LegacyFX Outlook For S&P, Nasdaq And More April 2022

Analysts at LegacyFX cast their expert eye over the world events and the impact they may have on key markets. From the S&P and Nasdaq (US100) in the US, to a potentially overbought FTSE 100 in the UK, technical analysis signals some possible price moves.

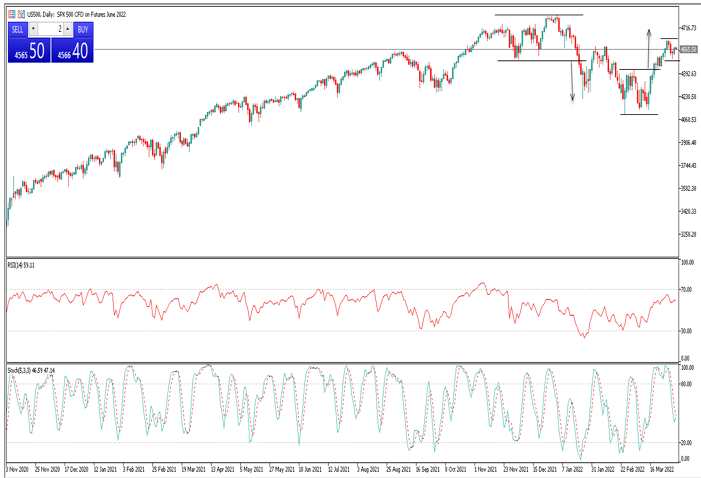

S&P 500 (US500)

The rally from the March 2022 low has lost momentum over the past five days and the index has been trading in a narrow range between 4,500 and 4,630. The weekly stochastic and the daily RSI indicators have approached overbought territory suggesting that the rally is likely to take a breather soon.

We noted that the VIX Index has declined over the past month and has approached a band of support between 16.69 and 18.05, where support appears strong and is likely to hold.

The daily RSI indicator on the VIX has approached oversold levels suggesting that the index is likely to rally soon.

The price action of the S&P 500 and the VIX often moves in opposite directions: when the S&P falls, the VIX rises and vice-versa.

Although at this stage the S&P 500 remains within the boundaries of its narrow range, the ancillary tools mentioned above suggest that any upside from here is likely to be limited and that the index is vulnerable to a pull back. A break below minor support of 4,500 would confirm that a short-term top is in place and could trigger a decline to 4,390.

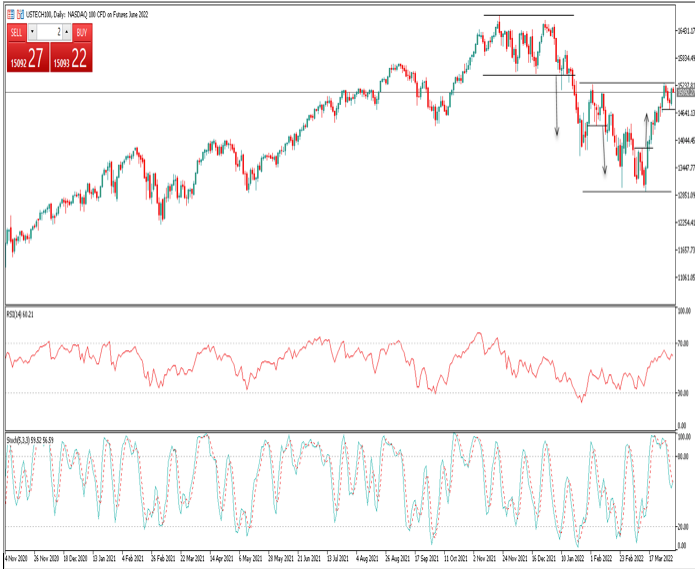

NASDAQ 100 (USTECH100)

The rally from the March 2022 low has rebounded to its previous high of 15,259 where selling pressure has been encountered. The tech heavy index traded in a narrow range over the past five days showing that the bulls are becoming cautious and might struggle to push the benchmark higher in the short-term.

The 4H stochastic indicator has turned down from overbought levels pointing to a likely pull back in the short-term.

A decline to 14,725 appears likely and is the key level to monitor, as a break below it would signal that a short-term top is in place. Such a breakout would confirm that the rally from the March 2022 low is complete and is likely to trigger a decline to 14,300.

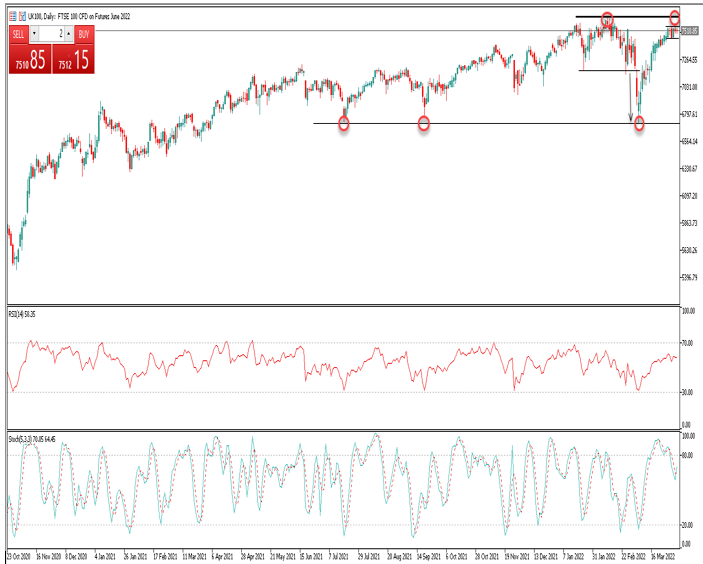

FTSE 100 (UK100)

The recovery from the March 2022 low has been remarkable in terms of size and pace, despite all the headwinds surrounding equity markets. More monetary tightening is on track, continuously rising inflation which is well above Bank of England’s 2% target and the recent inversion of the yield curve.

While at this stage there is no reversal signal evident on the chart, we are of the view that the short-term upside from here is likely to be limited as the index is close to its key overhead resistance of 7,629 and is approaching overbought territory on a daily and weekly basis.

A break below minor support of 7,447 would signal that a short-term top is in place and is likely to trigger a pull back to 7,340.