TP Global FX Review 2024

- Daytrading Review TeamTP Global FX will suit forex traders who value true STP pricing, good educational resources and copy trading.

TP Global FX is an offshore broker with a strong focus on education and technical analysis tools. It offers STP pricing and up to 1:500 leverage on 50+ forex pairs and a smaller range of stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers additional services including copy trading and an informative daily blog.

Forex Trading

TP Global FX offers trading on 50+ forex pairs with a good selection of minors and exotics as well as the majors. The broker offers fast 30ms execution speeds with a Straight-Through Processing system. Very tight spreads starting from 0.2 are available on pro accounts, while standard commission-free account spreads start from 1.2.

Stock Trading

TP Global FX offers trading on leading indices such as the Dow Jones, alongside major company shares such Tesla and Facebook. Spreads are also impressive and start from 0.2 points.

CFD Trading

TP Global FX clients can trade CFDs on forex as well as around 12 stocks, 12 indices, five cryptocurrencies and commodities including gold, silver oil and gas. CFDs trade with up to 1:500 leverage on the hugely popular and reliable MT4 and MT5 platforms.

Crypto Trading

TP Global FX offers CFDs on five cryptocurrencies paired with USD. Spreads are lower than many alternatives and users can trade crypto 24/7 without interruption.

Copy Trading

Follow and copy multiple professional traders using performance analytics and market signals at TP Global FX.

Awards

- Most Transparent Broker 2021 - Forex Broker Awards

- Best FX Educational Broker 2021 - Forex Broker Awards

- Best Affiliate Program 2021 - Forex Broker Awards

✓ Pros

- Good range of frequently updated educational resources

- Demo profile with unlimited simulated funds

- Very tight spreads from 0.2

- Support for MT4 and MT5

- Copy trading service

- Accepts crypto deposits

- ~30ms execution speeds

- High leverage available

- True STP pricing

✗ Cons

- Limited consumer protections in place including negative balance protection

- High commissions of $15/$8 for the low-spread accounts

- Not overseen by any top-tier regulators

- Narrow choice of deposit options

- Small range of non-forex assets

TP Global FX is a forex and CFD brokerage that focuses on providing transparency and innovative trading features. The broker has a lot to offer, with over 200 instruments, STP pricing (spreads from 0.2 pips) and a wealth of educational resources. Our 2024 review will assess the online trading provider, helping you decide whether to open a TP Global FX account.

Company Details

TP Global FX was founded in 2016, launching brokerage services the following year. The multi-asset broker offers trading opportunities on forex, indices, commodities, cryptocurrencies and more.

The mission of the company is to revolutionize the forex market with innovative investment technology and top-tier education. The brokerage also offers a bespoke copy trading service.

TP Global FX operates via three global entities with offshore regulation from the VFSC (Vanuatu), CAMA (Nigeria) and the SVGFSA (St Vincent & the Grenadines). Full details can be found in the regulatory section below.

Head office locations span the world, including Dubai, Cyprus, Mauritius, Armenia, Nigeria and Vanuatu.

Trading Platforms

TP Global FX offers two trading platforms; MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Both MT4 and MT5 are available to download to Windows and Mac devices, though they can also be used as a web-based profile. Useful download links are available on the broker’s website.

MetaTrader 4

The MT4 cabinet is suitable for traders of all skill levels. It is the platform of choice for most brokers, with millions of traders using the online trading software. The terminal offers:

- 3 execution modes

- 23 analytical objects

- 4 pending order types

- 30 technical indicators

- Access to full trading history

- Customizable charting features

- 9 time-frames, from one minute to a month

- Access to Expert Advisors (EAs) for automated trading systems

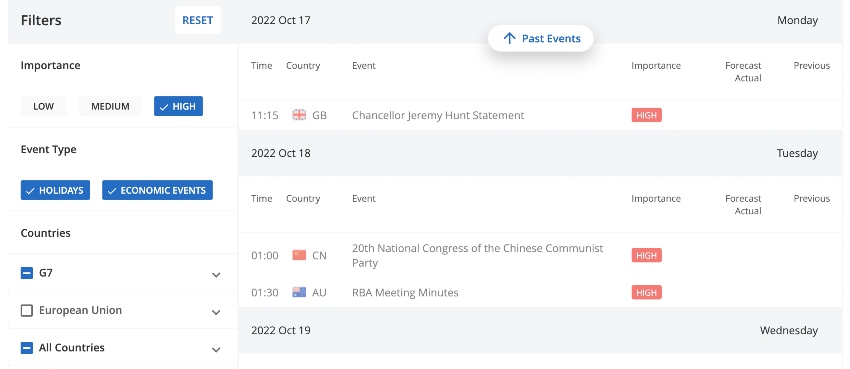

MT5

MT5 is a comprehensive multi-asset trading platform, aimed at skilled traders. Offering more advanced trading tools than its predecessor, it is a powerful online investing solution. The platform offers:

- 21 timeframes

- Depth of market data

- Integrated economic calendar

- MQL5 programming language

- 80 built-in technical indicators

- 2,500+ algorithmic trading applications

- Additional pending orders and execution types

- Direct access to Expert Advisors (EAs) for automated trading systems

Note, a proprietary web terminal has also been developed by TP Global FX, though this is available to financial institutions only rather than individual investors.

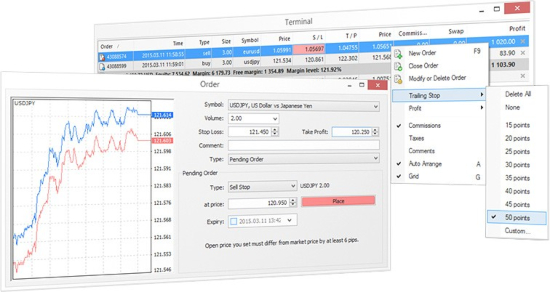

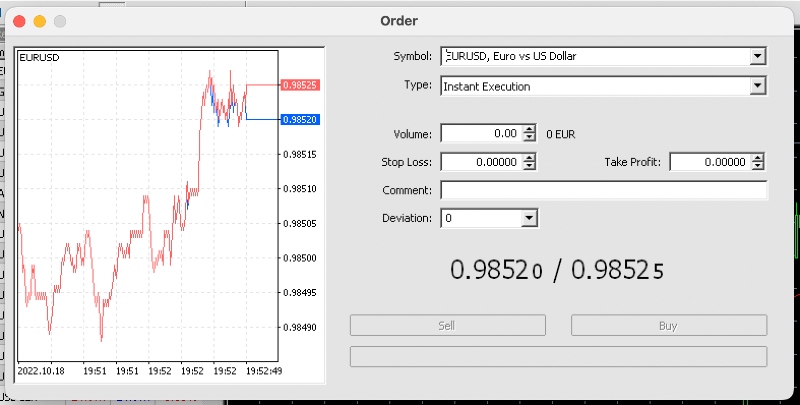

How To Place A Trade

- Register for a TP Global FX live account

- Once verified, make an initial deposit

- Download the MT4 or MT5 software or open the web terminal

- Login with your registered credentials

- Select an asset using the navigation search bar

- Select the white page icon/add order button to the right of new asset

- Enter your trade parameters including trade size, execution mode, plus stop loss or take profit level

- Select sell or buy to confirm the trade

Note, TP Global FX provides straight-through-processing (STP) forex execution. The trading environment allows investors to place their orders directly into the marketplace, taking advantage of multiple tier 1 liquidity providers.

Assets & Markets

TP Global FX offers 200+ global instruments:

- Indices – Trade on 12 of the world’s largest stock indices including the Dow Jones, NASDAQ and DAX

- Stocks – Trade 12+ global company stocks including major players Apple, Amazon, Tesla and Facebook

- Forex – Speculate on 50+ major and minor currency pairs including USD/EUR, GBP/USD and EUR/JPY

- Commodities – Spot trade 3 precious metals including gold and silver, and invest via CFDs on hard and soft commodities including crude oil and gas

- Cryptocurrency – Establish cryptocurrency positions across 5 popular digital currency coins paired with USD including Bitcoin, Litecoin and Ethereum

Live quotes can be found on the TP Global FX website.

Spreads & Fees

Trading fees vary depending on account type and instrument. Spreads at TP Global FX are tight for Pro Account and Institutional Account customers, though the Standard Account spreads are not as competitive. That said, commission charges are also typically higher than the industry norm.

- Standard Account – No brokerage commissions. Spreads from 1.2 pips

- Pro Account – Tight spreads from 0.2 pips. A high commission fee of $15 per lot

- Institutional Account – Tight spreads from 0.2 pips. Commission charge of $8 per lot

Leverage Review

As a broker regulated outside the EU, TP Global FX offers substantial margin trading opportunities due to the limited regulatory restrictions. The maximum leverage available across all account types is 1:500, though this can be manually reduced when registering for a new profile. The stop-out level is 40%.

Note, high leverage can mean huge profits but equally could lead to great losses.

Mobile App

TP Global FX utilizes the MT4 and MT5 platforms which both support mobile devices. The mobile apps are fully featured and easy to navigate. Access 24/5 customer support, including a live chat function, which is readily available to assist with technical issues.

From the MetaTrader mobile applications, you can also manage your account, open and close positions, check live global pricing and view charts while on the go. In addition, TP Global FX mobile traders can make deposits and withdrawals, claim promos and access the full range of instruments.

Note, there are a wealth of tutorials on the MetaQuotes mobile applications online.

Payment Methods

TP Global FX offers a limited choice of deposit options:

- Tether

- Bitcoin

- FairPay

- Bank transfer

The broker does not apply a deposit fee for any payment methods, although third-party charges may apply. Minimum deposit values vary by account type, the lowest being $50 with the Standard profile.

Bank transfers typically take between 3-5 working days for funds to clear. Cryptocurrency payments are blockchain-dependant, therefore the time taken for funds to clear to your trading account may vary.

Withdrawals submitted before 10 AM will be processed by the broker on the same working day. Minimum limits apply for bank wire transfers, with fees applicable for withdrawal requests of less than $1000.

Demo Account

TP Global FX offers an MT4 or MT5 demo account. The paper trading profiles integrate real-time market conditions enabling clients to practice trading safely. Leverage is flexible and individuals can benefit from unlimited virtual funds. When we used TP Global FX’s demo account, we were able to learn platform features and test tools in a risk-free setting.

A short registration form needs to be completed online before you can start trading. You can switch between a live/demo profile within your client portal dashboard.

Deals & Promotions

There were no deposit bonuses available at TP Global FX at the time of this review. However, the broker was running a ‘trader of the week’ contest, with exclusive prizes available based on trading profits. This included financial rewards up to $500.

Always check the terms and conditions of financial incentives before signing up.

Keep an eye on the broker’s website for upcoming deals.

Regulation & Licensing

TP Global FX is a unified brand name of TP Global Services Limited which encompasses the following entities;

- TP GLOBAL FX – regulated by the VFSC (Vanuatu) with registration number 40409

- TP Global FX Africa Limited – registered in the Federal Republic of Nigeria, operating under the Companies and Allied Matters Act 1990

- TP Global Services Limited – incorporated in St. Vincent & The Grenadines and registered as an International Business Company under the license number 25274 BC 2019

Note, these regulatory bodies are not strong financial authorities and offer limited oversight. There isn’t currently any client account segregation or negative balance protection in place, raising questions about how trustworthy the broker is,

The broker is legally able to operate in many countries worldwide and is accessible to traders in India, the UK, and Cyprus, among others.

TP Global FX Additional Features

Education is at the core of the TP Global FX philosophy: Educate, Execute, Earn. The website features a blog page that is home to daily technical analysis reports and regular market news. An economic calendar and forex calculator are both available, aiding forex trading. Webinars, educational videos and online mentors are also due to launch soon on the TP Global FX website. In addition, the broker has teamed up with Trading Central to provide expert market insights and analysis tools.

Our experts also came across a bespoke TP Global FX education app to learn how to trade on different financial instruments. When using the application, you can access a briefing on major currency pairs through fundamental analysis and a summary of the latest financial news.

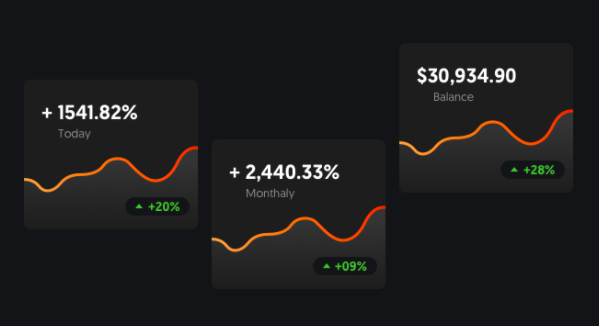

Copy Trading

TP Global FX clients can access a copy trading service. This feature is available via an Android (APK) compatible mobile app or can be integrated into the MetaTrader platforms.

Traders can analyze and follow professional investors via their published performance statistics and risk appetite. Copy trading can be an effective way to diversify a portfolio, without needing extensive market knowledge. But remember, profits are not guaranteed and past successes are not necessarily a true indication of future results.

Account Types

TP Global FX offers three live trading accounts. Packages are tailored to suit different types of traders depending on investment goals, previous experience and risk appetite. All accounts feature fast executions, leverage up to 1:500, 100% margin calls, and access to all instruments.

Standard Account

- Ideal for beginners

- Zero commissions

- Spreads from 1.2 pips

- Minimum deposit $200

Pro Account

- Ideal for intermediate traders

- Spreads from 0.2 pips

- Minimum deposit $500

- Commission fee of $15 per lot

Institutional Account

- For advanced traders

- Spreads from 0.2 pips

- Minimum deposit $25,000

- Commission fee of $8 per lot

Note, swap free/Islamic accounts are available.

How To Get Started

When we registered for a new account with TP Global FX, it took just a few minutes to sign up.

A simple online registration form must be completed, including providing KYC-compatible documents. This can be found via the ‘register’ logo at the top right of each webpage.

Once your account is verified, you can deposit to your live trading profile and start investing.

TP Global FX Trading Hours

TP Global FX’s trading hours will vary by instrument. The forex market is available to trade 24 hours per day between Sunday to Friday, following the financial markets from Sydney to Tokyo, London and then to New York. Cryptocurrency, on the other hand, can be traded 24 hours per day, 365 days a year.

You can monitor published session timetables via the broker’s terminal interface.

Customer Support

The customer support team is available 24/5 via email, telephone, live chat or via a support message on the website:

- Chat – live chat icon

- Telephone – +44 7441 416320

- Email – support@tpglobalfx.com

- Online Contact Form – found on the ‘contact us’ webpage

Office addresses:

- 1810, 1811, Prime Tower, Business Bay, Dubai, UAE

- 45, Labaiwa road, Oke-aregba Abeokuta Ogun State Nigeria

Security & Safety

Our experts found no evidence of personal data safeguarding and segregated client funds. Nonetheless, the MetaQuotes platforms use industry-standard security protocols. This includes two-factor authentication (2FA) and one-time passwords (OTPs) that can be added to all client accounts.

TP Global FX Verdict

TP Global FX is still a relatively new broker with a strong ethos centered around education and technological innovation. When we used the services offered by the online brokerage, we were pleased with the various account profiles and STP execution model. However, there are some drawbacks, the main being the absence of top-tier regulatory oversight. The narrow product range and limited account protections also raise some doubts.

FAQs

What Leverage Can Be Applied To TP Global FX Accounts?

The maximum leverage available to TP Global FX clients is 1:500. Be cautious when trading with such a high margin as losses can quickly add up.

How Much Capital Do I Need To Trade With TP Global FX?

The minimum deposit to open an account at TP Global FX is $200 (Standard Account). This makes it accessible for beginners.

What Are The Minimum Trading Volumes At TP Global FX?

The minimum trade size is 1 micro lot, or 0.01 of a lot, equating to 1,000 CCY.

When Do The Markets Open At TP Global FX?

TP Global FX is open for trading during standard market hours, 24/5. See the broker’s website for a breakdown of opening hours by instrument.

Do I Have To Provide Any Documents To TP Global FX To Open An Account?

To open a live account with TP Global FX, identification documents and proof of address are required. These can be emailed or uploaded to the broker’s client portal. Document checks take place within 24 hours of receipt.

Top 3 Alternatives to TP Global FX

Compare TP Global FX with the top 3 similar brokers that accept traders from your location.

-

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

Vantage – Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Go to Vantage

TP Global FX Comparison Table

| TP Global FX | AvaTrade | FP Markets | Vantage | |

|---|---|---|---|---|

| Rating | 3.9 | 4.9 | 4 | 4.7 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | – | $100 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | SVGFSA, VFSC, CAMA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | ASIC, CySEC, ESMA | FCA, ASIC, FSCA, VFSC |

| Bonus | Seasonal Bonuses | – | – | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Leverage | 1:500 | 1:30 (Retail) 1:400 (Pro) | 1:30 (UK), 1:500 (Global) | 1:500 |

| Payment Methods | 2 | 13 | 9 | 12 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | AvaTrade Review |

FP Markets Review |

Vantage Review |

Compare Trading Instruments

Compare the markets and instruments offered by TP Global FX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TP Global FX | AvaTrade | FP Markets | Vantage | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

TP Global FX vs Other Brokers

Compare TP Global FX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of TP Global FX yet, will you be the first to help fellow traders decide if they should trade with TP Global FX or not?