ROInvesting Review 2024

Please see the list of similar brokers or the Best Brokers List for alternatives.

ROInvesting is an online CFD broker regulated by the CySEC.

Forex Trading

Trade a range of FX pairs with 1:30 leverage.

Stock Trading

Trade in global companies with 1:5 leverage.

CFD Trading

Trade CFDs with low spreads & high leverage.

Crypto Trading

Trade cryptocurrencies with 1:2 leverage.

Awards

- Best Forex Broker CFDs 2020 - FXDailyInfo

- The Best CFD Broker Europe 2020 - IAFT

ROInvesting.com is a CySEC-regulated CFD broker offering seamless trading on both desktop and mobile apps. This article unpacks live and demo accounts, how to contact support, and customer reviews. Find out if you should login and trade with ROInvesting.

ROInvesting Company Details

Founded in 2017, ROInvesting forms part of the Royal Forex Limited group and is based in Nicosia, Cyprus, where it holds a license with the CySEC. The broker offers multi-asset trading on superior platforms, suitable for retail and professional clients in Europe. ROInvesting is also well known as the official partner of the AC Milan football team.

Trading Platforms

MetaTrader 4

The MetaTrader 4 (MT4) platform is held in high regard, offering advanced technical analysis tools, fast execution, and reliability. Users of all levels can enjoy various trading modes and detailed price dynamics, among other features:

- 30 built-in technical indicators & charting tools

- Stop loss & take profit functions

- Real-time balance level

- In-platform price alerts

- Rich historical data

- One-click trading

- Live chat support

- 9 time frames

MT4 can be downloaded directly from the broker’s website. There are also useful video tutorials on the MT4 page with platform basics.

MetaTrader WebTrader

WebTrader is an easy-access platform allowing users to trade directly from an internet browser, with no download needed.

Traders can implement different strategies with one-click trading and a variety of execution modes, including four pending and two stop orders, as well as trailing stops. There’s also access to 30 built-in technical indicators and advanced charting tools such as moving averages and Fibonacci Retracements.

WebTrader can be accessed straight from the broker’s website and is compatible with all major internet browsers.

Markets

ROInvesting offers 350+ assets across 10,000 markets:

- Forex – Trade over 40 currency pairs, including EUR/USD, AUD/USD, and USD/JPY

- Indices – Trade on some of the world’s most popular indices, including the FTSE 100 and Dow Jones

- Stocks – Trade stocks in global companies, such as Facebook, Deutsche Bank, and Uber

- Cryptocurrencies – Diversify your portfolio with a range of cryptocurrencies, including Bitcoin and Ethereum

- Commodities – Over 20 hard and soft commodities are available, including gold, coffee, and oil

- ETFs – Trade multiple underlying assets with Exchange-Traded Funds

Spreads & Commission

Spreads are fairly competitive at ROInvesting. For forex pairs, spreads start as low as 0.7 pips for the EUR/USD, 0.9 pips for the EUR/GBP, and 1.3 pips for the GBP/USD. For major indices, spreads start at 1 point for the FTSE 100, and for commodities, you’re looking at 0.37 for silver and gold, and 0.03 for crude oil.

Whilst ROInvesting does not charge a commission, there are other fees to be aware of, including swap charges for overnight positions as well as an inactivity fee charged on dormant accounts.

Superior Alternatives To ROInvesting

ROInvesting Leverage

For retail clients, maximum leverage depends on the market:

- Stocks – 1:5

- Forex – 1:30

- Indices – 1:20

- Commodities – 1:10

- Cryptocurrencies – 1:2

For professional clients, leverage up to 1:500 is available.

Mobile Apps

ROInvesting offers the MT4 mobile app for fast and seamless trading on any iOS and Android smart device. Trade on 9 timeframes, with access to financial news, one-tap actions, and a range of technical indicators and charting tools. Users also benefit from push notifications so that opportunities aren’t missed.

You can download the MT4 app straight from the Apple App Store or Google Play Store.

Payment Methods

Deposits

ROInvesting offers a range of payment methods:

- PayPal

- Bank wire transfer

- Credit & debit cards

- E-wallets (Skrill, Neteller, Trustly, Paysafe, Payvision, SafeCharge, Orangepay, INPAY, etc)

ROInvesting does not charge deposit fees, however intermediary fees from the chosen payment method may apply. The minimum accepted deposit for retail traders is $250.

Further details of deposits will be provided once you register and sign in to your account.

Withdrawals

Withdrawals can be made via the same methods above and requests must be made either by contacting customer support or using the form within the client portal. Withdrawals may incur fees if they are below €100, but traders should check with their account managers for details.

Demo Account

After signing up on the website, you can practice trading skills in a risk-free live account simulation. Users get $100,000 in virtual funds for 365 days. The demo account is available once you download and login to MetaTrader 4.

Deals & Promotions

As per regulatory restrictions, ROInvesting does not offer any deposit bonuses or promotions. With that said, it’s worth checking the broker’s website when you open an account.

Regulation & Licensing

Royal Forex Ltd (ROInvesting) is fully licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 269/15. The CySEC is one of the most trusted regulatory bodies along with the UK FCA.

The broker ensures the safety of client funds, with segregated accounts at first-class global banking institutions.

Additional Features

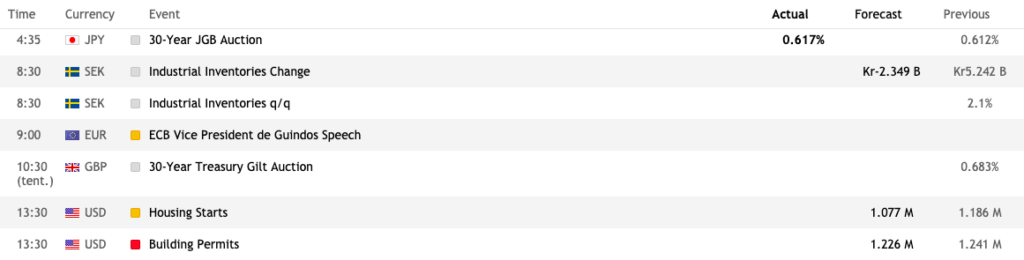

ROInvesting offers an impressive range of educational resources and trading tools, suitable for beginners and experts:

- E-books on market analysis, beginner strategies, capital management, and more

- Economic calendar, earnings calendar, and CFD expiration calendar

- Courses on CFD and stock investing tools, plus social trading

- On-demand video tutorials for beginner and advanced levels

- Regularly updated webinars and articles

- MetaTrader 4 tutorials

- Trading signals

Account Types

ROInvesting offers Silver, Gold, and Platinum accounts for retail and professional clients. Maximum leverage across all three accounts for retail customers is 1:30, whilst for professional clients, leverage goes up to 1:500. The minimum deposit for all accounts is $250. Hedging is allowed on all three accounts.

With the Gold account, a swap discount is available at 25% and for the Platinum account, the discount goes up to 50%. The Gold account offers a good range of additional features, such as a dedicated account manager, access to webinars and videos, plus 10-hour support. As well as the above, the Platinum account also offers news alerts and free VPS use.

Benefits

Benefits of trading with ROInvesting include:

- Wide range of tools & resources

- Mobile & web trading

- 350+ tradable assets

- Transparent pricing

- CySEC regulated

Drawbacks

Disadvantages of trading with ROInvesting include:

- UK traders not accepted

- Withdrawal fees may apply

Trading Hours

Trading hours for most currencies are 00:00 – 24:00 GMT (Monday to Friday) and for cryptocurrencies, trading hours are 00:00 to 23:59 GMT. For gold and silver, trading hours run from 01:00 – 24:00 GMT. Other commodities vary – check the broker’s website for specific opening times. Similarly, for indices and stocks, the broker’s website provides details of the trading hours for each asset within the accounts page.

Customer Support

ROInvesting customer support is available from 07:00 – 17:00 GMT (Monday to Sunday) via various methods:

- Telephone – +80050026003

- Email – support@roinvesting.com

- Online contact form – Contact Us page

- Live chat – Located on the right-hand side of the website

The customer support team is fairly responsive via live chat and can help with a range of queries, from leverage and fee questions to instructions on how to delete your live account.

ROInvesting’s head office address is located at City Home 81, 3rd Floor, 128-130 Limassol Avenue, 2015 Strovolos, Nicosia, Cyprus.

User Security

Firewalls and Secure Sockets Layer (SSL) encryption are in place across the broker’s website and platforms. ROInvesting’s servers are located in SAS 70 certified data centres and there is also level 1 PCI compliance (Payment Card Industry) to ensure the highest standards of payment data security.

ROInvesting Verdict

ROInvesting offers a competitive service for both novice and experienced traders. Clients benefit from the MT4 platform, a vast CFD product list, tight spreads and three live accounts. The broker is also a legitimate and trustworthy provider regulated by the CySEC.

Top 3 Alternatives to ROInvesting

Compare ROInvesting with the top 3 similar brokers that accept traders from your location.

-

Admiral Markets – Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

Go to Admiral Markets -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

ROInvesting Comparison Table

| ROInvesting | Admiral Markets | AvaTrade | Pepperstone | |

|---|---|---|---|---|

| Rating | 1.8 | 3.5 | 4.9 | 4.8 |

| Markets | Forex, CFDs, ETFs, indices, shares, energies, metals, cryptocurrencies | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $100 | – | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC, SEBI | FCA, CySEC, ASIC, JSC | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | 1:500 | 1:30 (EU), 1:500 (Global) | 1:30 (Retail) 1:400 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 9 | 11 | 13 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Admiral Markets Review |

AvaTrade Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by ROInvesting and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ROInvesting | Admiral Markets | AvaTrade | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | No | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

ROInvesting vs Other Brokers

Compare ROInvesting with any other broker by selecting the other broker below.

FAQ

What accounts are available at ROInvesting?

There are three account types available at ROInvesting, for both retail and professional clients: Silver, Gold, and Platinum. The minimum deposit across all accounts is $250 while the maximum leverage available is 1:500. Higher account levels come with dedicated account managers, swap discounts and free VPS use.

Does ROInvesting offer a demo account?

Yes, the demo account gives traders access to $100,000 in virtual funds and is available for 365 days after sign-up.

How can I get in contact with ROInvesting?

ROInvesting can be contacted via the online contact form, email (support@roinvesting.com), telephone (+80050026003), and live chat.

What leverage is offered at ROInvesting?

For professional clients, the maximum leverage available is 1:500. For retail clients, the maximum leverage is 1:30.

Is ROInvesting a legitimate broker?

ROInvesting is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), one of the highest-level market regulators. Nonetheless, traders should always conduct thorough research into any broker that they are considering.

Customer Reviews

There are no customer reviews of ROInvesting yet, will you be the first to help fellow traders decide if they should trade with ROInvesting or not?