Gold And Oil Outlook From LegacyFX Heading Into April 2022

Analysts at LegacyFX take a look at two markets that often feel the impact of geo-political turmoil more than most – oil and gold. Often referred to as a safe haven, Gold has seen a relatively large amount of volatility of late. Oil is a key market with a huge range of price drivers – and plenty of political inputs.

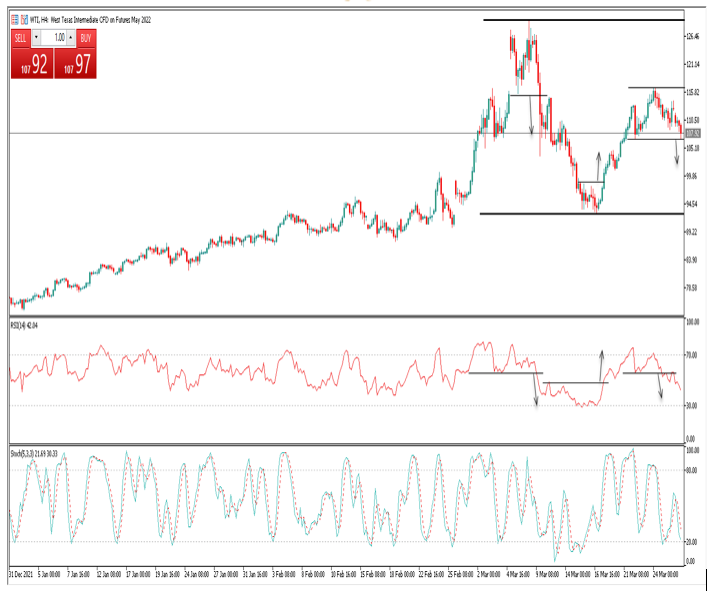

Crude Oil (WTI)

The strong rebound from the March 16, 2022 low has lost momentum and over the past two days the price of crude oil has been trading in the red.

The daily stochastic indicator has turned down from overbought territory suggesting that lower prices are likely to unfold in the days ahead. The 4H RSI indicator broke below its support also pointing to lower levels in the short-term.

A break below minor support of $107.07 is highly likely and would confirm that a small top is in place. Such breakout is likely to trigger a decline to $101.50. Shanghai’s lockdown for Covid-19 testing over the coming week weighs on oil prices as China is the world largest crude importer.

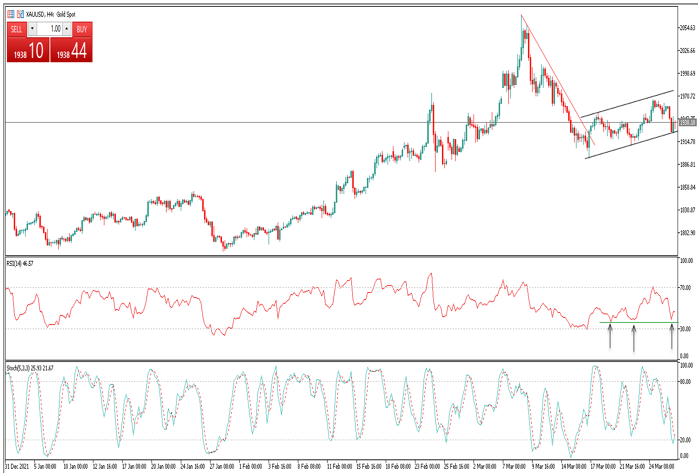

Spot Gold (XAUUSD)

The pull back from the March 2020 high of $2,070 has lost momentum and over the past week the price of gold has been trading in an upward trajectory within the boundaries of an up trend channel.

The recent price action retraced to its short-term up trend line crossing at $1,925 which is an important level to monitor in the short-term. As long as dynamic support of $1,925 holds a rally to $1,965 could unfold in the short-term. Should support of $1,925 gets broken instead, a decline to $1,910 first and $1,900 thereafter is likely to follow.

The gold market has benefited from significant safe-haven demand as Russia’s invasion of Ukraine enters its fifth week. Even if the war in Eastern Europe is resolved, the safe-haven demand is not likely to dry up completely. The conflict has become a critical pivot point that is changing the global geopolitical landscape and financial markets.

In the current environment, nations friendly to Russia, like China could continue to diversify away from the U.S. dollar, which means gold will become an essential tool for central banks.

Disclaimer