Opofinance Review 2024

Opofinance is an offshore forex and CFD broker, offering copy trading services and the MT4 platform.

Forex Trading

Opofinance offers 35+ spot currency pairs, covering all majors and top minors.

Stock Trading

Opofinance offers CFDs on 60+ US and European stocks.

CFD Trading

Opofinance offers leveraged CFDs on stocks, indices and commodities.

Crypto Trading

Opofinance offers trading on crypto/spot currency pairs, including BTC/USD.

Copy Trading

Opofinance offers copy and social trading through Fiboda.

Opofinance, previously OpoForex, is an offshore broker offering multi-asset trading. It provides DMA and ECN services, as well as copy trading opportunities. Our broker review will cover minimum deposit requirements, the sign-up and login process, live spreads, account types, and more. Find out whether to start trading with Opofinance today.

Opofinance Headlines

Opofinance is a financial services provider offering global trading services. It operates under the name ‘Opo Group LLC’ and was established in 2021, with offices in Kingston, Saint Vincent and the Grenadines. It was formerly known as ‘OpoForex’.

The company offers 300+ instruments and has more than 8,000 active users. The brokerage aims to provide traders with a stable investment foundation paired with innovative trading features. Unfortunately, Opofinance is not regulated by a reputable financial regulator.

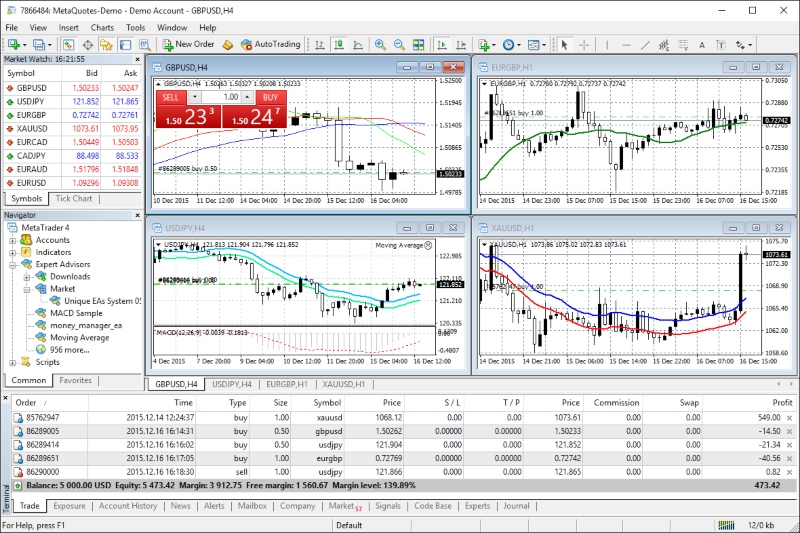

Platform

Clients are provided with the MetaTrader 4 (MT4) trading platform. MT4 is compatible with all major web browsers and can be downloaded to desktop, mobile, and tablet devices. Features include:

- Historical data

- Live news streams

- Customisable charts

- 4 pending order types

- 3 order execution types

- Access to Expert Advisors

- One-click order execution

- Automated trading via APIs

- MQL4 programming language

- 30+ built-in technical indicators

- User-friendly, multilingual interface

Note, Opofinance does not offer MetaTrader 5.

Products

Clients are offered investment opportunities in popular financial markets:

- Forex – 35+ currency pairs, including majors and minors such as EUR/GBP and GBP/USD

- Spot metals – Trade metal and base currency pairs, including silver and gold

- Spot energies – Trade oil and natural gas

- Indices – Speculate on 12 indices in the world’s biggest economies, including the NASDAQ, DAX and S&P 500

- Stocks – Speculate on 60+ major EU and US companies, including Amazon, ING Group, BNP Paribus and Nestle

- Cryptocurrencies – Invest in digital and fiat currency pairs, including Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), and Binance Coin (BNC)

Fees

Fees and commission vary by Opofinance account type. There are no commission fees with the Standard and Copy accounts, however, relatively high spreads are charged, starting at 1.8 pips on the Standard solution and 2.5 pips on the Copy Trade account. The ECN account offers the tightest spreads, starting at 0.8 pips, though a $6 commission per trade is also charged.

Unfortunately the broker provides limited information on additional fees, such as inactivity charges. With that said, swap-free allowance days are offered on forex and precious metal trades.

Leverage

Leverage varies by asset and volume. Opofinance withholds the right to change margin ratios on customer accounts deemed a significant risk. Clients are offered margin opportunities of up to 1:1000 on major forex pairs for 0-5 lots trading volume. On a volume of 100+ lots, 1:25 leverage is available.

Keep in mind that leverage can amplify losses.

Major Forex Pairs

- 0-5 lots: 1:1000

- 5-20 lots: 1:500

- 20-50 lots: 1:200

- 50-100 lots: 1:100

- 100+ lots: 1:25

Minor & Exotic Forex Pairs, Spot Metals, Spot Energies & Indices

- 0-5 lots: 1:500

- 5-30 lots: 1:200

- 30-50 lots: 1:100

- 100+ lots: 1:50

Mobile Trading

MetaTrader 4 is also available as a mobile application. The app is free to download and is compatible with iOS and Android (APK) devices. The mobile solutions allow users to access the full trading features provided on the desktop platform, including analytical tools, plus customisable charts and graphs.

Other features include:

- Nine timeframes

- 24 analytical objects

- Full transaction history

- 30+ technical indicators

- Interactive symbol charts

- Live financial market news

- All order types and execution modes

- Three chart types including bar and Japanese candlestick

Payments

Deposits

Minimum deposit requirements start at $100 on the Standard and ECN accounts. The broker does not disclose any fees charged for deposits, however, third-party charges may apply.

Traders can use bank wire transfers, credit/debit cards and e-wallets, including Skrill and Neteller, to fund accounts. Unfortunately, there is limited information on processing times for live accounts, though digital payments are often instant.

Withdrawals

Withdrawals can be made free of charge. Those submitted before 10 am will be processed within the same working day, though clearing times may vary by method.

In line with anti-money laundering (AML) policies, withdrawals must be made back to the original payment method. And, clients may not request or receive a withdrawal until know-your-customer (KYC) compliance documents are provided, which include proof of residency.

Note, there are many negative reviews of previous difficulties getting the broker to pay-out entitled funds. Of course, some complaints may come from clients who did not complete verification checks before requesting a withdrawal.

Demo Account

Opofinance offers a free demo account. This is a good way to practise trading, navigate platform features, or test a forex strategy risk-free. Once signed up, traders can access virtual funds and experience real-time trading conditions and prices.

The broker provides Standard, ECN and ECN PRO as demo formats. And just a simple online registration form is required to open a paper trading account.

Deals & Promotions

At the time of writing, Opofinance did not offer any promotions or bonuses to retail clients. This included no deposit bonuses or other sign-up offers.

It is not uncommon to see enticing financial incentives used by brokers with limited regulatory guidance, but always read the terms and conditions before you opt-in to an offer. For example, upon reviewing previous incentives used by Opofinance, we found generous welcome bonuses offered to new clients. Yet when reading the conditions, the broker states they reserve the right to alter any aspect of the Trading Benefit Scheme at any time. This includes the minimum trade volume requirement to be eligible to withdraw profits.

Opofinance Regulation

Opo Group LLC is a member of The Financial Commission (FINACOM). This is not a governmental body – it is an independent organisation that maintains a register of financial services organisations. As a result, limited regulatory protection is afforded to active clients. And importantly, we always recommend opening an account with a broker that is regulated by a recognised authority, such as the FCA, CySEC or ASIC.

Despite the limited oversight, FINACOM does provide a compensation fund of up to €20,000. Plus, a dispute resolution service is available through the FINACOM website, promising an average dispute resolution time of 7 days. Client funds are also held in segregated accounts.

Additional Features

Opofinance does have a link to an online trade academy, suitable for beginners and advanced investors. However, this service was unavailable at the time of the review. This sets the company below most of the top brokers in the market, many of which offer reliable training materials.

Copy trading is one attractive feature for clients. Their social investing platform allows users to implement strategies executed by seasoned investors. Benefits include rapid access to major financial markets with limited experience and the ability to diversify portfolios.

Live Accounts

Retail clients have access to four account options. Whilst asset access varies by account, all options provide the MetaTrader terminal. Minimum deposit requirements start from 100 USD. Below are the main features broken down by account type.

Standard

Instruments: forex, spot metals, spot commodities, CFDs on indices, US shares, EU shares and cryptocurrencies.

- 80% margin call

- Instant execution

- 40% stop out level

- No commission fees

- Spreads from 1.8 pips

- 0.01 minimum lots per trade

- $100 minimum deposit requirement

ECN

Instruments: forex and spot commodities, CFDs on indices and cryptocurrencies

- 80% margin call

- 40% stop out level

- Spreads from 0.8 pips

- Market order execution

- $6 commission fee per trade

- 0.01 minimum lots per trade

- $100 minimum deposit requirement

Copy Trade

Instruments: spot metals and spot commodities, CFDs on indices

- 80% margin call

- 40% stop out level

- No commission fees

- Spreads from 2.5 pips

- Market order execution

- 0.01 minimum lots per trade

- $200 minimum deposit requirement

ECN Pro

All instruments

- No spreads

- 80% margin call

- 40% stop out level

- Market order execution

- $4 commission fee per trade

- 0.01 minimum lots per trade

- $5000 minimum deposit requirement

Account registration takes a matter of minutes, however, you may need to provide documents to verify your identity to comply with AML policies.

Benefits

- Demo account

- Copy trading platform

- Leverage up to 1:1000

- 24-hour customer contact option

- Industry renowned MetaTrader 4

Drawbacks

- Unregulated

- Scam warnings

- Negative client reviews

- No educational materials

- Services not available in all jurisdictions

Opening Hours

The platform operates in a GMT +3 time zone. Asset trading times are posted on the broker’s website, plus upcoming closure dates, such as public holidays. Forex typically trades 24/5 while stocks reflect their respective exchange’s opening times.

Customer Support

Opofinance offers 24/7 customer service via:

- Telegram

- Online contact form

- Whatsapp – +44 2081236500

- Email – support@opofinance.com

- Telephone – +35724267200 (8 AM to 5 PM, GMT+3)

- Social media – Instagram, Facebook and LinkedIn

- Address – Opofinance, Kingstown, First Floor, First St Vincent Bank Ltd Building, James Street

Note, there is no FAQ portal for a quick resolution to simple issues.

Security

The members area is password-protected and all personal data between client terminals and the platform is encrypted. Opofinance claims to comply with national laws on the security and privacy of data, funds, investments and transactions. However, given that the company is based in the Caribbean, it’s unlikely that these laws will be as stringent as other jurisdictions.

The MetaTrader terminals are renowned for secure login features, industry-standard data privacy, and integrated dual-factor authentication options.

Opofinance Verdict

Opofinance, formerly OpoForex, is an unregulated broker, which is something we recommend avoiding where possible. Many global brokers offer more reliable trading products. Despite this, there are some Opofinance positives. In particular, the copy trading terminal, 24-hour customer service and the free demo account. Overall though, we’d recommend alternative providers.

FAQs

Is Opofinance Regulated?

No, Opofinance is an offshore, unregulated trading broker. Be cautious when investing personal capital with unlicensed providers as recourse options may be limited.

Does Opofinance Have A Mobile Trading App?

Opofinance does not have a proprietary mobile investing application. However, MetaTrader 4 can be downloaded for free and offers all the same features as the desktop terminal.

What Trading Platforms Does Opofinance Offer?

Opofinance uses the globally recognised MetaTrader 4 (MT4). This terminal has advanced features, including customisable charts, technical indicators and live financial news. It’s a great option for beginners and experienced investors.

Does Opofinance Offer A Demo Account?

Yes, Opofinance has a free demo account. Paper trading accounts are a good way to test out a new broker or platform. Users can access virtual funds and experience real-time trading conditions and prices.

What Are The Minimum Deposit Requirements To Trade With Opofinance?

The minimum deposit at Opofinance is $100 for the Standard and ECN accounts. This is in line with competitors, though beginners may want to opt for a brokerage with a lower deposit requirement.

Top 3 Alternatives to Opofinance

Compare Opofinance with the top 3 similar brokers that accept traders from your location.

-

IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Go to IC Markets -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

Opofinance Comparison Table

| Opofinance | IC Markets | AvaTrade | Pepperstone | |

|---|---|---|---|---|

| Rating | 1.8 | 4.8 | 4.9 | 4.8 |

| Markets | Forex, commodities, cryptocurrencies, stocks, indices | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $200 | – | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FINACOM | ASIC, CySEC, FSA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | None | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | 1:1000 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail) 1:400 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 5 | 14 | 13 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IC Markets Review |

AvaTrade Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by Opofinance and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Opofinance | IC Markets | AvaTrade | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Opofinance vs Other Brokers

Compare Opofinance with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Opofinance yet, will you be the first to help fellow traders decide if they should trade with Opofinance or not?