OBR Invest Review 2024

- Daytrading Review TeamOBR Invest is a good pick for beginners with its easy-to-use trading platform, free demo account, education centre, and access to popular financial markets.

OBR Invest is a CySEC-regulated investment firm offering the MetaTrader 4 platform and 300+ instruments. The brokerage launched in 2012 and has since proven popular with forex and CFD traders with a choice of live accounts to suit different strategies and budgets.

Forex Trading

With 55 forex pairs, OBR Invest offers a decent selection including all majors plus popular crosses and some exotics. The variable spreads are also fair, with EUR/USD available from 1.6 pips, but there is nothing to make this broker's forex offering stand out.

Stock Trading

OBR Invest traders can speculate on more than 100 global stocks from international exchanges using CFDs. This is not a very wide selection of stocks, but we like that it includes some top international companies including Apple, Adidas, Ferrari and Royal Shell.

CFD Trading

OBR Invest offers CFDs on 300+ instruments including forex, stocks, indices, commodities and cryptocurrencies. Although we feel this selection is fairly small, it is good to have the choice of a beginner-friendly web platform or MT4.

Crypto Trading

OBR Invest offers a decent selection of popular cryptos, including crypto cross pairs and fiat pairs with Bitcoin. CFDs – retail client accounts generally lose money

✓ Pros

- Regulated broker with CySEC license

- Free demo account with quick sign-up

- MetaTrader 4 integration plus intuitive web platform

- Full range of investments including popular cryptocurrencies

- Multiple payment methods with free deposits

- Leverage up to 1:400 for professional clients

- Trading Central market insights

✗ Cons

- OBR Invest is not available to US, UK or Belgian clients

- Withdrawals fees apply for basic accounts

- No copy trading platform

- €80 inactivity fee

OBRInvest is a licensed broker offering forex, stock, index, commodity, and cryptocurrency CFD trading. This review will cover all you need to know about trading with the firm; from the fee structure to platforms, leverage and regulation. Find out what OBRInvest has to offer.

OBRInvest Headlines

OBRInvest is owned and operated by OBR Investments Limited. The company was founded in 2012 and today, its 300+ assets are available to trade worldwide.

OBRInvest provides a full range of financial services to both institutional and private clients. Its services are regulated by the Cyprus Securities and Exchange Commission (CySEC).

The online brokerage also offers a user-friendly education hub for beginners and accepts a long list of popular deposit options, including Visa, Mastercard, Skrill, Neteller, and Rapid Transfer.

Trading Platforms

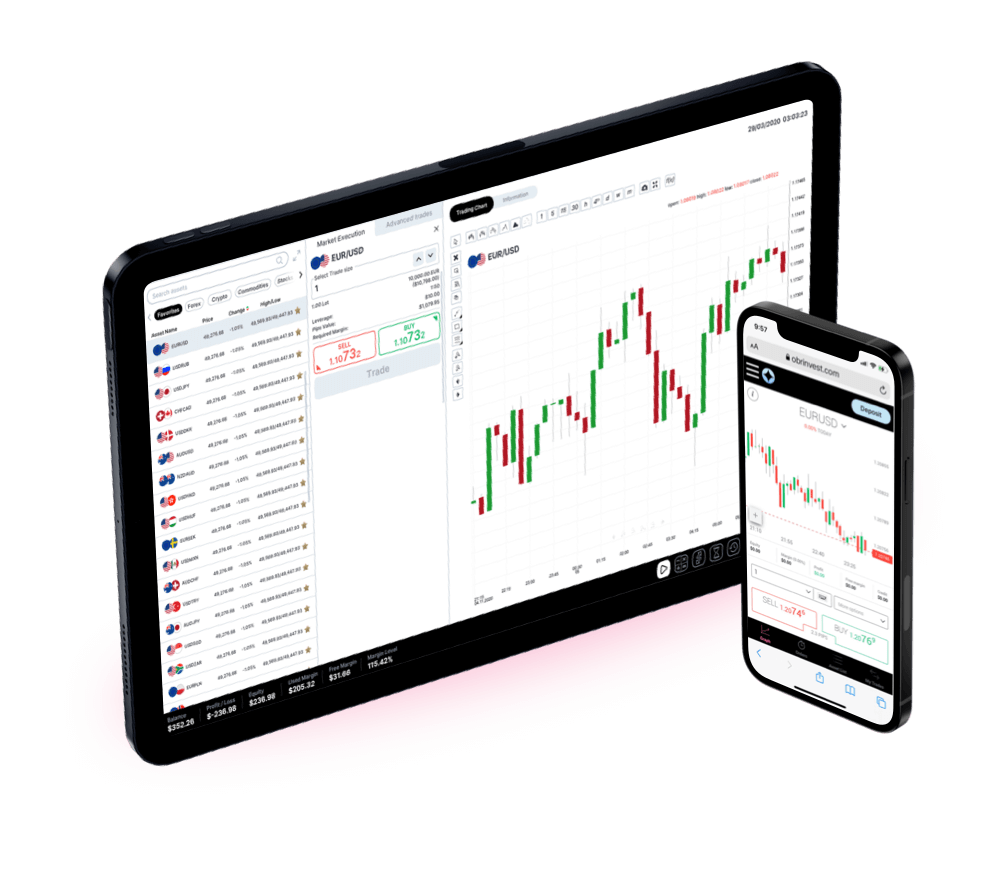

WebTrader

To access the web-based platform, select Trade in your client portal. The WebTrader platform allows clients to trade directly through the internet without the hassle of downloading software onto their device.

A straightforward charting view is available with key market information available per asset. Clients can choose between market execution and advanced trades with pending orders and take profit/stop loss orders.

The OBRInvest WebTrader is a good option for beginners. Platform tutorial videos are also available for new investors.

How To Place A Trade

Making a trade with OBRInvest is quick and easy:

- Head to the OBRInvest website and login

- Navigate to the Assets search bar on the left-hand side

- Search for the asset you wish to trade

- Enter the size of lot and add parameters

- Select Trade

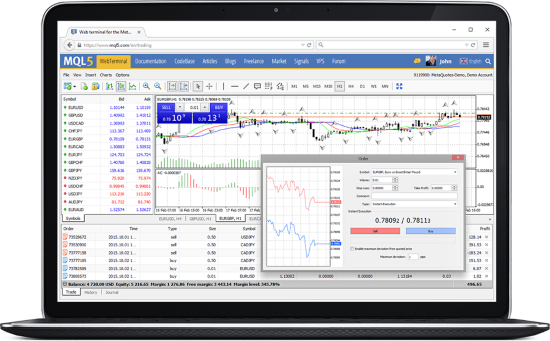

MetaTrader 4

OBR Invest also offers the hugely popular MetaTrader 4 (MT4) platform in addition to a web-based alternative. MT4 is one of the most popular trading platforms on the market, so for many traders, it will need little introduction. But, for those that are less familiar, the platform offers the following features:

- One-click trading

- Intuitive interface

- Automated trading

- Instant order execution

- Built-in custom indicators

- Mobile support via iOS and Android

- Advanced charting with 9 timeframes

- 23 analytical objects and 30 integrated indicators

The platform is available for download directly from the broker’s website.

Assets & Markets

OBRInvest offers more than 300 trading instruments, including:

- Forex – 55 forex pairs

- Commodities – A great way to diversify a portfolio, trade precious metals, energies and coffee

- Stocks & indices – Access global indices and shares, such as Dow Jones, DAX 40, Amazon and Intel

- Cryptocurrencies – The biggest names in crypto including Bitcoin, Ethereum, Ripple, Polkadot and Tether

Spreads & Commission

A spread is the difference between the bid (sell) and ask (buy) price. At OBRInvest, premium account holders will have access to the tightest spreads.

Spreads at OBR Invest are not the most competitive we’ve come across. The EUR/USD spread, for example, begins from 1.6 pips – much higher than the industry average of around 1 pip. Basic account holders will also be subject to even higher costs. These spreads can eat into profit margins, so we’d advise that you compare spreads at a number of brokers to ensure you’re getting a fair rate.

Leverage Review

Leverage is also referred to as borrowed capital. It is a strategy used to increase potential profits by multiplying the initial cash outlay. OBRInvest offers high leverage levels up to 1:400 for professional clients and 1:30 for retail clients.

Traders should be cautious when using leverage as it can boost returns but can also significantly increase losses.

Mobile Trading

Clients can trade on the go using OBRInvest’s mobile web platform. Mobile trading provides ultimate flexibility so you can view positions and execute orders anytime, anywhere. The app, which is available to download for Android and iOS devices, receives positive reviews online owing to its user-friendly interface and range of functions.

OBRInvest Payment Methods

Clients can deposit using a credit card, e-wallet or bank wire transfer. To do so, log in and then select the Deposit option. You will be required to verify your transaction. There are no fees for making a deposit.

To make a withdrawal, click on the Banking tab followed by the Withdrawal tab, which can be found in your live portal. There are no minimum amounts for withdrawals made to credit cards or e-wallets. Those made by bank wire transfer have a minimum limit of £80.

Withdrawal charges will vary according to the account type held. Premium holders can make withdrawals for free, while Platinum holders can make three free withdrawals each month. Gold holders can make a single free withdrawal per month, while Basic holders can only make one free withdrawal.

Withdrawal requests are usually processed within 24 hours. Once processed, it can take up to five days for the funds to appear in your account.

Demo Account

OBRInvest offers a demo profile to all clients. Demo accounts are credited with 100,000 in virtual funds. It is strongly recommended that clients make use of this opportunity. Demo accounts are a great way to explore a new trading platform, trial strategies and explore the range of assets on offer.

Head to the OBR Invest website to open a demo profile.

Deals & Promotions

In accordance with CySEC regulation, OBR Invest is not able to offer any promotional bonuses or trading incentives.

OBR Invest Regulation

OBR Invest is owned and operated by OBR Investments Limited, a Cypriot Investment services firm. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 217/13. This is a top-tier regulator and a reassuring sign that the broker can be trusted.

Unfortunately, the company is not licensed with the ASIC or FCA for traders from Australia and the UK.

Additional Features

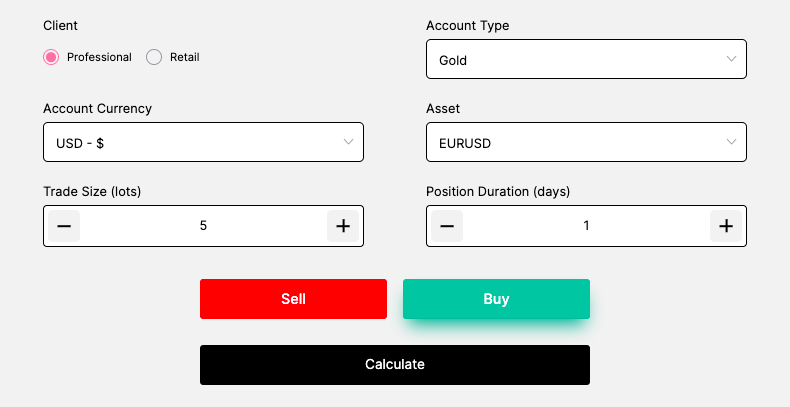

A range of additional resources can be accessed via the OBRInvest website. You can find basic tools such as a glossary and an economic calendar in addition to some more specialized resources:

- Trading Central – Provides news, insights and market analysis

- Tip ranks – View tips and tricks to help spot a future trading opportunity

- Cost calculator – Determine trading fees before opening a position

You can also find additional information in the form of webinars and eBooks on popular topics such as technical analysis, margin, leverage and strategies. Head to the Education tab on the broker’s website to find out more.

OBRInvest Accounts

OBRInvest offers four account types; each gets progressively more competitive.

For retail clients, there are two options:

- Basic – The minimum deposit is €250. Floating spreads start at 3.0 pips for EUR/USD, 3.4 pips for GBP/USD and 3.3 pips for USD/JPY. Clients can make one free withdrawal.

- Gold – The minimum deposit is €25,000. Floating spreads start at 2.7 pips for EUR/USD, 3.0 pips for GBP/USD and 3.0 pips for USD/JPY. Clients can make one free withdrawal per month.

For professional clients, there are two options available:

- Platinum – The minimum deposit is €100,000. Floating spreads start at 2.1 pips for EUR/USD, 2.5 pips for GBP/USD and 2.4 pips for USD/JPY. Clients can make three withdrawals per month for free.

- VIP – The minimum deposit is €250,000. Floating spreads start at 1.6 pips for EUR/USD, 2.0 pips for GBP/USD and 1.9 pips for USD/JPY. There are no withdrawal fees.

Trading Hours

Trading hours vary according to the market and asset traded. The forex market is open 24 hours a day except for weekends, spanning several time zones. The 24-hour market guarantees liquidity, which is one of the reasons that the forex market is so appealing. For the best rates, traders are advised to trade during periods of high volume.

Cryptocurrencies can be traded 24 hours, 7 days a week. Assets such as commodities, stocks and indices vary but are typically traded Monday – Friday. Information regarding specific sessions can be found via the account portal.

Customer Support

Customer support can be accessed via the OBRInvest website, which is available in eight languages including English and Spanish. You can make contact by either:

- Phone – +357 25763605

- Email – info@obrinvest.com

There is also a live chat function hosted on the broker’s website.

Safety & Security

OBR Invest takes steps to ensure the safety of client funds. All transactions are secured with a 128-bit SSL encryption certificate.

As part of the registration process, prospective clients will be required to submit a host of personal details to verify their identity. Additional verification will also be required when making a withdrawal. The broker also adheres to EU GDPR rules in relation to data protection.

When we used OBR Invest’s services, we did not have any concerns regarding the safety of client funds.

OBRInvest Verdict

OBRInvest is suitable for novice, experienced and professional traders. The broker has a good range of assets and accounts in addition to a popular trading platform, demo account and mobile investing solution. OBRInvest also operates under EU regulation and prioritizes the safety of client funds.

However, the fee structure is not the most competitive we have seen. Clients may be liable to pay for withdrawals and inactivity charges. And while using OBRInvest, our experts found that the spreads were notably above the industry standard. Basic account holders are particularly stung by the fee model. If you find yourself in the Basic bracket, there are more price-competitive brokers available.

FAQs

What Is The Minimum Deposit To Open An Account With OBRInvest?

$250 or equivalent is the minimum deposit required to open an OBRInvest standard account. The minimum capital outlay also increases as you move up the account tiers.

How Can I Login To My OBR Invest Trading Account?

To access your live trading profile, head to the broker’s website. In the top right corner, you will find an option to ‘Log in’. Click here and enter your account details.

Does OBRInvest Offer A Demo Account?

Yes, clients have the opportunity to get to grips with the broker’s services before opening a live account. Sign up for a demo profile with no charge and enjoy risk-free trading. It is recommended that clients make use of the demo account before investing capital.

Which CFDs Are Available With OBR Invest?

OBRInvest offers forex, cryptocurrencies, stocks, indices and commodities. There are more than 300 CFD trading instruments available.

How Can I Contact OBRInvest?

If you have encountered an issue with your trading account, or if you’d like to know more about their services, you can contact the broker on the phone at +357 25763605, email at info@obrinvest.com, or live chat. For more general inquiries, head to the online broker’s website where you will find a series of FAQs.

Top 3 Alternatives to OBR Invest

Compare OBR Invest with the top 3 similar brokers that accept traders from your location.

-

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade

OBR Invest Comparison Table

| OBR Invest | Pepperstone | IG | AvaTrade | |

|---|---|---|---|---|

| Rating | 3.6 | 4.8 | 4.4 | 4.9 |

| Markets | Forex, commodities, cryptocurrencies, stocks, indices | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $0 | – |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Leverage | 1:30 (Retail), 1:400 (Pro] | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:30 (Retail) 1:400 (Pro) |

| Payment Methods | 11 | 11 | 6 | 13 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Pepperstone Review |

IG Review |

AvaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by OBR Invest and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| OBR Invest | Pepperstone | IG | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | No | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

OBR Invest vs Other Brokers

Compare OBR Invest with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of OBR Invest yet, will you be the first to help fellow traders decide if they should trade with OBR Invest or not?