WH SelfInvest Review 2024

WH SelfInvest facilitates multi-asset trading through web & downloadable platforms.

Forex Trading

Trade on the FX market with flexible leverage.

Stock Trading

Trade stocks in 120 market centres.

CFD Trading

Invest in multiple financial markets with leveraged CFDs.

WH SelfInvest is a reputable ECN and forex broker, offering its advanced proprietary NanoTrader platform and excellent customer support. This review offers insight into the broker’s assets, mobile app, spreads and leverage. Get all you need to know before you start trading with WH SelfInvest.

WH SelfInvest Details

WH SelfInvest S.A is a Luxembourg-based broker founded in 1998. The company is now one of the largest forex and CFD brokers in Europe with offices in Frankfurt, Paris and Zürich. The broker caters to clients in over 28 countries, offering a range of equities, CFDs and forex options.

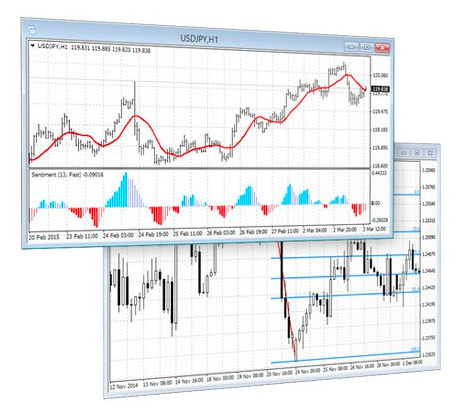

WHS NanoTrader Platform

WH SelfInvest offers trading through its proprietary platform – WHS NanoTrader. There is a free and premium version, NanoTrader Free and NanoTrader Full. The premium version is charged at a monthly fee of €29 and targeted at more advanced traders. Both versions offer direct market access but differ in their range of features and functionalities.

NanoTrader is regarded as one of the most advanced trading platforms around. It is easy to navigate and offers advanced charting and technical analysis tools.

Features include:

- 80 free trading strategies and signals

- Order placement & management tools

- Multiple trailing stops and target orders

- 10 chart types including TwinCharts

- Stock screeners

- Volume profile

- TradingView

Traders also have access to several other platforms including MT4 (available to download) for forex trading and NinjaTrader and SierraCharts for futures trading. Webtrader platforms and cloud trading are also available. Cloud trading is charged at €35 per day but the fee reduces as the number of trades made increases.

WH SelfInvest Assets

Clients can trade over 5,000 products across three key asset classes; futures, CFDs, and stocks. Trade CFDs on major commodities, bonds and ETFs. Alternatively, trade on up to 69 forex pairs and low-cost stocks covering 120 market centres in 26 countries.

Spreads & Fees

Clients can choose between a Mini account or a Standard account. The Mini option offers a low variable spread while the Standard account uses a simple flat fee commission. Commission for the Standard account is set at $0.035 per $1,000 traded.

Spreads are around the industry norm with major market indices starting at 0.3 points and forex spreads averaging around 2 pips on major currency pairs.

There is no monthly inactivity fee and no additional charges for modifying or cancelling orders. However, the VPS service is charged at €60 per month which on top of the €29 monthly platform fee for NanoTrader Full, does start to add up.

Leverage

The maximum leverage available at WH SelfInvest is 1:50 across CFDs, futures and stocks. Leverage for assets such as precious metals and other commodities is 1:33 and 1:20 respectively. Whilst low leverage reduces risk, more experienced traders may feel restricted. CFD margin requirements are available on the broker’s website.

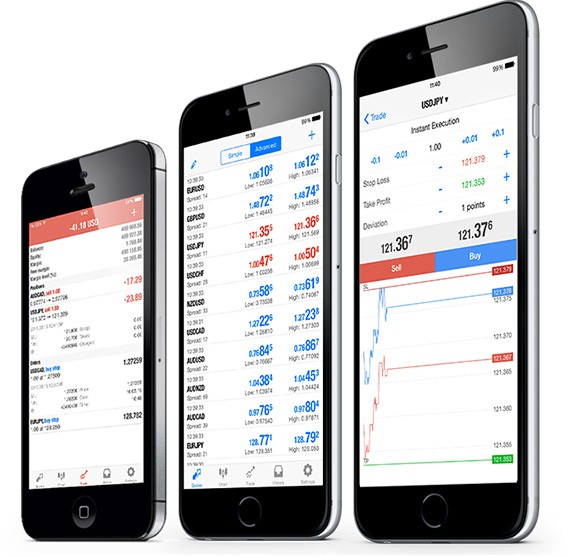

Mobile Apps

Both the NanoTrader and MetaTrader 4 platforms are available for download on smartphones and tablets. Access your futures, stock and CFD portfolio from anywhere and trade on-the-go. The mobile platforms deliver real-time market data, high-speed order execution and advanced charting.

The apps can be downloaded free of charge from the iOS store or Google Play Store and generally receive positive reviews.

Payment Methods

WH SelfInvest only supports payment via bank wire transfer, with no option to deposit from a credit/debit card or via online payment wallets such as AliPay, Neteller or Skrill. Transfer costs are €5 for amounts under €30,000 and 0.10% (maximum €50) for amounts over €30,000. The minimum deposit to open an account is €500.

To make a transfer, clients have to fill out the transfer form located on the broker’s website.

Demo Account

WH SelfInvest offers a free demo account to clients wishing to trial the NanoTrader platform. Enjoy risk-free trading with no restrictions. The demo account is a great way to test new strategies such as the Friday Gold rush and range breakouts, as well as evaluating the broker’s support services, before any investing funds.

Bonuses

WH SelfInvest does not offer any promotional deals or offers to traders. This is fairly standard among European brokers who are restricted from offering no deposit welcome bonuses and other incentives by regulators. Traders can, however, set up a free demo account and tune into a variety of webinars packed full of tips and industry news.

Regulation

WH SelfInvest’s presence in multiple European jurisdictions means that its operations fall under the scrutiny of several regulatory bodies. WH SelfInvest Ltd is regulated in Luxembourg by the CSSF and the Luxembourg Ministry of Finance. In addition, the broker is regulated by the FSMA of Belgium, the AFM of Netherlands, the ACPR of France, the BaFin of Germany and FINMA of Switzerland.

The company has a long-standing reputation for a safe and secure trading environment, providing traders with peace of mind.

Additional Features

WH SelfInvest offers a range of free, additional services to help assist traders including:

- APIs

- SignalRadar

- TradingView

- Market news

- Support forums

- Stock box service

- Trading library & store

- Webinars & seminar videos

WH SelfInvest Accounts

WH SelfInvest offers two account types: a spread-based account and a commission-based option. The spread-based account charges a variable spread per trade from around 2 pips. Alternatively, the commission-based account sees more competitive spreads, starting from 1 pip, but traders have to pay a set commission of $0.035 per $1000 traded. The minimum deposit, trading tools and customer support are the same across accounts.

Traders can sign up for an account and access the web login portal from the broker’s homepage.

Benefits

Opening an account with WH SelfInvest offers multiple benefits:

- All strategies permitted including scalping and hedging

- Award-winning proprietary trading platform

- No slippage and requotes

- Reliable customer service

- MT4 platform

Drawbacks

Flaws in WH SelfInvest’s offering include:

- VPS charge

- Platform fees

- No MetaTrader 5 platform

- No US, Australian or Belgian clients

- No cryptocurrency and Bitcoin trading

Trading Hours

Trading hours vary according to the asset and market traded. Forex contracts can be traded 24 hours from Sunday to Friday evening. The majority of CFDs have the same opening times as those of the underlying instrument. Traders can head to Symbol details on the WH SelfInvest’s website to find out further information.

Contact Support

WH SelfInvest offers a great customer service team which can be reached via:

- Phone hotline – +352 42 80 42 80

- Email – info@whselfinvest.com

- Live chat – ‘chat’ button

Customer support is localised, facilitating multi-language support.

Security

All client funds are held in segregated accounts with reputable banks. The company only accepts transfers signed by the account holder and there are no conversion commissions. As a broker regulated by some of the most reputable regulatory bodies, clients can feel assured their funds are secure.

WH SelfInvest Verdict

With a decent range of assets, competitive spreads and an elite platform, WH SelfInvest promises an excellent trading experience. However whilst the NanoTrader platform is popular, for some the high fees may deter potential traders. In terms of how WH SelfInvest compares vs IGmarkets, Interactive Brokers and CapTrader, the broker has a strong offering but clients should carefully consider what they are looking for and trial services before investing funds.

Top 3 Alternatives to WH SelfInvest

Compare WH SelfInvest with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

WH SelfInvest Comparison Table

| WH SelfInvest | IG | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4 | 4 |

| Markets | Futures, CFDs, stocks, bonds, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €500 | $0 | $1000 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | BaFin, CSSF, FSMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA |

| Bonus | – | – | – | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Payment Methods | – | 6 | 5 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Swissquote Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by WH SelfInvest and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| WH SelfInvest | IG | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

WH SelfInvest vs Other Brokers

Compare WH SelfInvest with any other broker by selecting the other broker below.

FAQ

Is WH SelfInvest regulated?

Yes, WH SelfInvest is a regulated broker subject to scrutiny from the BaFin, CSSF, FSMA, and AFM. As a result, the broker is a trusted and respected trading provider.

Does WH SelfInvest accept international traders?

Yes, WH SelfInvest accepts clients from over 28 countries. With that said, clients from certain countries, including the US, Australia and Belgium, cannot open a live trading account.

What is the minimum deposit required at WH SelfInvest?

The minimum deposit required to open a live account with WH SelfInvest is €500.

What trading platforms does WH SelfInvest offer?

WH SelfInvests offers a proprietary trading platform, NanoTrader, the popular MT4 and NinjaTrader.

Is WH SelfInvest a reliable broker?

Yes, WH SelfInvest is a reputable broker with a long history of providing a safe and secure trading environment.

Customer Reviews

There are no customer reviews of WH SelfInvest yet, will you be the first to help fellow traders decide if they should trade with WH SelfInvest or not?