Backwardation

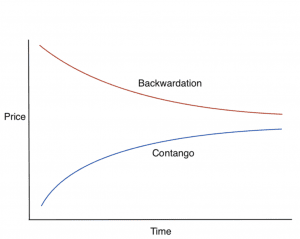

If the current cash price for an asset slips above the price for forward delivery, that’s known as ‘backwardation’.

Namely, backwardation is the idea that the price of a futures contract for some future delivery of the underlying asset is lower than the current spot price. For example, if the price of WTI crude oil on the spot market is $60 and the price of crude in two years’ time is $50, the crude oil price curve would be considered “backwardated”.

Top Brokers For Trading Backwardation Futures

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com

This can often be partially attributed to storage costs – termed the “cost of carry” – associated with the underlying asset or due to a lack of supply and/or high demand in the spot market relative to the future.

The opposite of backwardation is contango, where the spot price is below the price of a futures contract at some future expiration. This can be due to high supply and/or low demand in the spot market or aided by low storage costs associated with the commodity.

Applications for Day Traders

Backwardation can also be an opportunity for arbitrageurs looking to lock in profits.

If WTI crude oil is trading on the spot market for $60 and the futures contract expiring two years hence is trading at $50, an arbitrage opportunity could exist where one sells the $60 spot amount and goes long the $50 two-year forward price. Futures prices are expected to converge to the spot price over time, providing a $10 profit per contract over the specified time period.

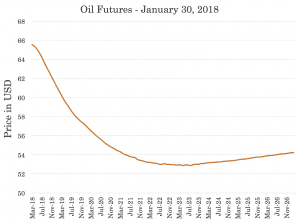

The image below shows the state of the WTI crude oil market as of January 30, 2018, showing a market distinctly in backwardation.

Is Backwardation “Normal”?

For most assets, one expects a higher price in the future for holding an asset. Theoretically, if there weren’t an expected positive return on investment (ROI) there would be no logic behind investing in it to begin with. Therefore, negative return expectations in the future, as implied by a backwardated curve, are considered by some to be an abnormal market condition.

Nonetheless, certain markets generally warrant backwardation due to the nature of the underlying commodity. For example, soft commodities markets, such as sugar, soybean, wheat, and corn, which are perishable and seasonal, frequently have backwardated curves to reflect the associated cost of carry.

For this reason, the term “normal backwardation” is frequently used to express the idea that backwardated markets are not necessarily anomalous or irrational.

The terms “normal backwardation” and “backwardation” are normally used interchangeably, though there is a subtle difference between the two. “Normal backwardation” refers to a futures contract whose price is below the expected spot price at expiration. The standard definition of backwardation refers to a futures contract whose price is below the current spot price.

Precious metal markets are rarely backwardated to any appreciable extent, as commodities like gold, platinum, silver, and palladium are better known for their monetary qualities rather than as industrial inputs. Therefore, temporally related supply concerns are minimal.