Spread Betting Demo Accounts

Many online brokerages offer new investors a demonstration, or ‘demo’, account to trial both their software service, and to allow you the investor to test and train your trading prowess. Here we look at why this is good practice, and provide a list of the best spread betting demo accounts.

Spread betting is an efficient way of taking a position, making a bet on a wide variety of assets, such as shares, indices, commodities, forex, composite funds.

It is efficient because, firstly, as you are not buying and selling the asset you can usually avoid the tax triggered by acquisition and disposal of assets (i.e., Stamp Duty and Capital Gains Tax). Read more about tax implications here.

Secondly, it is an efficient use of funds because you don’t have to buy the underlying asset (share, currency, and so on) thus your money can be used to cover bigger bets – this is called leverage.

Spread Betting Demo Accounts

#1 - AvaTrade

Why We Chose AvaTrade

AvaTrade continues to offer spread betting for UK traders via the MT5 platform, with zero tax on profits. There are no extra currency conversion fees on any asset and leverage is available up to 1:30. You can also practice in the free demo account.

"AvaTrade offers the full package for short-term traders. There is powerful charting software, reliable execution, transparent fees, and fast account opening with a low minimum deposit."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting

- Regulator: ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM

- Platforms: WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail) 1:400 (Pro)

About AvaTrade

AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Pros

- The broker’s unique risk management tool, AvaProtect, protects against losses up to $1 million and is easy to activate in the platform

- WebTrader is well-suited to beginners and features a strong suite of technical analysis tools and market research for day traders

- The broker offers reliable 24/5 multilingual customer support with fast response times during testing

Cons

- It’s a shame that there are no rebate schemes for serious traders looking for additional perks - CMC Markets would be a better choice here

- A high $2000 minimum investment is required to use DupliTrade, which will be out of reach for many beginners

- Traders from the US are not accepted

#2 - Pepperstone

Why We Chose Pepperstone

Pepperstone extends financial spread betting services to both retail and professional traders, enabling you to speculate on forex, indices, shares, and more. Additionally, Pepperstone offers comprehensive training resources if you are new to spread betting, helping to facilitate your journey into this tax-efficient form of trading. Pepperstone also now offers spread betting on TradingView, making it one of a handful of brokers that provide this service.

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

- DayTrading Review Team

- Instruments: CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting

- Regulator: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB

- Platforms: MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail), 1:500 (Pro)

About Pepperstone

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates of 25%+ through the Active Trader program.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

#3 - CityIndex

Why We Chose CityIndex

Spread bet on thousands of global markets with no commissions and tight, fixed spreads.

"City Index is best for new and intermediate traders looking for a wide selection of assets on user-friendly platforms."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Cryptos, Options, Commodities, Bonds

- Regulator: ASIC, FCA, MAS

- Platforms: MT4, TradingView, TradingCentral

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail), 1:50 (Accredited Investor), 1:200 (Sophisticated Investor), 1:300 (Wholesale Investor), 1:400 (Professional Trader). Varies with jurisdiction.

About CityIndex

City Index is an established and award-winning forex, CFD and spread betting broker with top-tier global regulation, including in the UK (FCA) and Australia (ASIC). With 30+ years in the industry, 13,500+ instruments and 24/5 customer support, City Index is a solid pick for aspiring traders.

Pros

- Extended hours trading on 70+ popular shares including Amazon and Tesla

- Excellent reputation with over 1 million account holders and tier-one regulatory oversight

- Tight spreads from 0.5 pips on EUR/USD and competitive commissions on CFD shares

Cons

- US traders not accepted

- Cryptocurrency trading not available in all locations

- $15 monthly inactivity fee

#4 - Spreadex

Why We Chose Spreadex

Trade on thousands of financial markets with a bet size from £0.01 and the best margin rates in the industry. Spread bets are tax free in the UK, and Spreadex traders can access the markets via three slick proprietary trading platforms.

"Spreadex will appeal to UK day traders who are interested in both spread betting on financial markets and placing traditional bets on sports events. Fees are low on short trades and profits are tax-free on spread bets. There's also a powerful proprietary charting platform, plus £0 minimum deposit required to get started. "

- DayTrading Review Team

- Instruments: Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting

- Regulator: FCA

- Platforms: Spreadex Platform, TradingView

- Minimum Deposit: £0

- Minimum Trade: £0.01

- Leverage: 1:30

About Spreadex

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

Pros

- The broker offers an easy-to-use proprietary charting platform and mobile app

- There's a good selection of signals, analysis tools and risk management tools, including guaranteed stops

- Spreadex gives UK traders the opportunity to make tax-free profits through spread betting

Cons

- The proprietary terminal lacks comprehensive charting features of platforms like MT4 and MT5

- The lack of a demo account will frustrate prospective clients who want to test Spreadex's services

- No third-party e-wallets are accepted

#5 - Trade Nation

Why We Chose Trade Nation

Trade Nation offers competitive spread betting conditions and transparent fees on hundreds of assets. On the proprietary platform, spread betters also enjoy a user-friendly and customisable interface.

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

- DayTrading Review Team

- Instruments: Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Cryptos (Bahamas Entity Only)

- Regulator: FCA, ASIC, FSCA, SCB, FSA

- Platforms: MT4

- Minimum Deposit: $0

- Minimum Trade: 0.1 Lots

- Leverage: 1:500 (entity dependent)

About Trade Nation

Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

Pros

- The trading firm offers tight spreads and a transparent pricing schedule

- Full range of investments via leveraged CFDs for long and short opportunities

- Multiple account currencies are accepted for global traders

Cons

- Fewer legal protections with offshore entity

The spread in spread betting means the difference between the broker’s buy and sell price, there is no commission to pay on a spread bet as the broker’s costs are built into the spread.

In order to understand how anyone thinking of entering this market can benefit from the best spread betting demo accounts, we need to look at leverage as it is the supercharger in the trading process, it magnifies your gains but also your losses.

Leverage And Risk

Leverage means that you only need to front up a small percentage of the asset value to take a position. The amount you put up is your equity (or margin).

While this gives you more bang for your buck it also exposes you to greater risk, as a few points change in the price of the underlying asset can wipe out your stake.

For example, if you have £1,000 on your account and maximum leverage granted by the broker/platform of 10:1 then you can take a position with an asset value of up to £10,000.

If the price moves against your bet your margin could be wiped out, however, brokers will offer a stop-loss limit, so that your position is closed at a pre-set level if the market moves against you.

Practise

We can see that leverage increases the size of the bet you can make, and thus the amount of profit, but it also increases your risk.

Most spread betting platforms are duty bound to report that between 65% and 75% of retail investors (out of an estimated total of 100,000 UK traders) lost money on spread betting.

Spread Betting Demo Accounts

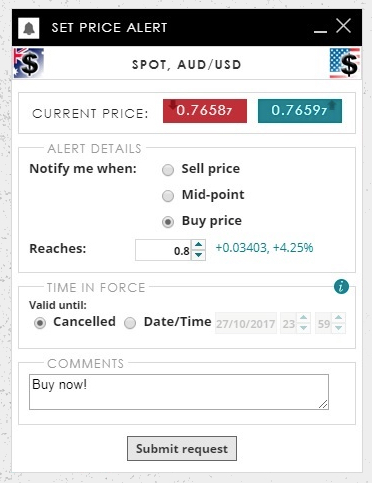

In practice, it is tricky to track price changes and calls upon your margin, so it is vital to be familiar with the tools offered by the different brokers, how these are presented, their sensitivity, and how they work together.

The demo account should exactly imitate the live spread betting platform. This is crucial not only in order to familiarise yourself with a particular platform but also in helping you select the platform which best suits you. You are training in the demo, and like anything, practice will make perfect.

The best spread betting demo accounts are the ones that give you the information and tools to help you to make fast decisions and execute them in a simple and clear way.

Charts

Typically, the brokers will use a Candlestick chart to show price movements over the time period you select. Each day’s prices are represented by an icon that looks like a candle with a wick at both ends (appropriate for day traders).

The candle part represents the price movement during exchange trading hours, the wicks track any up or down price movement in after-hours trading. This chart is usually the central part of the screen and takes up the largest area.

The key tools are the size, stop, and limit settings that you can use to govern the position which you decide to take.

‘Size’ is simply the amount you want to trade; the ‘stop’ is your limit on losses for that trade, and the ‘limit’ setting enables you to set when you want to take your profits.

Data, Market Sentiment, Discussion Groups

All of these sources of information play a part in influencing Wall Street and City professionals, so a good spread betting demo account will have a Twitter feed somewhere on your dashboard.

Bloomberg, Reuters, CNBC, AP and a few mavericks will often feature. You will have to research outside the demo when you have a particular asset focus. There are many sources of good and not so good data, and no-one knows what will actually happen.

Learn

The most useful exercise a potential spread betting investor can undertake is to play in a demo account to test spread betting skill and stamina.

Taking a position is different from reading a headline and thinking, for example, gold might rise or fall over the next week.

You have to risk your virtual money. Going through the process of typing in the amount and then pressing the ‘place deal’ button gives your choices an intense focus. Whether it is a demo or not you, and your skin, are in the game.

Trading Psychology

Most spread betting will come from the gut and depend on your nerve. A demo account used properly gives you an edge over your competition.

Using the best spread betting demo accounts means you are able to test the amount you want to invest in assets as any losses you incur will only be of the virtual money the platform allocates to you when you open the account.

You will learn the best times to trade which assets. You will see which types of announcement affects asset prices and how. All of these are useful but the crucial benefit a spread betting demo account gives you is an arena in which to test your nerve.

Very quickly a user becomes possessive over even their virtual funds, we don’t want to lose so we pay close attention. We will be bruised, beaten, and disheartened at times, and this will help us reach that top quartile of all spread betting investors – the ones who make money.