SmartFX Review 2024

- Daytrading Review TeamBased on my time using the platform, I think SmartFX is a good choice for new traders looking for multi-asset trading opportunities on the MT5 terminal. However, the offshore VFSC regulation doesn't fill me with confidence and I don't appreciate the lack of transparency on the website.

SmartFX is an offshore regulated CFD and forex broker with MT5 integration and 5000+ instruments. The brand offers 24/5 customer support and one account type for simplicity. SmartFX is regulated by the Vanuatu Financial Services Commission (VFSC).

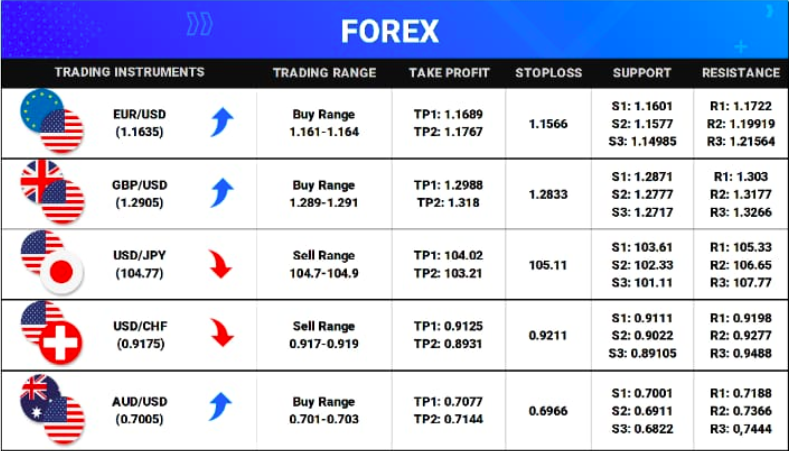

Forex Trading

I found an average range of 45+ major, minor and exotic currency pairs at SmartFX, tradable on the MT5 platform. I did appreciate the flexible leverage up to 1:400 and minimum order sizes from 0.01 lots.

Stock Trading

I was impressed with the 1,600+ EU and US share CFDs from leading companies including Adidas, Amazon, Facebook and Google. You can benefit from real-time pricing on the terminal, as well as MQL5 programming for algo traders.

CFD Trading

I think the 5000+ CFD instruments including forex, commodities, indices and stocks should serve active traders well. The MT5 platform also offers plenty of advanced tools and features to facilitate complex CFD trading strategies.

✓ Pros

- I'm pleased to see the world-renowned MetaTrader 5 terminal available, with all integrated tools including the MQL5 development environment, signals and a forex VPS

- There's 24/5 multilingual customer support available via live chat, telephone and email, making it easy for clients to reach the broker during peak times

- I found commission-free deposits and withdrawals on offer with instant processing times for some account funding methods

- I like that beginners can access copy trading opportunities via the Social Trading network

✗ Cons

- I'm concerned about the general lack of transparency on the website which makes me question how much trust I can put in this broker

- The offshore regulatory oversight by the Vanuatu Financial Services Commission (VFSC) raises serious security concerns for me

- There's barely any additional tools and resources available, and the educational content is weak compared to top brands

- I wasn't able to access any cryptocurrency trading opportunities, which is a drawback compared to similar brands

SmartFX is an online broker offering several trading options including currency pairs, commodities and stocks. The broker offers a simple trading solution with one account and a single trading platform. Our review details the login process, account types and trading hours. Read on to find out if becoming a SmartFX trader is the right choice for you.

Company Overview

SmartFX has offices in Dubai and Vanuatu and is operated by Smart Securities and Commodities Limited. The company is regulated by the Vanuatu Financial Services Commissions (VFSC) and looks to separate itself through its straightforward trading proposition with its real-money Smart account and the MetaTrader 5 platform.

Note the company has no affiliation with EA SmartFX ultimate scalper or associated products.

MetaTrader 5 Platform

SmartFX.com offers the latest trading technology through the MetaTrader 5 (MT5) platform. The platform is available for download via the broker’s website or mobile. The latest model of the popular MT4 system, the terminal is a powerful all-in-one trading solution with an array of useful features:

- 21 timeframes

- Trading signals

- Built-in forex VPS

- Netting & hedging

- Market event alerts

- MetaTrader Market

- 80 built-in analysis tools

Products

SmartFX offers forex and CFD trading options, from major, minor and exotic currency pairs to popular commodities like oil and gas. Clients can also buy and sell in indices from major countries, plus stocks and shares in leading online companies. Whilst not the most extensive array of trading instruments, our review was satisfied that the needs of most traders will be met.

Spreads & Commission

SmartFX isn’t transparent regarding specific instrument spreads, however, the broker claims that its floating spreads are competitive. The lack of information surrounding trading fees is a concern. Providers operating scams often aren’t clear when it comes to fees so this is a red flag.

Leverage Review

SmartFX offers maximum trading leverage of 1:400. Details regarding different instrument leverage rates are available once the trader’s smart account has been approved or via the demo account. Whilst leverage levels are high it does mean the risk of losses is amplified so we would recommend approaching carefully.

Mobile Apps

Clients can download the Smart FX app to use the MetaTrader 5 platform on the go. The app is available for iPhone (iOS) and Android (APK) devices. Downloads are available from the relevant app stores. The app is an excellent portable solution promising a variety of instant and pending orders, demo trading, rapid payment options and built-in chat support.

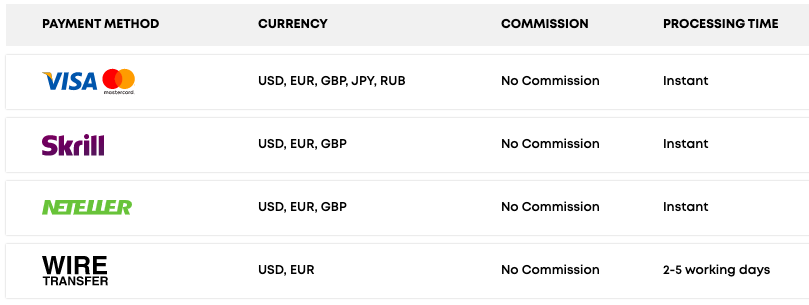

Payment Methods

All payment methods at SmartFX allow traders to deposit and withdraw via USD and EUR. Standard payment options, such as Skrill, Neteller and bank wire transfer are available. It’s free to finance your account and processing times are mostly instant.

This review was pleased to see depositing and withdrawing funds is quick and easy.

Demo Account

A demo account is available which allows users to practice trading on the MT5 platform before proceeding with a full account. To open a demo account, select Practice from the broker’s homepage. Once you’ve submitted some basic details you can download the MT5 platform and start trading in forex and CFD markets without risking real capital.

Bonuses

At the time of writing, SmartFX does not offer any deposit bonuses or promotions. Whilst new traders may be disappointed, it’s common practice among reputable providers not to offer welcome deals. In case this changes, check the broker’s website before you open an account.

Licensing Review

SmartFX is operated by Smart Securities and Commodities Limited and is regulated by the Vanuatu Financial Services Commissions (VFSC). Unfortunately our reviews are always disappointed to see oversight from less reputable bodies, such as the VFSC. Users won’t get the same robust protections afforded by the likes of the FCA.

Despite offices in Dubai, SmartFX is not authorised to provide financial services in the UAE.

Additional Features

SmartFX offers access to the MetaTrader Market opening the door to a huge array of additional indicators, automated trading solutions and charting tools. The brokerage also provides daily market analysis, covering indices and commodities. The only thing missing is hands-on learning resources, such as webinars, which might deter some beginners.

Trading Accounts

SmartFX only offers one account, the Smart Account. Registering for the Smart account is quick and easy requiring only a few personal details and identification documents to be uploaded. Once opened, users can trade the full range of CFDs, forex and futures. The minimum position size is 0.01 lots and payments are free.

Trading Hours

SmartFX offers the option to trade 24 hours a day, 5 days a week, effective Monday to Friday. Trading hours for commodities and indices may vary. Login to the MT5 platform and head to instrument specifications to view market opening hours.

Customer Support

Customer support can be reached via:

- Phone – +97144319003

- Email – support@smartfx.com

- Live chat – located in the bottom right-hand corner of the website

On testing the live chat service, responses were fast however detailed information is only available after you’ve provided personal contact details.

Client Safety

Whilst SmartFX isn’t transparent about the security protocols used on its website, the MT5 platform is secure. From 128-bit encryption and 2FA protocols, executed trades are relatively safe and the payment options offered are secure.

SmartFX Verdict

SmartFX offers a simple solution to forex and CFD investing using the industry-leading MT5 platform. To get a taste of using the broker, clients can open a demo account. SmartFX is not a scam however users should be aware that the broker is not heavily regulated and doesn’t offer negative balance protection.

Top 3 Alternatives to SmartFX

Compare SmartFX with the top 3 similar brokers that accept traders from your location.

-

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers

SmartFX Comparison Table

| SmartFX | Swissquote | IG | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 1.3 | 4 | 4.4 | 4.3 |

| Markets | Forex, CFD-indices, CFD-equities, futures | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $1000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | VFSC | FCA, FINMA, DFSA, SFC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB |

| Bonus | – | – | – | – |

| Education | No | No | Yes | Yes |

| Platforms | MT5 | MT4, MT5, AutoChartist, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:400 | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Payment Methods | 4 | 5 | 6 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Swissquote Review |

IG Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by SmartFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SmartFX | Swissquote | IG | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

SmartFX vs Other Brokers

Compare SmartFX with any other broker by selecting the other broker below.

FAQ

Is SmartFX regulated?

SmartFX is operated by Smart Securities and Commodities Limited and is regulated by the Vanuatu Financial Services Commissions (VFSC). Note the VFSC is not the most trustworthy regulator.

What trading platforms does SmartFX use?

SmartFX only offers one trading platform, the MetaTrader 5 (MT5) terminal. Aimed at experienced retail and professional traders, users get a range of powerful trading features.

Is SmartFX available on mobile?

Yes, the Smart account is available to download and the SmartFX app is compatible with both iOS and Android phones.

Does SmartFX offer a demo account?

SmartFX allows you to trade with a practice account before signing up for their full account. Select Practice from the broker’s website and follow the sign-up instructions.

Who owns SmartFX?

Smart FX is operated by Smart Securities and Commodities Limited. Limited information is available about the owners and management team, which is a little concerning.

Customer Reviews

There are no customer reviews of SmartFX yet, will you be the first to help fellow traders decide if they should trade with SmartFX or not?