Oil Brokers 2026

Oil trading is one of the most popular forms of commodities trading. And it’s easy to see why. It is a highly liquid market, meaning investors can enter and exit positions quickly. Oil prices can also be highly volatile, which means speculators often have ample opportunities to make a profit.

This guide for beginners will explore the financial instruments that individuals can use to trade oil, discuss how the oil market works and what moves prices, detail different trading strategies, and explain how to get started.

Quick Introduction

- Oil is the world’s most popular energy source and is hugely versatile, making it one of the world’s most important commodities.

- Crude oil prices are influenced by a broad range of macroeconomic and geopolitical factors, as well as more specific market conditions related to supply and demand.

- The Brent and WTI benchmarks are the most important reference points for pricing oil.

- Traders have a variety of ways to profit from the oil market, including crude futures, oil stocks and exchange-traded funds (ETFs).

Best Oil Trading Brokers

After reviewing dozens platforms, we found that these 4 brokers offer the best oil trading conditions, from investment vehicles and fees to tools and research:

-

1

NinjaTrader

NinjaTrader -

2

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

3

FOREX.com

FOREX.com -

4

xChief

xChief

Understanding Oil Markets

There is no such thing as a ‘standard’ oil price. This is because more than one type of black commodity exists based on their physical characteristics. However, these different blends are usually placed under one of two categories for the purposes of trading.

The first type is known as West Texas Intermediate crude (or WTI for short). It is a light, sweet crude oil that is – as the name implies – chiefly produced in the US. The second is Brent crude, a heavier form of the liquid that is predominantly extracted from the North Sea.

These categories form the basis of two benchmarks that companies, governments and traders use to price oil. The Brent and WTI price touchstones value oil in US dollars and by the barrel, and they tend to trade within a tight range and in the same broad direction.

Like any commodity, there are limited reserves of oil on the planet. These supplies have been steadily declining for decades as the global population has grown, and extraction of the key energy source for heat, light, transportation, manufacturing, agriculture and countless other end markets has ballooned.

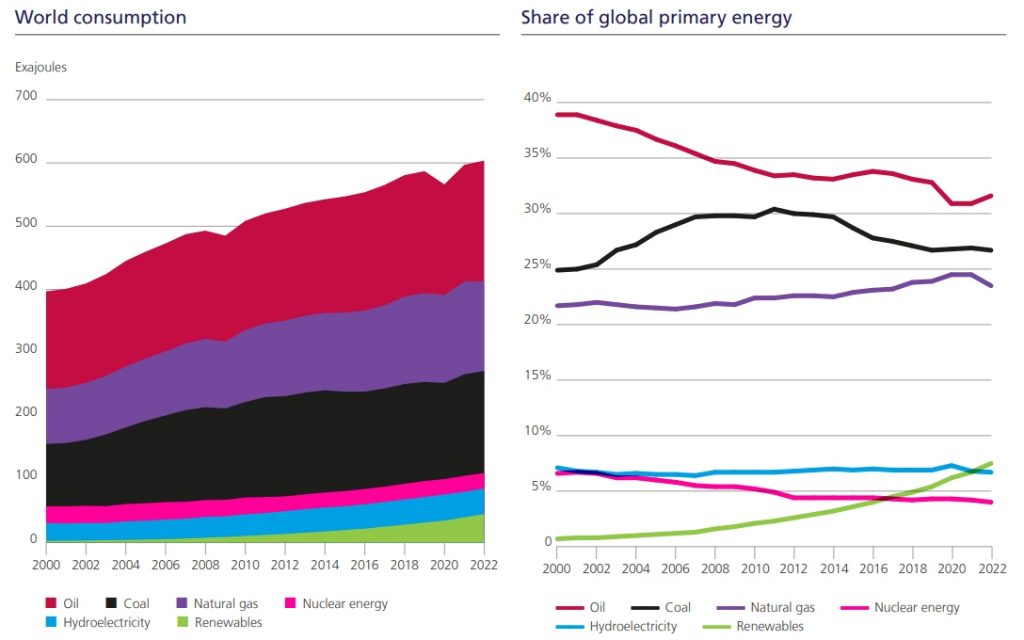

Today, oil trading accounts for around a third of the world’s energy needs. But unlike other hard commodities like copper or gold, or soft commodities such as cotton or coffee, oil consumption is largely expected to start to decline within the next decade as the climate crisis accelerates the growth of the green economy.

The International Energy Agency (IEA) expects crude demand to continue rising in the short-to-medium term. Worldwide consumption is tipped to grow another 990,000 barrels per day in 2024, taking the total to new record highs of 102.8 million barrels each day.

However, the IEA also thinks demand will peak before the end of the decade, as cleaner renewable energy sources (such as wind and solar) steadily take over and electrification of the transportation sector continues.

Some other oil participants, commentators and industry bodies are more sceptical about such predictions, most notably the Organization of the Petroleum Exporting Countries (also known as OPEC).

What Influences Oil Prices?

The basic principle of market economics – that of supply and demand – plays a critical role in the direction of the oil trading market. Prices of the commodity rise when supply is limited and demand is high, and vice versa.

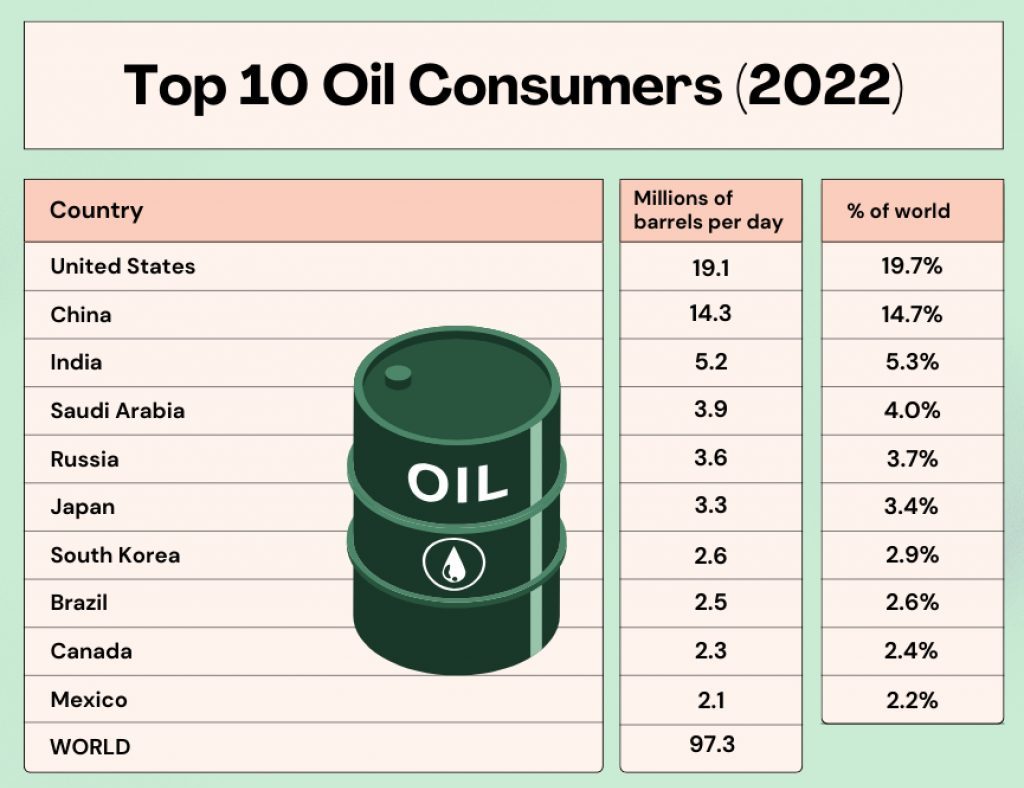

Oil is a critical engine of economic growth, and consumption of it is closely correlated to the performance of the world economy. The US is the world’s biggest consumer, though the gap with China is steadily closing.

The countries shown above account for just over 60% of global oil consumption. So traders carefully study economic conditions in these territories for pointers as to where energy prices could be heading.

The US is also the world’s biggest oil producer, and in 2022 accounted for 19% of all supply, according to the Energy Institute. This is thanks to the country’s shale oil boom which has seen domestic crude supply surge over the past decade.

Its position at the top of the list means supply–related news is a key driver of energy values. It also means that inventory data released weekly by the US Energy Information Administration is always closely watched.

Decisions on production quotas by the OPEC+ group of countries also have a significant impact on the oil benchmarks.

This cartel – which accounts for approximately 40% of all production – was set up in 2016 to manage output levels collectively and thus maintain market stability. It comprises of the 13 OPEC members including Saudi Arabia, Iraq, Iran and the United Arab Emirates, as well as other major producers including Russia and Kazakhstan.

So what are the specific datasets and news items that can influence oil trading prices? It’s a long list that includes:

- Key macroeconomic data – Jobs data from the US, Chinese factory activity, and eurozone GDP numbers for instance can provide clear insights into future oil demand.

- Supply-side announcements – News on the weekly US rig count, minutes from OPEC+ meetings and new project announcements in North America can indicate potential supply gluts or shortages.

- Geopolitical events – Political upheaval and terrorist incidents in core-producing countries can have a significant impact on oil supplies, as can the implementation of trade sanctions that affect production and distribution.

- Extreme weather and natural disasters – Catastrophes such as hurricanes and earthquakes can drive oil prices dramatically higher as supply worries spike.

- Currency markets – Oil is priced in US dollars, so as the greenback gains strength demand for the black liquid tends to fall. The opposite is also true.

- Government policies – Laws and regulations related to subsidies, taxes, environmental legislation, and broader energy strategy can all affect long-term oil demand.

- Technological innovation – Advances in exploration or drilling techniques can boost supply, for example, while electric vehicle (EV) improvements can adversely impact the demand outlook.

It is possible for these different determinants, either alone or in combination with others, to have a significant impact on oil prices. This creates the volatility that can make this market such a profitable one for traders.

Oil Trading Vehicles

The Futures Market

Oil, like the vast majority of commodities, is traded in futures contracts. This is where a buyer and a seller agree to trade a pre-determined amount of crude, at an agreed price and on a specific date.

The use of futures means that traders don’t have to take physical delivery of the asset. Contracts can be of various lengths, stretching many months into the future, although those that expire within a three-month timeframe tend to be the most popular.

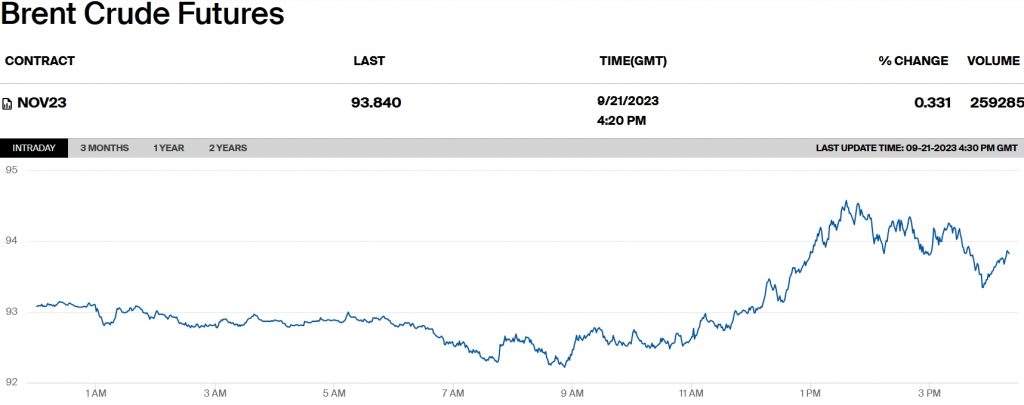

Oil futures that use the WTI benchmark are traded on the New York Mercantile Exchange (NYMEX). This is also the place where Brent contracts are transacted, along with the Intercontinental Exchange (ICE). Around two-thirds of the world’s oil futures are quoted using the Brent benchmark.

Here is an example of a Brent oil futures contract traded on ICE. It shows the month when the contract expires in other words the point when settlement or delivery is due to take place (November 2023). It also illustrates the unit price ($93.840 per barrel) and trading volumes (259,285).

Traders can choose to ‘roll over’ their futures contracts in order to continue beyond the expiry date. This involves closing out the initial contract and opening a new one with a later expiration date.

The Spot Market

At the other end of the scale are spot contracts, which provide price quotes for immediate delivery.

This accounts for only a tiny proportion of oil market transactions, and the most active buyers and sellers here are energy producers, distributors, refiners, traders and consumers. Having said that, the spot market plays a critical role in determining the prices of oil futures.

Traders who have the facility to store oil will look to strike when markets move into contango. This is where the spot price is higher than the futures price, meaning an investor can buy at the cheaper price and then sell it back at a higher sum to make a profit.

Oil Stocks

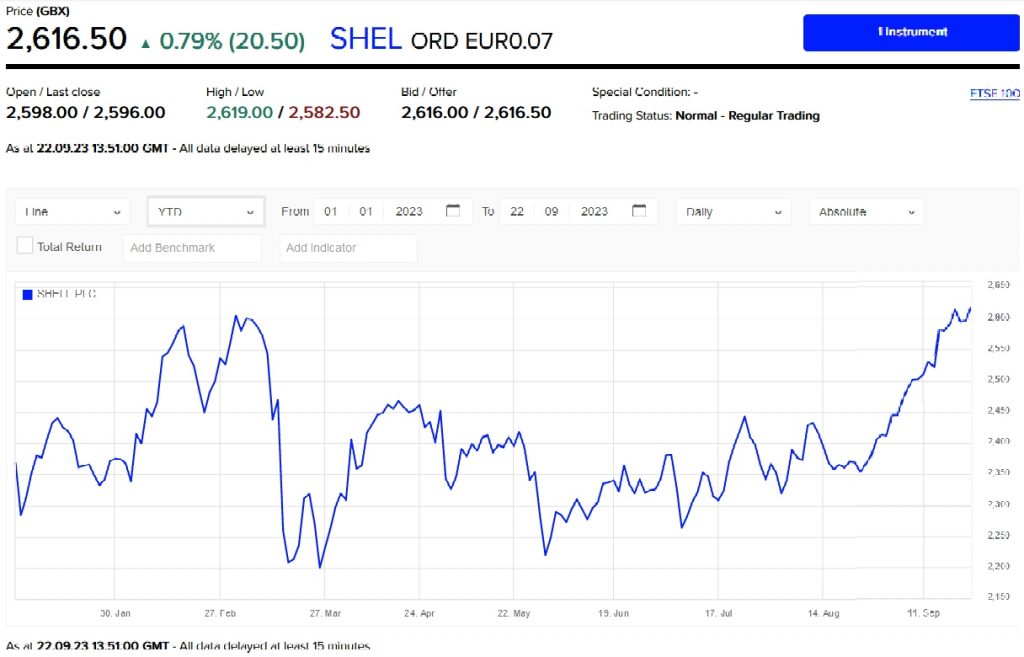

Traders can indirectly capitalize on rising crude prices by purchasing shares in oil producers. When prices of the commodity increase, these companies also tend to rise in value as profits boom.

The following price chart shows how FTSE 100 oil major Shell’s share price rose during 2023 as strong Chinese demand and production curbs by OPEC+ nations drove crude prices higher.

Larger oil trading companies also like to return cash to their shareholders when times are good. These can come in the form of large dividends as well as share buybacks.

On top of tracking the oil trading prices, the share price performance of these businesses will also respond to operational performance. As a result, an investor can receive even greater profits if a producer performs well than if they’d just traded in oil futures.

Of course, investing in oil stocks can also deliver worse returns than say buying a futures contract if company newsflow underwhelms.

Many traders also choose to invest in ‘pick and shovel’ stocks. These are companies that provide a product or a service to oil businesses, and they can include drilling contractors, pump manufacturers and geological experts.

Revenues at these shares can rise strongly when crude prices are on the up and oil companies increase spending. They are generally considered to be less risky investments than oil explorers or producers where profits-sapping operational problems can be commonplace.

Exchange-Traded Funds (ETFs)

Exchange-traded funds, or ETFs, are a type of pooled investment that change hands on stock exchanges. Oil traders can choose a fund based on either the Brent or WTI benchmark, which allows individuals to profit from price changes without having to deal with the complexities of futures trading.

Alternatively, investors can select an ETF that holds a basket of companies that work in the oil industry. These can be a great way for investors to spread risk: exploring for and producing crude can be problematic and the chances of failure are high. Taking a diversified approach can help protect a trader from large losses.

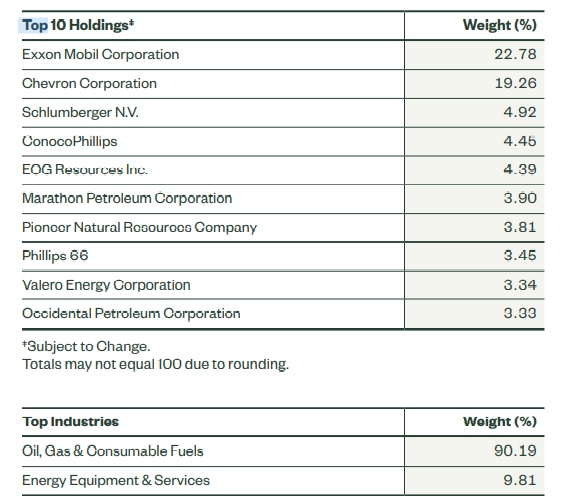

The Energy Select Sector SPDR Fund is one such investment trust. At the time of writing it held positions in 23 different oil-related companies. A selection of its top holdings can be seen below.

Options

Traders use options contracts to obtain the right (but importantly not the obligation) to buy or sell a specified amount of oil at a pre-determined date and at an agreed price. They can also use these derivative instruments to trade stocks.

The most widely used options contracts are call options and put options. Calls are used when an individual expects energy values to rise, and gives them the opportunity to buy the oil at a particular price before the contract expires. Put options are used by bearish traders who have the right to sell on or before a specific date.

Contracts For Difference (CFDs)

Speculators also frequently use contracts for difference (or CFDs) to profit from oil price changes. As with options contracts, traders do not actually own the underlying asset, but instead simply bet on whether energy prices will rise or fall using these derivative products.

CFDs and options allow individuals to use leverage (borrowed funds from their broker). This means they can build a larger position size than they would have been able to using just their own funds, and thus make more money when oil prices move in a favourable direction. The bad news is that leverage can amplify losses when trades go wrong.

CFDs are not permitted in the US, however, due to fears over transparency and the potential for large losses.

Pros & Cons Of Oil Trading

Pros

- High volatility – A range of macroeconomic, geopolitical, and market factors can all combine to make prices extremely choppy and therefore boost a trader’s opportunity to make profits.

- Strong liquidity – High oil trading volumes mean that speculators can enter and exit a position easily and swiftly.

- Tight spreads – Minor differences between the ask and bid prices – in other words, the prices that traders buy and sell a financial instrument for – mean that trading costs can be kept to a minimum.

- Long opening hours – With markets for certain oil instruments open 24 hours a day, five days a week, traders have great flexibility when it comes to deciding when to trade.

- Leverage – Traders who use options and CFDs have a chance to multiply their returns by using borrowed funds. Remember, though, that leverage can also cause losses to balloon if the market moves in an unexpected direction.

Cons

- Economic and political risks – Unexpected events can cause economically sensitive commodities like oil to unexpectedly and sharply plunge in value.

- A complicated market – Understanding all the different factors that cause oil prices to move can be tricky for novice investors.

- The green economy – Rising demand for renewable energy and alternative fuels (such as hydrogen and biofuels) could pull fossil fuel prices lower in the long term.

- The rise of ESG investing – Investing in certain oil assets like stocks and ETFs is becoming less fashionable as environmental, social, and corporate governance (ESG) considerations grow in importance.

How To Start Trading Oil

As in any other trading endeavour, the first port of call is to extensively research the oil market to understand what makes it tick. Pleasingly, a wealth of information exists that new traders can use to get up to speed including books, online trading guides and internet courses.

Once you’re confident that you have the knowledge, the next thing to do is to decide which type of financial instrument you want to trade. Do you wish to buy a futures contract that’s based on the WTI benchmark? Would you like to trade shares in an oil major like UK-listed BP or US-quoted Exxon Mobil?

Once you’ve answered these questions, you will need to come up with an oil trading strategy. Many market participants choose to go down the day trading route, which involves opening and closing positions within the same day.

A scalping strategy, on the other hand, involves executing a huge volume of trades and opening and closing positions within mere minutes, perhaps even seconds. Swing traders can hold their positions from several days to many weeks, while position traders take an even longer-term strategy where positions can last years.

All this groundwork will help inform the next step: choosing which broker to trade with. If you decide to use CFDs, for example, you may want to find a platform that allows you to use leverage to bulk up your trading position.

There are other considerations to be had when picking a broker. Do they offer competitive fees and charges? Is their trading platform easy to use, and does it offer useful features like charting tools and filtering options? Do they allow you to trade on the move with a mobile app?

Ensuring that the brokerage you use is regulated is also important. Failing to do so can leave a trader exposed to potential fraud, unfair practices, poor transparency, and a lack of recourse if things go wrong.

Many brokerages today also offer demo accounts to help traders get started. These can be a great way to try out your oil trading strategy before putting any of your money on the line. If you’re happy with how things are going after a period and ready to get started with real cash, it’s a good idea to start small to build confidence and manage risk.

Bottom Line

The volatility of crude oil trading prices, coupled with the high number of traders that take part, provide plenty of opportunities to profit from the oil market. There is a wide range of financial instruments investors can use to trade successfully, too.

As with any financial market, participants should undertake thorough fundamental and technical analysis to boost their chances of building wealth and reducing risk.

FAQ

How Can I Trade Oil?

There are many financial instruments traders can use to make money from oil. They can get direct exposure to market movements by buying a futures contract, or they can aim to profit indirectly by buying shares in an oil company.

What Moves The Oil Market?

A wide range of macroeconomic and geopolitical factors can affect crude values by altering perceptions of the supply and demand balance. The market can be highly volatile so while profits can stack up quickly, so can losses.

Can I Make Money If Oil Trading Prices Rise Or Fall?

Yes. Traders can take a ‘long’ (or buy) position with futures, options or CFDs, and make money by selling high if oil prices rise. Conversely, they can profit if the market falls by taking a ‘short’ (or sell) position and buying low later on.

Can I Trade Oil Flexibly?

It depends. Spot and futures contracts can be traded almost every day, although company shares and ETFs can only change hands when stock markets are open.

Article Sources

- Oil Trading Manual: A Comprehensive Guide to the Oil Markets, David Long

- 40 Classic Crude Oil Trades: Real-Life Examples of Innovative Trading, Owain Johnson

- Statistical Review of World Energy 2023, Energy Institute

- Brent Crude Futures, Intercontinental Exchange (ICE)

- Shell Share Price, London Stock Exchange

- Energy Select Sector SPDR Fund factsheet

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com