NBH Markets Review 2024

NBH Markets offers 60+ assets with floating spreads and a suite of tools.

Forex Trading

Start trading a range of currencies online with ultra-low spreads.

Stock Trading

Trade on cash indices with NBH Markets.

CFD Trading

NBHM offers highly leveraged CFDs on multiple financial markets.

NBH Markets (NBHM) LLC is a precious metals, indices and forex broker backed by physical gold. It is one of several global companies that sits under the National Bullion House Group established in Dubai, alongside NBH Markets EU Limited. Read this trading review of NBHM to find out more about the premium offshore broker including specific markets and promos available.

NBH Markets Headlines

Formerly known as NBH Markets Ltd, NBH Markets LLC was established in 2018 in St. Vincent and the Grenadines. It is registered under the St. Vincent and the Grenadines Financial Services Authority (No. 241 LLC 2020).

NBH Markets belongs to the NBH Group, which provides services such as risk management and CFD trading under one hub. NBH Market’s vision is to provide premium services to investors, with gold-backed stability offered by the National Bullion House.

Trading Platforms

MT4

NBHM offers the popular MT4 forex trading platform, which provides an impressive range of indicators, analytical functions and highly customisable charts. The interactive charting has 9 timeframes ranging from minute to monthly. Additionally, 30 built-in indicators and 2,000 free custom indicators enable market analysis of varying complexity. 24 analytical objects allow for trend detection and price forecasting.

The built-in MQL4 programming language can be used to create bespoke Expert Advisor robots to automate trading strategies. These bot algorithms can also be downloaded from the free codebase.

MT4 has a community chat function that enables traders to connect with a global network of experts and learn about successful trading strategies.

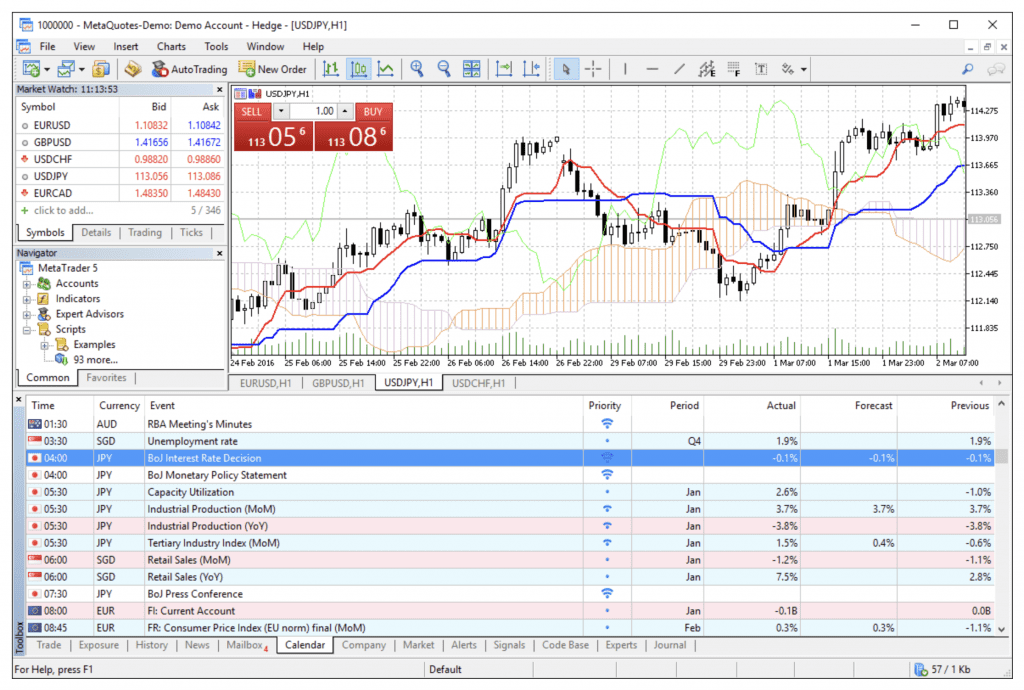

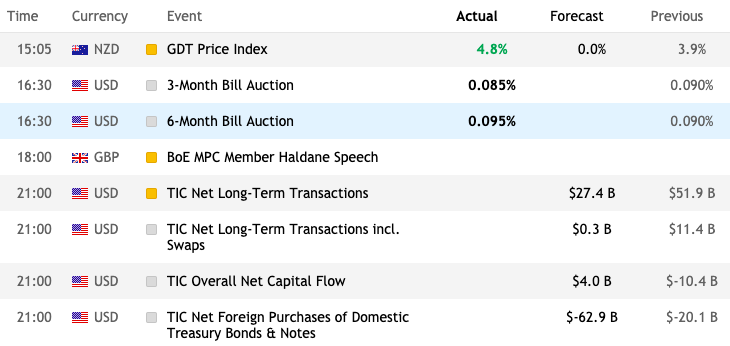

MT5

NBH Markets also provides the multi-asset platform MetaTrader 5, which is the successor to the popular MT4. MT5 boasts 8 additional built-in indicators and a further 12 timeframes. Additional functionality includes one-click trading and an economic calendar delivering macroeconomic news. MQL4 programming language is replaced by MQL5, which delivers programs that run up to 20 times faster.

MT4 and MT5 are available for desktop download or can be accessed using the cloud network and mobile app.

FIX API

NBH Market’s proprietary Financial Information Exchange allows traders to create automated trading systems, with high-speed order routing and wide market coverage. Trades are executed directly through servers resulting in latency as low as 1 millisecond.

Assets

NBHM clients can trade over 60 different markets from a single account, with CFD trading on forex, cash indices and precious metals available. The widest offering is forex, with 44 major and minor pairs offered. Additionally, customers can trade popular cash indices such as DE30cash and precious metals (gold and silver).

While NBH Markets provides weekly articles discussing a range of topics including Bitcoin, it does not currently offer trading of cryptos.

Spreads & Commission

The spreads available and commission charged varies depending on the account type, though all spreads are floating. The spreads are competitive for the Pro and Elite accounts, however these come with higher minimum deposits so may not be accessible for some traders.

Spreads start at a minimum of 1.6 pips for the Standard account, reducing to a minimum of 0.2 pips and 0.0 pips for the Pro and Elite accounts respectively.

No commission fees are charged for trades using the Standard account, but customers will be charged $2.5 per $100,000 traded with the Pro account and $20 per $1 million traded with the Elite account.

Leverage

NBH Markets offers leverage from 1:100 up to a generous 1:500 across all account types. This enables traders to increase their position for a given cash outlay. However, high leverage can result in larger losses, so customers should ensure they are aware of the risks before they start trading.

Mobile Apps

The MT4 and MT5 trading platforms both offer apps that are compatible with iOS and Android and are highly rated on the App Store and Google Play. Both apps offer all tradeable assets available through the desktop platform, but with only three graph types and a reduced selection of indicators and analysis tools. Chat functionality and push notifications are also available on the app.

Payment Methods

Deposits

NBHM accepts deposits using Mastercard and Visa, eWallets and wire transfers. There are no deposit fees for card payments and wire transfers, however transaction fees are charged for several of the eWallet providers:

- Skrill – 0%

- Neteller – 0%

- ADVcash – 3%

- Fasapay – 0.75%

- Globe pay – 4%

- PayTrust – 3%

Withdrawals

Same day withdrawals are available for all methods except wire transfer which takes 3-5 working days depending on the bank. A minimum withdrawal of 5USD applies to all withdrawals. Commission fees apply for some online eWallet withdrawal methods:

- Skrill – 1.5%

- Neteller – 2.5%

- ADVcash – 6USD/EUR + 3%

- Fasapay – 0%

- Globe pay – 1.5%

- PayTrust – 1.8%

Demo Account

NBHM provides a demo account for customers to test their trading strategies in a risk-free environment. Upon registration customers will receive $300,000 of virtual funds to trade with. A live account isn’t required to test this NBHM demo account, though the account will expire after one month.

NBH Markets Bonus

NBH Markets currently does not offer a welcome bonus. However, an expired promotion gave customers the opportunity to win 1kg in gold, by trading forex, cash indices or commodities. Customers are therefore advised to check the official website for any future offers and promos.

Regulation Review

NBHM is registered with St. Vincent and the Grenadines Financial Services Authority (SVG FSA) under No. 241 LLC 2020. However, SVG FSA is not considered a fully-fledged financial operator and does not provide the same protection as more reputable agencies such as the FCA.

Customers should be aware that NBHM LLC is a white label of NBHM EU Ltd, and shouldn’t confuse NBHM LLC with this company, which is underwritten by the Cyprus regulator CySEC.

Despite this, NBHM LLC has insurance underwritten by Lloyd’s of London which provides all clients with protection up to $5,000,000 without any additional cost. By doing so, NBHM aims to provide coverage against errors, omissions, negligence, fraud and other risks that may lead to financial loss.

Additional Features

NBHM has a substantial collection of educational tools, targeted at traders with varying levels of experience:

- Daily videos from the strategic and financial commentator, discussing specific forex pairs. These videos can also be viewed on the NBHM YouTube channel

- Weekly outlook articles, containing the latest financial news

- Weekly gold analysis from the strategic and financial commentator

- Economic calendar with regular updates from industry researchers, supplemented with interactive charts

- NBHM blog with articles released a couple of times per week. Example articles include information on trading for beginners and a review of trading platforms. However, the majority of these articles have not been updated since July 2020 so we hope that these return soon.

Additionally, NBHM has announced plans to provide live forex tutorials in the future.

Trading Accounts

Three account types are available when trading with NBHM, offering varying spreads and commission in exchange for different minimum deposit requirements:

Standard

- Spreads from 1.6 pips

- Minimum deposit $100

- Commission $0

Pro

- Spreads from 0.2 pips

- Minimum deposit $5000

- Commission $2.5 per $100,000 traded

Elite

- Spreads from 0.0 pips

- Minimum deposit $25,000

- Commission $20 per $1 million traded

The margin call is 100% and the stop out level is 50% for all account types.

Benefits

Trading with NBHM offers several benefits:

- Dedicated support team with live chat and callback service

- Access to the popular MT4 and MT5 trading platforms

- Quality online educational tools

- Up to 1:500 leverage

- 44 forex pairs

Drawbacks

The broker has some downfalls that customers should be aware of:

- Absence of information regarding the history of the company

- Does not hold a licence with a reputable authority

Trading Hours

NBHM trading session hours are in line with forex which is 24/5. However, the broker advises that metals have different trading hours and therefore customers should contact NBHM for details of specific markets.

Customer Support

NBHM has a dedicated support team that provides a 24/6 response service including a live chat option, available by clicking on the chat logo in the bottom right-hand corner of the website. Email contact details are provided for different departments:

- General enquiries – info@nbhm.com

- Customer support – support@nbhm.com

- Documentation and new accounts – backoffice@nbhm.com

A UK contact number is available on the website and callbacks can be requested by submitting a form on the Contact Us page:

- +442039363039

The address for NBHM is also available on the website if required.

Security

The MetaTrader 4 and 5 platform login is secure, with 128-bit data encryption. NBH Markets confirms that all funds are held in segregated accounts in trusted banks and card details are not saved. However, NBHM could be more transparent about login security for its own website as there is no mention of any specific encryption standards.

NBH Markets Verdict

NBH Markets offers high leverage on a good selection of forex, in addition to some commodity and cash index offerings, with unique gold-backed stability. It offers the popular MT4 and MT5 platforms which are easy-to-use yet provide high functionality. However, NBH Markets is registered under SVG FSA and therefore customers should not expect the same grade of financial protection as provided by authorities such as the FCA.

Top 3 Alternatives to NBH Markets

Compare NBH Markets with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade

NBH Markets Comparison Table

| NBH Markets | IG | FP Markets | AvaTrade | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4 | 4.9 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | – |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | St. Vincent and the Grenadines FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, ESMA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (Retail) 1:400 (Pro) |

| Payment Methods | 7 | 6 | 9 | 13 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

FP Markets Review |

AvaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by NBH Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| NBH Markets | IG | FP Markets | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

NBH Markets vs Other Brokers

Compare NBH Markets with any other broker by selecting the other broker below.

FAQ

What is the minimum deposit at NBH Markets?

The minimum deposit amount offered by NBH Markets is $100 with a Standard account. This climbs to $5,000 with the Pro account and $25,000 with the Elite solution.

Does NBH Markets offer a demo account?

Yes, the broker offers a one month demo account with $300,000 virtual funds. Clients can switch to a real-money account when they’re ready.

Where is NBH Markets regulated?

NBH Markets is registered under VSG FSA (No. 241 LLC 2020). This authority does not provide as high a level of protection as regulated authorities such as the FCA.

How do I contact NBH Markets?

Customers can call NBH Markets directly on +442039363039 or request a callback at their convenience. NBHM also offers a live chat service and provides an email solution at support@nbhm.com.

What is the maximum leverage at NBHM?

NBHM offers generous leverage options of up to 1:500. These are high rates and should be used with caution as they can lead to losses.

Customer Reviews

There are no customer reviews of NBH Markets yet, will you be the first to help fellow traders decide if they should trade with NBH Markets or not?