House Of Borse Review 2024

House of Borse offers trading in over 200 financial instruments on MT4 and MT5.

Forex Trading

Trade an extensive list of online currency pairs with up to 1:30 leverage.

Stock Trading

House of Borse offers global cash and futures indices on major exchanges.

CFD Trading

Trade leveraged CFDs with competitive and dynamic spreads.

House of Borse is an online broker trading in global markets including CFDs, forex, commodities and indices. This article reviews the MT4 and MT5 platforms, the minimum deposit requirement, and the regulatory status of the company. Read on before you open a live trading account at House of Borse.

Company Details

House of Borse is an FCA regulated broker, established in 2001 and incorporated as a private limited company in 2014. Headquartered in London and with a presence in the Middle East, the broker has built a global client base with a focus on professional traders. House of Borse operates using an ECN model, connecting clients directly to the interbank market to secure the best prices.

Trading Platforms

House of Borse offers the globally recognised MetaTrader 4 (MT4) and MetaTrader 5 (MT5). You can download either to desktop devices or trade through major web browsers. Both solutions are also available as a slick mobile app so you can invest on the go.

MetaTrader 4

Highlights of MT4:

- One-click execution

- Customisation features

- Multilingual accessibility

- 30+ pre-installed technical indicators

- Highly secure with encryption protocols

- Expert advisors for automated online trading

- Various order types supported, including market order, pending order, stop loss and take profit

MetaTrader 5

Highlights of MT5:

- Tick chart trading

- Market depth analysis

- 20+ time frames for charting

- Various order types supported, including instant execution, buy stop limit, sell stop limit orders

Please refer to the broker’s website for full details on the installation of the platforms and account opening requirements.

House Of Borse Assets

House of Borse offers clients access to over 200 financial instruments in the following markets:

- Forex – 60+ forex pairs; majors, minors and exotics, including EURUSD, USDJPY, and EURGBP

- Equities – Company stocks including Google, Apple, Facebook, and Amazon

- Indices – Global cash and futures indices including the UK100 and US30

- Commodities – Including gold, silver, and energies

Fees

Spreads are competitive, with zero-pip spreads available on major currency pairs under the ECN pricing model. Spreads on leading pairs, such as the GBPUSD and EURGBP, start at 0.4 pips. Dynamic spreads are updated in real-time in the MT4 and MT5 platforms.

Commissions vary from $4 per $100,000 traded with Silver accounts to a $3 commission in Platinum accounts. Commission charges drop with increased trading volumes.

Leverage

Leverage rates are capped at 1:30 in line with ESMA regulations for retail traders. HOB does provide leverage up to 1:100 for professional traders. Leveraged trading should always be approached with caution.

Mobile Apps

The MT4 and MT5 platforms are both available for mobile trading, compatible with iOS and Android devices. The mobile offering supports the functionality found on the desktop terminals.

Key features of the MetaTrader mobile apps include:

- Offline mode

- Interactive charts

- Multiple languages

- Real-time streaming quotes

- History of completed transactions

Payments

Deposits

The minimum deposit at House of Borse is $5,000. Accepted methods include bank wire transfer (1 – 5 days), plus debit and credit cards (24 – 48 hours). Bank fees and card charges apply from transferring banks, more details can be found once logged in to the customer portal. Clients can deposit funds through the Member’s Area.

Withdrawals

Clients must complete a withdrawal request form to collect any profits. House of Borse process payments within 2 working days if submitted before 11 am (GMT) on business working days.

Demo Account

The broker offers a demo account where users can test their strategies on the MT4 and MT5 platforms. The client must complete an online registration form to practice trading in forex, gold, or silver. Virtual deposit funds are available up to $1,000,000.

House Of Borse Bonuses

At the time of writing, there are no promotions or bonuses, this includes a new account welcome deal and no deposit bonus. This is standard practice at FCA regulated brokers.

Regulation Review

House of Borse is authorised and regulated by the Financial Conduct Authority (FCA), a reputable financial agency. Clients are also covered under the Financial Services Compensation Scheme (FSCS) and funds are segregated from the company’s equity in FCA approved tier 1 banks.

The online trading broker also operates under the EU’s MiFID II (Markets in Financial Instruments Directive). This allows it to provide services across the European Economic Area.

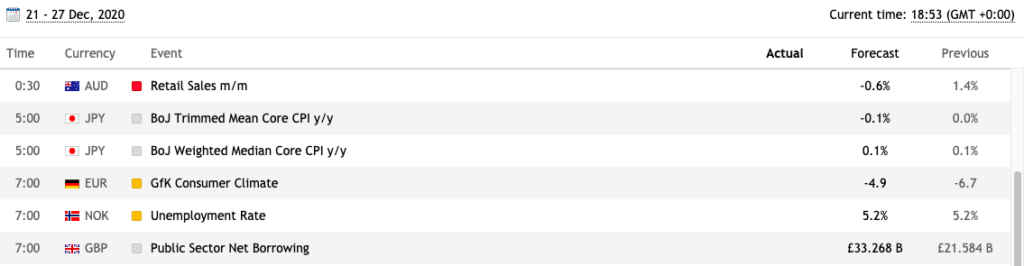

Additional Features

The only additional tool of note at HOB is the economic calendar which keeps you up to date with key financial events. Aside from this, clients have to make do with the features built into the trading platforms. This is disappointing and may deter some beginners who benefit from useful extras.

House Of Borse Accounts

House of Borse offers several accounts depending on trading volumes:

- Silver Trader – less than 100 million

- Gold Trader – up to one yard

- Platinum Trader – more than one yard

All accounts offer:

- Hedging

- ECN execution

- Competitive spreads

- Leverage up to 1:100

- 0.01 minimum lot size

- Base currency in EUR/USD/GBP

To open an account, clients must complete an online application form with supporting identification, proof of residence, and details of trading experience.

Benefits

- Demo account

- Dynamic spreads

- 24/5 customer support

- FCA regulated and FSCS protection

- Industry renowned MT4 and MT5 trading platforms

Drawbacks

- No negative balance protection

- Large $5,000 minimum deposit

- Not available to residents in the USA

Trading Hours

House of Borse operates 24 hours a day, Sunday through to Friday. But trading hours do vary by instrument and a full list can be found on the broker’s website.

Customer Support

House of Borse Ltd offers several customer support channels:

- UK telephone – 44(0)203 327 7001

- Email – support@houseofborse.com

- Online contact form – contact us page

- Address – Berkley Square House, 2nd Floor, Berkley Square, Mayfair, London, W1J 6BD

Security

All data between client terminals and trading platforms have high-tech encryptions and secure logins. The MT4 platform also supports the use of RSA digital signatures and dual factor authentication.

House of Borse Verdict

House of Borse offers a range of live accounts and multiple trading instruments, including forex, indices and commodities. This, combined with access to the globally recognised MT4 and MT5 platforms, alongside tight spreads and 24/5 customer support, means the broker has a lot to offer new traders.

Top 3 Alternatives to House Of Borse

Compare House Of Borse with the top 3 similar brokers that accept traders from your location.

-

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

Vantage – Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Go to Vantage -

IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Go to IC Markets

House Of Borse Comparison Table

| House Of Borse | Pepperstone | Vantage | IC Markets | |

|---|---|---|---|---|

| Rating | 2.5 | 4.8 | 4.7 | 4.8 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5000 | $0 | $50 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, FSCA, VFSC | ASIC, CySEC, FSA |

| Bonus | – | – | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | ProTrader, MT4, MT5, TradingView, DupliTrade | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade |

| Leverage | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:500 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Payment Methods | 4 | 11 | 12 | 14 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Pepperstone Review |

Vantage Review |

IC Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by House Of Borse and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| House Of Borse | Pepperstone | Vantage | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

House Of Borse vs Other Brokers

Compare House Of Borse with any other broker by selecting the other broker below.

FAQ

Is House of Borse regulated?

House of Borse is authorised and regulated by the UK Financial Conduct Authority (FCA). This is a highly regarded financial regulator.

Does House of Borse offer a demo account?

Yes, the broker offers a demo account so traders can test their strategies risk-free with $50,000+ in virtual funds.

What currencies can I deposit with at House of Borse?

House of Borse accepts deposits in EUR, GBP and USD. Note payments into these currencies may incur fees.

What is the minimum deposit requirement to trade with House of Borse?

All account types have a $5,000 minimum deposit amount. This is high and means the broker isn’t the most accessible choice for beginners.

What trading model does House of Borse operate?

House of Borse operates under an ECN/DMA trading model. Clients trade directly through the interbank market with prices sourced from multiple liquidity providers.

Customer Reviews

There are no customer reviews of House Of Borse yet, will you be the first to help fellow traders decide if they should trade with House Of Borse or not?