Bond Rating

The risk of default on bonds varies from issuer to issuer. Credit-rating agencies provide these securities with a bond rating to help you gauge their risks.

Top Recommended Bonds Brokers

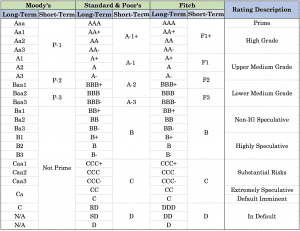

In the US and other developed markets, bond and credit-related securities issuances are provided independent ratings by the “Big 3” credit rating agencies, comprised of Moody’s, Standard & Poor’s, and Fitch.

Ratings are based on analysis of the issuer’s financial capacity to pay principal and interest payments on its bonds or credit-based securities in a timely manner. This is predominantly done by assessing the issuer’s credit statistics, or analyzing measures of cash flow against measures of debt or interest. The higher the cash flow or income relative to the measure of debt or interest, the higher the rating is likely to be.

Bond Rating: Implications for Day Traders

The central purpose of a bond rating is to inform market participants of the general quality of a bond or credit-based instrument. Given the credit agencies’ longstanding role in fulfilling this duty in the financial community, a security’s bond rating will influence investors’ demand for it, and therefore its price and yield to maturity.

Bonds are graded on a scale running from AAA to D (for S&P and Fitch) and/or Aaa to C (for Moody’s), similar to the standard letter-grade evaluation system, going from high-quality to low-quality. There are various quality sub-distinctions within each letter rating.

In the S&P and Fitch rating systems, AAA to BBB- are considered “investment grade” (or IG) quality. This corresponds to Aaa to Baa3 on the Moody’s rating system. Ratings of this quality are given to governments and corporations perceived to have low default risk and a positive outlook.

AAA (or Aaa) credit ratings are seen among the most stable governments in high GDP per capita countries, such as Australia, Canada, Denmark, Germany, Liechtenstein, Luxembourg, Netherlands, Norway, Singapore, Sweden, and Switzerland. Sometimes Finland, Hong Kong, and the United States also have perfect credit ratings.

BB+ or lower is considered “non-investment grade” (or non-IG) quality. This corresponds to Ba1 or lower on the Moody’s rating system. Ratings of this quality are given to governments and corporations perceived to have higher default risk. Non-IG bonds generally attract investor interest through their higher yields. Bond yields increase as ratings decrease.

Shortcomings of Bond Ratings

It should be emphasized that credit ratings are not perfect and can often differ, sometimes materially, from the true credit quality of the security. Ratings are assigned via a process that must be fundamentally based on projection, and the future of an issuer’s ability to pay principal and interest in timely fashion can’t be perfectly guaranteed.

Some believe that independent rating agencies played a role in the 2007-10 financial crisis. Moody’s, in particular, was later found to provide higher ratings for certain mortgage-backed securities, in exchange for payment from their issuers, to augment investor demand. The bonds were later downgraded from an Aaa rating after the onset of the crisis.

Most long-term investors may benefit from carrying the bulk of their fixed-income exposure in investment grade bonds for the sake of reliable, long-term cash flow. For traders who use non-investment grade debt for the volatility or as a specialized focus, the reward is higher but at the expense of potentially much higher risk.