AUD Trader – What Takes AUD into 60c?

On Friday, the AUDUSD closed at an 11-year low, taking the YTD losses in the pair to 5%, with the trade-weighted AUD also eyeing the lowest levels since 2009. Only the NOK has fared worse in G10 FX this year, which is unsurprising given Brent crude hones in on $50 and WTI crude oscillating around the figure.

Granted, we’re seeing some buying of AUD’s today, in line with some confidence coming back as the market rolls into latter Asia trade, but rallies are to be sold in my opinion.

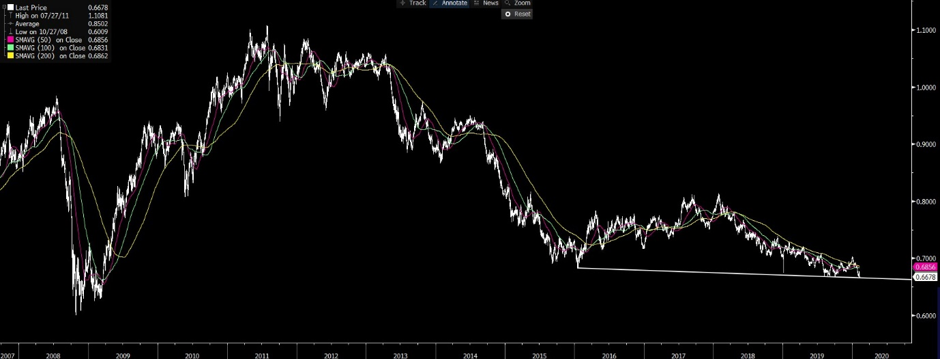

The Technical Set-up – A Break Of 0.6656 Seems Key

The set up on any timeframe above four-hours fascinates, as there has been rock-solid support seen below the 67-handle since early August. While price closed through this support on Friday, it still needs work to erode the bids, subsequently offering a higher conviction on a full resumption of the bearish trend.

We can then take the time frame out a touch and see trend support (drawn from the 2015 lows) at 0.6656, which is effectively the last bastion of clear technical support until the October 2008 and post-GFC low of 0.6009.

If I were trading this from the short side, I would be adding to short positions on a close through 0.6656.

The RBA Seems Too Optimistic

The interesting aspect here is the RBA, while maintaining its easing bias in the last paragraph of the February meeting statement, have offered a more glass-half-full outlook. We heard Governor Lowe’s testimony last week, detailing the bank still expect;

“progress to be made towards the inflation target and full employment, but only gradual“.

Lowe cautioned that further interest rate cuts would just encourage increased debt levels while acknowledging that he was pleased that house prices had risen of late.

Clearly, the barrier to cutting again have risen, and in some capacity, the RBA sees structural headwinds to their mandate, where to get anywhere near the banks 2-3% inflation target (in two year time) “we’d need to cut interest rates 3 or 4 percentage points than where we are now, so it’s just not practical at the moment“.

It’s hard to disagree with this call, and rates traders have responded, pushing out the probability of a rate cut in the March meeting to just 10%, 29% for April, with the May meeting a coin toss at 46%.

We can look further out and see 31bp basis points of cuts priced over the coming year, having fallen from 44bp seen in the week prior.

The AUD As A China Proxy

The question is whether changes in interest rate pricing really dominate the variance of the AUD when the greater influence seems to be the shape of the Chinese economy in Q1 and beyond, given the radical actions of Chinese authorities to contain the Coronavirus.

Traders are buying USD’s on a broad basis, given its status as the best house on a bad neighbourhood, or the least dirty shirt, with capital moving as far away from China and those countries with incredibly close economic links, such as New Zealand and Australia.

One also suspects the market is highly sceptical that the RBA will be on the money with its latest forecasts/assumptions for growth.

Take its updated Q420 GDP forecast (from last weeks SoMP), for example, which we saw cut to 2.7%.

This is already 40bp above the consensus call, which I’d then argue is in itself too high given it is affected and skewed by investment banks calling for Q420 GDP above 3% and this will soon be downgraded.

Growth aside, it’s the labour market that is key though, which is a worry given it is a lagging indicator in many capacities, with Lowe saying;

“If the unemployment rate were to be moving materially in the wrong direction and there was no further progress being made towards the inflation target, the balance of arguments would tilt towards a further easing.”

My preferred leading indicators, which include ANZ job ad’s or NAB capacity utilization rates, suggests upside risk to the unemployment rate in the next two to three quarters and a slight rise from the current rate of 5.1%.

Employment Reports

This puts the next two employment reports (19 March and 16 April) as potentially setting the stage for a cut in May, with May heightened by the fact we have Aussie Q1 CPI print on 29 April.

Of course, should we see financial markets really roll over, causing a sharp tightening of financial conditions, then a cut in March or April becomes more likely, but in this environment, we’re likely to see rate cut expectations ramp up globally and not just in Australia?

The RBA Should Change The Mindset Of The Consumer

My own view, for what it’s worth, is the RBA need to evolve and engineer animal spirits in Australia.

Change the psyche of the consumer, get them spending and not just through heavy discounting.

This could entail getting well ahead of the curve – Get the cash rate down to the lower bound, suggest QE is a policy tool they are locked and loaded to use, put the wind to the AUD’s back and import inflation.

Offset the risk to asset prices and debt levels with macro-prudential. Then hope China has done enough over the coming weeks to contain the virus and US economics stay firm ahead of the US election.

This perhaps all sounds rather simplistic, but with the reflation trade on ice, with this message clear in the bond and commodity markets, the AUD will look less at domestic factors and becomes a vehicle for expressing the economic prowess of the Chinese economy.

Should we get any chinks in the labour market, and the AUD will find sellers all too easy to find, and that gulf between 0.6656 and 0.6009 will be filled rather quickly.