Should the Stock Market Be Shut Down?

Given the extreme volatility over the past few weeks, as the coronavirus shuts down businesses, hits earnings and jobs, and is having knock-on effects in the global credit system, some are of the opinion that the stock market should simply be shut down for a period.

Markets are not serving some of their intended roles: the volatility and wild swings don’t make the price signals that useful, undermines confidence in the markets as a storehold of wealth, and companies cannot use them to raise capital.

Should the stock market be shut down?

The Philippines tried this for a few days to take a rest from the volatility. When it reopened, one-quarter of its wealth was wiped out. It doesn’t change the reality of what’s still going on in the real world even if it’s given a break.

Corporate earnings are taking a hit as people bunker down. Companies have less work they need done as activity slows. A question people often have about the economy is why don’t companies simply cut workers’ wages instead of laying them off during a recession? The basic answer is because the work that previously needed to get done is no longer needed entirely or no longer exists. In some cases, it is a matter of degree. But usually when work needs to be cut back 10 percent, instead of reducing everyone’s wages by 10 percent, companies will pare back their workforce by the appropriate percentage and keep the high-performers over the weaker ones.

In the current crisis, many companies are hurting for cash and need to cut back on the labor they need. This causes more defaults, credit spreads widen, lenders pull back, and debt squeezes continue. This makes companies worth less. When people need cash, they sell, causing various types of assets to decline in value.

Shutting down the stock market won’t cure what’s actually going on.

Moreover, stocks are a critical source of cash for companies and investors. If people need a way to tap into liquidity, they have a relatively liquid source of it in the asset markets even if it’s less liquid than normal.

The stock market is also a key indicator of the economy. Prices move based on the discounted expectations of the future. They provide a broad measure for the economy, for countries, for specific industries, and for individual companies of how good or bad things might be.

This is particularly useful information for fiscal and monetary policymakers who typically look at lagging datasets (e.g., unemployment, output, investment, spending) before determining how to act.

The rush to sell everything

The capitalist system is set up such that financial assets outperform cash. People who have good uses for cash will use it and borrow it to invest it in a way that generates a higher return. If you look at what we wrote in ‘How to Build A Balanced Portfolio’ this is what the construction of said portfolio is based on.

Financial assets outperforming cash is the one thing you can be most sure of over the long-run. The time when that isn’t true you have a depression. This is when cash outperforms all financial assets, and central banks and fiscal policymakers have big incentives to get money flowing back into the capital markets.

Traditional safe-haven assets like gold and Treasuries have fallen even as stocks have plunged. When people need cash to make payments and meet other obligations due to a shortfall or expected shortfall, people will sell basically any asset they have available.

Banks and other financial institutions that traditionally provide liquidity to the markets as part of their operations have also cut back. Bid-ask spreads have widened and trading has become more difficult.

Exchange-traded funds (ETFs), which collect different securities to make up a diversified investment vehicle, can normally be exchanged for the underlying at equal value. Some trading firms exclusively perform this type of ETF arbitrage. Arbitrageurs are less willing to take risk. This has resulted in ETFs moving materially away from the value of their underlying assets.

This is particularly true with respect to corporate bonds, which are less liquid securities. Several of the largest bond ETFs have declined to record discounts in relation to the value of their holdings.

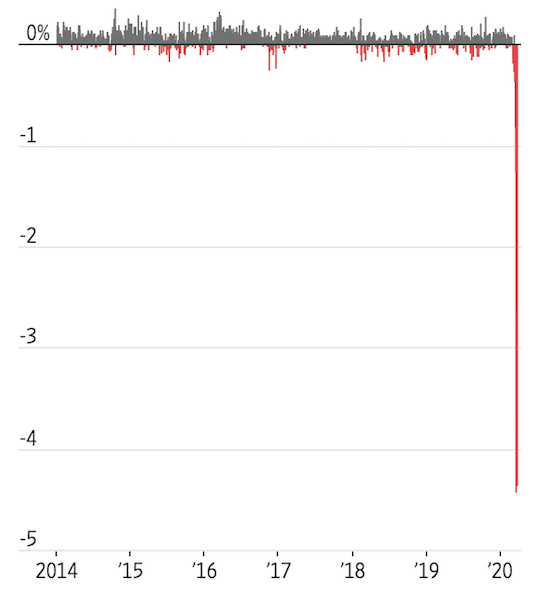

Discount or premium to net asset value (NAV) of the iShares Core US Aggregate Bond ETF

(Source: Refinitiv)

Overnight lending markets required government support as private lenders withdrew.

The markets are volatile and may seem “broken” but the need for cash is perfectly normal in a crisis.

When people and entities buy assets, they are commonly done using leverage. That leverage incurs a cost. Selling off assets to pay debts – or because higher leverage makes margin calls easier to come by – accompanies every market decline. And the price effects are worse when losses are broadly sustained on a leveraged basis.

Some are selling because they expect prices to fall further.

Those facing unemployment, furloughed from their jobs, or facing the loss of income or bonuses need to tap liquidity from their investments or 401(k)s. This is already showing up in the form of large withdrawals from mutual funds.

Pension funds, endowments, insurance companies, and charities need money to pay pensioners and cover their operating costs. Based on the present value of their liabilities and the long-run returns on assets, they will collectively not make ends meet. While coronavirus has triggered problems in some of these entities faster than they anticipated, they are already problems that will be around for a long time.

Many other economic actors are in the same boat. Oil producers are among those in the worst shape and will need to sell assets to account for the shortfall.

As companies cut dividend payments and other costs (e.g., labor, supplies) to lower their burn rate, they will need to tap into other forms of capital to meet their needs. If the capital markets close down, they can’t do that.

The drops in prices are also reflective of the economic fallout that is being discounted in. JP Morgan has forecasted that the US economy could contract by 14 percent in the second quarter on an annualized basis. This would be the worst quarterly performance ever. US Treasury Secretary Steve Mnuchin asserted that without directed government help, the headline unemployment rate could reach 20 percent.

The Winners

Markets are volatile but they’re also discerning at the same time. It hasn’t been a uniform rush out the door in everything. There’s been a host of winners, or stocks that are holding up or even benefiting from the situation.

Companies providing consumer staples – e.g., Walmart, Walgreens, Dollar General, Hormel Foods, Costco, Campbell’s Soup, Proctor and Gamble, Clorox – are seeing their stocks lose anywhere from a mild amount – which means over-performing the broader market by a lot – or seeing big gains.

Pharmaceutical companies like Gilead Sciences and Regeneron Pharmaceuticals have been up as they work for treatments or cures.

Price signals

One of the best economists is the stock market. When the tech bubble popped in March 2000, it indicated that a contraction was coming. Stocks topped again in October 2007 before the financial crisis and two months after the first cracks in subprime began to emerge with BNP Paribas. The economy, retrospectively, entered recession in December 2007.

In this cycle, the market topped on February 19, 2020. We’ll find out down the road that the economy entered recession in March 2020. In the US, recessions are officially determined by the National Bureau of Economic Research (NBER) business cycle dating committee.

Financial markets are quality leading indicators of the economy. And not just the stock market by itself. Particularly what’s going on “under the hood” of the stock market – i.e., defensives (staples, healthcare, utilities) versus cyclicals (consumer discretionary, banks, homebuilders, autos, shipping).

You can go beyond the stock market. What’s the shape of the yield curve? When it’s steep, you probably have room to run. When it’s flat or inverted, as it is now, you’re probably around the top of the economic cycle as the collective opinion is that the central bank needs to hold or ease. Flat yield curves can be a constraint on lending activity. Banks’ and non-bank lenders’ funding costs are at the front of the curve while they normally lend at higher rates at further points out on the curve. They profit from that spread. When that spread is absent, they’re less likely to lend. Accordingly, consumers and businesses have less spending power when credit isn’t freely available, slowing down the economy.

(But you don’t need an inverted yield curve to have a recession. While yield spreads are important to some businesses, inversions preceding recessions is a statistical correlate, not a causal factor in itself.)

Markets convey useful messages to governments. Like all traders and investors know, markets provide feedback in real-time.

When markets are continuing to decline – stocks, commodities, gold, and even the safest forms of fixed income – that means people are in “sell everything” mode to raise cash. The economy can’t operate that way for very long. The US dollar is in the midst of a short squeeze. The USD, as the world’s top reserve currency, is the most common way payments are invoiced and exchanged globally. People need dollars to meet their obligations. When the supply is low relative to demand, this creates a squeeze higher.

The federal government has pieced together a bill will amount to at least $2 trillion. But the markets are telling a loud and clear signal that it’s not good enough to offset the damage to the economy that the various virus-related restrictions are causing. President Trump, who has made the stock market a big indicator of his own personal performance in the White House, would seem especially likely to be in the “whatever it takes” camp.

However, the scale of the stimulus is unprecedented and will require a level of spending that would have previously been unfathomable. Coming out of the financial crisis, the 2009 stimulus bill was $787 billion (later marked at $831 billion). Now, at a minimum, given the extent of US corporate and individual losses and depending on how the funding is structured among short-term bridge loans, credit guarantees, direct payments, and so forth, it is likely to be over $2 trillion.

The ‘self-spiral’ argument

One argument for closure of the stock market has to do with the dynamics of how markets break down. Markets go down, which feeds into margin calls from lenders, which causes more selling, which leads to more margin calls, and so on.

Clearly this dynamic exists. But closing the market simply creates a delay until those who to have to sell will liquidate what they need to in reality. It’s also bad for those lending the money.

Moreover, when people can’t sell in one market it will move over into another. If that means the bond market it’ll create more bond liquidation. If people have commodities, selling will re-route there. If they have cryptocurrency, it’ll move into cryptocurrency. For all the talk about cryptocurrency as a potential source of diversification, bitcoin failed its first big test in that respect. The arrow in the bitcoin chart below points to the top in the US stock market. (Note: The bitcoin and cryptocurrency market is full of speculators and it shouldn’t be expected to hold up in a material “dash for cash” risk-off event.)

(Source: Trading View)

People sell what they can. Stocks are among the riskiest instruments available to the public. Naturally, in a time of crisis, they’d prefer to sell the riskiest assets or whatever they have the most of as a way to tap into equity. If the stock market is shut down then that selling flows into other asset markets and other ways of cutting back. When the stock market comes back, particularly if before the problem has been “fixed” – policymakers are still moving too slowly – then the inevitable happens.

Ban short selling?

Banning short selling has already been called for and implemented in some form in several European countries. Short sellers have been a common scapegoat for centuries when markets fall. Or else they’re resented by most others who are hit in a bad market or economy.

But such bans don’t work in practice, haven’t worked in the past, and the dynamics of how short selling works is not broadly understood by the public or policymakers.

In down markets and highly volatile market action, liquidity is already pulled back. People lose money and have to liquidate so their activity is cut back. Computer-based and high-frequency systematic trading has trouble reading fundamental news and widens their bid-ask spreads. Arbitrageurs also feel less confident. Many sources of liquidity are suppressed.

Adding on another regulatory action where traders can’t sell short makes it worse. Short selling is an important part of market makers’ operations. They hedge dynamically and this requires them being able to go both ways. Cutting off another source of important liquidity is a mistake.

Short selling doesn’t happen in a vacuum. For every share sold short there’s an offsetting buyer of that share. One share can be lent out numerous times, increasing the float. By definition, the net number of shares will remain equal to shares outstanding as a basic matter of double-entry accounting.

Moreover, short selling is not particularly relevant to what’s going on right now. New short positions of approximately $60 billion in March on the US equity markets are small in comparison to the trillions of dollars that have been traded overall.

The “long selling” has been driving the markets, not the short selling.

Also, because of the large up moves that have accompanied the selling, it’s easier for shorts to get shaken out of their positions. The two biggest daily point moves in the Dow happened over the course of the current ~35 percent shakeout.

Final Thoughts

The US stock market has closed before due to unique circumstances.

It closed after 9/11 and it closed for two days due to Hurricane Sandy, which directly hit New York City in 2012. Any potential closure associated with the coronavirus crash would likely stem from the logic that the government would need a bit of time to get a comprehensive relief plan in place and passed. Individual stocks are often halted before management is about to release major news. It’s unlikely but a possibility.

In 1933, President Roosevelt closed the market with a week-long bank holiday to end the bank runs that were spreading. Customers tried to take out their money due to rumors that banks might fail and their money would be lost. There was the dollar devaluation that broke the link with gold and removed the “gold clause” from debt contracts. That helped debtors relative to creditors by making liabilities less expensive and easier to service and was a positive for stocks.

The market is currently in bad shape. We are fundamentally in a crisis that has a component of steep earnings and economic output losses, a component of credit problems triggered by said profit shortfalls, and a component where the central bank can no longer ease monetary policy through interest rates and asset buying because those rates are already at or very near zero percent.

These are real economic problems. While the capital markets affect the economy, they are simply reflecting the current slate of issues. Closing them would simply cause more problems and cure virtually none.