TradeZero Review 2024

- Daytrading Review TeamWe recommend TradeZero for active stock traders looking for zero commissions, powerful software and extended hours trading.

TradeZero is a stock and ETF broker established in the Bahamas in 2015. Though the global entity is regulated offshore, the US subsidiary is overseen by FINRA with SIPC registration. The powerful proprietary trading software makes it a popular choice for active day traders.

Stock Trading

TradeZero supports short-term stock trading on 100+ shares listed on the Nasdaq and NYSE. There is no commission for limit orders with a stock price of at least $1 while leverage up to 1:6 is available for accounts with $2,499+.

✓ Pros

- ZeroPro provides access to advanced charting features, instant alerts, customizable hotkeys and, for an extra monthly fee, OTC Level 2 markets

- High intraday leverage up to 1:6 for global accounts with balances of $2,499+ and up to 1:4 for US clients

- Four in-house platforms including a proprietary mobile app with real-time data streaming

- Simple pricing structure; free or paid stock and options orders (eligibility requirements apply)

- On-demand tutorial videos and live stream market insights

- The US entity is registered with the FINRA and SIPC

- Innovative solution to mark unused locates for credit

- Pre-market and post-market trading hours

✗ Cons

- TradeZero only facilitates trading US stocks, with UK, EU and other international markets unavailable

- High deposit and withdrawal fees; $50 for outgoing and $25 for incoming (waived if over $500)

- The TradeZero global entity has weaker regulatory oversight from the SCB of the Bahamas

- A $59 monthly fee applies to the ZeroPro and ZeroWeb terminals

- Customer support is available 24/7 with a responsive live chat

TradeZero is an online brokerage firm that operates platforms within the US and internationally. The broker offers a variety of day trading options and opportunities, through a selection of platforms, assets and subscription levels. This 2024 review will answer any questions you may have, exploring TradeZero’s pricing, platforms, leverage, security and more. Read on to find out whether you should consider opening an account.

TradeZero Headlines

Founded in 2014, TradeZero is a global broker that provides stock, ETF and options trading to its clients. The international division of the brokerage has headquarters in the Bahamas and is regulated by the Securities Commission of the Bahamas. TradeZero’s US trading broker has a head office located in New York and is regulated by FINRA.

Trading Platforms

Trading platforms is an area in which TradeZero specialises. Traders can choose from a selection of bespoke platforms on which to manage their assets and accounts or open and close positions. From the mobile optimised ZeroMobile to the advanced trading tools of ZeroPro, the broker aims to offer a platform for every type of trader.

ZeroFree

As its name suggests, ZeroFree is TradeZero’s free platform offering real-time HTML5 browser-based trading capabilities. Despite being the least advanced of the three desktop platforms, ZeroFree provides many beginner or intermediate traders with all the functionality they need. Offering several order types, charting facilities with indicators, as well as full NYSE, AMEX and NASDAQ Level 1 feeds, ZeroFree can also be scaled up for an extra fee to include features like options trading and Level 2 feed windows.

ZeroWeb And ZeroPro

For $59 a month, TradeZero clients can access the advanced platforms ZeroWeb and ZeroPro. The former is a web-based platform containing all the features of ZeroFree alongside advanced and customisable hotkeys, up to six windows of charting and indicator data and fully customisable layouts. The ZeroPro software takes trading to the next level, offering full options trading facilities, instant price alerts and up to ten charting windows.

Assets & Markets

As a broker fully focused on trading rather than investment, TradeZero provides clients with access to over 100 stocks and ETFs. The firm offers advanced options contracts, including short selling, and leverage rates up to 1:6 to traders that meet certain requirements. However, only US exchange-traded stocks are available on the platform. Furthermore, the broker does not support the trading of crypto assets like Bitcoin, commodities or forex. However, the broker has recently announced the upcoming launch of a crypto trading platform.

Fees

TradeZero has a different fee structure for its US and international brokerage services.

US Fees

For its US platform, TradeZero offers its clients free trades on all orders for assets listed on the NYSE or NASDAQ. Traders interested in penny stocks may be put off by the broker’s fees for stocks trading under $1.00, which stand at $0.003 per share. Any after-hours trading also comes with a commission of $0.003 per share but options contracts are free from any commission.

International Fees

For global clients, TradeZero’s fee structure is a little more complicated. The broker charges zero commissions on limit order trading but levies a $0.005 per share fee on market orders or trades that are immediately matched. Additionally, trades of fewer than 200 shares are subject to a flat $0.99 fee, while options contracts cost $0.59 per contract.

Margin & Leverage

TradeZero leverage rates depend on the time a trade is placed and the level of capital deposited. Clients with between $500 and $2,499 in their accounts can access rates up to 1:4, while those with more than $2,500 can take advantage of a maximum rate of 1:6. Overnight and after-hours leverage rates are capped at 1:2.

Overnight borrowing on TradeZero is subject to 4x average fees for the first night, with additional days charged at 1x average cost. The margin rate is set at 8% annually, which is quite high for the small improvements in buying power offered.

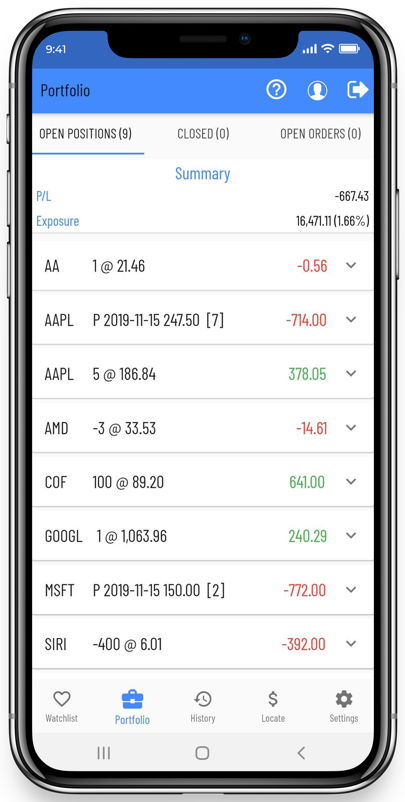

ZeroMobile

TradeZero provides a bespoke mobile interface to their clients free of charge called ZeroMobile. The application allows clients to follow curated market news, check their watchlists and portfolios and monitor open trades. Advanced traders may be left disappointed by the limited functionality compared to the desktop platforms but ZeroMobile serves as a handy tool for checking trades and market news. The application is free for all existing clients and can be downloaded to both Android (APK) and Apple (iOS) devices.

Payment Methods

Perhaps one of the most limiting aspects of a TradeZero account is the lack of account funding options. The broker only allows bank-to-bank wire transfers, with payments from credit or debit cards, PayPal and e-wallets not supported.

TradeZero deposits are subject to a $25 fee and withdrawal charges are even higher, at $50. Deposit fees are waived on an initial deposit if funding an account with over $500 but subsequent deposits of any amount will be subject to the $25 flat charge. There is a $200 minimum deposit limit.

Crypto Platform

Clients that sign up for the waiting list of the recently announced TradeZero crypto platform can earn up to $100 in Bitcoin as a joining bonus. As more people sign up, the reward decreases, so make sure to register your interest quickly.

Regulation & Licensing

The global TradeZero brokerage is registered to operate globally by the Securities Commission of the Bahamas, while the US-based division is locally licenced by FINRA and the SIPC. The broker is also a member of the Securities Investors Protection Corporation, insuring clients in the case of insolvency.

Account Types

While TradeZero does not explicitly offer different account types, access to account features like options trading and leverage margin is only available to traders that meet certain requirements. To access options, clients must subscribe to the ZeroPro platform or pay $25 a month for options to be enabled on the ZeroFree platform. Different leverage levels are available to clients depending on their total deposited capital and assets and traders must have at least $500 in their accounts to disable pattern day trading restrictions.

In the US, TradeZero offers a Platinum level account for traders with over $50,000 in assets and capital. Platinum account members have their ZeroPro platform fees waived, discounted short selling and a personal account liaison with whom to discuss their trading.

Trading Hours

Clients can trade on the live markets during US trading hours, as well as after-hours and overnight. During these times, leverage rates are limited to 1:2. TradeZero’s platforms and accounts can be accessed and managed at all times.

Customer Support

Customer support is an area in which TradeZero excels. Support is available 24/7 and is often instantly responsive during US market hours through the broker’s live chat feature. The customer service team consists of friendly support staff that are familiar with the ins and outs of the firm’s policies and platforms.

On top of live chat, the broker offers contact options through email and telephone.

- Email: support@tradezero.us

- US Telephone: 1-877-4-87233-0

- International Telephone: +1-954-944-3885

Safety & Security

TradeZero is a reputable and regulated broker that promises high levels of security for client personal information and a secure login portal, The broker uses the latest in SSL/TLS encryption to keep data and accounts safe. However, the firm does not support two-factor authentication (2FA), so traders looking for an extra level of account security may be disappointed. Customer capital is held separately from company assets in tier 1 banks, demonstrating greater security of client funds.

TradeZero Verdict

TradeZero is a reliable global and US trading service with a variety of advanced, proprietary trading platforms on offer. While deeper market data and more advanced customisation and charting options must be paid for with the ZeroPro platform, the ZeroFree option is still competitive and sophisticated. Leverage rates are relatively low at 1:6, though the broker stands out with after-hours margin trading at a rate of 1:2.

Trading fees are very low, though the transaction, inactivity, overnight and platform fees might put some traders off. Moreover, only stocks, ETFs and options can be traded, so clients looking for forex and CFD opportunities must look elsewhere, though a crypto platform is in the works.

FAQs

Does TradeZero Have A Minimum Deposit?

TradeZero has an account minimum of $200. $500 is required for unrestricted trading and $2,500 is needed to access the highest amount of leverage. On a trader’s first deposit, the broker will waive the $25 fee if the amount exceeds $500.

Does TradeZero Support Premarket Trading?

TradeZero clients can take advantage of the broker’s after-hours trading facilities to trade in both premarket and postmarket sessions. Leverage rates are capped at 1:2 for after-hours trading.

What Are The Available Countries For TradeZero Accounts?

TradeZero operates US-based and international brokerages. Non-US citizens can open an account with the global brokerage platform, which also excludes Bahamian Citizens and Canadians but accepts all other jurisdictions, including the UK and Germany.

Is There A TradeZero Mobile App?

TradeZero offers access to its free mobile app ZeroMobile. ZeroMobile can be used to keep up to date with financial news, monitor markets and check open trades.

Can I Trade Crypto With TradeZero?

TradeZero has recently announced the upcoming launch of a cryptocurrency platform. The broker has not revealed many details but interested clients can join a waitlist to keep updated.

Top 3 Alternatives to TradeZero

Compare TradeZero with the top 3 similar brokers that accept traders from your location.

-

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote

TradeZero Comparison Table

| TradeZero | Interactive Brokers | IG | Swissquote | |

|---|---|---|---|---|

| Rating | 2.6 | 4.3 | 4.4 | 4 |

| Markets | Stocks, ETFs, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $0 | $1000 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SCB, FINRA | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:30 |

| Payment Methods | 1 | 6 | 6 | 5 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Swissquote Review |

Compare Trading Instruments

Compare the markets and instruments offered by TradeZero and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TradeZero | Interactive Brokers | IG | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

TradeZero vs Other Brokers

Compare TradeZero with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of TradeZero yet, will you be the first to help fellow traders decide if they should trade with TradeZero or not?