SynergyFX Review 2024

SynergyFX is an Australian broker offering ECN accounts & the MetaTrader platforms.

Forex Trading

Trade forex with competitive spreads.

Stock Trading

Trade shares in household names.

CFD Trading

Trade across several financial markets with up to 1:400 leverage.

Awards

- Best Forex Broker 2018 - International Business Summit Malaysia

- Australian Best Forex Broker 2015 - Global Financial Market Review

- Best Currency Management Fund 2015 - GFMR

SynergyFX is an Australian forex broker, offering ECN accounts on the downloadable MT4 and MT5 trading platforms. If you’re deciding whether to register and login to SynergyFX, take a look at this review for the pros and cons.

SynergyFX Details

Founded in 2011, SynergyFX is an Australian provider of forex and derivative products. In 2018, the company merged with the ACY Capital Group to provide a high-quality trading experience with low commissions.

The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

Trading Platforms

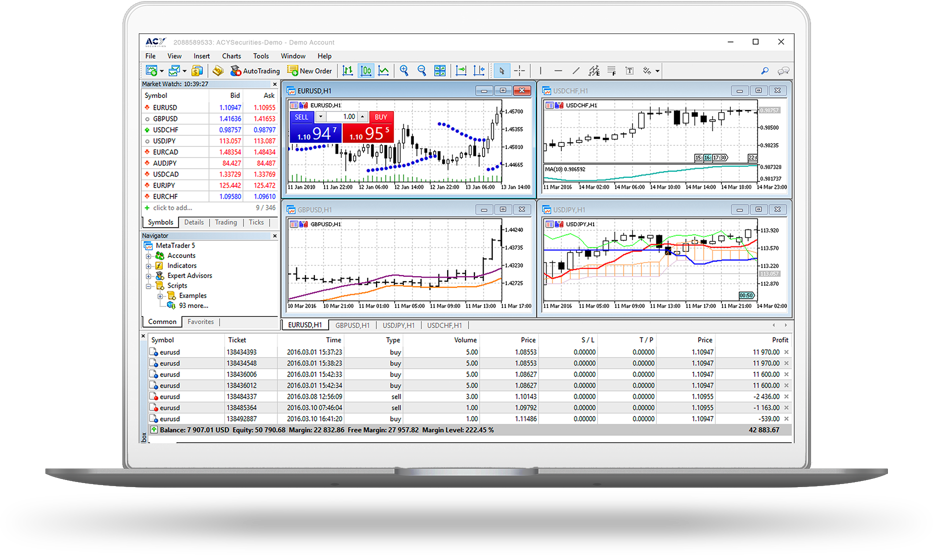

MetaTrader 4

SynergyFX offers MT4 to active traders. With access to forex, indices, and commodities, the platform offers a customisable dashboard and fast execution speeds. Traders also get access to instant live quotes, 40 technical indicators, and several time frames. The platform is also a good option for those looking to build and use automated trading robots.

Windows users can download MT4 from the broker’s website after registering for an account.

MetaTrader 5

MT5 offers more advanced order options, hedging abilities, 21 timeframes, and Level II market depth. As a result, the platform offers a faster and more powerful experience than its predecessor. MT5 works with Windows PCs and can be downloaded once an account has been created.

MetaTrader WebTrader

SynergyFX also offers the web-based versions of both the MT4 and MT5 platforms – ideal for MacOS users, or those who don’t want to download any applications. The WebTrader solution offers seamless trading with just as much power and speed as the desktop platforms, plus all the technical and analysis features.

SynergyFX Markets

SynergyFX offers a wide range of assets, including 40+ currencies, 10+ commodities and precious metals, 20 global indices, and over 600 of the world’s largest share CFDs. You can also now trade Chinese offshore Yuan (CNH) on the MT4 platform.

Trading Fees

Spreads at SynergyFX are competitive, with major FX pairs around 0.8 pips with the stpECN account and 0.2 pips with the zeroECN account. Major indices such as the FTSE 100 are around 1.4 pips, and crude oil is around 0.030 with stpECN pricing.

There are no commission charges with the stpECN account, but you can expect $6 and $5 per lot charges with the zeroECN and pureECN accounts respectively.

SynergyFX Leverage

Leverage is available up to a maximum of 1:500 across all accounts. Details of margin requirements are provided in the broker’s terms and conditions, or from within the client portal.

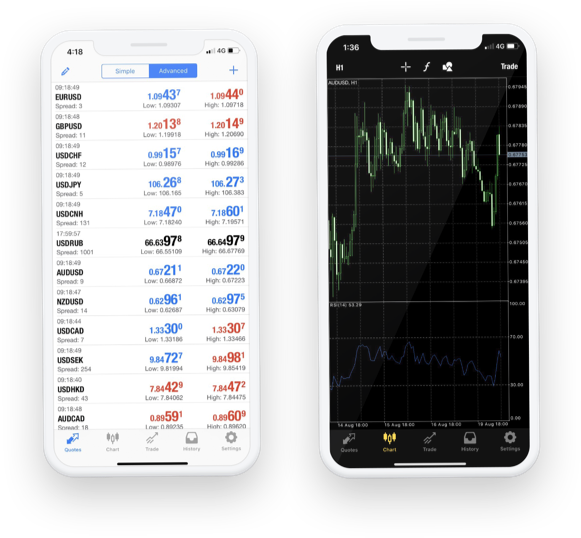

Mobile Apps

Both MT4 and MT5 are available for mobiles or tablets, via the App Store or Google Play store. Traders can access ultra-tight spreads 24 hours a day from their smart devices, with access to advanced charting functions, live pricing data, and full trading history. Traders can also set mobile alerts to stay on top of their orders whilst on the go.

Payment Methods

Deposits

Account funding is available via bank wire transfer (local and international), credit/debit cards, Skrill, Doku Wallet, China Union Pay, and other e-wallets. SynergyFX does not charge for funding by bank transfer, though international payments may incur a bank fee. Received and cleared funds for bank transfers may take 2 – 3 business days.

Withdrawals

The same options are available for withdrawals, however, you can only withdraw via bank wire if you originally deposited by credit card. There is a $25 service charge per withdrawal for international bank transfers and a 3% merchant fee for payments via Skrill. Australian local bank transfers are free three times per month, after which there is a $25 charge per additional withdrawal. In most cases, withdrawals are processed in 1 – 2 business days.

Demo Account

A demo account is available in 17 different languages and can be opened within minutes. Demo accounts are helpful for beginners who wish to try out the trading platforms before signing up for a live account. With a default virtual account balance of $50,000, SynergyFX users can place demo trades free from financial risk for 30 days.

Bonuses & Promos

SynergyFX offers a $2.28 billion Spin and Win draw, with premium prizes up for grabs each month including sports cars, holidays, gadgets, and cash prizes. Note that you need to deposit $2,000 to your account in order to qualify.

There’s also a 2020 Trading Cup competition with thousands of dollars to win per prize. Again, you will need to deposit $2,000 to be eligible for the contest.

Regulation

ACY Securities Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) under license number 403863. ACY Capital Australia Limited is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 012868. SynergyFX is the brand name of ACY Securities.

Client funds are held in segregated accounts at AAA-rated banks: Commonwealth Bank Australia and HSBC. Note that the broker doesn’t provide negative balance protection, but the company’s reputation and regulatory licenses do provide a good level of safety nonetheless.

Additional Features

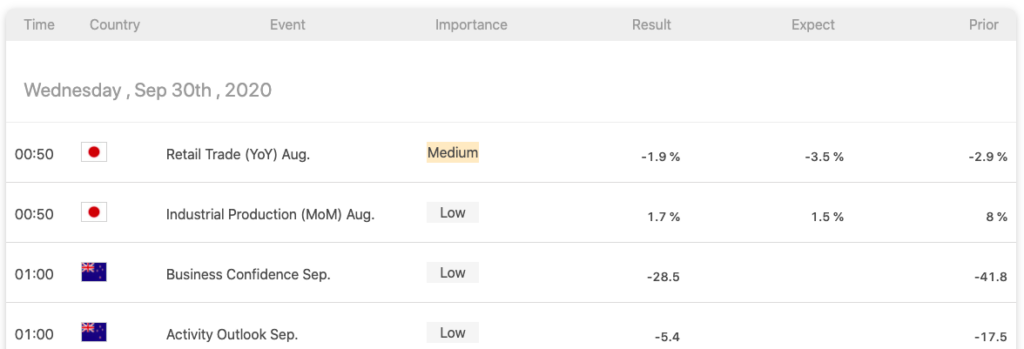

New and experienced traders can benefit from the resources and educational content on offer, which includes market analysis courses and webinars, a free trading e-book, forex articles, a news blog, and an economic calendar.

Though there is nothing particularly unique, the educational offering is sufficient for beginners. To compete with other brokers, SynergyFX could include forex calculators and other trading tools.

SynergyFX Accounts

Depending on your trading style, there are three main accounts on offer at SynergyFX, in 7 different currencies: stpECN, zeroECN, and pureECN. All accounts require a minimum trading volume of 0.01 lots.

stpECN

The stpECN account offers competitive market pricing, with no commissions and a minimum deposit of $50. Swap-free trading is also available with this account.

zeroECN

The ZeroECN account offers direct access to tier-1 liquidity providers for tighter spreads, commissions from $6 per round turn lot, and a minimum deposit of $2,000. The minimum deposit thereafter is $100.

pureECN

The pureECN account also offers direct access to tier-1 liquidity, with tight spreads, commissions from $5 per round turn lot, and an initial minimum deposit of $20,000. The minimum deposit thereafter is $100.

Traders can also get exclusive access to hundreds of share CFDs via the commission-based MT5 Xchange account.

Benefits

There’s an impressive offering at SynergyFX, with competitive features including:

- Tight ECN spreads across all accounts

- Commission-free trading

- Prizes and competitions

- MT4 & MT5 platforms

- ASIC-regulated

Drawbacks

Improvements could be made in the following areas:

- Cryptocurrencies not offered

- US clients not accepted

Trading Hours

Trading hours for currency pairs are 00:00 – 24:00 GMT+2 / GMT+3 (DST) Monday to Friday. Server times for indices and commodities vary depending on the market and are provided in the product specifications page on the website.

Customer Support

SynergyFX have multilingual support offices based in Sydney, Taiwan, China, and Malaysia, which provide assistance 24/5 via:

- Email – support@acy.com

- Online contact form – Contact us page

- Live chat – responses received within 2 minutes when tested

- Telephone – +61 2 9188 2999 (international) / +02 5594 4927 (Taiwan)

Security

SynergyFX keeps to industry-standard security measures to safeguard data between servers. Platforms are secured with 128-bit encryption systems and transactions are safely carried out within the client portal, CloudHub.

SynergyFX Verdict

SynergyFX’s core offering includes tight ECN spreads on forex, indices, and commodities. The Australian broker also provides some additional education and the MT4 and MT5 platforms, suitable for those with limited experience as well as those using advanced trading strategies.

Top 3 Alternatives to SynergyFX

Compare SynergyFX with the top 3 similar brokers that accept traders from your location.

-

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

Admiral Markets – Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

Go to Admiral Markets -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade

SynergyFX Comparison Table

| SynergyFX | FP Markets | Admiral Markets | AvaTrade | |

|---|---|---|---|---|

| Rating | 2.5 | 4 | 3.5 | 4.9 |

| Markets | Forex, CFDs, indices, shares, commodities | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $100 | $100 | – |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC, VFSC | ASIC, CySEC, ESMA | FCA, CySEC, ASIC, JSC | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | Spin & Win Draw | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | MT4, MT5, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 (EU), 1:500 (Global) | 1:30 (Retail) 1:400 (Pro) |

| Payment Methods | 7 | 9 | 11 | 13 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | FP Markets Review |

Admiral Markets Review |

AvaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by SynergyFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SynergyFX | FP Markets | Admiral Markets | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

SynergyFX vs Other Brokers

Compare SynergyFX with any other broker by selecting the other broker below.

FAQ

Where is SynergyFX based?

The broker’s global head office is at Level 18, ACY Tower, 799 Pacific Hwy, Chatswood, NSW 2067, Australia.

Who owns SynergyFX?

SynergyFX is owned by ACY Securities, a private limited company that is not listed on a stock exchange. The owners and management team have over 10 years of experience working in the financial markets.

Does SynergyFX accept UK clients?

Yes, this broker accepts clients from the United Kingdom.

Does MetaTrader 4 have trailing stop orders?

Yes, you can set trailing stop orders in MT4, along with a number of other stops and limits.

How do I open a SynergyFX account?

You will need to fill in a short form to apply for an account. SynergyFX will then email you a link to download the trading platform, along with your login details.

Customer Reviews

There are no customer reviews of SynergyFX yet, will you be the first to help fellow traders decide if they should trade with SynergyFX or not?