Fondex Review 2024

Please see the list of similar brokers or the Best Brokers List for alternatives.

Fondex is an award-winning forex and CFD broker with industry low trading costs.

Forex Trading

Fondex offers trading opportunities on 80 currency pairs, including majors.

Stock Trading

Fondex offers access to over 500 global shares including major brands in the technology and finance space.

CFD Trading

Fondex offers leveraged CFDs on a wide range of popular financial markets.

Crypto Trading

Trade cryptocurrencies on the cTrader platform.

Copy Trading

Fondex offers a top-rated copy trading solution where beginners can mirror the buy and sell positions of experienced investors.

Awards

- Best cTrader Broker, 2020

- Best Technology Corporate Leadership, 2019

- Best FX Trading Platform, 2018

- Best Trade Execution, 2018

- Best Partner Program, 2017

- Best Retail Platform, 2017

✓ Pros

- Full range of investments

- Multiple account currencies

- Multiple payment methods

- Low minimum deposit

- Copy trading

- Demo account

- Regulated

✗ Cons

- No MT4 integration

Fondex is a global forex and CFD broker based in Cyprus. Spreads start from 0.0 pips and users benefit from zero-commission trading through the powerful cTrader platform. This 2024 review of Fondex will unpack account types, mobile apps, demo trading, and more. Find out if our team recommend trading with Fondex.

Fondex Has Moved…

The broker has terminated operations under the ‘Fondex’ brand. New clients can sign up with the global firm – TopFX.

TopFX is a regulated broker with 1000+ instruments. As well as the popular MetaTrader 4 and cTrader platforms, a copy trading service is available.

See our TopFX review for the key pros, cons and features.

Key Takeaways

- High leverage up to 1:500

- Withdrawals in 24 hours

- 600+ instruments spanning 6 asset classes

- Copy trading with hundreds of strategy providers

- Global entity is regulated by offshore agency

Company Details

Fondex Limited is a trading name of TopFX Ltd, a Cyprus-registered global investment firm regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles.

Since opening in 2011, the broker has picked up multiple awards and recognition for its straight-talking platform and low trading costs. Traders benefit from ultra-tight spreads and zero commissions. The $0 minimum deposit also makes the brand accessible for beginner traders.

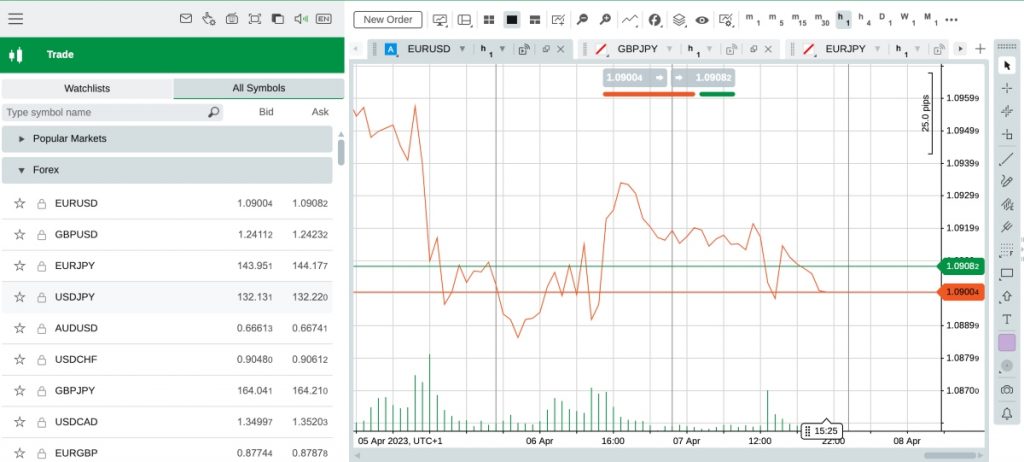

Trading Platform

Fondex uses the globally recognized cTrader platform. The downloadable and web-accessible software is a great all-around system, meeting the needs of beginners and experienced traders.

cTrader has over 70 indicators, 40 time frames and 9 different charts. Multiple types of order execution are available:

- Stop Loss and Take Profit orders

- Market Order on Open

- Trailing Stop Loss orders

- One Cancels the Other

- Time of The Day

- Good till Day

Signals are available from Trading Central and Autochartist. Automated trading is also available through cBots, allowing tried and tested strategies to be put on autopilot. In addition, sophisticated risk management tools allow traders to keep a handle on profit and loss.

The only downside is that for traders uncomfortable with cTrader, there aren’t any alternatives available, such as MetaTrader 4. Overall though, cTrader is a robust and reliable trading platform.

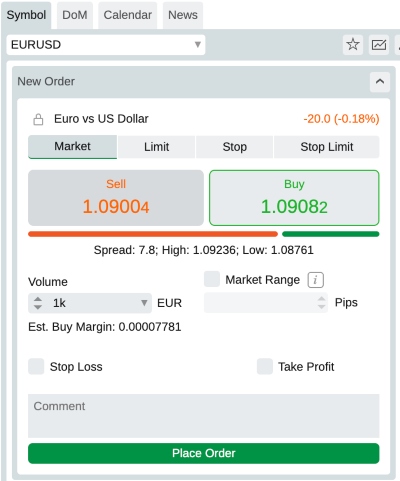

How To Place A Trade

- Select an instrument from the ‘Trade’ menu in the left of the platform

- In the ‘New Order’ widget on the right choose an order type (Market, Limit, Stop, Stop Limit etc)

- Choose between ‘Sell’ and ‘Buy’

- Input the volume and pips

- Enter any stop loss or take profit levels

- Add a comment (optional)

- Select ‘Place Order’ to confirm the trade

Assets & Markets

Over 600 trading assets are available at Fondex.

The broker provides access to 80+ forex pairs, including majors, minors, and exotics. Also available are 15 major global indices, over 500 shares, plus metals, energies, ETFs, and cryptocurrencies.

This is a decent selection that rivals leading brokers in 2024.

Spreads & Commissions

Spreads and trading fees at Fondex are low.

Spreads start from 0.0 pips with a professional account and 0.5 pips on the standard solution. When we used Fondex, average spreads on the EUR/USD and GBP/USD forex pairs were 0.45 and 0.8 pips, respectively.

Commissions are also transparent, with $2.5 charged per $100k trading volume on forex, metals, and energies. A $1 charge is levied per side of 100 shares and ETFs, while users get zero commissions on indices and cryptocurrencies.

Overall, Fondex ranks highly among our broker reviews for trading costs.

Fondex Leverage

Leverage levels range from 1:2 up to 1:30, in line with regulatory requirements in the EU. More conservative leverage can help keep a handle on losses and reduce new traders’ risk exposure.

However, by complying with eligibility criteria, professional traders can increase their rates up to 1:500. Traders with registered with the global entity can also access higher leverage up to 1:500.

Mobile Apps

A fully functional Fondex cTrader app is available to download from the Apple App Store for iOS devices and Google Play for Android devices. The mobile app offers the same portfolio of assets and markets as the desktop platform.

Over 60 mobile indicators are available, plus five chart types, including candlesticks, bar charts, and line charts.

A market sentiment indicator shows how others are trading, while symbol watchlists allow traders to save their favorite symbols.

In addition, price alerts can be set up to receive notifications when predetermined price levels are hit. Responsive one-tap trading is also available. Finally, the mobile app offers detailed performance statistics so you can review trading strategies.

Payment Methods

Fondex offers a decent selection of deposit and withdrawal methods:

- Debit & credit cards

- Yandex Money

- Bitcoin Wallet

- Wire transfer

- Paysafecard

- Webmoney

- Neteller

- Neosurf

- Giropay

- PayPal

- Sofort

- Skrill

- QIWI

- POLi

Deposits are processed instantly and incur zero fees. There is also no minimum deposit, which is great for new day traders.

Withdrawals take 24 hours and must be processed using the same method as your deposit. No fees apply for withdrawals, but your bank may have its own charges.

Deposits and withdrawals through bank wire take 1-3 days. The minimum amount you can withdraw is 50 EUR or equivalent. Another exception to the rule is the minimum deposit and withdrawal amount for USDT, which is $250.

Overall, while using Fondex, we were impressed with the range of payment options, the speed of processing, and the low fees.

Demo Account

The Fondex demo account comes with 100k in virtual money and lets you test the cTrader platform using real-time market data.

Select ‘Try a free demo’ from the top-right of the broker’s website, enter your email address and telephone number, choose a password, select your country of origin, and then you’re good to go.

The broker will send login credentials to the registered email address, which can then be used to open the cTrader desktop software or web terminal.

Bonuses & Promotions

Fondex does fall short when it comes to sign-up bonuses and promotions, with no offers available at the time of writing. This is partly because of restrictions from the European Securities and Markets Authority (ESMA).

Still, bonuses can be found on other sites and act as an incentive for new traders.

Regulation & Licensing

Fondex is regulated by the Cyprus Securities and Exchange Commission (CySEC) and is overseen by the European Securities and Markets Authority (ESMA).

As a result, the broker is regularly audited, provides its clients with negative balance protection, and is signed up to the Investor Compensation Fund.

Also, under licensing conditions, the broker keeps client funds in segregated accounts with Tier-1 banks.

In addition, Fondex holds a license with the Financial Services Authority (FSA) of Seychelles, license number SD037. However, this is not a well-regarded regulator and thus provides limited protection for retail traders that sign up with the global branch.

Additional Features

Our experts found that Fondex offer several useful additional features. The website has Market News and Educational Articles sections which provide users with extra market insights. However, the quality and depth of content are limited.

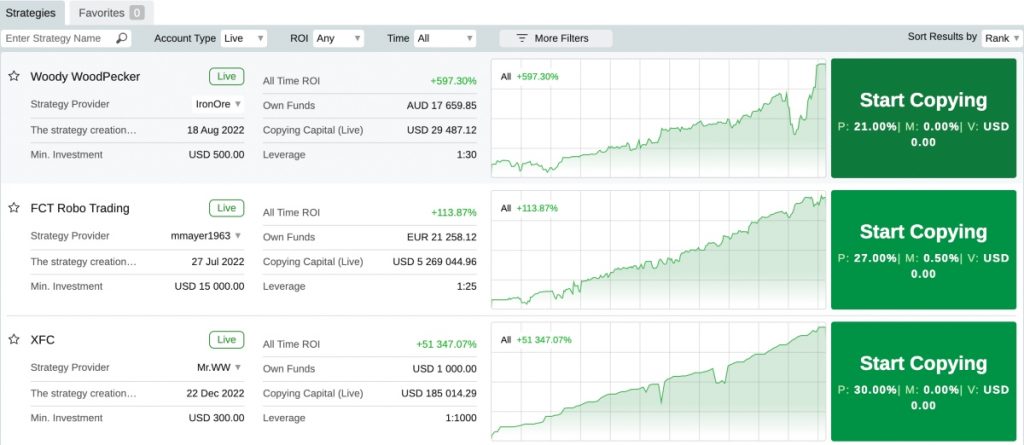

Copy Trading

Copy trading allows users to copy the techniques of high-performing traders. It can be an excellent option for beginners starting out and for traders tight on time.

Hundreds of strategies are available, and analysis tools help you find a strategy that will meet your investment goals. In turn, profitable strategies can be offered to other users to bring in extra revenue.

How To Copy Traders

- Sign in to the cTrader platform via desktop, web or app

- Select ‘Copy’ from the menu in the left

- Use the search bar to find strategy providers

- Alternatively, you can filter traders by Rank, ROI, Copiers, and Copying Capital (Live)

- Select ‘Start Copying’ next to the strategy provider you want to copy

- In the pop-out window, select ‘Start Copying’ again to initiate the program

Fondex Accounts

The broker offers only one account type. However, different variations are available:

- Standard Account – Suitable for beginners and intermediate traders, this is the main account. The standard version provides access to all tradable assets. There is no minimum deposit and the minimum trade size is one micro lot. Scalping, hedging, copy, and automated trading are available.

- Swap-Free Account – Suitable for Islamic traders, this account removes interest deductions or overnight payments. Aside from that, it’s the same as the standard account. To apply for the swap-free account, traders will need to fill out an application form on the website and email it to customer support along with proof of faith.

- Professional Account – To qualify you must meet two of the three criteria. You need to have made 10 big transactions per quarter, have a portfolio that exceeds EUR 500,000, or have worked in the financial industry for at least one year. This option offers orders executed in milliseconds, 3 types of market depth, up to 1:500 leverage, and 0.0 pips minimum spread.

Note, both accounts are a hybrid execution model of ECN/STP, combining fast executions with flexible spreads.

Trading Hours

Trading hours follow standard market opening and closing times. So forex trading hours open at 22:00 GMT Sunday through to 22:00 GMT Friday. Metals operate from 23:00 GMT Sunday through to 22:00 GMT Friday. Stock indices and shares follow the opening times of their respective market operating hours.

Customer Support

Fondex customer support is available in English, French, Russian, Greek, and Arabic 24/5 via:

- Live chat – online chat box available in the bottom right-hand corner of the website

- Telephone support – +357 25028079

- Email – support@fondex.com

We would recommend live chat as the first point of contact. During testing for this Fondex review, the wait time for chat support was less than a couple of minutes, and representatives could answer most product and platform queries.

To keep up with the latest Fondex news, you can also find the broker on social media:

Security & Safety

Fondex uses industry-standard security protocols to secure client data, including 512-bit encrypted transactions. This coupled with the segregation of client funds and regulatory compliance with the CySEC, means that we are satisfied they are secure.

Fondex Verdict

This all-around broker offers a wide range of assets, low trading fees, and an excellent platform. As this review has indicated, Fondex is particularly good for beginners, with no minimum deposit requirements, a straightforward standard account, and copy-trading available.

FAQ

Is Fondex A Good Broker For Beginner Day Traders?

Yes – the platform offers plenty of educational resources, news, alongside lower fees, account protection, and copy-trading. Tight spreads and fast execution speeds also make it a good pick for new day traders.

Is Fondex Available In The US?

No – Fondex doesn’t operate in the US and several countries where regulation doesn’t permit it, such as Canada and North Korea. However, most other countries are accepted.

Is Fondex Legit Or A Scam?

Fondex is a legitimate brokerage, owned by TopFX Ltd. The firm is registered with the Cyprus Securities & Exchange Commission and offers various account safeguarding measures, including negative balance protection.

How Long Does A Deposit & Withdrawal Take At Fondex?

Deposits are instant at Fondex while withdrawals take 24 hours using most payment methods. With that said, bank wire transfers take 1-3 days. Overall, these are fast payment timelines compared to many alternatives.

Which Markets Can You Trade With Fondex?

You can trade over 600 instruments across 6 asset classes: forex, shares, indices, precious metals, energies, and cryptocurrencies. Clients can place trades through the cTrader platform and app.

Does Fondex Offer A Demo Account?

Yes – Fondex offers a demo account with 100k virtual capital for day traders to practice and test their strategies. Prospective traders can register for a paper trading account through the official website. The sign-up process only takes a couple of minutes.

How Can I Start Trading With A Live Fondex Account?

To open a live trading account with Fondex, fill out the registration form. Enter some basic contact details and upload identification for verification. Once processed, your account will be activated and you will receive login credentials.

Is Fondex Regulated?

Yes – Fondex is a trading name of TopFX Ltd and is licensed with the Cyprus Securities and Exchange Commission (CySEC). The broker is also authorized by the the Financial Services Authority (FSA) of Seychelles.

Can I Copy Trade With Fondex?

Yes – you can access the copy system from within the cTrader platform. It is available from the left-hand side of the main platform interface. From there, users can copy the trades and strategies of successful traders.

Is There A Minimum Deposit To Start Trading With Fondex?

There is no minimum deposit requirement at Fondex. This makes it a good broker for novice traders starting out.

Can I Lose More Than My Deposit Trading With Fondex?

No – Fondex uses negative balance protection so traders cannot lose more than their initial deposit.

Top 3 Alternatives to Fondex

Compare Fondex with the top 3 similar brokers that accept traders from your location.

-

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Go to IC Markets -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

Fondex Comparison Table

| Fondex | Pepperstone | IC Markets | FP Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4.8 | 4.8 | 4 |

| Markets | Forex, CFDs, ETFs, indices, shares, energies, metals, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $200 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FSA, CySEC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA | ASIC, CySEC, ESMA |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | cTrader, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) |

| Payment Methods | 13 | 11 | 14 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Pepperstone Review |

IC Markets Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Fondex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Fondex | Pepperstone | IC Markets | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | Yes | Yes |

Fondex vs Other Brokers

Compare Fondex with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of Fondex yet, will you be the first to help fellow traders decide if they should trade with Fondex or not?