Liquidity The Driver – But Valuations Will Matter Eventually

The sweet spot for global equities looks even more pronounced here and as suggested yesterday, the current debate is not whether you are bullish, but whether there is too much short-term euphoria.

My own view on many global equities is that when liquidity is the dominant driver, we can afford a little overheating. However, at some stage valuation will matter, or at least cap the upside, and the fact the S&P500 trades on 17.5x forward (see below) – the highest consensus price-to-earnings ratio since February 2018 is a consideration.

As is the slight widening in high yield credit. Here we see the S&P 500 (yellow-inverted) vs the HY/UST yield spread – white

Low Implied Volatility Soothing Traders

However, for now, implied volatility is low in all asset classes (helped by better liquidity), and traders are happy to pay up for the future earnings and cash flows, with small caps still leading, cyclicals outperforming defensives and value working beautifully as a factor.

I look at the S&P 500 value index ETF (IVE), which has put on an additional 0.7% today and trades at all-time highs.

As far as the market internals go, I look at the number of companies making new 4- and 52-week highs, as well as the number of companies above their 20-, 50- and 200-day MA, and those with an RSI above 70 and above the top Bollinger Band.

Here, I still haven’t got a signal that too much euphoria is backed in, or at least one that gives me any conviction to exit longs.

Europe And China

This is also true in other equity markets where Europe and China look truly bullish.

We offer clients the China A50 index, and that has seen some increased attention of late, closing at the highest levels since 2018.

It needs a bit more work, but when it comes to equities, China is the home of FOMO, as it is primarily retail-driven and there is nothing more emotive than watching your neighbour getting rich.

Consider that the CSI 300 is now up 32.1% YTD (29.3% in USD terms).

Europe is also looking sensational, with the EU Stoxx putting on a further 1.1%, while the DAX gained 1.4%.

Europe is a play on China, so as long as we are seeing gains in China’s markets then EU equities will find support.

A weaker EURCNY would presumably help too, but EURCNY holds a 7.9000 to 7.75 range and seems destined to hold this in the ST.

Dynamics Facing The RBA And Australian Banking Landscape

Here in Australia, the ASX 200 lacks the same sort of trend and momentum, and for me the index is a sell into 6770, although, given the moves in the SPI futures overnight, and our opening call of 6719 (+33p) is still some way off that level – this being the top of the multi-month range and top Bollinger band.

Today’s tape again focused not just on the moves in materials, where I’d expect to see BHP opening 1% to 1.3% higher, but more so financials, which got so shaken as a result of a 15% cut in WBC dividend.

If ever there was a more glaring endorsement that the RBA are either at their lower bounds in the cash rate or have perhaps had just one more cut left in them, it is a cut to a major banks dividend.

A flatter curve, ever-lower rates and with no clear offset from higher credit growth will not work well for banks, and the RBA will be cognisant of this as they need these institutions working effectively to help with the effectiveness of their own policy, but the effect lower equity prices have on the wealth effect. Too big to fall if you like.

It should be reflected in a more balanced, neutral statement from the RBA today when they hand down their statement and outlook.

AUD

The move in the AUD really comes when we mark-to-market the statement against rates pricing, where we see around 13bp (or just over 50% chance) of cuts priced for February and 17bp by September.

With a clear wait-and-see attitude, a better feel to the external picture (specifically trade and Brexit) and a tick down in unemployment, this meeting should, in theory, be a non-event for both the rates and AUD.

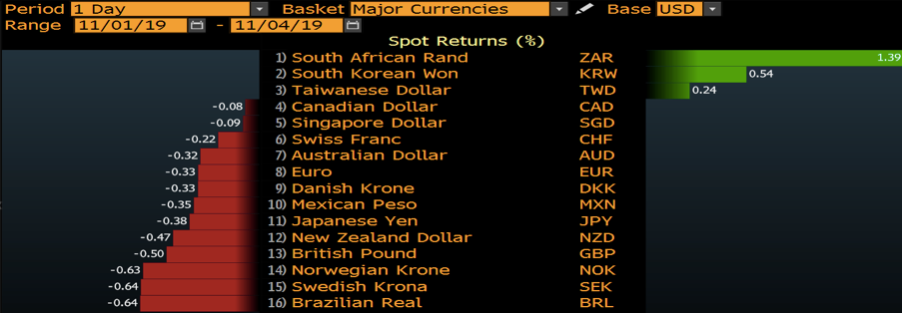

The fact we see the AUDUSD down 0.32% on the session, is not a play on concerns around holding AUD longs into the RBA meeting, more a broad USD rally, with the greenback gaining modestly against all G10 currencies.

USD

Why the USD has rallied is the subject of debate, and after last week’s bearish technical developments I remain of the view that there are greater near-term downside risks for the USD.

However, despite a 0.6% drop in factory orders, and a 1.2% decline in durable goods, which has seen the Atlanta Fed’s Q4 GDP nowcast model taken down to just 1%, and we are seeing modest gains.

We also saw an 8ppt move higher in the Fed’s loan officer survey. This often gets overlooked by the market but I see it as important and therefore have placed in my ‘Fed consideration’ model – see below

Here we see 5.4% of respondents (in large corps) see tighter leading conditions, which is the highest level since 2016 and while that doesn’t sound like a lot, consider in the last two recessions this percentage (who saw tighter lending conditions) stood at 14% and 10% respectively.

It suggests to me that if we see corporate credit spreads widen further against Investment-grade and US treasuries then equity will find sellers.

Also consider that despite this series of US we’ve seen a slight steepening of the curve, with long-end yields selling off fairly aggressively (US 10s are +7bp) and I question if the rise is driven by carry buyers in G10, with the US yield advantage working.

Let see how the USD fares with tonight’s event risk in the form of US services ISM (02:00aedt), with expectations of 53.5.

Again, I have this in my Fed model, so a number below 52.0 could see rate cut expectations push up a touch, where at this juncture we see 46bp of cuts priced by December 2020.

*all charts source from Bloomberg