A Hedge Fund Comeback?

The average hedge fund has 80 to 90 percent correlation with the stock market, which has been and is a long-term headwind for the success of the industry as a whole.

The idea behind pensions, endowments, foundations, sovereign wealth funds, among other investors, allocating to hedge funds has been about differentiated returns. Having a bunch of equity beta doesn’t accomplish that very well.

Most hedge funds last for only a single-digit number of years, underperforming stock benchmarks (naturally because of trading costs and other operating expenses) and eventually returning investor capital.

While it’s easy to determine who the bad funds are, it’s harder to determine the ones in the mediocre to good range. It can take up to five years or more to separate out managers who add value from those who don’t.

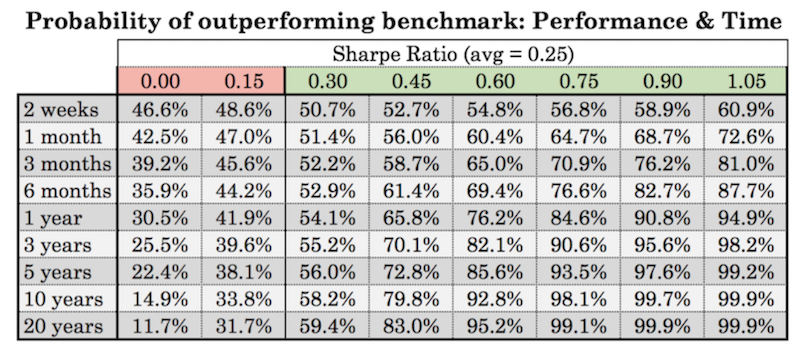

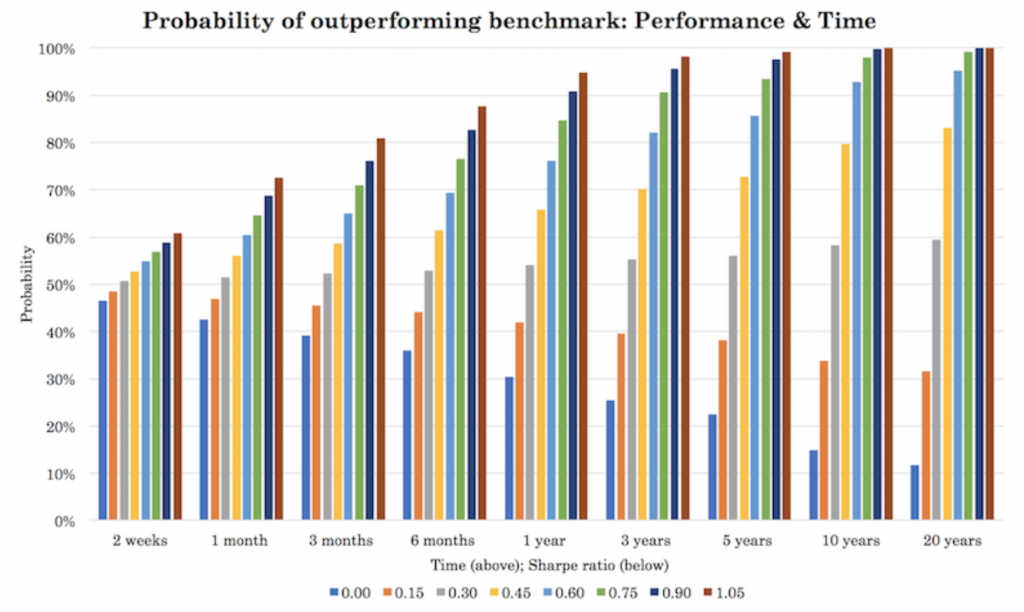

For example, let’s say you determine a manager’s skill level based on their Sharpe ratio, which measures returns in excess of cash divided by volatility. The metric isn’t perfect, but it’s the industry standard.

The ratio of excess returns divided by excess risks over the long term is expected to be somewhere in the 0.2-0.3 range. This is generally a middle ground.

When they go lower, the returns don’t compensate for the risk. When they go higher, more capital begins chasing investments.

If an investment manager is no different from parking your money in cash, which would equal a Sharpe ratio of zero, then there’s still nearly a 1-in-4 chance that they’ll outperform a benchmark (e.g., S&P 500 or whatever their strategy is most appropriate to compare to) over five years.

If a manager is a little bit better than cash but worse than standard returns from bond or stock indices, there’s still nearly a 40 percent chance they’ll beat a benchmark over five years. And a 32 percent chance they’ll beat it over 20 years.

Even for a respectably good manager (Sharpe ratio = 0.45), there’s a 28 percent chance of underperforming the benchmark.

These odds are shown below in tabular and graph format.

The general idea is that managers in the middle third are hard to differentiate.

Managers in the 0.15-0.45 range are expected to outperform a benchmark 42 and 66 percent of the time, respectively.

When we go up to three years, it’s just 40 and 70 percent.

After even ten years, it’s 34 and 80 percent.

Even if you are one of these good managers, it’s probably not encouraging that there’s still a 1-in-5 chance that over ten years you won’t add value in excess of a benchmark.

This is also why many funds require long lock-up periods. Many investors, even at the institutional level, are looking for the “hot hand”.

They would pull their capital if they could at the slightest drag in performance to put it elsewhere if they deem someone else might have a better edge.

Once in the 0.75+ Sharpe ratio range, the level of outperformance becomes more prominent faster. But that type of performance is rare, especially over longer periods.

Alpha is a zero-sum game. While there are beta approaches that can strategically increase Sharpe ratios by blending assets well, most hedge funds are known for their tactical bets. And a lot of them do the same types of things with a lot of focus on equities.

To add value relative to a benchmark, someone else must lose. While over the long run there is a large pool of beta, alpha nets out to zero.

It’s actually a negative-sum game figuring in transaction costs, financing costs, technology and people costs, compliance costs, taxes, and general marketing and administrative fees.

A simple benchmark doesn’t have any of those costs associated with it. That’s why most won’t beat it over a long enough time period.

This is a big structural headwind against hedge funds long-term. It’s important for them to have an edge in some way.

They not only have to beat a benchmark, they have lots of fixed costs to beat on top of that.

Increasingly, it’s a just-make-money game where the investment business is no longer as different from that of a private business.

In the past, investment managers typically specialized in mostly equities or credit.

Now approaches are more unique, with blended portfolios, multi-strategy, and quant trading.

Many funds want to take apart the various building blocks of a portfolio (stocks, credit, commodities, currencies) and use various tactics (e.g., financial engineering, derivatives) to reconstruct those efficiently.

Most good managers are also closed to new investment. Once managing a certain size, you become a material portion of a market.

For example, a small cap manager can’t put much into each individual stock before moving the market due to its relative illiquidity.

Becoming a material portion of the market can also set one up to being squeezed. If a certain firm is a material part of a market, other managers might try to trade against them to see how much pain their can stand to squeeze them out.

This happened to Long-Term Capital Management, and was considered at the forefront of modern investing in the 1990s.

Some management teams will even try to squeeze out those betting against their company. Their compensation tied heavily to their company’s stock price. “Funding secured” comes to mind.

A higher stock price also helps with funding. Moreover, it helps with general “buzz” and public perception around a company, even when its price is detached from its fundamentals.

The “Covid period” for hedge funds

Hedge funds actually did quite well through the Covid period. Most hedge funds were long fixed income heading into it and were not quite as exposed to equities.

(Even though they have a lot of risk in equities, their allocations are lower. A 60/40 portfolio has about 90 percent of its risk in stocks given they’re more volatile than bonds.)

This led to outperformance. In every downturn, a hedge fund is expected to outperform given its greater diversification, on average, than a pure beta-1 equity allocation.

It may not be a so-called hedge fund comeback, per se, but the 2020 Covid period was the best year for many funds in around a decade.

The opportunity set from 2016 to 2018 was low due to low volatility. Hedge funds typically don’t do as well during those kinds of environments.

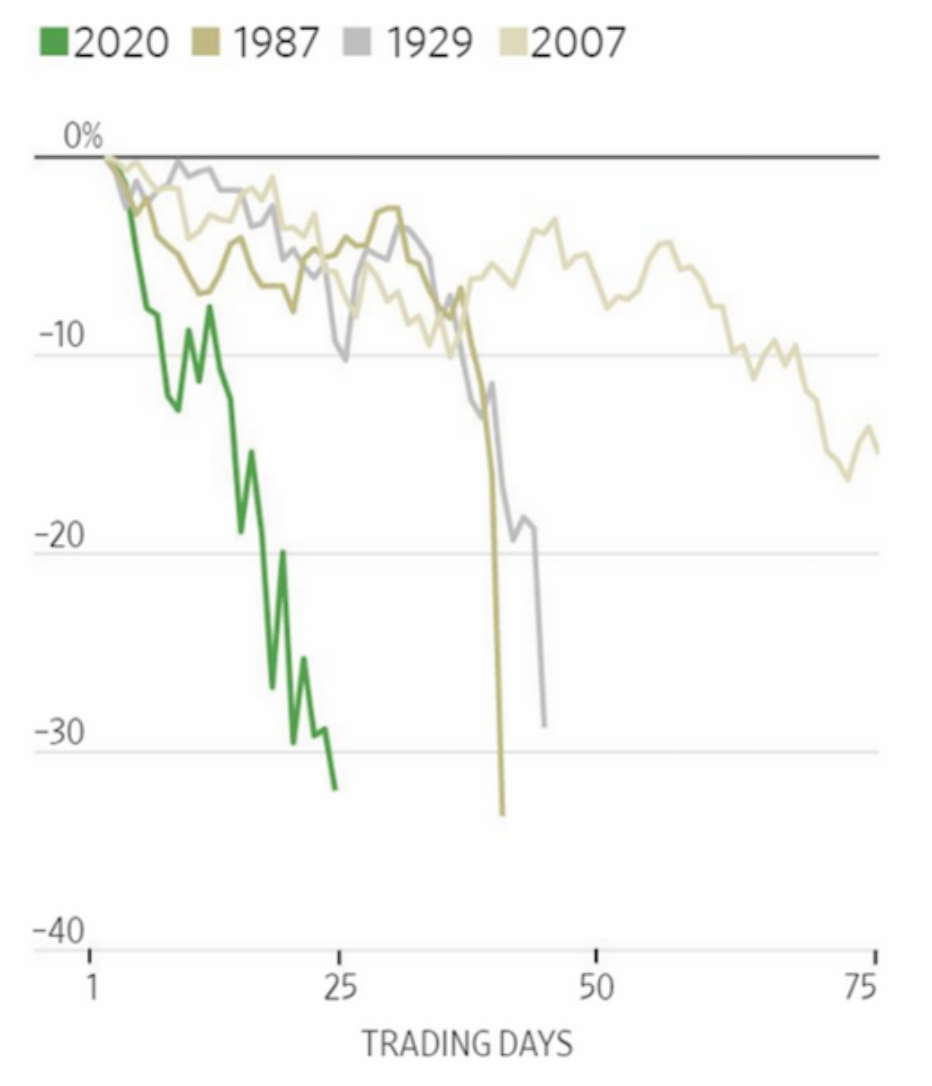

2020 brought on periods of volatility not seen since 2008 and, in many ways, not since 1929. The market sell-off was even more rapid than in 1929.

(Source: Wall Street Journal)

Directional macro funds did particularly well, given their long fixed income positions heading into the pandemic. These benefited from a drop in interest rates and investors’ need for safety and liquidity.

They also adopted a pro-risk stance in equities and credit once markets rallied.

Those leveraged to growth stocks have also done exceptionally well.

After the bottom in equities, many investors began seeking out companies that could more closely resemble stores of wealth.

Interest rates were back at zero. Therefore, cyclical companies no longer could rely on interest rate cuts to offset lost income are no longer as attractive.

Companies that are at the forefront of developing new technologies started looking more attractive. Moreover, their discounted cash flows are further out in the future and not as disrupted by present circumstances.

These factors led to the outperformance of growth stocks and for funds overweight exposure to them.

As the “post-Covid plunge era” progressed, hedge funds took a more pro-risk stance, with a tilt toward large cap tech and media stocks. (Some of the popular stocks are naturally a mix between tech and media – e.g., Google, Facebook, Amazon, Netflix.)

As vaccine progress headlines became more prominent, more managers approached the market with more of an “early cycle” playbook.

They began moving into value and cyclical sectors – industrials and manufacturing, consumer discretionary, and materials.

Hedge funds going forward

A lot of returns have already been made being long fixed income, so there’s less of a tailwind there.

Traditionally, many funds have the basic strategy of adding fixed income to an equities portfolio to diversify and improve risk-adjusted returns.

With bond yields in all the reserve currencies very low to negative, that’s not much of a plan anymore.

Central banks are committed to anchoring rates around zero going forward to help work off the debt overhang that was a problem at the sovereign level going into the Covid-19 pandemic and became even worse of a problem since.

Nominal yields can only go so low. Pushing yields much lower than zero doesn’t help stimulate private sector credit creation. Lenders will still want to be careful about who they lend to and prospective borrowers still need to save no matter how low rates go.

Replicating recent returns in fixed income isn’t particularly likely.

Non-traditional strategies will pick up in popularity.

More investors will have to find alternatives to traditional fixed income investments in reserve currencies. More capital is likely to shift from West to East.

Even though nominal yields are low in all the main reserve currencies (USD, EUR, JPY), they are not low in certain Asian countries. Cyclical emerging countries are one of the viable investing spheres globally and a place where most investors are under-allocated.

Inflation-linked bonds don’t have the same types of constraints given there is no technical lower-bound in terms of how far real yields (i.e., nominal yield minus inflation) can go. Even if nominal yields are anchored, inflation can go higher.

That could mean moving more into store hold of wealth commodities like gold, and to a lesser extent silver or platinum.

It could mean other types of commodities beyond precious metals.

Commodities are priced as a fixed quantity per unit of currency. If the currency is devalued, commodities go up in money terms.

Commodities have been considered alternative currencies to varying extents (depending on what they are) throughout time. But they are also quite volatile and not the best investments over time.

Their real returns (i.e., inflation-adjusted returns) tend to net out to about zero over the long run. They have to be sized appropriately.

Investors could also move into certain equities that don’t rely on interest rate cuts to offset lost income. That could mean companies that will grow their earnings by selling products that people need to physically live (e.g., many consumer staples).

It could also mean certain technology companies that are producing the things that will drive forward human productivity gains and not as reliant on how the macroeconomy does like cyclical sectors.

Many hedge funds will sacrifice liquidity to go after certain types of private businesses with higher returns than what they’ll see in public markets.