Trade Pro Futures Review 2024

- Daytrading Review TeamTrade Pro Futures will appeal to high-volume traders looking for low-cost forex and futures trading with low to zero commissions. However, the $2500 minimum deposit means the broker is best for experienced traders.

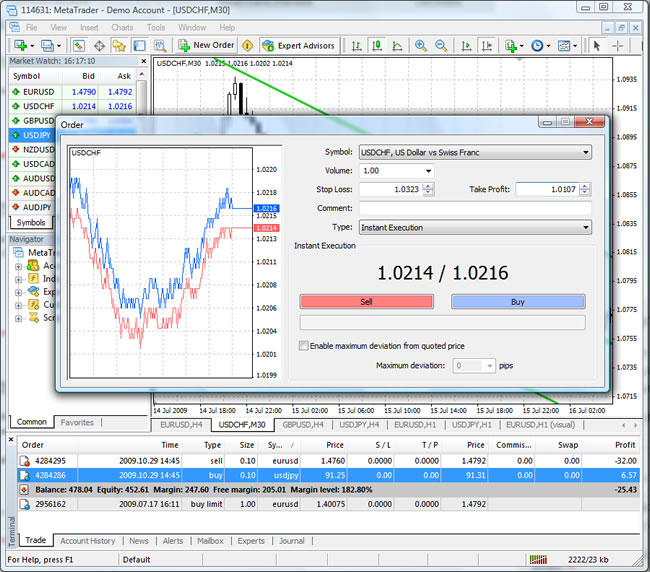

Trade Pro Futures is an NFA-regulated forex and futures brokerage. Aimed towards high net-worth investors, the brand offers a large catalog of powerful trading platforms and tools, including MetaTrader 4. The broker also provides demo walkthroughs, transparent pricing and reliable customer support.

Forex Trading

Trade Pro Futures offers 50+ major, minor and exotic currency pairs on MT4, TradingView or Collective 2. Leverage up to 1:100 is available on forex futures.

✓ Pros

- Good regulatory credentials with authorization from the NFA

- One of the largest suites of trading platforms and tools including Multicharts, CQG, MT4 and R-Trader

- Access to seven futures and options exchanges including CME, CBOT, NYMEX and ICE for trade opportunities

- Transparent pricing structure with exchange fee and NFA charges listed by instrument

- Responsive customer support and platform assistance via live chat, telephone and email

- Demo walkthroughs available by request for all trading platforms and investment tools

✗ Cons

- High minimum deposit of $2500 for a forex account and $5000 for a futures account

- Narrow choice of payment methods with bank transfer and cheque only

- Third-party fees apply for access to some software

- Instruments are restricted to forex and futures

Trade Pro Futures is an online broker specialising in futures and forex on several platforms. Our review covers how to start investing with Trade Pro Futures including deposits and withdrawals, signals for automated trading, plus account registration and login.

Trade Pro Futures Details

Established in 2006, Trade Pro Futures offers global trading services from its head office in Austin, USA. The company is licensed and regulated by the National Futures Association (NFA) and provides access to several exchange markets including CME, CBOT, and EUREX.

Trading Platforms

The broker offers multiple trading platforms to meet the needs of all individuals; whether trading forex, futures, or both. Platforms are available to download from the broker’s website to desktop devices.

Note some investment software incurs a monthly fee.

Forex

Trade Pro FX

- Multiple languages

- 40+ technical analysis tools

- Supports several order types

- Real-time account information and news

- Fully customisable user interface and adaptable charts

MetaTrader 4

- Strategy panel testing

- Customisable interface

- Order execution panel

- Advanced tools and indicators

- Expert Advisors for automated trading

Forex & Futures

Multicharts

- One-click trading

- Automated execution

- High definition charting

- Support for 20+ data feeds

- 300+ built-in indicators and strategies

Sierra Charts

- Advanced visualisation

- Single-click order execution

- Supports multiple data feeds

- Integration with advanced order types

Futures

Trade Pro Trinity

The broker’s established software, benefits include:

- Direct market access

- Auto execution model (AutoX)

- Trade directly from 10+ charts with 30+ built-in indicators

- Depth of market tool for complex strategies including OCO and trailing stops

Other useful trading tools and solutions include:

- R-Trader – Appropriate for swing and low latency futures and options trading

- CQG – For high performance traders with a focus on execution without the need for analysis tools

- Active Trader – Suitable for high volume traders offering reliability, fast execution and simplicity

- Quantower – A modern trading tool with charting and analytical functionality via a professional interface

- Overcharts – Designed by traders, the platform offers multiple data feeds for analysis on a simple, intuitive platform

- X Trader – Trade multiple markets from 1 customisable interface with speed, stability, accuracy, and single-click order execution

- CTS-T4 – Offers full functionality and customisation features. Real-time quotes, one-click trading, economic indicator feeds, and a built-in charting package

For full software details, visit the broker’s website.

Trade Pro Futures Products

Trade Pro Futures offers clients trading opportunities in:

- Forex – major, minor and exotic currency pairs

- Futures – including currencies, indices, energies, metals, meats and grains

Spreads & Commission

Trade Pro Futures charges no commissions or exchange fees. Instead the broker offers floating spreads which average around 1.4 pips on the EUR/USD. While not ultra-tight, the company’s spreads are around the industry norm. The brokerage also charges additional fees for some of its trading platforms, depending on your account. See the broker’s website for more details.

Leverage

Leverage up to 1:100 is available at Trade Pro FX. The highest leverage rates are available on major currencies while leverage up to 1:25 can be accessed on all other products. These are reasonable leverage ratios and strike a good balance between providing traders with additional cash and capping risk exposure.

Mobile Apps

MetaTrader 4 (MT4) is available as a mobile trading tool, compatible with iOS and Android devices. The app supports account management and price analysis from a mobile or tablet device. The application is popular across the forex industry and offers many of the pending order types and risk management tools found on the desktop terminal.

Deposits & Withdrawals

Minimum deposit requirements are dependent on the asset class; forex accounts require a $2,500 deposit and futures accounts need a $5,000 payment. The broker accepts multiple currencies including GBP, EUR, USD, and JPY:

- Wire bank transfers – Same day transactions in some currencies

- Cheques – Non-US banks not accepted and subject to 5 days hold to clear

Demo Account

The broker offers demo accounts, with simple sign-up requirements. Given the long list of trading platforms and tools, a practice account is a great way to find a trading terminal that works for you. Head to Trade Pro Futures website to open a demo account and upgrade to real-money trading when you feel ready.

Trade Pro Futures Bonuses

At the time of writing, Trade Pro Futures does not offer any promotions to new or existing clients, including no deposit bonuses.

Regulation Review

Trade Futures Pro is regulated by the National Futures Association (NFA), a license required by all futures commission merchants. The NFA is a legitimate organisation for the US derivatives industry designated by the Commodity Futures Trading Commission (CFTC) to ensure members meet regulatory trading standards.

Additional Features

The broker’s website offers educational tools via training videos and online resources. Trade Pro Futures also provides an easy to use download centre with platform set-up links and how-to guides. Overall, the company scores well compared to competitors when it comes to additional trading tools.

Trading Accounts

The broker offers account types by client residency and asset class. All Trade Pro Futures account types have the same minimum deposit requirements of $2,500 for forex trading and $5,000 for futures trading. Accounts are split into:

- Futures Account

- Forex Account – US residents

- Forex Account – Non-US residents

- Forex Account – Canadian residents

To open a trading account, individuals must complete an online registration form, which differs depending on the chosen trading platform. Identity documentation and proof of residence must also be provided before you can start trading.

Trading Hours

Trading Pro Futures follows standard office hours and offers 24-hour trading Monday to Friday, though timings may vary by instrument. Note, the broker also offers an hour of pre-market trading on a Sunday.

Visit the broker’s website for full trading hour details by instrument.

Customer Support

The broker offers a range of customer support options:

- Fax – (512) 682-9116

- Email – info@tradeprofutures.com

- Live chat engine – broker’s website

- Address – 11610 Bee Caves Rd, Suite 210, Austin, TX 78738

- Telephone – main (866) 938-4990, trade desk (512) 366-3299 (7:30 am – 4:30 pm CST)

Security

Customer portal access is password protected and account registration follows strict privacy policy guidelines. The MT4 platform assures high-tech encryptions and secure logins, however the safety of funds and data with other enabled trading platforms is less clear.

Trade Pro Futures Verdict

Trade Pro Futures provides an opportunity to trade on established and bespoke platforms. Minimum deposit requirements are high compared to other brokers; something to consider before you start trading. But for US and Canadian traders, in particular, it’s good to see an online brokerage regulated by the NFA.

Top 3 Alternatives to Trade Pro Futures

Compare Trade Pro Futures with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

Trade Pro Futures Comparison Table

| Trade Pro Futures | IG | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4 | 4 |

| Markets | Forex, futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $2500 | $0 | $1000 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | NFA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA |

| Bonus | – | – | – | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Payment Methods | 2 | 6 | 5 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Swissquote Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Trade Pro Futures and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Trade Pro Futures | IG | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Trade Pro Futures vs Other Brokers

Compare Trade Pro Futures with any other broker by selecting the other broker below.

FAQ

Does Trade Pro Futures offer a demo account?

Yes, Trade Pro Futures offers demo accounts on trading platforms for users to test strategies risk-free. Head to the broker’s website and follow the registration instructions.

How many indicators are offered by Trade Pro Futures?

Trade Pro Futures trading platforms offer a vast array of indicators. Multicharts, for example, provides 300+ built-in indicators.

What are the minimum deposit requirements for a Trade Pro Futures account?

The minimum deposit to open a forex trading account with Trade Pro Futures is $2,500 while to open a futures investing account you’ll need $5,000.

What currencies does Trade Pro Futures accept?

Trade Pro Futures accepts deposits in GBP, EUR, USD, JPY, AUD and NZD.

Is Trade Pro Futures regulated?

Yes, Trade Pro Futures is authorised under the National Futures Association (NFA) designated by the Commodity Futures Trading Commission (CFTC).

Customer Reviews

There are no customer reviews of Trade Pro Futures yet, will you be the first to help fellow traders decide if they should trade with Trade Pro Futures or not?