have gone to pay taxes can instead be used to pay a company’s lenders.

The implication of that is a more highly leveraged company has more available cash flow than the equivalent business using less leverage.

EBIT (earnings before interest and taxes) is not necessarily all cash available to a business. If interest expense eats up all of EBIT, then a company will not owe income taxes.

If interest expense is low, taxes will consume a lot of available EBIT.

During the late 80s when the junk bond boom was flying, companies were able to borrow an amount so large that all of EBIT was frequently used to pay interest.

Though, as one might imagine, being this leveraged is dangerous and lenders will pull back in less robust environments. EBIT shrinks in downturns as revenues slide, increasing the risk of financial stress or bankruptcy.

A better measure of cash flow would be after-tax income (i.e., net income or earnings) plus the portion of cash flow going to pay interest expense.

On The Topic Of Depreciation

Depreciation is an important concept to understand when evaluating investments. It is a non-cash expense. Therefore, it reduces earnings but not cash flow.

When a company buys a piece of equipment, it’s required under generally accepted accounting principles (GAAP) to expense that piece of equipment over its useful life. This is what depreciation effectively is in practice.

Depreciation adds back to cash on the cash flow statement (being a non-cash expense).

However, because depreciation is a real thing, capital expenditures must be used to fund new plant, property, equipment, and other fixed assets that wear out over time.

Capex is therefore a direct offset to depreciation. Analysts will often set depreciation equal to capex in their models, especially for more mature firms such that there’s no net effect on cash flow.

Newer firms tend to have capex above depreciation because they have to invest a lot to get up and running and have so much catching up to do. Older companies might have capex below depreciation.

A lot of it is a matter of timing. A company might invest heavily in plant, property, and equipment, then generate depreciation allowances in excess of capital spending going forward, generating a net tailwind to cash flow.

Cash must nonetheless be available whenever fixed assets need to be replaced. If capital investment is less than depreciation over an elongated period of time, then that means the company is essentially undergoing a process of liquidation.

On The Topic Of Amortization

The amortization of goodwill is a non-cash expense, like depreciation. But it is more of an accounting invention than something that represents a real business expense.

During the takeover or merger and acquisition process, a company is typically purchased for more than its total enterprise value and tangible book value. This is to incentivize shareholders to accept the takeover offer.

When this occurs, shareholders accept the offer, and the transaction is completed, accounting rules require the buyer to create an intangible asset on the balance sheet.

This is known as goodwill, and essentially plugs the gap between book value and the premium paid by the buyer of the company.

This goodwill is then amortized over a number of years depending on what the accounting rules are.

When goodwill charges are taken it doesn’t necessarily reflect a genuine decline in the economic value of the business or something that can be spent to preserve its value.

How EBITDA Became Accepted

Why EBITDA became the common standard for operating cash flow is not entirely clear.

EBIT (earnings adding back interest and taxes) is not an accurate measure of a company’s cash flow from its ongoing earnings stream. Adding back all of depreciation and amortization does not make it more meaningful.

Using EBITDA as a cash flow proxy basically ignores capital expenditures or assumes that the business would not make any over time. This is rare for any business.

It is more relevant for an oil producer than a software company, but still relevant nonetheless.

Many of the leveraged buyout of the late 1980s were based on the presumption of rising cash flows in the future from the takeover of mature businesses.

Namely, there would be a reduction in capital expenditures, freeing up cash flow that could then be distributed to the owners of a business.

However, a business needs to spend to grow. A company is unlikely to see increasing cash flow if adequate capital spending is not made and likely to see declining financial results and economic value if it doesn’t.

Knowing the required level of capital spending needed for a business is often difficult. Analysts usually quote it as a percentage of revenue in their models and is often based on an average or median figure for the line of a business a company is in.

Business engage in capex for a variety of reasons. They might do it to simply maintain their asset base, to compete more in certain areas, to grow in existing businesses, and/or to diversify their existing asset base and develop different streams of revenue.

Capital expenditures to remain operational are definitely necessary. Capex to maintain existing levels of income or growth are also necessary to validate modeling assumptions of revenue.

Growth capex is important but can be cut in a pinch, so they are good to have but not essential.

Expenditures for purposes of diversification are also in the “nice to have” category, though there’s the whole debate about a company diversifying versus competing in areas where it’s best equipped to do so.

Identifying maintenance versus growth expenditures generally requires inside knowledge about a company.

Because knowing this information has traditionally been difficult, many investors simply chose to ignore it and compare companies without regard to capex (by excluding depreciation expense).

Moreover, some investors and analysts viewed the subtraction of capex from EBITDA are unnecessary given such spending could be financed through other means.

This could include debt, lease financing, and equipment trust certificates (ETCs; allows a company to take possession of equipment and pay for it over time).

This approach would mean that all of EBITDA would be available pre-tax cash flow available to pay down debt. So, essentially no money would be needed for capital investment.

However, this is just a separate way of financing capex. The cost is still there and thus the effect on cash flow will be there as well.

Moreover, the assumption of having access to external financing arrangement is dependent on a company’s health and the economic environment around it.

Companies experiencing lower creditworthiness will have more limited access to financing for any type of purpose. Firms that aren’t able to finance these purchases may be forced into insolvency without a lifeline.

EBITDA’s Widespread Use Among Investment Banks

EBITDA is widely used on the sell-side (e.g., investment banks) because the metric tends to overestimate available free cash flow.

This, in turn, can be used to justify higher takeover or merger and acquisition prices for their clients. This helps with commissions, fees (e.g., advisory, securities underwriting, management of assets), and potential repeat business.

Earnings are more restrictive than EBITDA, given the former is at the very bottom of an income statement (and thus a lower value) while the latter is higher up (and thus a higher value).

Using a new measurement and calling it “cash flow” can help justify higher prices.

EBITDA Can Obscure The True Quality Of A Business

EBITDA, while on its own a flawed measure of operating cash flow, also conceals the importance of other components of a company’s cash flow.

Pre-tax earnings and deprecation allowance make up a company’s pre-tax cash flow. Earnings are the return on the capital invested in a business. Depreciation is basically a returning of the capital invested in a business.

Consider two different examples of how EBITDA analysis can skew perception of the cash flow in a business.

Company A

- Revenue: $1,000

- Cash expenses: $700

- Dep & Amor: $300

- EBIT: $0

- EBITDA: $300

Company B

- Revenue: $1,000

- Cash expenses: $700

- Dep & Amor: $0

- EBIT: $300

- EBITDA: $300

Investors and analysts who use EBITDA as the sole valuation and analysis metric would view these two businesses the same.

However, when viewed at the same price and viewing their growth trajectories as equals and so on, most investors would prefer to own Company B. It earns $300 versus none for Company A.

Even though their EBITDA’s are the same, they are not as equally valuable as each other.

Company B could be a services business whose depreciation expense is minimal.

Company A could be an industrial business with a relatively large amount of fixed assets.

Company A should be prepared to reinvest its depreciation allowance back into the company to remain competitive. It may need to spend more to grow, keep up with peers, or keep pace with things like inflation. It would have no free cash flow over time unless it can grow its revenue in excess of expenses.

Company B, on the other hand, doesn’t have these capital spending requirements and maintains higher amounts of free cash flow over time.

Anyone buying Company A on leverage would have issues, as there is no free cash flow to service the debt payments.

If some of the $300 in EBITDA is used to pay down the debt, then there would be an insufficient amount to invest back into the business on plant, property, and equipment that needs to be replaced.

Company A could eventually go bankrupt if it can’t invest sufficiently to maintain its fixed asset base and it isn’t able to service its debt.

Company B, on the other hand, with its free cash flow, could be an attractive leveraged buyout candidate.

Being aware of these difference and how EBITDA can conceal material differences between businesses is important.

The shifts from after-tax earnings to EBIT and then even further up to EBITDA can create poor comparisons that make for suboptimal investing decisions.

Final Word

EBITDA can be useful as a tool to evaluate corporate mergers and acquisitions, restructurings, recapitalizations, and for valuing companies’ enterprise value (the value of all claims on the business).

It can help control for a company’s capital structure (by subtracting out interest expense), jurisdiction (by subtracting out tax expense), asset base structure (by subtracting out depreciation expense), and takeover history (by subtracting out amortization expense).

These are exclusions of important expenses, though they can help get a general understanding of a company’s operations. This is ultimately more important than taking it as a matter of free cash flow, of which it is often an imperfect representation.