LDC Review 2024

Lebanese Dealers Corporation (LDC) offers online trading in forex and CFDs across a choice of platforms.

Forex Trading

Trade dozens of currency pairs with competitive floating spreads, including majors and minors.

Stock Trading

LDC provides leveraged stocks and indices across its trading platforms, including MT4.

CFD Trading

Start trading on the markets with up to 1:100 leverage at LDC.

Lebanese Dealers Corporation (LDC) is a financial intermediary specialising in forex and CFD trading. The broker provides optimal transaction conditions and advanced operational technologies to create a user-friendly trading environment. Our LDC broker review covers the account opening application process, mobile apps, regulatory licenses, payment fees, and more.

LDC Headlines

LDC was established in 2007, offering financial services from its head office in Beirut, Lebanon. The broker is licensed and authorised by the Central Bank of Lebanon. A variety of educational tools and popular financial instruments are offered, alongside on-hand customer support and instant deposits.

Platforms

LDC offers several platforms to meet varying client needs. Both downloadable desktop terminals and web-accessible trading solutions are available.

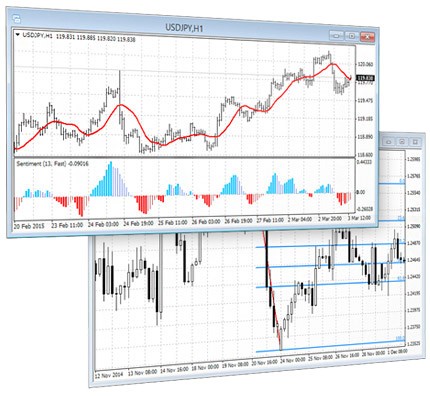

MetaTrader 4

A favourite among forex traders, MT4 is an excellent investing platform. Dozens of technical indicators, drawing tools and chart types mean a variety of strategies can be used. Clients can place instant and pending order stops and can enhance the trading terminal with hundreds of add-ons from the MetaTrader Market.

Benefits include:

- Market signals

- Instant order execution

- Customisable interface

- Risk management alerts and tools

- Expert Advisors for automated investing

VertexFX

VertexFX offers an alternative to MT4. The user-friendly solution offers a clean display with multiple charts, a market watch window and a host of drawing and analysis tools. The VTL 10 scripting language and dynamic API structure make it great for automated trading. The platform has also picked up awards for its ease of use.

Benefits include:

- Custom-built indicators

- Enhanced market watch

- Automated trading services

- Server scripting support (VTL) and API structure

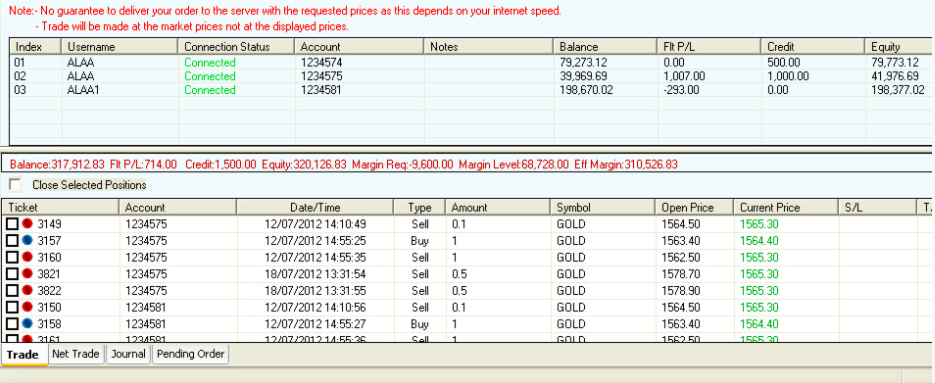

VertexFX Enhanced

The E-Broker platform is available for money managers trading across multiple accounts. The browser-based solution is built from the VertexFX platform but doesn’t require a desktop download. The E-Broker platform comes with much of the same features, market access and security as the downloadable terminal.

Markets

Lebanese Dealers Corporation offers investment opportunities in dozens of online currencies, including majors such as the EUR/USD, as well as a suite of minors and exotics. Clients can also use contracts for difference to take positions on popular markets, including major stock indices, single stock shares, and commodities, such as silver, gold and oil.

Unfortunately, the list of tradable assets is limited compared to other brokers. For example, users can’t start trading in cryptos, such as Bitcoin. ETFs, futures and binary options are also unavailable.

Spreads & Commission

LDC is not forthcoming when it comes to fees. The broker takes its cut from floating spreads but does not publish details of average spreads across popular assets. This is a red flag and may indicate that LDC is more expensive than other providers.

On a brighter note, LDC does not charge trading commissions, though users should be aware of rollover costs and inactivity fees.

Leverage

Leverage varies across instruments. The maximum leverage available is 1:100 on forex pairs. This is notably higher than the 1:30 cap applied by EU-regulated brokers. This could be good news for users looking to seriously increase their positions, but it does mean potentially larger losses. We recommend caution before trading with high leverage ratios.

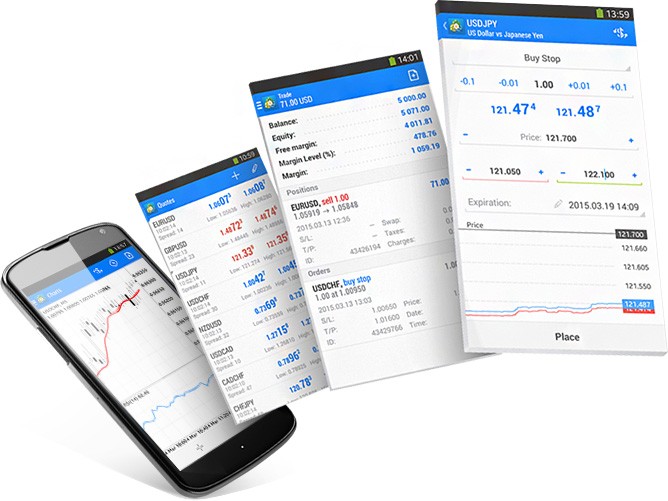

Mobile Apps

The MetaTrader 4 mobile application is compatible with iOS and Android devices. The app allows for complete account management from mobile and tablet devices. SMS market alerts are also available, along with instant and pending orders, a built-in economic calendar, and watch lists. The MT4 app can be used to supplement the desktop investing experience or for mobile-only investing.

Deposits & Withdrawals

To fund an LDC account, users need to deposit at least $100. Instant payments are available through the following methods:

- Bank wire transfer

- Local payment methods

- Credit/debit cards including Visa and Mastercard

A request form is required to withdraw funds from live accounts. Withdrawals must be processed via the original deposit method. It typically takes three days for payments to land in client accounts. Note, LDC may request additional identity documents in line with its anti-money laundering policy.

Demo Account

LDC offers a free demo account on the MT4 platform. For prospective traders, the trial account is an easy way to test the different platforms and instruments offered. The demo account can also be used to build out strategies before applying them to real-money trading. To open an LDC demo account, users need to fill out a quick online registration form, available on the broker’s website.

LDC Deals & Bonuses

At the time of writing, LDC does not offer any deals or promotions to new or existing clients. While this may disappoint some, this is standard practice among regulated brokers. It’s always worth checking the LDC website before opening an account in case new promotions are rolled out.

Regulation

LDC is regulated by the Central Bank of Lebanon under license 13. The regulatory board is respected in Lebanon, providing stringent compliance standards for brokers, ensuring secure and transparent financial services. This includes the segregation of client funds. The broker also submits regular financial reports to the board to demonstrate capital stability and regulatory compliance.

Additional Features

The broker’s website provides educational training and research materials. Resources also include real-time independent price quotes across hundreds of instruments, an economic calendar, market news, and live financial charts. The online education centre offers simple investing information including economic analysis and the basics of trading forex and CFDs.

Live Accounts

The Lebanese Dealers Corporation offers a single live account for straightforward market access. The minimum deposit is $100 and users get full access to forex and CFD instruments. Each platform and all educational resources are available to real-money trading clients. There are no hidden fees.

To open a live account, a straightforward online application form needs to be filled out. Identity documents and proof of residency are required before you can fund your account and start trading. Clients can open accounts from multiple jurisdictions, including Europe and the UAE.

Benefits

- Demo account

- Fast withdrawal times

- 24/5 customer support

- Respected regulatory board

- Multiple trading platforms, including MT4

Drawbacks

- Low trust rating

- Poor customer reviews

- Narrow product range and no cryptos

- Lack of sign-up bonuses and promotions

- Limited information regarding market spreads

Trading Hours

Trading is typically available 24 hours a day Monday to Friday. With that said, timings may vary by instrument. The MT4 terminal displays opening hours in local time zones.

Customer Support

LDC follows standard office hours, with a team of representatives available during the working week. You can contact the customer support team via:

- Fax – +961-5-459-111

- Email – info@ldc.com.lb

- Telephone +961-5-458-444

- Live chat – Contact us page

- Online contact form – Contact us page

- LDC head office address – 2nd floor, Galerie Semaan bldg., 657 Galerie Semaan Avenue, Beirut, POB 45-322, Lebanon

Trader Safety

LDC assures secure operations using SSL data encryption protocols and PCI compliant transactions. Client portal access is password protected and the MetaTrader platform follows industry-standard data privacy policies.

LDC Verdict

The Lebanese Dealers Corporation company offers a range of trading platforms, educational resources and low minimum deposit requirements under the guidance of a respected regulatory board. However, the lack of transparency on the broker’s website, including around spreads, is a concern. We’d recommend considering other brokers first.

Top 3 Alternatives to LDC

Compare LDC with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote

LDC Comparison Table

| LDC | IG | AvaTrade | Swissquote | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.9 | 4 |

| Markets | Forex, CFDs, stocks, indices, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | – | $1000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | Central Bank of Lebanon | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, FINMA, DFSA, SFC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, AutoChartist, TradingCentral |

| Leverage | 1:100 | 1:30 (Retail), 1:250 (Pro) | 1:30 (Retail) 1:400 (Pro) | 1:30 |

| Payment Methods | 4 | 6 | 13 | 5 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

AvaTrade Review |

Swissquote Review |

Compare Trading Instruments

Compare the markets and instruments offered by LDC and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| LDC | IG | AvaTrade | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | No |

LDC vs Other Brokers

Compare LDC with any other broker by selecting the other broker below.

FAQ

What does the LDC broker stand for?

LDC stands for Lebanese Dealers Corporation – an online trading broker based in Lebanon. The brokerage was established in 2007 and operates across multiple continents.

Can I trust the LDC broker?

The Lebanese Dealers Corporation company operates under a license from the Central Bank of Lebanon, a respected body in the country. With that said, there are some negative customer reviews online so we would recommend caution.

What documents are required to open a live account with LDC?

To activate a trading account, clients need to provide proof of residency and identity documentation such as a passport or driving license.

Does LDC offer a demo account?

Yes, you can register for a demo account to access the MetaTrader 4 platform. Clients can then switch to a live trading account when they’re ready.

What deposit methods are accepted to fund a live account with LDC?

LDC accepts deposits via various methods including debit/credit cards, bank wire transfers, and local payment methods.

Customer Reviews

There are no customer reviews of LDC yet, will you be the first to help fellow traders decide if they should trade with LDC or not?