ICM Brokers Review 2024

- Daytrading Review TeamICM Brokers could serve traders that are looking for fixed spreads, high leverage and willing to pay the $250 minimum deposit.

ICM Brokers is a Vanuatu-based broker offering a range of markets including CFDs, forex, futures, and options. The broker does not hold any top-tier licenses and there is limited company information available online.

Forex Trading

Trade a small range of currency pairs with fixed spreads and high leverage up to 1:400. On the downside, fees are not the most competitive vs other brokers.

Stock Trading

ICM Brokers offers a small selection of global shares, available from 1:30 pm to 8:00 pm GMT. Unfortunately, the broker does not offer any stock market news or insights to complement online trading.

CFD Trading

CFDs are available to trade on the powerful MT4 platform with a free demo account to test out strategies. With that said, the demo is only available for 20 days, which is disappointing.

✓ Pros

- Daily technical analysis report on key markets, including EUR/USD and Dow Jones

- Access to the renowned MetaTrader 4 platform with customizable charting tools

- Integrated economic calendar for keeping up with market events

- Highly leveraged trading up to 1:400

✗ Cons

- Uncompetitive fixed spreads and high commissions

- Withdrawals must be made via request form

- Offshore regulation reduces client safety

- Limited range of trading instruments

- Narrow range of funding methods

- Slow customer support upon testing

ICM Brokers facilitates online trading in forex and CFDs. Retail and institutional clients can access a MT4 platform download, three live accounts, plus a demo simulator. Read our review to find out whether you should login and start trading with ICM Brokers.

ICM Brokers Company Details

ICM Brokers is based in Port Vila, Vanuatu, and has a customer service office in Dubai, UAE. The broker is regulated by the Vanuatu Financial Services Commission (VFSC) and licensed as an Investment Dealer in Currency Derivatives, Commodity Derivatives, and Equities.

Now operating in over 20 countries worldwide, the broker aims to be a leader in execution and clearing services for OTC financial instruments, including spot forex, precious metals, futures, and equity CFDs.

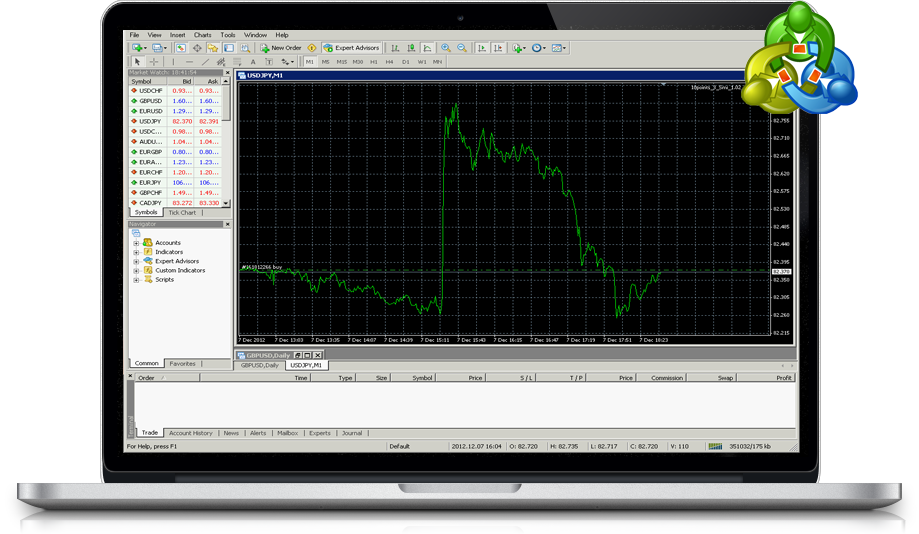

MetaTrader 4 Trading Platform

ICM Brokers offer the MetaTrader 4 (MT4) trading platform across all of its accounts. The award-winning platform is well regarded for its customisable technical analysis features and user-friendly interface. Traders can execute advanced trading operations and view detailed price dynamics using multiple time-frames and built-in charting tools.

Features include:

- 30 built-in technical indicators & two-dozen graphical objects

- Multiple order types & execution modes

- Real-time quotes in Market Watch

- 9 time-frames & 3 chart types

- One-click trading

- Trading history

The MT4 platform can be downloaded once you have registered and signed in to the client portal.

Markets

ICM Brokers offers a range of trading markets:

- Forex – Trade over 20 currency pairs including majors and minors

- Equity CFDs – Trade stocks in eight global companies, including Microsoft and Citigroup

- Metals – Trade OTC gold and silver in spot markets

- Futures – Trade commodity futures, such as oil and natural gas, financial futures, including the Euro and Japanese Yen, plus index futures, such as the FTSE 100 and NASDAQ

Spreads & Commission

Spreads are fixed for the Standard and Prime accounts, with major pairs like EUR/USD around 2 pips. For spot gold, spreads are 0.3 and for the FTSE 100 futures, the spread is 3.5. There is also a $20 commission charged on a per-contract basis. With the combination of spreads and commissions, the broker isn’t the cheapest provider around.

There may also be overnight financing and rollover fees, details of which can be found in the terms and conditions.

Leverage

The maximum leverage offered at ICM Brokers is 1:400. For professional clients, leverage is capped at 1:100. These are decent leverage levels and allow clients to trade big with minimal capital.

Details of margin levels can be found in the contract specifications.

Mobile Apps

The MetaTrader mobile app allows users to trade securely anywhere and at any time. The mobile app offers many of the same capabilities as the desktop version and full control over trading accounts. Traders also enjoy the benefits of mobile-friendly features like one-touch trading and push notifications.

The app is compatible with iOS and Android smart devices.

Payment Methods

Deposits

ICM Brokers offers several fast funding options, including PayPal, card payments, bank transfer, and Neteller. Although the broker claims it does not charge any initial deposit fees, $15 is charged to cover the broker’s banking transfer fee. There may also be additional charges from your payment provider or bank.

Withdrawals

You can request a withdrawal via credit/debit card, bank wire, or PayPal. Withdrawal times vary but generally take up to two working days for cards, three to five working days for bank wire, and one working day for PayPal. ICM Brokers does not charge for withdrawals.

Demo Account

ICM Brokers offers a 20-day free trial account on MetaTrader 4. The ICM Brokers-demo account is a great tool for beginners who wish to practice trading within real market conditions and access live pricing.

Note that many other brokers offer demo accounts for at least 30 days, so the practice account offering at ICM Brokers is limited.

Deals & Promotions

At the time of writing, ICM Brokers does not offer any deposit bonus deals or promotions. Traders should check the website and social media pages for any future deals.

Regulations

ICM Brokers is a financial institution regulated by the Vanuatu Financial Services Commission (VFSC) and licensed under the Securities (Licensing) Act under company number 40320.

As far as regulatory frameworks go, the VFSC is certainly not as robust as CySEC or ASIC, for example. In recent years, regulators like the VFSC have made some efforts to tighten their restrictions, but traders should be aware of how these frameworks operate.

Additional Features

Additional tools that you can find on the ICM Brokers website include an introduction to forex for beginners, information on technical analysis, daily and weekly reports, an economic calendar, and examples of trading rules for each market.

If you’re looking for a more extensive range of resources and features, other providers are more attractive.

Accounts

There are three account types available at ICM Brokers:

- Micro and Standard Account (fixed) – Spot forex, spot metals, OTC metals futures, OTC futures, CFDs

- Prime Account (fixed) – Spot forex, spot metals, OTC metals futures, OTC futures, CFDs

- Professional Account (floating) – Spot forex, spot metals, OTC futures

The minimum deposit is $300 for the Standard ICM Brokers-live accounts and $500,00 for the Professional account. The minimum lot size is 0.01 for the Standard and Prime accounts and 1.0 with the Professional account. All accounts are in USD.

Trading Hours

Trading hours are in GMT and as follows:

- Forex – 21:00 – 21:00 (Sunday to Friday)

- CFD Stocks – 13:30 – 20:00 (Monday to Friday)

- Commodities Futures – 07:30 – 17:00 (Monday to Friday)

- Spot metals, metals futures, financial futures, and energy futures – 22:00 – 21:00 (Sunday to Friday) with a 1-hour break between 21:00 and 22:00 each day

Customer Support

ICM Brokers’ customer support is available Monday to Friday from 08:00 to 18:00 (UK time) via:

- Telephone – +1 212 918 4602

- Email – info@icmbrokers.com

- Online contact form – Contact Us page

- Live chat – located in the bottom right-hand corner of the website

Disappointingly, despite contacting within the opening hours, we did not receive a response via live chat.

ICM Brokers is headquartered at Govant Building, PO Box 1276, Port Vila, Republic of Vanuatu.

ICM Brokers Farsi can be selected from the bottom of the homepage.

Trader Security

The MT4 platform uses industry-standard security protocols, which include Secure Sockets Layer (SSL) encryption as well as the option to enable two-factor authentication (2FA) upon login.

ICM Brokers Verdict

ICM Brokers offers the reliable MT4 platform download on three live accounts. Overall, the broker would be a good option for those looking for fixed spreads, but traders who are after a competitive demo account, a more comprehensive range of educational tools, and reliable customer service, might want to look elsewhere.

Top 3 Alternatives to ICM Brokers

Compare ICM Brokers with the top 3 similar brokers that accept traders from your location.

-

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG

ICM Brokers Comparison Table

| ICM Brokers | Swissquote | FP Markets | IG | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 4 | 4.4 |

| Markets | Forex, equity CFDs, precious metals, energies, futures | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $1000 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | VFSC | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA |

| Bonus | – | – | – | – |

| Education | No | No | Yes | Yes |

| Platforms | MT4 | MT4, MT5, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral |

| Leverage | 1:400 (Retail), 1:100 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:250 (Pro) |

| Payment Methods | 5 | 5 | 9 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Swissquote Review |

FP Markets Review |

IG Review |

Compare Trading Instruments

Compare the markets and instruments offered by ICM Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ICM Brokers | Swissquote | FP Markets | IG | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

ICM Brokers vs Other Brokers

Compare ICM Brokers with any other broker by selecting the other broker below.

FAQ

How do I open an account with ICM Brokers?

You can open a live account from the main website by filling out the online registration form. You will need to select your account specifications, trading experience, and upload your identity documents.

How can I fund my ICM Brokers account?

Once you have registered for an account, you will receive a link where you can deposit funds into your account via PayPal, wire transfer, or credit card.

Does ICM Brokers offer a demo account?

Yes, the demo account will allow you to practice trading within a live account simulation. Demo accounts are available for 20 days.

What is ICM Brokers’ address?

ICM Brokers is located at Govant Building, PO Box 1276, Port Vila, Republic of Vanuatu. From Vanuatu, the broker offers trading services to clients in multiple countries from around the world.

Is ICM Brokers regulated?

ICM Brokers is regulated by the Vanuatu Financial Services Commission (VFSC). It’s worth pointing out this isn’t the most reputable of regulatory agencies.

Customer Reviews

There are no customer reviews of ICM Brokers yet, will you be the first to help fellow traders decide if they should trade with ICM Brokers or not?