Real Estate Investment Trusts: How To Trade REITs

Real estate investment trusts (REITs) are companies that allow traders to profit from property without having to own the physical assets themselves. They facilitate the pooling of resources from investors, which investment managers then use to procure real estate.

This guide will explain how to trade REITs, uncovering how these property-focused financial vehicles work, their benefits and risks for traders, and the steps to follow to get started.

Quick Introduction

- Real estate investment trusts, also known as REITs, are financial vehicles that can provide a steady passive income through regular rent collections or mortgage interest.

- REITs must pay a significant proportion of their yearly rental profits by way of dividends, which means they often have higher yields than property stocks.

- While primarily aimed at long-term investors, they can also provide short-term traders with exposure to a vast array of property sectors and regions.

- REIT dividends are subject to special taxation rules, so you should consider your personal circumstances and the potential for higher tax liabilities before you start trading them.

Best Brokers For Trading REITs

What Are Real Estate Investment Trusts?

It’s important to understand the make-up of real estate investment trusts to ensure you choose an approach that aligns with your trading goals…

Individuals can get exposure to the property market in two ways: privately through direct ownership of real estate, or by clubbing their capital together with others and giving it to an investment manager to build a portfolio of physical assets like REITs.

These financial instruments are a popular option for short- and long-term traders alike. They predominantly change hands on stock exchanges, and are now traded in dozens of countries across the globe following their introduction in the US in the 1960s.

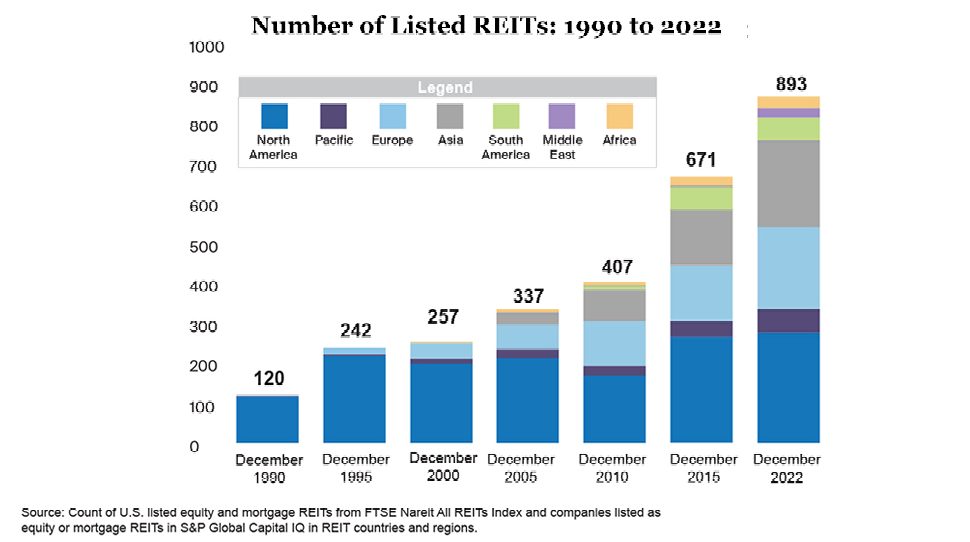

There were 893 REITs with a combined equity market capitalization of $1.9 trillion traded on global exchanges at the end of 2022:

The fundamental difference between REITs and conventional property stocks lies in their tax status. Generally speaking, these investment trusts are exempt from having to pay income and corporation tax.

In return for these tax advantages, REITs are required to pay the lion’s share of annual profits from their rental activities in the form of dividends.

In the US and UK, these trusts are required to pay at least 90% of yearly profits out in the form of dividends. This can make them ideal investments if I am an investor seeking passive income.

While REITs themselves do not pay income tax, the dividends they pay can be taxed as ordinary income in certain regions. This means traders may – depending on their individual circumstances – be forced to pay more tax on them than on dividends from stocks.

Different Types

There are three main types of REIT traders can choose from today:

- Equity REITs. The most common form of REIT out there, these vehicles own and operate properties and generate income through rent collections.

- Mortgage REITs (or mREITs). These companies make money by lending money to real estate operators, or by buying existing mortgage-backed securities. The profits they generate primarily come from the margin between the interest earned on mortgage loans and the cost of funding these loans.

- Hybrid REITs. As the name implies, these trusts invest in both physical assets and mortgages. They generate income through a blend of rent and interest.

Within these, REITs provide exposure to a wide range of different property sectors, including:

- Offices

- Retail assets (such as shopping malls and retail parks)

- Warehouses and logistics hubs

- Residential property

- Healthcare facilities

- Student accommodation

- Data centres

- Forests and timberland

Some of the UK-listed REITs I hold in my portfolio include medical real estate specialist Primary Health Properties and warehouse operator Tritax Big Box REIT.

Trading Routes

You have several different ways to get exposure to real estate through these investment vehicles:

Publicly Traded

These trusts change hands on stock exchanges like the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE).

They attract large numbers of buyers and sellers, ensuring deep liquidity which makes it simpler and quicker for short-term traders to enter and exit positions.

Like stocks, publicly traded REITs are subject to market fluctuations, and their prices can be impacted by interest rate movements, changing economic conditions, or amendments to sector regulations.

This is often the route of choice for traders, and we detail the steps to start dealing in publicly traded REITs below.

Public Non-Traded

These investment trusts raise money by selling shares to investors through the use of broker-dealers or financial advisors.

The downsides of these REITs include much lower liquidity compared with exchange-traded vehicles; higher costs; and possible restrictions on redemptions.

Traded and non-traded REITs are both subject to strict rules laid down by regulators like the US Securities and Exchange Commission (SEC).

However, trusts that trade on stock exchanges face greater regulatory scrutiny and corporate governance standards.

Private

Accredited and institutional investors can put their cash in non-public REITs via private placements or direct investment. As a consequence, liquidity is usually poorer with private REITs.

These vehicles are not subject to intense scrutiny from bodies like the SEC. This means they can have more flexible investment strategies, and therefore the potential to deliver greater returns. But it also means they are less transparent and not subject to regulatory rules that protect traders and investors.

It’s worth mentioning that I can also get exposure to REITs by opening a position in an exchange-traded fund (ETF). These are securities that deploy trader funds in a portfolio of different ETFs, a characteristic that reduces risk through even greater diversification.

How To Trade REITs

It’s fairly straightforward to get started with publicly traded REITs. Here are the key steps for trading these popular investment vehicles:

Consider Regional Differences

Today REIT traders have a chance to make money in more than 40 countries. While this provides individuals with greater flexibility, it also means that they really need to do their homework if trading across jurisdictions.

The trouble is that the rules concerning things like tax, dividends, and ownership can differ greatly from country to country. Traders like me therefore need to go through local regulations with a fine-tooth comb and consider whether investing in a particular trust is suitable based on my personal circumstances.

Pick A REIT

If I can pass this stage, the next thing to consider is what property sectors and regions provide investment potential, and which REITs would allow me to capitalize on this most effectively.

I can get this information by studying the trust’s website, looking at financial news websites, reading analysts’ notes, and checking investor bulletin boards, for example.

From a short-term perspective, I’d need to think about which trusts could experience price volatility.

Select A Broker

The next step is to check that my broker allows me to trade the REIT (or REITs) that I’ve selected. Some brokerages do not allow their clients to trade these investment trusts at all.

But the search doesn’t end there. There are plenty of other things I must contemplate before doing business with a particular broker.

Are they fully regulated, and how transparent are they on issues like pricing? How good is their trading platform, and do they provide additional resources like advanced charting tools and educational resources? These are just a handful of things I need to ask.

Fortunately, our experts have done the hard work for you – collating a list of the best REIT trading brokers above.

Open An Account And Deposit Funds

Once I’ve picked a broker, I need to provide them with a raft of personal information including my name and address, employment status and trading objectives. I’ll also likely need to provide them with identification and proof of address for regulatory purposes.

This stage should take a few minutes, after which point I’ll be able to deposit funds in my account to start trading REITs. I can choose to do this via bank transfer or credit card, although some brokers also allow deposits to be made with e-wallets and even cryptocurrencies.

Once the funds appear in my account I’ll be ready to go trading REITs.

Pros & Cons Of Trading REITs

Pros

- High yield: Because REITs pay most of their taxable income in dividends, they can have a higher yield than normal stocks.

- Ease of trading. It is far easier and cheaper for an individual to buy and sell their shares in a REIT than to trade in physical property. Furthermore, these assets provide access to real estate with minimal initial outlay.

- Price volatility. REIT markets can be extremely choppy. This can provide ample opportunities for short-term traders to profit, though remember that volatility can also increase the chance of losses.

- Leverage. Investment trusts can make use of large amounts of borrowed money. This can help them to generate better returns, although bear in mind that high leverage also brings greater risk.

- Sector rotation. Traders can easily rotate in and out of different property sectors with REITs to capitalize on changing conditions.

- Diversification. REITs often invest in a wide range and number of properties, a strategy that helps traders to spread risk.

- Hands-off trading. REITs protect individuals from the inconvenience of day-to-day property management, which can be a costly and time-consuming enterprise.

Cons

- Taxes at the investor level: Even though REITs often have no corporate taxes, investors receiving dividends may be taxed. Depending on the regulations of each country, REIT dividends can end up being taxed higher than other dividends.

- Long-term investments: As with most real estate investments, REITs are primarily aimed at producing benefits long-term. They are not the best vehicle if you are looking at short-term returns.

- Lack of diversification: One criticism is that they tend to be specialized in a particular industry, which means they have little diversification. If that type of property loses its value, the REIT may do too. REIT ETFs are a way of avoiding this.

- Market volatility: Although REITs are not a very volatile asset, public REITs are subjected to market fluctuations and therefore the price might not always be linked to the quality of the REIT and its properties.

Bottom Line

REITs (and REIT ETFs) allow traders to make money on the property market with low upfront costs and reduced hassle. They can be effective ways for traders with different investment strategies, although these securities are designed mainly with long-term investors in mind, as opposed to short-term traders like day traders.

To get started, see our ranking of the best REIT brokers.

Article Sources

- Global Real Estate Investment – Nareit

- Real Estate Investment Trusts – London Stock Exchange

- Investor Bulletin: Real Estate Investment Trusts (REITs) – Securities and Exchange Commission

- Guide To Investment Strategy: How To Understand Markets, Risk, Rewards And Behaviour – The Economist, Peter Stanyer And Stephen Satchell

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com