Seasonality – Opportunities From Pepperstone

We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID-19 pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique.

The notion that past performance does not guarantee future returns is always true, and while I know many will disagree with this comment, on the whole I see markets as random – I know the system is almost structurally set up for equity and credit to only move in one direction, with the Fed targeting asset prices as its third mandate, and Trump seeing a higher stock market as a political weapon, but on the whole, I still see markets, especially FX, as random.

In terms of incorporating seasonality into trading, I will never take a position based on seasonal factors in isolation, but it certainly is a factor that is worthy of consideration – similar to say CFTC futures positioning or risk reversals when we see extremities.

It can assist in our assessment of probability but its price that we’re ultimately trading.

Given the political and economic challenges we’re facing through August and into September, notably in the near-term with the US fiscal negotiations going down to the wire, we need to consider the specific risk this time around.

That said, liquidity and participation are always there, and the US/EU/UK Summer holiday period is a structural issue.

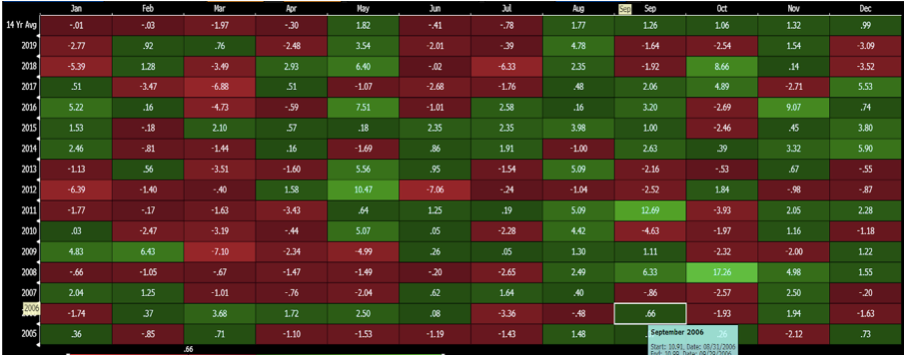

Looking At The Statistics Over The Past 15 Years

Volatility is a good place to start, and August is arguably the best month to be long volatility with returns in the VIX almost double that of the next best month (May) – We see the VIX index having gained (in August) in 10 of the past 15.

Surprisingly then that we see the S&P500 closing the month lower 46% of the time. The ASX200 tends to fare less well having declined 3.1% last August and lower for five of the past six Augusts.

In FX, again we see FX volatility (vol) most pronounced in August with the Deutsche FX volatility index moving higher in 13/15 months of August.

More recently, we’ve seen higher vol play out in the last seven consecutive months of August. If we use AUDJPY as a G10 risk proxy, we see AUDJPY 1-month implied vol rising sharply in August for the five consecutive years (or 11 of the last 15).

(Deutsche global FX 1-Month vol index)

(Source: Bloomberg)

Gold works well in August, where in the past 15 years we see the average return at 1.6%, only surpassed by January (average return of 3.9%). That is clearly working well now with gold backing up a 10.9% gain in July, with a 2.1% appreciation in August.

Happy to remain a gold bull and look for a move into $2050/70.

Without scanning all the FX pairs Pepperstone offers, it’s really risk FX that underperforms. There is no clear move in EURUSD, with the pair losing an average of 0.4%, closing lower in 9 of 15 months of August.

GBPUSD, on the other hand, is one that struggles in August, with an average loss of 1%, and falling for the past six consecutive Augusts and 11 of the past 15 years. There is no real trend in USDJPY.

USDMXN is interesting as the average gain has been 1.8%, arguably the best month to be betting against the MXN, with gains coming each of the past five years and 13/15 years. I’m not really seeing the set-up in USDMXN to really convince here, but we have broken out of a recent consolidation pattern which offers me some belief we can push into 23.35.

The AUD And NZD Typically Struggle In August

Here is AUDJPY – with an average loss of 2.2% in August. Lower in 12 of the past 15 years.

AUDUSD – an average loss of 1.9%

EURAUD – average gain of 1.6%

This is especially interesting as I have EURAUD on my radar – a break of horizontal resistance and the 200-day MA and I’ll be long for 1.7000

NZDJPY – an average loss of 2%

So, some telling seasonal’s, specifically when it comes to volatility and risk FX, such as AUD, NZD and MXN. However, will this time be different? Markets don’t repeat but they do rhyme.