The USDJPY Is Set To Test Lower Prices

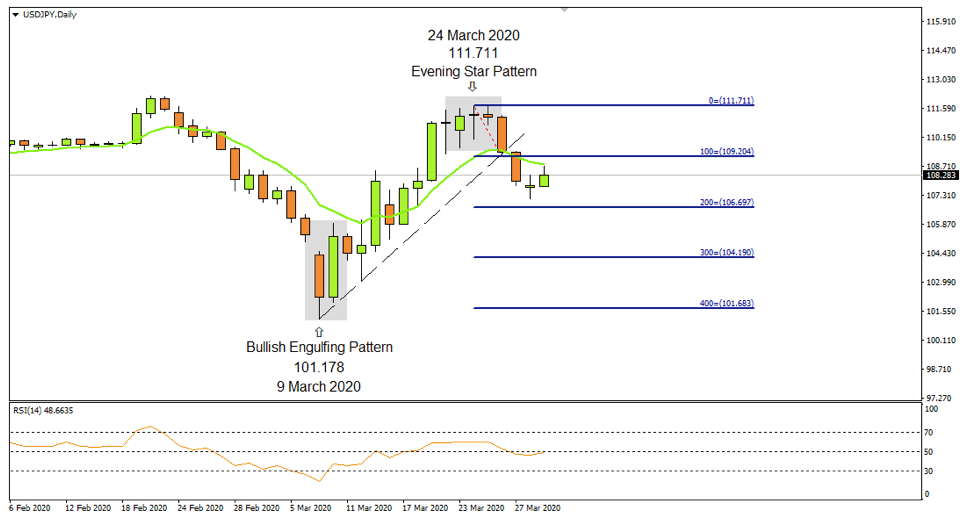

The USDJPY currency pair on the Daily Chart has been following an upward path since 9 March 2020, having found support at the 101.178 level.

The formation of the Japanese candlestick reversal pattern known as Bullish Engulfing signaled the very beginning of the upward bias.

The low prices attracted buyers who entered the market with long positions and as a result, they have pushed the USDJPY currency pair to higher levels.

Evening Star

Subsequently, the currency pair formed an Evening Star pattern near the resistance level of 111.711, which hinted at the end of the rally and the potential beginning of a decline.

Upon applying Technical analysis on the price chart, one can see that the Japanese candlestick after the Evening Star pattern managed to close below the 10-period Exponential Moving Average line.

This fact that also points to the downward direction and the bearish bias in the market.

Additionally, the Relative Strength Index Oscillator registers values below the fifty line, which also confirms the negative sentiment in the market.

Both technical indicators, as well as the Japanese candlestick reversal pattern, are in agreement in terms of the pair’s downward bias.

Trends

Furthermore, the current price is trading below the upward trend line, which also implies that supply is greater than demand.

Applying the Fibonacci Retracement tool to the low price of the Bearish Japanese candlestick at the price of 109.204 and dragging it up to the high price of the pattern at the price of 111.711, three price targets were calculated:

- The first price target is estimated at 106.697 (200%).

- The second price target is seen at 104.19 (300%).

- The third price target is projected at 101.683 (400%).

Of course, it remains to be seen whether the crowd psychology as well as the sellers’ pressure will be able to maintain control of the market, and push the USDJPY currency pair lower.

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FXTM Brand: ForexTime Limited is regulated by the CySEC (license no. 185/12) and licensed by the SA FSCA with FSP number 46614. Forextime UK Limited is authorized and regulated by the FCA (license no. 777911). Exinity Limited is regulated by the Financial Services Commission of Mauritius with license number C113012295.