NSFX Review 2024

NSFX delivers tight spreads across FX and CFDs on the JForex & MT4 platforms.

Forex Trading

Buy and sell over 50 currencies with competitive floating spreads.

Stock Trading

NSFX faclitates trading on the largest indices from around the world, including in the US, UK, Europe and Asia.

CFD Trading

Speculate on a range of financial markets with leveraged CFDs at NSFX.

NSFX is an online trading brokerage, headquartered in Malta. Founded by a group of experts in the finance industry, their aim is to create a professional and transparent trading environment. Their ethos is built on three pillars; innovative platforms, expert tools and superior trading conditions. This review will assess the services offered by NSFX to help you decide whether to open a live account.

NSFX Headlines

Founded in 2012, NSFX Ltd. is a forex and CFD broker, regulated by the MFSA. The company operates in English, French, German, Italian, and Arabic speaking markets. The brokerage is led by John Cassar Torregiani who has had a reputable career in international banking and EU policy-making. David E. Gristci TEP, a prominent financial services lawyer in Malta, is also a director at NSFX.

The company’s board of directors, regulation and client fund protection all indicate the broker is trustworthy.

Trading Platforms

NSFX offers the JForex terminal and the well-known MT4 platform. Both can be downloaded to desktop and mobile devices or accessed via webtrader solutions.

MT4

MT4 is widely regarded as the leading retail trading platform, with millions of users worldwide. With a range of customisable analytical functions, it suits beginners up to experts. The desktop option offers the most functionality, delivering an array of additional charting tools, strategies, indicators and expert advisors.

Key features include:

- Powerful charting tools

- Custom trading strategies

- Multiple execution modes

- Real-time quotes and one-click trading

- Automated trading alarms and market signals

JForex

JForex is also suitable for traders of all skill levels. ECN and STP technology connect traders directly to the markets. The platform offers top-tier liquidity and execution, resulting in tighter spreads. The built-in API allows for custom strategies and programming.

Prominent features include:

- Secure login

- Tight spreads

- Rapid execution

- ECN & STP trading

- Cross-connected platforms

- Over 180 technical indicators

- Integrated economic calendar

Markets

There are over 140 products to trade with:

- Forex – 50+ currency pairs, including all majors

- Indices – Leading global indices, including the FTSE, DAX and US 30

- Commodities – Precious metals such as gold and silver, plus crude oil

Whilst a fair selection, our review would have liked to see cryptocurrencies such as Bitcoin.

Trading Fees

Spreads at NSFX are fairly competitive. Both fixed and variable spreads are available depending on the account type. Note variable spreads can widen significantly during periods of low liquidity and high volatility.

Spreads on forex major pairs:

- EUR/USD – 0.5 pips

- GBP/USD – 1.2 pips

- USD/JPY – 1.4 pips

- USD/CHF – 1.2 pips

Spreads on major indices:

- FTSE 100 – 3.0 fixed spread, 1.3 ECN spread, 0.05% commission

- USA 30 – 4.0 fixed spread, 3.0 ECN spread, 0.01% commission

- DAX 40 – 3.0 fixed spread, 1.5 ECN spread, 0.05% commission

NSFX Leverage

As an EU-regulated broker, leverage is capped at 1:30. This translates into a 3.33% margin requirement. This is in line with most reputable online brokers. Always approach leveraged trading with caution as it can amplify both profits and losses.

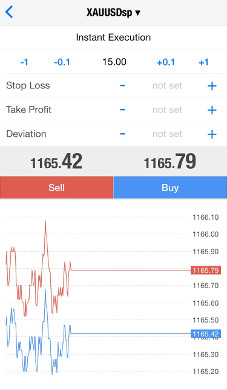

Mobile Apps

Designed for traders on the move, the MT4 app offers full access to investment portfolios and settings. Instant and pending orders are available along with floating spreads and dozens of technical indicators. A user-friendly and secure mobile application, the MT4 app is an excellent mobile forex trading solution.

Available on Apple and Android, the JForex app has a slick interface while boasting a host of charting and analytical tools. The only major drawback is that expert advisors, custom strategies and DOM data are limited on the mobile application. For full trading functionality, we’d recommend sticking with the desktop JForex platform.

Deposits

A range of deposit and withdrawal methods are offered by NSFX. All deposits are secure, recorded and trackable. There are no deposit fees with any of the payment solutions:

- Wire transfer – 2-3 days

- Mastercard – Instant

- Maestro – Instant

- Visa – Instant

- Skrill – Instant

- Neteller – Instant

Withdrawals

Withdrawals can be made via the MyNSFX dashboard. Fees and processing times are as follows:

- Wire transfer – Up to 2 business days, no fees

- Mastercard – Up to 1 business day, no fees

- Maestro – Up to 1 business day, no fees

- Visa – Up to 2 business days, no fees

- Skrill – Up to 1 business day, 2.9% fee

- Neteller – Up to 1 business day, 2.9% fee

Demo Account

NSFX offers a free demo account for an opportunity to practice trading in simulated market conditions. The account comes with an opening virtual balance of $100,000 and can be used on the MT4 and JForex platforms. This is a great option for new traders or established investors looking to test the broker’s tools and strategies without risking capital.

NSFX Bonuses

There were no deals or promotions at the time of writing; however, NSFX has been known to run deposit bonus schemes. Refer to the broker’s website for the latest promotions.

Regulation Review

NSFX Limited is regulated by the Malta Financial Services Authority (MFSA). The broker is also subject to oversight from other bodies across Europe, including the BaFin, ACP, Consob, CNMV, Finanstilsyne. Additionally, NSFX is MiFID compliant. Regulatory oversight from the financial bodies listed above provides a high level of transparency and trust.

NSFX Ltd. also pays into a compensation scheme. This protects 90% of investor funds, up to €20,000, against insolvency. Negative balance protection and client fund segregation with reputable partner banks such as Barclays also adds to the broker’s trust rating. Overall, we are comfortable NSFX Ltd. is not a scam.

Additional Features

NSFX offers a host of educational resources. The academy area of the website is home to webinars, videos and eBooks on a plethora of topics. The educational content is well designed, illustrated and curated to teach everything from beginner courses up to advanced strategy lessons.

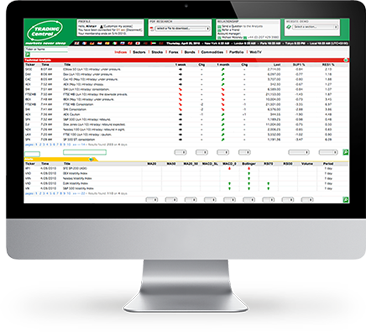

The broker has also partnered with Trading Central – an innovative analytics service. They offer daily newsletters, a web portal and a plug-in that can be used on your MT4 account.

You can also use the Guardian Angel MT4 plug-in with NSFX. Guardian Angel offers real-time risk guidance and market feedback to capitalise on live trading conditions. Additional tools include an economic calendar, financial news and fundamental analysis from the broker’s analysts.

NSFX Accounts

There are three account types to choose from, each tailored to suit traders with different needs and skillsets. The minimum trade size on all accounts is 0.01 lots.

MT4 Fixed

This account is designed for trading major forex pairs with fixed spreads. The minimum deposit is $300. Execution is instant and there is no commission. Scalping and expert advisors are not allowed.

MT4 ECN

This account offers forex, indices and commodities at variable spread rates. The minimum deposit is $3,000. Commission is $8 per lot. Market execution is offered, scalping is allowed and expert advisors are enabled.

JForex

This account offers forex, indices and commodities with variable spreads and DOM data. The minimum deposit is $5,000 and the commission is again $8 per lot. Scalping is allowed and expert advisors are available. A personal account manager is also assigned to the JForex account.

Benefits

- MT4 trading

- ECN technology

- MFSA regulation

- Educational resources

- $300 minimum deposit

Drawbacks

- Slow customer support

- No cryptos

- No VPS

Trading Hours

NFSX is open for trading during standard market opening times. See the broker’s website for a breakdown by instrument. Note trading during periods of low liquidity typically results in wider spreads.

Customer Support

There are a variety of ways to contact NSFX. International contact numbers and email addresses are accessible via the ‘Contact Us’ section on the website.

- Email – support@nsfx.com

- Live chat – logo on website

- Malta HQ telephone – (+356) 2778 1919

Unfortunately, we experienced very slow replies on the live chat and email which may deter some traders.

Note, the company’s office addresses are listed on the broker’s website.

Security

SSL software and firewalls are in place on the NSFX website and platforms to protect personal information. Data isn’t shared or published unless the broker is legally required to do so. Privacy policy and terms and conditions are available on the company website.

NSFX Verdict

NSFX is a transparent broker. The website and platforms are easy to navigate and there is a wealth of educational tools. Whilst the brokerage doesn’t offer the most extensive range of financial instruments, spreads are reasonable and there is a choice of live accounts. The strong regulatory oversight is also a good sign NSFX is a legitimate company that can be trusted.

Top 3 Alternatives to NSFX

Compare NSFX with the top 3 similar brokers that accept traders from your location.

-

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

NSFX Comparison Table

| NSFX | Swissquote | AvaTrade | FP Markets | |

|---|---|---|---|---|

| Rating | 2.5 | 4 | 4.9 | 4 |

| Markets | Forex, CFDs, indices, commodities | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $300 | $1000 | – | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | MFSA | FCA, FINMA, DFSA, SFC | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | ASIC, CySEC, ESMA |

| Bonus | – | – | – | – |

| Education | No | No | Yes | Yes |

| Platforms | MT4, TradingCentral | MT4, MT5, AutoChartist, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | 1:30 | 1:30 | 1:30 (Retail) 1:400 (Pro) | 1:30 (UK), 1:500 (Global) |

| Payment Methods | 6 | 5 | 13 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Swissquote Review |

AvaTrade Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by NSFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| NSFX | Swissquote | AvaTrade | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

NSFX vs Other Brokers

Compare NSFX with any other broker by selecting the other broker below.

FAQ

Is NSFX a regulated broker?

NSFX Ltd. is regulated by the MFSA and operates under MiFID, BaFin, ACP, Consob, CNMV, and Finanstilsyne. This means the broker complies with a range of policies that protect clients from illegal and unethical conduct on the part of NSFX.

Which trading platforms does NSFX offer?

NSFX offers the renowned MetaTrader 4 platform and its JForex terminal. Both of these are available on mobile, desktop and as webtrader solutions.

Does NSFX offer a demo account?

A demo account is available with NSFX and comes with $100,000 in virtual funds. This is perfect for anyone that wants to learn how to trade before investing real money.

How much capital do I need to trade with NSFX?

The minimum deposit at NSFX is $300. This will open the MT4 Fixed account, a forex trading solution offering static spreads and the MetaTrader 4 platform.

Is NSFX a good broker?

NSFX is a good and reliable broker. Strong regulation and client fund protection inspire confidence and trust. The educational resources available are also a positive asset, creating a strong community of traders.

Customer Reviews

There are no customer reviews of NSFX yet, will you be the first to help fellow traders decide if they should trade with NSFX or not?