Best M-Pesa Brokers 2024

M-Pesa is an international mobile banking service set up in Kenya that allows users to store money and transfer it to others on the network. The payment method is now popular amongst traders in a range of countries across Africa and around the world, including Tanzania, Ghana, South Africa, Mozambique, Lesotho, DRC, Nigeria, Uganda, Rwanda, Zambia, Egypt and Ethiopia. This article explores what M-Pesa is, its history, meaning, how it works and how it revolutionised mobile payments, as well as the different fees, tariffs, withdrawal charges and rates in 2024. We also rank and list the best brokers that support M-Pesa deposits and withdrawals.

Best M-Pesa Brokers

After thorough testing, these are the 5 highest-rated brokers that accept M-Pesa:

M-Pesa Brokers Comparison

| Broker | Minimum Deposit | Instruments | Platforms | Leverage | Visit |

|---|---|---|---|---|---|

|

$5 | Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures | MT4, MT5 | - | Visit |

|

$10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | BDSwiss Webtrader, MT4, MT5 | 1:30 | Visit |

|

$100 | Forex, CFDs, Indices, Shares, Energies, Metals, Cryptos | CMTrading Webtrader, MT4 | 1:200 | Visit |

|

$10 | Options, Stocks, Commodities, Forex, Crypto, Futures, | Expert Option Web Platform | N/A | Visit |

|

$50 | Forex, CFDs, indices, shares, commodities, cryptocurrencies | MT4, MT5 | 1:500 (Crypto 1:50) | Visit |

|

$5 | Forex, Stocks, Indices, Commodities, Cryptocurrencies | MT4, MT5 | 1:1000 | Visit |

#1 - XM

Why We Chose XM

XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC.

"XM is one of the best forex and CFD brokers we have tested. The flexible account types will suit a variety of short-term trading styles while the $5 minimum deposit and smooth sign-up process make it easy to start trading."

- DayTrading Review Team

- Instruments: Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures

- Regulator: ASIC, CySEC, DFSA, FSC, FSCA

- Platforms: MT4, MT5

- Minimum Deposit: $5

- Minimum Trade: 0.01 Lots

Pros

- 1000+ instruments are available, including recently added thematic indices, providing exposure to emerging industries

- XM continues to deliver diverse and multilingual educational materials and offers a useful live education schedule for its webinars and insights

- Accessible trading accounts with a $5 minimum deposit and fast account opening

Cons

- There's $5 inactivity fee after only 3 months, though this won't affect active traders

- PayPal deposits are not supported

- There is weak regulatory oversight through the global entity

#2 - BDSwiss

Why We Chose BDSwiss

BDSwiss is an award-winning forex and CFD broker founded in 2012. The firm offers 250+ instruments to clients in over 180 countries. With spreads from zero pips and three powerful charting platforms, they offer a rounded day trading package for beginners and seasoned investors alike. The broker is regulated by the Mauritius FSC and Seychelles FSA.

"BDSwiss will suit active day traders looking for raw pricing, fast execution and powerful trading software with a range of pre-included analysis tools. That said, the range of 250+ assets is smaller than most top competitors."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, Crypto

- Regulator: FSC, FSA

- Platforms: BDSwiss Webtrader, MT4, MT5

- Minimum Deposit: $10

- Minimum Trade: 0.01 Lots

- Leverage: 1:30

Pros

- The knowledgeable support team is available 24/5 in 20 languages and the live chat service is responsive based on tests

- There are several account types to suit different traders and budgets, with just a $10 minimum deposit and dynamic leverage up to 1:2000

- BDSwiss is a globally recognised brand with a 10+ year history transparent trading conditions

Cons

- The lack of a top-tier regulator like the CySEC or ASIC brings down the trust score a little

- VPS plans start from €30 per month, which is not the cheapest

- There's a $30 inactivity fee after 90 days which is higher than several top competitors, including XM which only charges $5

#3 - CMTrading

Why We Chose CMTrading

CMTrading is one of South Africa's leading online day trading brokers, offering trades with leverage up to 1:1000 on the MetaTrader 4 and browser-based Sirix platforms as well as a bespoke copy trading service. The brokerage launched in 2012 and holds a license with South Africa’s Financial Sector Conduct Authority (FSCA).

"CMTrading is a great choice for traders based in South Africa looking to access highly leveraged forex and CFDs, plus copy trading tools and short-term signals."

- DayTrading Review Team

- Instruments: Forex, CFDs, Indices, Shares, Energies, Metals, Cryptos

- Regulator: FSCA, FSA

- Platforms: CMTrading Webtrader, MT4

- Minimum Deposit: $100

- Minimum Trade: 0.01 Lots

- Leverage: 1:200

Pros

- Clients can access free short-term forex signals from the broker's platform

- There's a decent array of educational resources for beginners on the online academy

- The broker supports the powerful MetaTrader 4 platform plus a proprietary Webtrader and a bespoke social trading feature

Cons

- The broker's market coverage is limited, including only 100+ stocks

- There are no additional third-party analysis tools such as AutoChartist

- Spreads are uncompetitive across accounts compared to competitors

#4 - Expert Option

Why We Chose Expert Option

Expert Option is an offshore broker that offers a simple and intuitive trading experience through a bespoke, user-friendly platform. Short-term traders can access 100 popular assets via binary options contracts with payouts up to 95%, free educational resources, and market data available to upper-tier account holders.

"Expert Option will suit aspiring traders who want to access the financial markets through an options broker with a very easy-to-learn bespoke platform. The user-friendly day trading platform is clear and reliable."

- DayTrading Review Team

- Instruments: Options, Stocks, Commodities, Forex, Crypto, Futures,

- Regulator: SVGFSA

- Platforms: Expert Option Web Platform

- Minimum Deposit: $10

- Minimum Trade: $1

- Leverage: N/A

Pros

- There's a decent range of educational resources, including trading strategies, webinars and platform tutorials

- The broker offers an easy to use, beginner-friendly proprietary trading platform with 4 chart types and social trading features

- Minimum deposits are low, starting from $10

Cons

- Very expensive $50 dormancy fee after 3 months of no trading activity

- Expert Option isn't available in several countries, including the EU, Australia and the US

- The SVGFSA is a weak financial regulator with limited safeguarding measures

#5 - LiteFinance

Why We Chose LiteFinance

LiteFinance is an offshore-regulated broker with 55 forex pairs and a range of international stocks as well as a smaller list of indices, commodities and cryptocurrencies. With support for the MetaTrader 4 and MetaTrader 5 platforms as well as a proprietary mobile app, there is a good selection of tools available. The broker offers a Classic commission-free account as well as an ECN account with spreads starting from zero and a commission per lot.

"LiteFinance will suit traders seeking high leverage on forex, stocks, commodities, indices and cryptocurrencies. The social trading system will also suit newer investors looking to learn from seasoned traders."

- DayTrading Review Team

- Instruments: Forex, CFDs, indices, shares, commodities, cryptocurrencies

- Regulator: CySEC

- Platforms: MT4, MT5

- Minimum Deposit: $50

- Minimum Trade: 0.01 Lots

- Leverage: 1:500 (Crypto 1:50)

Pros

- Low starting deposit of $50

- Good range of forex pairs

- High leverage available up to 1:500

Cons

- Does not accept US traders

- Wide spreads on the Classic account

- Some complaints online about difficulties withdrawing funds

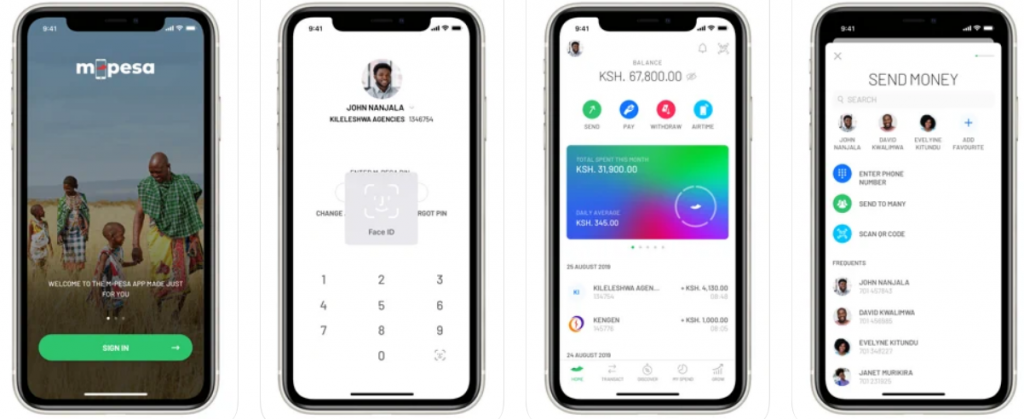

What Is M-Pesa?

M-Pesa launched in Kenya in 2007 as an Africa joint venture between Vodafone (Vodacom) and Safaricom, the largest mobile phone operator in Kenya. Under the ownership of these two companies, M-Pesa has experienced large growth and now boasts a variety of operating areas and countries. The drive behind the venture was to provide financial services to the underbanked or unbanked. This drive for financial inclusion in Kenya and across Africa seeks to include residents that cannot access banks or afford the required minimum deposits to conduct online digital banking. The definition of M-Pesa is simply M-Money (in Swahili).

M-Pesa’s headquarters are in Nairobi, Kenya. The company directly operates in Kenya, Mozambique, DRC, Lesotho, Ghana, Egypt, Afghanistan, South Africa and Ethiopia. On top of this, it has several users in Zambia, Nigeria, Uganda, Rwanda, Zimbabwe, Malawi, Qatar and many more countries. Using the system is simple, customers simply insert a SIM card into their mobile device and are then able to complete transactions, make payments and transfer money to vendors.

M-Pesa is very popular across Africa as it provides an easy and efficient way for customers to transfer money without having to jump through hoops to open bank accounts. Generally, people use it as a wallet where they store money and send it to vendors and other users. There are more than 100 million users globally and the company’s revenue exceeds half a billion USD. M-Pesa is very popular among African traders, offering an easy way to deposit funds. Many international brokers, such as XM and Plus500, accept M-Pesa as a form of payment.

Fees

The fees charged by M-Pesa vary depending on the amount of money being transferred. All charges are calculated in Kenyan shillings (KES). When funding a trading account, transfers are free up to 100 KES, after which costs start to be incurred. To transfer 3000 KES, you are charged 51 KES. The charges for sending 10,000 and 11,000 KES are 97 KES. Generally, the fee is a small percentage of what you are transferring. The service is essentially free, you only pay for the airtime purchased. Check the website for any new charges, tariffs and updates in 2024.

M-Pesa does have a daily deposit limit of 300,000 KES. This is also the maximum amount allowed in an account and the maximum daily transaction value. The maximum individual transaction limit is 150,000 KES. Users cannot withdraw less than 50 KES and cannot withdraw more than the maximum allowed transaction of 150,000 KES. This limit was increased recently from 70,000 KES. Typically, brokers do not charge any fees for deposits and withdrawals made using this method, though this varies by broker as some charge blanket fees for all deposits and withdrawals, regardless of payment method. Check your broker’s website to confirm whether or not additional fees will be charged when making a deposit or withdrawal.

Speed

M-Pesa tends to be a very fast method for payments, often instant. M-Pesa provides quicker deposit times compared to bank transfers, which can take up to 1-2 business days for a deposit to come through. This is ideal for customers as it means that they can deposit funds and start trading cryptocurrency and other assets almost instantly. Customers can also use the M-Pesa super business app to make deposits, which is available to download on the Google Play Store (APK) and Apple App Store (iOS). Once this is done you can add M-Pesa express as a billing method, making it simple and easy to make payments to brokers from your phone.

Withdrawals are a little different. They tend to take a little longer and vary from broker to broker. The time taken is not limited on M-Pesa’s end, it is usually the time it takes for the broker to process the transaction. Typically, this can take anywhere from 24 hours to two business days at different brokers. For example, XM takes around 24 hours to process transactions. Once processed by the broker, you should receive your funds almost instantly.

Security

M-Pesa is built around customer care and keeping your data safe. Once you have completed registration online and signed in with your login details, M-Pesa assures the highest levels of security. Registration is completed through an authorised agent administrator. Following this, M-Pesa requires know-your-customer (KYC) checks to be completed before you can deposit funds into your M-Pesa account using Mastercard, Visa or another method.

When sending funds from the M-Pesa web portal, as you would when depositing funds to a brokerage account, M-Pesa verifies each transaction before it is completed. This ensures that you have the right to send the money and that it is going to a legitimate source. M-Pesa has conducted a case study in a variety of places, including Kenya, to check they were providing high levels of security. These studies were designed to ensure that they are implementing the right solutions and protecting all customer personal data like emails and passwords.

Overall, M-Pesa is a reputable and secure method for transferring money. When using the system in Africa, the UK or anywhere around the world, you can trust that your payments are safe and the money will be properly received.

How To Deposit Using M-Pesa

This section will provide a quick step-by-step guide so that you know how to make deposits and withdrawals at brokers through M-Pesa:

- Download the M-Pesa app from either the Google Play Store or Apple App Store.

- Next, launch the application and start your registration for a portal login. Fill in all the required information and provide the necessary documents.

- Ensure that you have inserted a Safaricom sim card into your phone. Connect this sim card with your new account.

- Once this is done, you are ready to deposit funds into your account. This can be done using cash through an M-Pesa agent or via a bank transfer or card payment.

- Now you are ready to send funds to your broker. Log in to your trading account and go to the deposits menu page.

- Select M-Pesa from the payments options list, log in and enter the amount you want to transfer.

Similarly, when you wish to make a withdrawal, head to the withdrawals page, select M-Pesa as the withdrawal method and enter the amount you wish to withdraw. Check the broker’s website to see how long withdrawals usually take and wait for your funds to appear.

Pros Of Using M-Pesa For Traders

Low Cost

The system is a safe and secure method of transfer with very low fees. There are next to no transaction and administration charges, users merely pay for the airtime.

Reliability

M-Pesa is a very reliable form of payment. Transfers are verified almost instantly and the system rarely goes down. Moreover, there are many security features in place to ensure your funds are stored safely and transferred safely.

High Maximum Transfer Amount

The daily transfer limit for the system is quite high at 150,000 KES, giving users the freedom to deposit large quantities into their trading accounts every day.

Accessible For Many Customers

Many of the platform’s users do not have access to banks or cannot afford high minimum deposits. The system offers an efficient and simple payment method that is open to anyone, regardless of financial background and proximity to banks.

Cons Of Using M-Pesa For Traders

Geographic Restrictions

One of the key issues with M-Pesa is the geographic restrictions. While it is incredibly popular within Africa, covering 70% of the continent’s countries, only a few external countries accept the payment method, making it difficult for users to trade through foreign brokers.

Lack Of Brokers

Another drawback is the lack of brokers accepting it as a form of payment. A lot of brokers still opt for other options like PayPal, even though they are more expensive.

Is M-Pesa Good For Day Trading?

M-Pesa is a Kenyan payment method designed to bring financial services and solutions to underbanked and unbanked customers throughout Africa and beyond. The platform is great for funding and emptying trading accounts, with quick verification and processing times alongside low-cost transfers. If you are looking to deposit funds to a trading account, M-Pesa provides a fast, secure and cheap option.

FAQ

How Do I Use M-Pesa To Deposit To My Live Trading Account?

M-Pesa works through a mobile app which acts as an online wallet. Once you have set up your app, you can then connect it your live trading account to make deposits.

Do All Brokers Accept M-Pesa?

No, they do not. Many international brokers do but you need to check each to see whether the one you are considering does. Alternatively, see our list of top brokers accepting M-Pesa here.

Is M-Pesa Available For US Traders?

Yes, M-Pesa has a partnership with Global Western Union, which allows traders to send and receive money from any part of the world. The platform has also recently launched in India.

Is It Cheap To Deposit To My Trading Account Using M-Pesa?

Yes, the platform has lower transaction fees for users and businesses compared to other methods like PayPal. Note, though, that some brokers may charge their own processing fees.