TusarFX Review 2024

- Daytrading Review TeamTusarFX will appeal to forex and metals traders looking for a hassle-free trading environment with a low minimum deposit and access to MetaTrader 4.

TusarFX is an unregulated forex broker. The brand offers MT4 integration, with a choice of four account types and zero commissions. Most trading strategies are permitted including Expert Advisors (EAs). New clients can also claim a welcome bonus.

Forex Trading

Speculate on 30+ major, minor, and exotic currency pairs including the EUR/USD, EUR/GBP, and GBP/JPY with leverage up to 1:500. The broker also offers dynamic spreads from 1.1 pips.

✓ Pros

- Promotions including trading loss rebates and no deposit bonuses

- Educational content and guides for beginners

- Swap-free Islamic account available

- No deposit or withdrawal fees

- High leverage up to 1:500

✗ Cons

- TusaFX is unregulated with no evidence of fund safeguarding

- Very slim product portfolio with forex and metals only

- Clients from the US and Canada are not accepted

- Trails the best brokers for market research and tools

- Outdated and clunky website

- Access to MetaTrader 4 only

- No copy trading service

TusarFX offers trading in forex and precious metals through the MT4 platform with high leverage. This review covers the client portal, contact details, deposits, and withdrawals. Find out if you should login and start trading with TusarFX.

TusarFX Company Details

TusarFX Ltd is part of FXCL Markets Ltd, a financial services provider, registered in Saint Kitts and Nevis. The global broker offers forex and gold and silver markets to traders of all levels, offering the most popular trading platform as well as four different accounts.

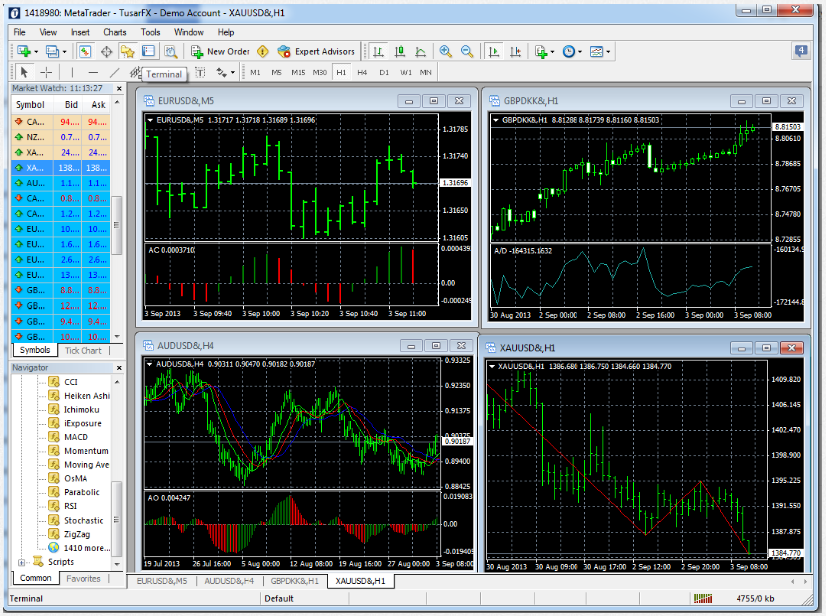

MetaTrader 4 Trading Platform

TusarFX offers the MetaTrader 4 (MT4) platform for all its users. As the most popular trading platform, MT4 offers a range of customisable features, including:

- 50 built-in indicators for technical analysis

- 3 chart types, 9 time frames

- Automated trading (EAs)

- 4 types of pending order

- One-click trading

MT4 can be downloaded directly from the broker’s website. Download instructions can be found in the client portal.

Assets

TusarFX offers trading in forex and commodities. Access over 30 major, minor, and exotic currency pairs, including EUR/USD, EUR/GBP, and GBP/JPY. Precious metals, gold and silver, can also be traded against USD.

The product list is fairly limited compared to other providers. The broker could improve its offering by adding shares, indices, and cryptocurrencies to its list of tradable assets.

Spreads & Fees

Spreads on major currency pairs such as EUR/USD start from 1.1 pips with the Premium account. Other pairs such as GBP/USD and EUR/GBP start from 2.2 and 3.1 respectively. Spreads on gold are around 40 and are approximately 3.5 on silver. These aren’t the lowest spreads, but the broker doesn’t charge commissions with lower account tiers. On the Premium account, a commission is charged at 0.6 pips per standard lot for swap accounts and 1.6 pips per standard lot for swap-free accounts.

Leverage

The maximum leverage offered is 1:500. These are high rates and allow traders to take large positions with a small amount of capital. The broker offers a useful margin calculator on its website.

Mobile Apps

TusarFX offers mobile trading on the MetaTrader 4 app, compatible with iOS and Android devices. The app allows users to access the markets anywhere with advanced mobile features, including real-time pricing, market news, and charting tools. It’s also user friendly and allows for total account management, including making deposits and withdrawals. Customer support is also available in the app.

Payment Methods

Deposits

TusarFX accepts USD wire transfers and payments via Perfect Money. Deposits through Perfect Money are instant via prepaid cards and terminals in Russia and Ukraine. Payments via exchanges from credit cards and numerous e-wallets are also accepted.

TusarFX does not charge deposit fees but traders should check for any intermediary fees with their payment systems.

Withdrawals

Withdrawals can also be made through USD wire transfers, or Perfect Money, which accepts direct payments via bank wire and various exchangers.

Again there are no withdrawal fees from TusarFX, but there may be fees levied by the chosen payment systems.

Demo Account

Traders can open an MT4 demo account by filling in the online registration form on the website. The demo account provides almost identical market conditions where traders can practice without any risk to funds. The simulator account is also a good way to test the MT4 platform and additional features.

Deals & Bonuses

Traders can access a 50% and 20% deposit bonus to bolster trading credit. Also, the broker offers a 70% loss rebate and a surprise birthday bonus. This is a good range of promotions and can help clients make the most of the trading platform and services available.

Regulation

TusarFX Ltd and FXCL Markets Ltd are both offshore companies. TusarFX is registered in Saint Kitts and Nevis while FXCL is registered in St Vincent and the Grenadines. Neither provide the strictest oversight, so clients aren’t afforded the same level as security from scams as FCA or CySEC-regulated providers, for example.

Additional Features

TusarFX offers some practical trading tools, including an economic calendar and a margin calculator. Traders can also access financial news as well as an education centre for beginners. Novice traders can learn how to read quotes, research types of trends, and the basic concepts of the forex market.

Account Types

There are four main account types to choose from, all in USD/EUR/RUR and requiring a minimum deposit of $1 with a minimum position size of 0.01. Leverage up to 1:500 is available across all accounts.

- Light (fixed) – no commission

- Standard (fixed) – no commission

- Advanced (dynamic) – no commission

- Premium (dynamic) – 0.6 pip or 1.6 pip per standard lot

Trading Hours

Market hours on the server run from Sunday at 22:00 to Friday 21:00 GMT+3 in summer and GMT+2 in winter.

Precious metals are available from 01:01 to 23:00 server time (Monday to Friday). Trading exotic pairs are available from 01:00 to 23:59 server time (Monday to Thursday) and from 01:00 to 23:00 server time (Fridays).

Customer Support

TusarFX’s customer support can be contacted via several methods:

- Email – support@tusarfx.com

- Skype – Password.TusarFX

- Online request form – contact us page

- Live chat – located in the bottom right-hand corner of the website

Wait times for live chat and telephone aren’t too long and customer service agents are helpful. Customer reviews of the broker’s support are also mostly positive.

The website is available in English, Russian, Indonesian, Chinese, Malaysian, and Thai.

Trader Security

TusarFX protects client data using 256-bit Secure Sockets Layer (SSL) encryption across the website, as well as using True-Site identity assurance. MT4 also provides dual-factor authentication and follows standard security protocols.

TusarFX Verdict

TusarFX offers forex trading on the popular MT4 platform with competitive leverage and low minimum deposits. The ability to access the platform on the app is also a bonus. The only serious drawbacks are the limited product list and lack of robust regulatory oversight. As a result, there are other providers we’d recommend first.

Top 3 Alternatives to TusarFX

Compare TusarFX with the top 3 similar brokers that accept traders from your location.

-

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

TusarFX Comparison Table

| TusarFX | Swissquote | IG | FP Markets | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 4.4 | 4 |

| Markets | Forex, commodities | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1 | $1000 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | – | FCA, FINMA, DFSA, SFC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, ESMA |

| Bonus | 50% deposit bonus | – | – | – |

| Education | No | No | Yes | Yes |

| Platforms | MT4 | MT4, MT5, AutoChartist, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | – | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:30 (UK), 1:500 (Global) |

| Payment Methods | 2 | 5 | 6 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Swissquote Review |

IG Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by TusarFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TusarFX | Swissquote | IG | FP Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

TusarFX vs Other Brokers

Compare TusarFX with any other broker by selecting the other broker below.

FAQ

What is the maximum leverage offered at TusarFX?

The maximum leverage offered is 1:500. These high rates can help increase returns, but they can also magnify losses.

How can I make a TusarFX withdrawal?

Withdrawals can be made via wire transfer and using direct or exchange payments through Perfect Money. Head to the client portal to make a withdrawal request.

Does TusarFX charge commission?

TusarFX does not charge a commission for the Light, Standard, and Advanced accounts. For the Premium account, a commission is charged at 0.6 pips per standard lot for Swap accounts and 1.6 pips per standard lot for Swap-free accounts.

How do I register for the TusarFX client portal?

You can register and login to the Trader’s Cabinet via the Live Account button on the website.

Is TusarFX a scam?

Traders should be aware that TusarFX is an unregulated offshore company. There is also a lack of company information on the website to prove its legitimacy.

Customer Reviews

There are no customer reviews of TusarFX yet, will you be the first to help fellow traders decide if they should trade with TusarFX or not?