RoboForex Review 2024

- Christian Harris, ReviewerRoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists.

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

Trading App

RoboForex continues to excel with its wide range of iOS and Android-friendly platforms to meet short-term trading needs, including MT4 and MT5. The R StocksTrader app performed particularly well during testing, with a vast selection of stocks and ETFs, portfolio analytics, customizable watchlists, an events tracker, plus a fast and dependable mobile trading environment. The only notable absence in the RoboForex offering is the increasingly popular cTrader app, that’s favored by many day traders.

Forex Trading

RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

Stock Trading

RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies.

CFD Trading

RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

Copy Trading

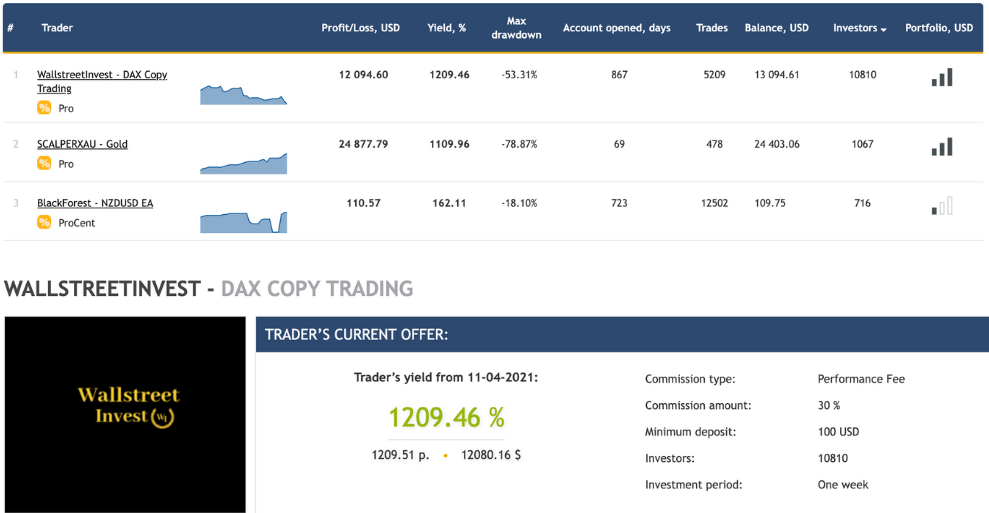

RoboForex’s CopyFX service is designed specifically for currency traders with flexible control over your funds. The ‘Rating’ view provides helpful metrics on master traders, notably profit/loss, maximum drawdown, balance and number of trades spanning time intervals from 1 week to 6 months. That said, the joining process and resources are convoluted, which may confuse newer investors, while the interface trails the smooth user experience provided by category leaders like eToro.

Awards

- Best Multi Asset Trading Platform 2023 - Global Brands Magazine Awards

- Best Trading Conditions 2023 - International Business Magazine Awards

- Best Mobile Trading App 2022 - GF Awards B2B

- Most Trusted Broker 2022 - International Business Magazine Awards

- Best Investment Products 2021 - Global Brands Magazine Awards

- Best Global Mobile Trading App 2020 - Global Forex Awards B2B

- Best Broker of the CIS 2019 - IAFT Awards

- Best Investment Products 2019 - Global Brands Magazine

✓ Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

✗ Cons

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

This RoboForex review examines the broker’s offering for short-term traders, informed by our direct experience testing its platforms and services over many years.

Regulation & Trust

3 / 5RoboForex is an established broker, with 15+ years in the industry and 40+ industry awards. It also maintains segregated accounts, distinct from the company’s own funds, adding a layer of protection for clients’ investments.

Additionally, the broker implements negative balance protection, mitigating the risk of day traders losing more than their account balance during volatile market conditions.

Furthermore, robust SSL encryption technologies are employed to safeguard sensitive data and financial transactions from unauthorized access.

On the downside, RoboForex is authorized by the International Financial Services Commission (IFSC) in Belize. This is a ‘Red Tier’ regulator with low levels of investor protection, especially compared to ‘Green Tier’ regulators, such as the FCA in the UK or the ASIC in Australia.

As a result, RoboForex does not rival our most trusted brokers for 2024, which all boast excellent regulatory credentials.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | IFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4 / 5Accounts

RoboForex offers five accounts: Prime, ECN, R StocksTrader, ProCent and Pro.

With a minimum deposit requirement as low as 10 USD/EUR for most accounts, RoboForex ensures accessibility to traders of all levels. The R StocksTrader account stands out, requiring a slightly higher initial deposit of 100 USD/EUR but still maintaining a competitive edge.

For seasoned traders, the allure of zero-pip spreads in the ECN and Prime accounts will be appealing, while the R StocksTrader account caters specifically to those interested in stock trading.

On the other hand, casual traders may find the ProCent and Pro-Standard accounts more suitable, with no commissions but larger spreads starting from 1.3 pips.

The key differences among these accounts extend beyond their fee structures to include minimum margin requirements, leverage options, and specific conditions like margin call/stop-out levels.

For instance, the Prime account’s 100% stop-out level may not be suitable for novice traders lacking stringent risk management practices, whereas the R StocksTrader account offers a more conservative stop-out level at 20%.

Additionally, RoboForex caters to diverse trading beliefs by offering Islamic swap-free accounts and innovative investment opportunities through platforms like CopyFX and Risk Allocation Management Model (RAMM), suitable for both short and long-term trading ambitions.

Setting up a real-money account via the RoboForex homepage is a straightforward process that I completed in a few minutes. Verification then took an additional few hours.

One notable drawback is that while the demo account offers a realistic simulation of standard account trading environments, it’s frustratingly limited to 90 days, which may not be sufficient for thoroughly testing day trading strategies.

Also, bonuses are exclusively available for Pro account holders, with no promotions for users of the R StocksTrader account.

Deposits & Withdrawals

RoboForex discontinued the majority of its base currencies in March 2024, so the platform now allows deposits in just two currencies – USD and EUR.

RoboForex supports a variety of payment methods, including international and local bank transfers, card payments, and numerous e-wallets. However, it’s worth noting that popular options like PayPal and Bitcoin deposits are notably absent from the list.

Despite this, all deposit channels are provided at no additional cost, ensuring quick processing, with most requiring a minimum deposit of just 10 USD/EUR for standard accounts.

When it comes to withdrawals, RoboForex offers equally numerous methods, although the availability may vary depending on your location.

I’ve observed that withdrawal processing times at this brokerage tend to be longer compared to other brokers. For instance, withdrawals via wire transfer may take up to 5 business days to reach your account, while withdrawals through Visa or Mastercard can extend up to 10 days.

Having said that, withdrawals executed through electronic payment options are typically much faster, often processed within minutes to a maximum of one day.

While RoboForex doesn’t impose fees for deposits into its wallet, I’ve encountered various withdrawal methods that incur charges. For example, withdrawals via SEPA bank transfers carry a 1.5% commission, while Visa withdrawals are subject to a 2.6% fee along with a flat charge of $1.30. Additionally, withdrawals through Skrill and Neteller are associated with fees of 1% and 1.9%, respectively.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | ADVcash, Alipay, AstroPay, Cashu, ecoPayz, Giropay, iDeal, MoneyGram, Neteller, Perfect Money, POLi, Rapid Transfer, SafeCharge, Skrill, Sofort, Trustly, Vietcombank Transfer, Visa, WeChat Pay, Wire Transfer | BPAY, Credit Card, Debit Card, Mastercard, Neteller, PayPal, POLi, Skrill, UnionPay, Visa, Wire Transfer | BPAY, Credit Card, Klarna, Mastercard, Neteller, PayPal, POLi, Rapid Transfer, SafeCharge, Skrill, Swift, UnionPay, Visa, Wire Transfer |

| Minimum Deposit | $10 | $0 | $200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4 / 5RoboForex has a strong investment offering relative to the industry standard, although its 12,000+ instruments appear modest when compared to giants like Blackbull (26,000+) and IG (17,000+).

Among its offerings, RoboForex presents over 8,400 stock and ETF CFDs sourced from leading global exchanges like Nasdaq, Dow Jones, LSE, Deutsche Boerse, and SIX Swiss Exchange. These ETFs cover a wide spectrum of industries and market characteristics, providing traders with ample opportunities for investment diversification.

Additionally, the platform features more than 3,000 real stocks of US companies, catering to traditional investors seeking direct equity investments.

Indices are moderately represented with 10 markets available for CFDs. These include prominent indices such as the S&P 500, Dow Jones, German DAX 40, and UK FTSE 100, offering traders the chance to speculate on the economic performance of various countries or industries.

In terms of commodities, RoboForex provides a limited selection of just 4 assets, primarily metals and energy. While gold trading presents opportunities, particularly with its competitive pricing in certain account types, other popular commodities like wheat and coffee are notably absent from the platform.

One notable drawback is that I can’t trade cryptos, bonds or options at RoboForex, a downside compared to alternatives like IG.

Fees & Costs

3.5 / 5The cost structure associated with different account types positions the broker competitively against counterparts like FXTM, but trails the cheapest brokers.

One aspect that sets RoboForex apart is its offering of accounts with either ECN or STP execution styles, providing the flexibility to prioritize lower spreads or zero commission trading based on trader preferences.

In accounts like Pro-Cent and Pro, fees are integrated into spreads, averaging at approximately 1.4 for EUR/USD and 1.75 for US indices. In the ECN accounts, spreads on major pairs like EUR/USD are as low as 0.1 pips, comparing well with firms like Pepperstone.

I encountered varying commission rates for ECN accounts, ranging from $10 per round lot in the Prime account to $20 per round lot in the pure ECN account. Despite these relatively high commissions, RoboForex offsets the impact to an extent through rebates on commissions and earnings from STP trade spreads.

Helpfully, investments in stocks and ETFs are exempt from commission charges, enhancing cost-effectiveness.

I’ve also appreciated that RoboForex refrains from imposing inactivity fees, ensuring that accounts remain unpenalized during periods of dormancy.

Notably, gold day trading on the platform presents an advantage, as the associated commission ($1 single turn, per lot) falls below the industry average, providing favorable conditions for trading precious metals.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.1 | 0.02 |

| FTSE Spread | 1.0 | 1.0 | |

| Oil Spread | 1.7 | 2.5 | 0.03 |

| Stock Spread | 0.01 | 0.02 | 0.02 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4.1 / 5RoboForex offers an excellent selection of platforms tailored to the diverse needs of its users, surpassing the offerings of most brokers in the industry.

Seasoned day traders are likely familiar with MT4 and MT5 platforms, renowned for their extensive customization options and seamless integration with Expert Advisors (EAs). These platforms are accessible through downloadable versions for Mac, PC, and Linux, as well as via the browser-based WebTrader and mobile apps for iOS and Android.

RoboForex’s proprietary platform, R StocksTrader, is designed specifically for stock trading. While it may not offer the same level of flexibility as MetaTrader platforms, it stands out with its integration of TradingView charts.

In my view, the TradingView charting package that’s integrated into RoboForex’s custom platform represents the industry’s pinnacle in terms of adaptability and functionality.

TradingView-powered charts provide an extensive array of analytical tools, various timeframes, and effortless zooming capabilities for analyzing price movements. In comparison, the charts on MetaTrader platforms can feel cumbersome and less intuitive to navigate, making the trading experience less seamless.

There’s also the CopyFX platform where traders can promote their own day trading strategies or follow the strategies of others.

The platform allows you to view participants by key metrics like profit/loss, yield and maximum drawdown. Each participant has the flexibility to choose their own commission structure, investment period and minimum deposit, giving them full control over their account.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | R StocksTrader, MT4, MT5, TradingView | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade |

| Mobile App | iOS & Android, R StocksTrader | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

3.8 / 5I’ve been impressed with the range of research tools available at RoboForex, which help me to formulate strategies and make informed trading decisions.

One standout tool is the economic calendar, which provides insights into key global economic events and indicators, aiding in predicting market movements based on forthcoming economic data.

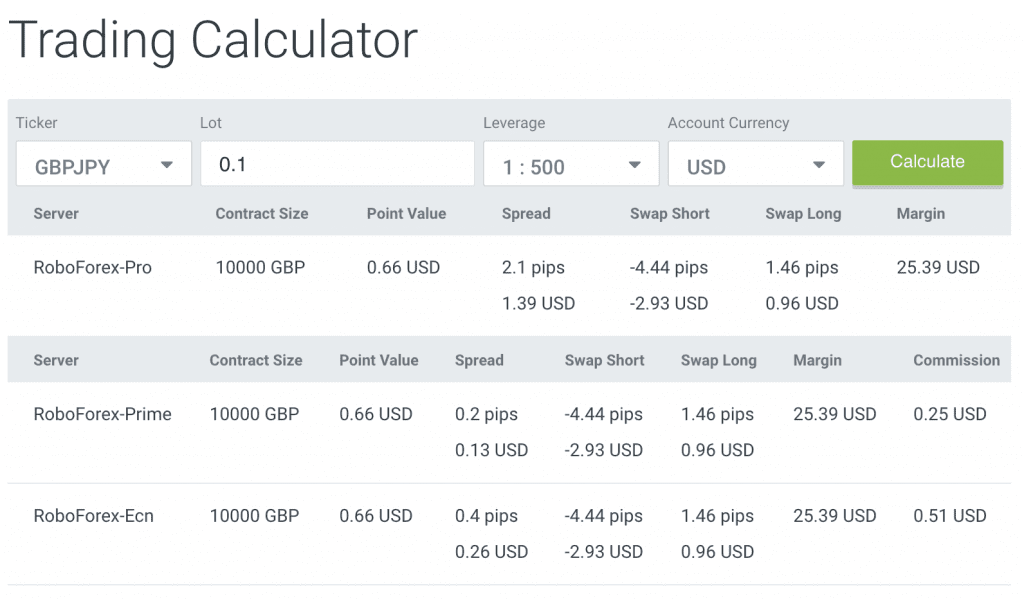

Additionally, the trading calculator has proven invaluable, allowing me to estimate potential profits, losses, and costs across various instruments.

RoboForex’s provision of daily market news and analysis are particularly beneficial, enabling users to identify new trading setups. Each piece of analysis includes several charts accompanied by concise technical analyses, offering valuable insights into market trends.

Furthermore, the heatmap tool is highly useful. It facilitates the identification of cross-market correlations and technical signals based on multiple indicators such as moving averages, oscillators, and volume indicators. This comprehensive overview of market sentiment can greatly influence your understanding of specific instrument price movements.

Lastly, staying updated on the latest market developments is intuitive through the news feed provided by RoboForex. Each article presented a blend of technical and fundamental analysis, shedding light on the initial market response and the current trading configuration.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.8 / 5The platform’s organization of trading subjects into distinct categories, coupled with a mix of written articles and videos, provides a practical and immersive learning environment.

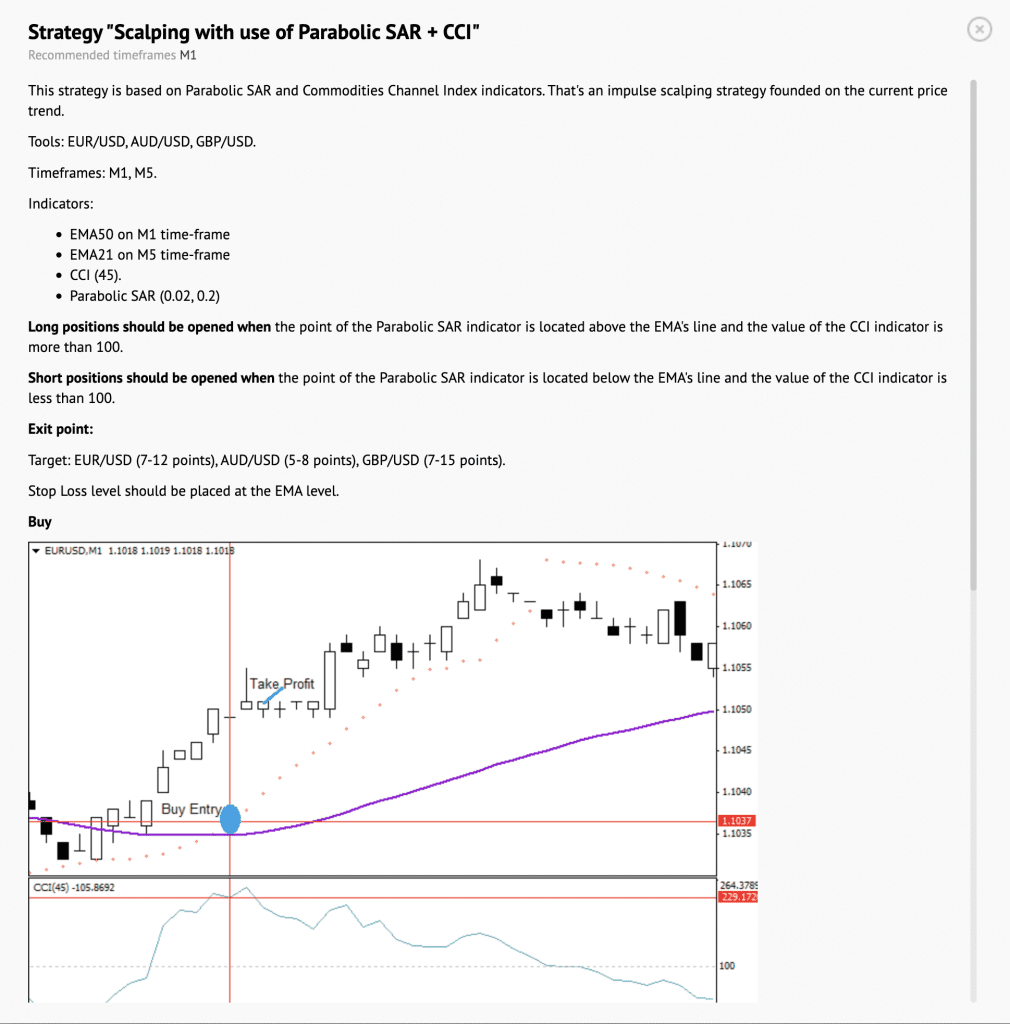

One aspect that stands out is RoboForex’s ‘Trading Strategies’. Delving into techniques ranging from ‘Scalping with use of Parabolic SAR + CCI’ to ‘Trading based on gaps’, these strategies are thoughtfully categorized by various timeframes, notably for short-term traders.

They offer beginner traders valuable insights and serve as catalysts for developing their own trading methodologies. Moreover, RoboForex’s glossary serves as a helpful companion, aiding newcomers in grasping the technical terms integral to trading.

However, the educational content on investing is somewhat limited, lacking comprehensive coverage of essential topics such as technical analysis crucial for effective CFD trading.

I’ve also found myself yearning for regular webinars or seminars to help me stay abreast of important market events.While these resources are readily available from other brokers like eToro and IG, their absence on RoboForex’s platform leaves room for improvement.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4.3 / 5RoboForex offers multilingual support, providing assistance in over 12 languages, including English, Malaysian, Indonesian, Arabic, and Spanish. Impressively, this support is available round the clock, 24/7.

Whether I’ve had general inquiries like registering for a real account or urgent issues such as login problems, I’ve found various support channels readily accessible for prompt and efficient assistance.

Instead of directly contacting the broker’s headquarters in Belize, I’ve been able to seek help through multiple avenues, including a 24/7 phone line, messaging apps like Telegram and WhatsApp, an email contact form, and live chat.

For simpler queries, I also find the website’s forum and FAQ section to be valuable resources. These sections provide answers to common questions, covering a wide range of topics such as account deletion, details on upcoming trading contests, and guides for navigating trading platforms.

| RoboForex | Pepperstone | IC Markets | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With RoboForex?

RoboForex is an established brokerage with over 15 years of experience and access to thousands of instruments. Its diverse range of offerings caters to a wide clientele, including STP and ECN accounts, derivatives, investment products, copy trading, and multiple platforms.

However, the brokerage has weak regulatory credentials, a narrow range of currency pairs and an increasingly slim selection of account currencies, reducing its appeal for some traders.

FAQ

Is RoboForex Legit Or A Scam?

RoboForex is a credible online broker offering a range of assets on secure platforms. It employs various security measures, including SSL encryption and negative balance protection, to safeguard client funds. Its long operational history adds to its legitimacy.

Is RoboForex A Regulated Broker?

RoboForex is regulated by the International Financial Services Commission (IFSC) of Belize, which is an offshore authority and not well respected compared to the likes of the UK’s FCA or Australia’s ASIC.

Is RoboForex Suitable For Beginners?

RoboForex is suitable for beginners thanks to its offering of a wide range of trading assets, user-friendly platforms, and low minimum deposits.

Additionally, RoboForex offers educational resources and a demo account option, allowing new traders to practice and learn the ropes of trading without risking real money.

Does RoboForex Offer Low Fees?

While specific fees can depend on the account type, trading platform, and market traded, RoboForex’s structure is designed to cater to a wide range of traders, emphasizing transparency. Some accounts include zero spreads, which can be particularly attractive for traders looking to minimize costs.

That said, RoboForex does trail the industry’s cheapest brokers with relatively high commissions in some accounts and rebates that require significant trading volumes to offset costs.

Is RoboForex A Good Broker For Day Trading?

RoboForex is suitable for day trading as it offers a wide array of instruments, competitive fees, and low minimum deposits. It supports excellent charting platforms including MetaTrader 5 and offers zero-spread ECN accounts, making it attractive to both novice and professional traders. High leverage options further enhance its appeal, though they also increase risk.

On the downside, execution speeds of 1-3 seconds may impede intraday strategies, especially compared to the fastest brokers with speeds of <0.1 seconds.

Does RoboForex Have A Mobile App?

RoboForex provides a comprehensive mobile trading experience with four apps available for iOS and Android: MT4, MT5, R MobileTrader and R StocksTrader. These apps allow users to engage with financial markets, manage trades, and utilize various trading tools on the go.

Top 3 Alternatives to RoboForex

Compare RoboForex with the top 3 similar brokers that accept traders from your location.

-

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Go to IC Markets -

Vantage – Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Go to Vantage

RoboForex Comparison Table

| RoboForex | Pepperstone | IC Markets | Vantage | |

|---|---|---|---|---|

| Rating | 4.5 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $200 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | IFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA | FCA, ASIC, FSCA, VFSC |

| Bonus | $30 No Deposit Bonus | – | – | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

| Education | Yes | Yes | Yes | Yes |

| Platforms | R StocksTrader, MT4, MT5, TradingView | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:500 |

| Payment Methods | 20 | 11 | 14 | 12 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Pepperstone Review |

IC Markets Review |

Vantage Review |

Compare Trading Instruments

Compare the markets and instruments offered by RoboForex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| RoboForex | Pepperstone | IC Markets | Vantage | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | No | Yes | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

RoboForex vs Other Brokers

Compare RoboForex with any other broker by selecting the other broker below.

Customer Reviews

3.5 / 5This average customer rating is based on 2 RoboForex customer reviews submitted by our visitors.

If you have traded with RoboForex we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of RoboForex

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I use RoboForex for its CopyFX platform, which I’ve been fairly pleased with. It’s easy to find strategy providers with decent performance stats. Only annoying thing is returns aren’t consistent but that’s the nature of copy trading I guess!!

RoboForex has been a mixed bag for me. The investment offering is massive, especially the stocks – there are thousands of shares available on the platform. However I would feel safer if the broker had better regulatory oversight. Also don’t expect a fast response from customer support, as live chat is really slow.