Bitcoin Brokers & Exchanges

Bitcoin brokers and exchanges provide tools to help traders capitalize on the BTC crypto market, either through owning the underlying asset or speculating on a derivative. However, selecting Bitcoin platforms is not straightforward, with different services offered and fees charged by each exchange.

In this tutorial, we review the most important factors to consider when choosing Bitcoin brokers, including regulations, platforms, mobile apps, plus safety and security measures. Alternatively, get started today with our rating of the best Bitcoin brokers and exchanges in 2024.

Bitcoin Brokers & Exchanges

#1 - AvaTrade

Why We Chose AvaTrade

Regulated in five continents, AvaTrade offers a secure way to access crypto markets. There's a great range of digital currencies including Bitcoin, Ethereum and Ripple, plus a crypto index. You can access competitive crypto spreads in the broker's wide choice of platforms as well as 1:2 leverage.

"AvaTrade offers the full package for short-term traders. There is powerful charting software, reliable execution, transparent fees, and fast account opening with a low minimum deposit."

- DayTrading Review Team

- Coins: BCH, BTC, BTG, ETH, LTC, XRP, EOS, DASH

- Crypto Mining: No

- Auto Market Maker: No

- Crypto Spread: BTC <1%, ETH 2%

- Crypto Lending: No

- Crypto Staking: No

- Platforms: WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade

- Regulator: ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM

About AvaTrade

AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Pros

- Day traders can access stable spreads and zero commissions with no hidden fees

- AvaTrade is a heavily regulated and trustworthy broker with licenses from the ASIC, CySEC and more

- There's a great range of fee-free deposit methods, including bank wire, credit cards and popular e-wallets like Skrill

Cons

- Traders from the US are not accepted

- There is no ECN account with raw spreads

- It’s a shame that there are no rebate schemes for serious traders looking for additional perks - CMC Markets would be a better choice here

#2 - OANDA US

Why We Chose OANDA US

You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

- DayTrading Review Team

- Coins: BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE

- Crypto Mining: No

- Auto Market Maker: No

- Crypto Spread: $100

- Crypto Lending: No

- Crypto Staking: No

- Platforms: OANDA Trade, MT4, TradingView, AutoChartist

- Minimum Deposit: $0

- Regulator: NFA, CFTC

About OANDA US

OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

Pros

- The broker offers a transparent pricing structure with no hidden charges

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

#3 - Deriv.com

Why We Chose Deriv.com

Deriv.com continues to offer a strong selection of 30+ crypto pairs - this is more than double the range offered at our leading competitor, IQ Cent. 1:2 leverage is also available so you can magnify potential returns, and there are no commissions which is ideal for newer day traders.

"Deriv.com will suit day traders looking to make fast-paced trades using CFDs and multipliers with high leverage up to 1:1000. The broker is also the industry leader in synthetic indices, which simulate real market movements and are available around the clock. "

- DayTrading Review Team

- Coins: BTC, LTC, ETH, USDT, USDC

- Crypto Mining: No

- Auto Market Maker: No

- Crypto Spread: From 0.5

- Crypto Lending: No

- Crypto Staking: No

- Platforms: Deriv Trader, MT5

- Minimum Deposit: $5

- Regulator: MFSA, LFSA, VFSC, BFSC

About Deriv.com

Deriv.com is a low cost, multi-asset broker with over 2.5 million global clients. With just a $5 minimum deposit, the firm offers CFDs, multipliers and more recently accumulators, alongside proprietary synthetic products which can't be found elsewhere. Deriv provides both its own in-house charting software and the hugely popular MetaTrader 5.

Pros

- There's a good range of fast deposit and withdrawal methods with zero payment fees and low minimum deposits

- Beginners and experienced day traders can access a good range of 20+ technical indicators in Deriv Trader vs 30+ in MT5

- Deriv bolstered its short-term trading opportunities in 2024 with accumulator options on simulated indices featuring up to 5% growth rates

Cons

- The range of 100+ assets trails some competitors such as Quotex which offers 400+

- There are limited copy trading tools and analysis features compared to alternatives like IQ Cent

- There's no loyalty program or rebate scheme for high volume traders

#4 - Pepperstone

Why We Chose Pepperstone

Pepperstone continues to prove itself as one of the most trusted crypto brokers. Although its selection of digital tokens is average, you can trade popular cryptos like Bitcoin and altcoins like Ripple with up to 1:10 leverage, while its crypto indices provide a holistic view of the digital currency markets not found on most day trading platforms.

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

- DayTrading Review Team

- Coins: BCH, BTC, ETH, LTC, DASH, ADA, LINK, DOGE, EOS, DOT, XRP, XLM, XTZ, UNI, BNB

- Crypto Mining: No

- Auto Market Maker: No

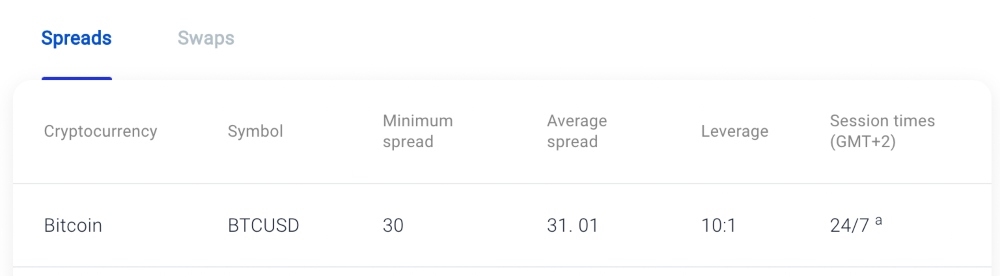

- Crypto Spread: BTC 30, ETH 0

- Crypto Lending: No

- Crypto Staking: No

- Platforms: MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

- Minimum Deposit: $0

- Regulator: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB

About Pepperstone

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Pros

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates of 25%+ through the Active Trader program.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- There’s no simplified proprietary trading platform, nor are there any social trading features, which could be a disadvantage if you are new to day trading.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets.

#5 - XM

Why We Chose XM

XM offers a handful of cryptocurrencies against the USD via the South African entity only. These are tradable via CFDs with high leverage up to 1:500. You can explore major tokens like Bitcoin, Ethereum and Ripple with just a $30 deposit.

"XM is one of the best forex and CFD brokers we have tested. The flexible account types will suit a variety of short-term trading styles while the $5 minimum deposit and smooth sign-up process make it easy to start trading."

- DayTrading Review Team

- Coins: BTC, ETH, LTC, XRP, BCH

- Crypto Mining: No

- Auto Market Maker: No

- Crypto Spread: Variable

- Crypto Lending: No

- Crypto Staking: No

- Platforms: MT4, MT5

- Minimum Deposit: $5

- Regulator: ASIC, CySEC, DFSA, FSC, FSCA

About XM

XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC.

Pros

- Transparent and low fees with spreads from 0.0 pips that will help protect day trading profit margins

- Powerful MT4 and MT5 platforms are available with 60+ and 80+ technical charting tools

- 1000+ instruments are available, including recently added thematic indices, providing exposure to emerging industries

Cons

- PayPal deposits are not supported

- There's $5 inactivity fee after only 3 months, though this won't affect active traders

- There is weak regulatory oversight through the global entity

How Do Bitcoin Brokers & Exchanges Work?

First, it’s important to understand the difference between a Bitcoin broker and an exchange.

Similar to forex, a Bitcoin exchange is simply a platform for users to deposit funds that can be exchanged for Bitcoin. This means the investor becomes the owner of an amount of Bitcoin, which needs to be stored in a crypto wallet. An exchange makes its money on the difference between the ask and sell price.

Bitcoin brokers act as middlemen between buyers and sellers to facilitate a trade. As well as having the option to buy the Bitcoin asset, brokers also allow investing on derivative products such as CFDs and binary options, enabling the trader to profit from price fluctuations without owning or storing any BTC itself. This is a key advantage of using a Bitcoin broker, with these derivative options also allowing the trader to use leverage. For traders that simply want to buy and hold or use Bitcoin, an exchange may be a good alternative.

Investors looking to buy or sell a large amount of Bitcoin will likely use an over-the-counter (OTC) broker, who finds a counterparty directly rather than trade on an exchange. This has benefits such as preventing the investor from impacting their own price point and avoiding slippage.

How To Compare Bitcoin Brokers & Exchanges

Here we discuss the most important factors to consider when comparing Bitcoin brokers.

Fees

Bitcoin fees are usually a percentage of the crypto value being purchased, though flat fees may also apply per transaction. In addition, expect to pay borrowing fees if holding a short position, conversion fees when depositing in certain currencies, account inactivity fees if the account becomes dormant, and rollover fees to hold an overnight position.

Financial Derivatives

Many Bitcoin brokers offer the option to speculate on financial derivatives as well as buying the underlying asset. This enables the use of leverage, as well as the option to open both short and long positions.

Bitcoin Exchange Traded Funds (ETFs) such as the Bitcoin Tracker Fund are a basket of securities that can be traded through Bitcoin brokers such as Interactive. They track the value of Bitcoin but trade on traditional market exchanges rather than cryptocurrency exchanges. Investors also have the opportunity to trade options and futures through Interactive Brokers, subject to meeting margin requirements.

Leverage

Leverage and margin investing is when a trader borrows capital from a Bitcoin platform so they can invest more with a lower outlay.

While this can result in higher returns, it also increases risk as losses will be amplified too. Eightcap is an example of a Bitcoin platform that provides the opportunity for traders to increase their buying power using leverage of 1:2 on all crypto-assets.

Interest

As well as Bitcoin trading, investors also have the opportunity to earn interest on BTC through a platform, which can be an excellent way to generate additional income. For example, Gemini offers 2% interest on Bitcoin holdings.

Note that this is not the same as crypto mining, which is done by individuals or as part of a mining pool.

Regulation

Using regulated Bitcoin brokers is highly recommended, as this ensures the company is abiding by certain rules and standards.

Top tier regulators include:

- Financial Conduct Authority (FCA) – UK

- Commodity Futures Trading Commission (CFTC) – US

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Australian Securities and Investments Commission (ASIC) – Australia

- European Securities and Markets Authority (ESMA) – European Union

However, regulation is often different for cryptos versus other assets. For example, while the FCA regulates cryptocurrency in the UK, consumers are unlikely to have access to the Financial Services Compensation Scheme (FSCS) for Bitcoin, meaning funds are not protected in the same way as when investing with traditional currency.

Equally, regulation does not apply to all countries. While the IG Group is among the top-rated Bitcoin brokers and platforms that is regulated by the FCA, one of its member companies IG Markets South Africa is not licensed to provide CFD products.

Security

2022 saw the collapse of FTX, among several other high-profile Bitcoin companies, raising questions about how some of the largest crypto exchanges manage client assets.

As a result, many traders are looking for legitimate Bitcoin firms with adequate safety and security protocols. One such measure is proof of reserves, which validates that a firm does indeed hold the BTC they claim to, meaning should users rush to withdraw funds, they have the capital to honour all requests.

Among the best Bitcoin brokers and exchanges that publish proof of reserves reports are BitMEX and OKX.

Platforms

The platform is the software provided by the broker or exchange used to carry out Bitcoin trading. The key things to look out for when researching a broker’s platform include:

- Indicators

- Chart types

- User interface

- Execution speed

- Demo account option

By signing up for a demo account, traders can try out the features offered by the platform risk-free, as well as practising technical strategies using charts and indicators. While many Bitcoin brokers offer the biggest platforms such as MetaTrader and cTrader, some also offer proprietary platforms with additional features.

AvaTrade is a Bitcoin broker that offers a vast array of platforms to suit all types of traders including their own platforms AvaTradeGO and AvaOptions, as well as the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Accounts

All Bitcoin brokers offer accounts that come with associated terms including minimum deposit requirements and leverage options. While this varies between platforms, some firms also offer several account types to suit different investing needs.

Checking account restrictions is key to ensuring BTC investing will be viable. For example, traders looking to buy Bitcoin through Interactive Brokers need a minimum deposit of a huge $10,000. The IG Group has a more reasonable minimum deposit requirement of £250, while eToro requirements vary depending on customer location and deposit method.

Bonuses

Many platforms offer Bitcoin sign-up bonuses and promotions for new customers. This includes no-deposit bonuses, which means a platform gives a live account with a free bonus balance for investing.

Usually only profit can be withdrawn rather than the bonus itself, however this provides a great opportunity to start investing in Bitcoin without any risk.

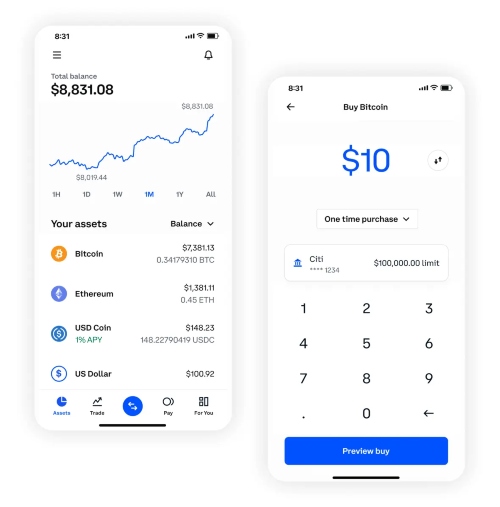

Mobile Apps

Many Bitcoin brokers and exchanges now offer mobile apps for traders to manage BTC on the go. This could be a broker specific app, or a platform one such as the MetaTrader application.

Check the app is compatible with your operating system and look out for user reviews on the App Store and Google Play. In particular, ensure you can access any indicators or features you require to execute trades, as the functionality may be more limited than on the desktop platform.

Customer Support

The best Bitcoin brokers and exchanges offer high-quality technical support that typically includes:

- Telephone

- Contact forms

- Live chat services

Additionally, make sure the customer support option you need is available at the times of day you will be investing.

Deposits & Withdrawals

Bitcoin brokers and exchanges have various requirements for depositing and withdrawing funds, which may affect how much or when you can trade. Look out for deposit currency requirements, deposit and withdrawal methods (including debit/credit card and e-Wallets) plus processing times, which can be up to several working days.

There are also some brokers that accept Bitcoin payments as an online deposit and withdrawal method, which allows for a secure and fast transfer solution.

Alternative Tools

Crypto bots are becoming increasingly popular, providing the opportunity to automatically place Bitcoin trades using logic based on asset price or technical indicators. Numerous Bitcoin brokers and exchanges exclusively provide this automated investing service, including Bitcoin Evolution, Bitcoin Code, Bitcoin Era, Bitcoin Up, Bitcoin Loophole, Bitcoin Revolution and Bitcoin Profit.

However, traders should remain cautious about the legitimacy of these Bitcoin brokers, holding them to the same standards as more traditional exchanges.

Accepted Countries

There are usually restrictions on the countries from which BTC brokers accept customers, making it necessary to check the ‘supported countries’ list before trying to open a Bitcoin account.

Pepperstone is one of the best Bitcoin brokers and platforms that accept traders registered in Australia (including Sydney), New Zealand, Thailand, the United Kingdom, South Africa (including Cape Town and Durban), Singapore, India, Switzerland, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates (including Dubai), Saudi Arabia, Kuwait, Luxembourg, Qatar, Belgium, Azerbaijan, Jordan and Chile.

Swissquote is also a great option for clients in Canada (including Toronto), Hong Kong, Turkey, Japan, Saudi Arabia, Macau, Belize, China and Lebanon, while traders in Kenya can open an account with XM.

Unfortunately, investing is not permitted by either eToro or Swissquote for customers in Iran, Madagascar, Maldives, Botswana, Cameroon, Nigeria, Namibia or Zimbabwe.

What Is Bitcoin?

Unquestionably the most famous cryptocurrency, Bitcoin is a highly volatile asset that has seen extreme surges and declines over the past 10+ years. Bitcoin was the first blockchain currency to successfully record transactions and has a higher market capitalization than any other crypto. Yet BTC was not immune to the recent turbulence seen in the digital asset market, losing more than 60% of its value in 2022.

The Bitcoin white paper was released in 2008 by the pseudonym Satoshi Nakamoto, although the true identity of Satoshi remains a mystery. The decentralized technology is based around a public ledger that can be accessed by anyone and is independent of any government or bank.

Bitcoin brokers have caught the attention of traders such that BTC price movements now have a large impact on the price of other cryptocurrencies. As well as being secure, its popularity has increased its liquidity and accessibility, with generally fewer fees versus other digital assets.

How Bitcoin Works

The Bitcoin network itself is a collection of computers called nodes. Each Bitcoin is a piece of data that is stored in a crypto wallet.

A transaction is the transfer of value between Bitcoin wallets. Transactions are verified by a network of people running computers (mining) to solve complex algorithms, who receive rewards in the form of BTC for their efforts. Once verified, the transaction is added to the public online ledger, called the blockchain.

As everyone’s ledger should be the same, this makes it extremely difficult to claim ownership of more Bitcoin than someone has, making the crypto both transparent and secure.

How To Check Bitcoin Brokers Aren’t A Scam

Here we list the most important things to check to ensure Bitcoin brokers are legitimate:

- Reviews – user reviews and expert ratings are the best way to find out other people’s experience with an exchange or platform. In particular, look out for key indicators that Bitcoin brokers are safe including their reputation, history and any awards.

- Website – does the website feel legitimate? This is another key gauge as to whether a Bitcoin platform is genuine.

- Regulatory status – check the regulator’s website, whether that’s in the USA, UK or Europe, to confirm that regulation claims are real and to further gain confidence that the Bitcoin exchange isn’t fake.

- Offers – while some Bitcoin brokers and exchanges offer good bonuses, look out for deals that sound like they’re too good to be true – as this usually means they are.

Final Word On Bitcoin Brokers & Exchanges

Bitcoin brokers enable traders to profit off the highly volatile BTC blockchain, but selecting the right exchange is key to ensure you aren’t being scammed. Also consider the key services you need, whether that’s online investing with derivatives, P2P lending platforms, or Bitcoin storage.

Review our list to ensure you’ve considered the most important factors when selecting the best BTC brokers for your strategy.

FAQ

Do Brokers Sell Bitcoin?

Bitcoin can be bought from a broker or an exchange. However, brokers also provide additional services such as access to derivatives including futures and options, allowing traders to speculate on the price of Bitcoin without owning the underlying asset.

How Do Bitcoin Brokers Make Money?

Bitcoin brokers make money through the spread, by charging commission fees, or using a hybrid fee structure. The spread is the difference between the buy and sell price, while commissions fees are usually a flat fee applied to every transaction.

What Do Bitcoin Brokers Do?

Bitcoin brokers provide investors with access to a cryptocurrency exchange, which enables them to buy and sell BTC through a platform. The platform usually also contains charts and indicators for carrying out technical analysis.

What Are The Best Bitcoin Brokers In The UK?

Whilst partly dependant on your strategy and needs, among the top 5 UK regulated Bitcoin brokers are the IG Group, eToro, CityIndex, Swissquote and XTB.

What Are Legitimate Bitcoin Brokers?

Legitimate Bitcoin brokers are regulated by reputable authorities such as the CySEC. Check for good user reviews and a credible website when searching for safe Bitcoin brokers. Also look for appropriate security measures like segregated client funds and proof of reserves.